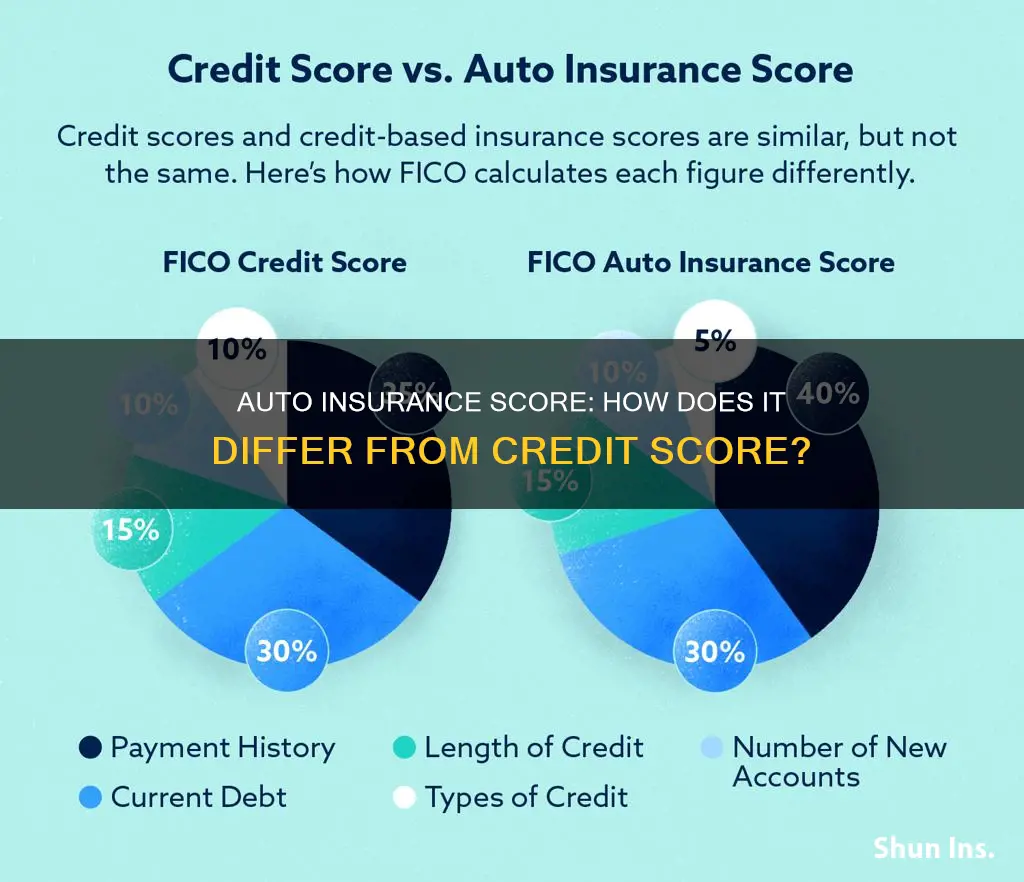

Credit-based insurance scores are different from the typical credit scores used by creditors. While credit scores predict the likelihood of a consumer being late on a payment, credit-based insurance scores predict the likelihood of a consumer filing insurance claims. Although the factors used to determine both scores are the same, they are weighted differently. Credit-based insurance scores are used by car insurance companies to calculate rates, with higher scores leading to better rates. However, this practice is controversial and banned in certain states.

What You'll Learn

- Credit-based insurance scores are different from credit scores

- Credit scores predict likelihood of late payments

- Credit-based insurance scores predict likelihood of insurance claims

- Credit-based insurance scores are calculated using credit history

- Credit-based insurance scores impact car insurance rates

Credit-based insurance scores are different from credit scores

Credit-based insurance scores are calculated by auto insurance companies to assess the likelihood of a consumer filing insurance claims that will cost the company more money than it collects in premiums. This is different from the purpose of a credit score, which predicts the likelihood of a consumer being late on a payment in the next 24 months.

While both types of scores consider similar behaviour, the factors used to calculate them are weighted differently. Credit-based insurance scores are calculated based on:

- Payment history

- Outstanding debt

- Credit history length

- Pursuit of new credit

- Credit mix

Credit scores, on the other hand, are calculated based on:

- Payment history

- Length of credit history

- Credit mix

- New credit/pursuit of new credit

- Types of credit used

Credit-based insurance scores are generally not available for consumers to see. While a "good" credit score is typically above 670, there is no clear definition of a "good" insurance score as it varies by insurer.

Ameriprise's Business Auto Insurance: What You Need to Know

You may want to see also

Credit scores predict likelihood of late payments

Credit scores are used by auto insurance companies to predict the likelihood of policyholders filing late payments. While auto insurance scores are not the same as credit scores, they are derived from them.

