In the state of New York, drivers are required to have personal injury protection (PIP) insurance. This is because New York is a no-fault state, which means that the at-fault party is responsible for paying for the other party's property damages, and each party pays for their own medical expenses under their PIP coverage. PIP insurance covers medical expenses and lost income after an accident, regardless of who caused it. The minimum coverage for PIP in New York is $50,000 for injuries from a single accident.

| Characteristics | Values |

|---|---|

| Is auto PIP insurance required in New York? | Yes |

| What is the minimum amount of PIP coverage required in New York? | $50,000 per person |

| What does PIP insurance cover in New York? | Medical costs, economic losses, death benefits, lost wages, household costs |

| What is not covered by PIP insurance in New York? | Car repairs, accidents outside the U.S., anyone in another vehicle |

| When should a PIP claim be filed in New York? | Within 30 days of an accident |

What You'll Learn

Minimum auto insurance requirements in New York

In New York, drivers are required to have personal injury protection (PIP) coverage as part of their auto insurance policy. This is because New York is a no-fault state, which means that the at-fault party is responsible for paying for the other party's property damage under their liability coverage, and each party pays for their own medical expenses under PIP.

The minimum PIP coverage amount in New York is $50,000 per person, with a minimum total coverage of $100,000 for the death/injury of two or more people in an accident. PIP covers economic damages, including medical expenses, lost wages, and reasonable and necessary expenses, as well as non-economic damages in cases of serious injury.

In addition to PIP, drivers in New York are also required to have a minimum level of several other types of coverage, including:

- Liability coverage, which protects against harm to other people and their property. The minimum coverage for bodily injury liability is $25,000 per person and $50,000 per accident, while the minimum for property damage liability is $10,000 per accident.

- Uninsured motorist coverage, which protects against injuries caused by an uninsured or hit-and-run driver. The minimum coverage for uninsured motorist bodily injury is $25,000 per person and $50,000 per accident.

It is important to note that these are the minimum requirements, and drivers may choose to purchase additional coverage for added protection.

Experian's Auto Insurance Offering: What You Need to Know

You may want to see also

What is covered by Personal Injury Protection (PIP) insurance in New York?

Personal Injury Protection (PIP) insurance in New York is mandatory for all drivers and covers medical costs, economic losses, and death benefits. The minimum amount of PIP coverage in New York is $50,000 per person, which is often referred to as "basic No-Fault coverage". This means that the driver and all passengers injured in your car, as well as any pedestrians injured by your car in New York State, are covered up to $50,000 per person.

Medical Costs

Most medical costs stemming from a car accident are covered by PIP insurance. This includes psychiatric and physical rehabilitation costs, diagnostic services such as X-rays, and treatment in accordance with a recognized religion.

Economic Losses

If you are unable to work due to your injuries, PIP insurance in New York will cover lost wages up to $2,000 per month or 80% of your monthly earnings, whichever is less, for up to three years after the accident and up to the policy's limits. Additionally, you can receive up to $25 per day to cover routine activities you can no longer do, such as laundry and home maintenance.

Death Benefits

In the event of the death of an eligible insured driver, the driver's estate is entitled to $2,000 to help pay for funeral and burial costs.

It is important to note that PIP insurance in New York does not cover property damage. It is also worth mentioning that there are situations where PIP coverage may not be applicable, such as if you are riding an ATV or are found to be intoxicated at the time of the accident.

Maximizing Auto Insurance Savings: Strategies for Smart Financial Planning

You may want to see also

When and how to file a PIP claim in New York

In New York, personal injury protection (PIP) is a mandatory component of car insurance policies. When involved in an accident, PIP coverage helps pay for medical expenses and lost wages, regardless of who is at fault.

When to File a PIP Claim in New York

According to the New York State Department of Financial Services, you can file a PIP claim up to 30 days after an accident if injuries are involved. The sooner you inform your insurance company about the accident, the better. Depending on your policy, there may be a time limit for filing your claim. Most insurance companies require individuals to submit a claim within 30 days of the accident.

How to File a PIP Claim in New York

To file a PIP claim in New York, follow the steps below:

- Notify your insurance company and law enforcement about the accident. Report the accident to the New York Department of Motor Vehicles (DMV) within ten days if the damage caused is over $1,000 or if individuals were injured or killed.

- Submit a written notice of the claim to your insurance company. Include the injured individual's information, the date, time, location, and circumstances of the incident.

- Complete and return the Application for Benefits (NF-2 form) and any other required forms as soon as possible.

- Continue seeking medical attention and follow your doctor's treatment plan. Ensure your medical provider knows your injuries resulted from a car accident.

- Submit written proof of your medical expenses and lost earnings to your insurance company. For medical costs, you have 45 days after the start of treatment to submit this information, while for lost earnings, you have up to 90 days.

- Your insurance company will have 30 days to pay you once they receive your forms. They may request additional information or an independent medical exam (IME) before paying your claim.

Tennessee Vehicle Insurance Requirements

You may want to see also

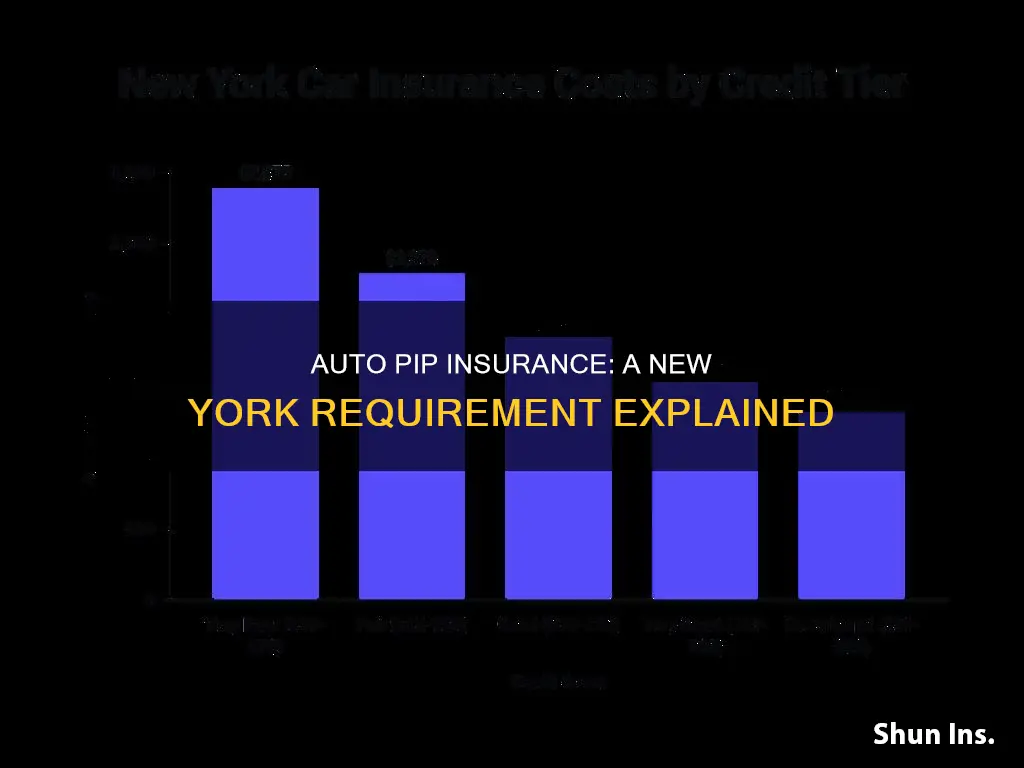

How much does New York PIP insurance cost?

The cost of Personal Injury Protection (PIP) insurance in New York varies based on your driving history, age, location, and information about your vehicle, such as its age, make, and model. The average cost of car insurance in New York is $3,833 per year for full coverage and $1,654 for minimum coverage. The minimum PIP coverage amount in New York is $50,000, and you can add Additional PIP coverage and Optional Basic Economic Loss (OBEL) coverage to extend your cap for coverage. Additional PIP provides an additional $50,000 (for a total of $100,000 in coverage), while OBEL offers an extra $25,000 of basic economic loss coverage, which includes payouts for lost wages, rehabilitation after an injury, and other forms of economic loss.

You may select a higher deductible, such as $200, which will lower your premiums slightly, but you cannot coordinate the coverage with your health insurance as you can in some other states. If you feel that $50,000 won't be enough coverage, you can also buy optional basic economic loss insurance (OBEL) and additional PIP coverage, which will increase your limits. OBEL and additional PIP are relatively cheap, costing less than $30 more per year for both, which gets you an extra $75,000 worth of coverage.

The cost of PIP insurance is also included in any quotes you receive from auto insurers in New York, regardless of the coverage options you select, as auto insurers in New York cannot sell you less than the minimum amount of coverage required by the state. Once you have secured coverage, you can see exactly how much you are paying for PIP by looking at your policy's declarations page, which includes details about your policy.

Burglary and Auto Insurance: Understanding Comprehensive Coverage

You may want to see also

Key things to note about PIP insurance in New York

Personal Injury Protection (PIP) is a mandatory component of your auto insurance policy in New York. Here are some key things to note about PIP insurance in the state:

- Understanding No-Fault Laws: New York is a no-fault state, which means that regardless of who is at fault in an accident, your PIP coverage will pay for your medical expenses and lost wages. This is different from liability coverage, which covers bodily injury and property damage when you are at fault.

- Minimum Coverage Requirements: In New York, you must carry a minimum of $50,000 in PIP coverage per person. This is higher than the minimum requirements in many other states. The minimum car insurance requirements in New York are higher than in many states due to the inclusion of PIP coverage.

- What PIP Covers: PIP covers medical costs, lost wages, and some other costs incurred as a result of an accident. It does not cover property damage. It also covers reasonable and necessary accident-related expenses, such as transportation to medical providers and household help.

- When to File a Claim: You can file a PIP claim up to 30 days after an accident if injuries are involved, according to the New York State Department of Financial Services. This claim can be for injuries sustained by you or your passengers.

- Differences from Medical Payments Coverage: PIP is similar to medical payments coverage, but it also covers rehabilitation, lost wages, and household help while recovering from injuries. Medical payments coverage only pays for hospital visits, surgery, and other qualified medical charges or funeral expenses.

- Exceeding PIP Coverage Limits: If your injury costs exceed your PIP coverage limit, you may be responsible for additional expenses. You can purchase supplementary medical payments coverage or rely on your health insurance to cover some expenses. If another party is at fault, their bodily injury liability coverage may also pay for your medical expenses.

- Serious Injury Exception: In a no-fault state like New York, you cannot usually file a claim against another person's insurance. However, if your injuries meet the "serious injury" criteria defined by New York's insurance law, you may be able to sue for additional damages.

Gap Insurance vs. Warranty: What's the Difference?

You may want to see also

Frequently asked questions

Yes, auto PIP insurance is required in New York.

The minimum amount of PIP coverage you can purchase in New York is $50,000.

PIP insurance in New York covers medical costs, economic losses, and death benefits.

PIP insurance in New York covers the medical expenses and lost wages of the driver and passengers in the vehicle, regardless of who was at fault for the accident.