Auto insurance companies use credit-based insurance scores to set rates. These scores are calculated differently from typical credit scores, such as a FICO score, and are not available for consumers to see. The exact calculation of a credit-based insurance score is a closely guarded secret, but it is believed to be based primarily on payment history.

An individual's credit score can impact their auto insurance rate. In most states, a higher credit score generally leads to a lower insurance rate, while a lower credit score results in a higher rate. This is because auto insurance companies believe that individuals with lower credit scores are more likely to file claims.

Late payments can have a significant impact on credit scores. Payment history accounts for approximately 35% of an individual's FICO score. A single late payment can cause a credit score to drop by up to 180 points, and the impact can last for up to seven years. However, the effect of a late payment diminishes over time, and recent payment history is given more weight.

To avoid late payments, individuals can set up autopay or due date alerts, change their payment due dates to match their paychecks, or consider debt consolidation. Maintaining a good credit score can help keep auto insurance rates low.

Auto Insurance: Checking Your GEICO Policy Coverage

You may want to see also

Credit-based insurance scores predict likelihood of insurance claims

Credit-based insurance scores are designed to predict the likelihood of a person filing insurance claims. These scores are calculated from credit history and other factors, and are used to set insurance premiums. A higher score indicates a lower likelihood of filing claims and can result in a lower insurance rate.

While the specific factors and their weighting may vary, common elements that contribute to credit-based insurance scores include:

- Outstanding debt or amount of debt

- Length of credit history

- Credit mix, such as auto loans, mortgage loans, and credit cards

- Payment history, including timely payments or credit delinquencies

- Pursuit of new credit, including recent attempts to open new lines of credit

It is important to note that credit-based insurance scores are not the same as credit scores. Credit scores predict the ability to repay debt, while credit-based insurance scores use credit history to predict the likelihood of filing an insurance claim. Additionally, credit-based insurance scores consider multiple types of information and are just one factor in determining insurance rates.

Writing a Complaint Letter to Your Auto Insurance Company

You may want to see also

Credit-based insurance scores are calculated using credit history

Credit-based insurance scores are calculated using several factors related to an individual's credit history and financial behaviour. While each insurer has its own proprietary formula for calculating these scores, common factors include:

- Payment history: How well an individual has made payments on their outstanding debt in the past.

- Outstanding debt: The amount of debt an individual currently has.

- Credit history length: How long an individual has had an open line of credit.

- Pursuit of new credit: Whether an individual has recently applied for new lines of credit.

- Credit mix: The different types of credit an individual has, such as credit cards, auto loans, or mortgages.

These scores are then used by insurers to assess the risk of providing coverage to a customer. Individuals with higher credit-based insurance scores are generally considered lower risk and may be offered more favourable rates. On the other hand, those with lower scores may be viewed as higher-risk and face higher premiums.

It's worth noting that improving your credit history and credit-based insurance score can take time, but it's worth the effort to ensure you're getting the best possible rates for your insurance coverage.

Switching Lanes: Exploring the Impact of Auto Insurance Company Changes on Rates

You may want to see also

Credit-based insurance scores impact car insurance rates

Credit-based insurance scores are calculated using factors such as outstanding debt, credit history length, credit mix, and payment history. These factors are also considered in traditional credit scores but are weighted differently in insurance scores. For example, according to the Department of Insurance, Securities and Banking, FICO weights payment history at 40% and outstanding debt at 30% for insurance scores.

The use of credit-based insurance scores in car insurance pricing is controversial. Critics argue that it is unfair to base car insurance rates on credit scores because they do not accurately predict a driver's accident risk. Additionally, there is a lack of awareness about the use of these scores, and consumer advocates have pushed back against this practice. As a result, some states, including California, Hawaii, Massachusetts, and Michigan, have banned or restricted the use of credit-based insurance scores in determining car insurance rates.

While credit-based insurance scores can significantly impact car insurance rates, they are just one factor among many. Other factors that influence car insurance premiums include driving history, vehicle type, demographics, coverage selections, and deductibles.

Auto Damage Repairs: Insurance, Tax, and You

You may want to see also

Frequently asked questions

No, your auto insurance score is not the same as your credit score. While the factors used to determine your score are the same, they are weighted differently.

A credit-based insurance score is used to determine how likely you are to file an insurance claim. It gives insurers an idea of how big a risk you are and helps them decide how much to charge you for coverage.

A credit-based insurance score is calculated using factors such as payment history, outstanding debt, credit history length, pursuit of new credit, and credit mix. The specific weighting of each factor may vary between insurance companies.

No, not all auto insurance companies use credit-based insurance scores. Some companies, such as Root Insurance and Dillo, have pledged to remove credit scores from their pricing models. However, about 95% of auto insurers do use insurance credit scores to determine rates.

To improve your credit-based insurance score, you can take similar steps as you would to improve your credit score. This includes paying your bills on time, reducing your credit card debt, and limiting hard credit inquiries.