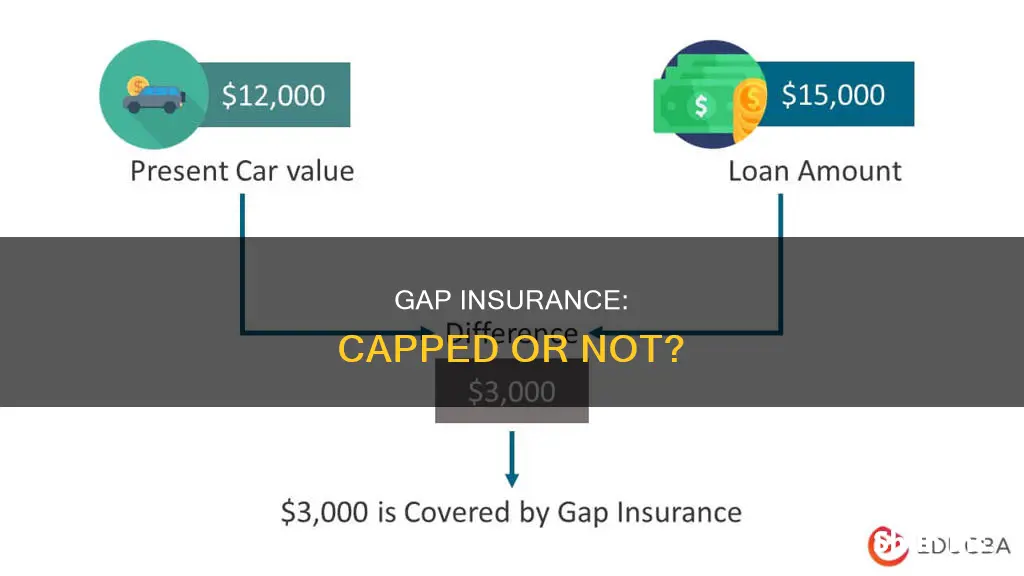

Gap insurance is an optional form of insurance that covers the difference between the amount owed on a car loan and the car's value in the event of a total loss. This can include situations where a car is stolen or involved in an accident. Gap insurance is designed to protect drivers from owing more on their car than it is worth. However, it is not necessary for drivers who do not have a car loan or lease. The cost of gap insurance varies depending on factors such as the car's value, the state of residence, and previous insurance claims.

| Characteristics | Values |

|---|---|

| What is gap insurance? | Optional coverage that pays the difference between what your vehicle is worth and how much you owe on your car loan at the time it’s stolen or totaled |

| What does gap insurance cover? | The remaining amount on your loan after a total loss, whether that’s the result of an accident or vehicle theft |

| How does gap insurance work? | Covers the gap between the total loss claim payout and the outstanding loan amount |

| Is gap insurance worth it? | Depends on whether you can afford to pay the difference between the amount you still owe and the value of your car |

| How to get gap insurance | From your auto insurer or through the dealership or lender, rolled into your loan payments |

| How much does gap insurance cost? | A few dollars a month or around $20 a year if bought from an insurer; a flat fee of around $500 to $700 if bought from a lender or dealer |

| Alternatives to gap insurance | New-car replacement insurance; better-car replacement coverage |

What You'll Learn

Gap insurance covers theft

Waiting Period

Gap insurance companies usually require a waiting period of around 30 days before a stolen car can be deemed unrecoverable. After this period, they will ask for a copy of the police report detailing the theft before agreeing to pay out a claim.

Total Loss

Each state has different rules on what constitutes a total loss, based on the estimated price of repairs compared to the car's value. If a stolen car is recovered but deemed a total loss, gap insurance will pay out.

Payout Process

To receive a gap insurance payout for a stolen car, you will need to get a copy of the police report, file a claim with your standard insurer, and then file a claim with your gap insurance provider. Gap insurance companies thoroughly investigate claims for stolen cars to prevent fraud, so expect a wait before receiving a payout.

Comprehensive Insurance

It is important to note that gap insurance does not cover theft directly. Your comprehensive insurance covers theft, and gap insurance covers the gap between the comprehensive insurance payout and the remaining loan or lease balance. If you do not have comprehensive insurance, gap insurance will not cover theft.

Insurance Coverage: Driver or Car?

You may want to see also

When gap insurance doesn't pay out

Gap insurance is a type of optional coverage that pays the difference between what your vehicle is worth and how much you owe on it in the event it is stolen or declared a total loss. However, there are certain situations in which gap insurance won't pay out. Here are some reasons why your gap insurance policy may not pay out:

- Your main motor insurer does not pay out: For a gap insurance policy to work, your primary motor insurance must cover the incident you are claiming for and pay out the market value for the vehicle. If your motor insurer does not pay out, you cannot claim on the gap insurance. For example, if you have been negligent in leaving your vehicle keys unguarded, or if the vehicle is used for excluded purposes like courier or taxi services, your motor insurer may not pay out.

- You do not have an 'insurable risk' on the vehicle: This means that you have taken out a gap policy in your name, but you are not the owner of the vehicle and do not have a finance agreement in your name. In this case, you cannot claim for a loss as you are not the registered owner.

- The vehicle is being used for certain commercial activities: Most gap insurance products do not cover commercial activities with standard cover. This includes activities such as 'hire and reward', which can include taxis, private hire, courier, and chauffeur work. Other areas of commercial work often not covered are tuition or driving school vehicles.

- You have stopped paying for the policy: If you elected to pay for the gap cover on a monthly basis or through a credit agreement and then stop paying, your coverage could end automatically.

- You sell the vehicle or change its owner: If you sell your vehicle, the gap cover normally ceases automatically. This can also be the case if you change the ownership of the vehicle to a family member.

- You have already made a claim on the gap policy: Gap insurance is typically a 'one-time-only' type of cover. You can only claim on it once when the vehicle is written off. If you successfully claim, the policy ends, even if you have time left on the cover.

- There is no 'gap' to fill: Gap insurance is designed to top up your motor insurer's settlement to the price you paid for the vehicle or to clear a finance or lease settlement. If there is no gap between the motor insurer's settlement and the original price you paid, your gap cover has no difference to make up.

- Your gap insurance policy has expired: All gap insurance products have a period of cover, after which you cannot normally renew or get new cover as you have owned the vehicle for too long.

- You are not fully comprehensively insured: Most gap insurance policies require that you have full comprehensive insurance for the full policy term. If you only have third-party cover, your motor insurer would not pay out for a fault claim or theft, and you would not be able to claim on the gap cover.

- Your vehicle does not appear in valuation guides: Some gap insurance policies use valuation guides to determine the write-off value of a vehicle. If your vehicle is not listed in these guides, your gap insurance may not cover you.

Additionally, gap insurance won't pay out for:

- Damage that isn't a total loss: Gap insurance only covers total losses and will not pay for repairs or maintenance.

- Claims that are over the limit: Some gap insurance policies have a limit on the amount of the claim, usually a percentage of the vehicle's value.

- Non-payment of policy premiums: If the policy has lapsed due to non-payment when the total loss occurs, the policy will not pay out.

Vehicle Insurance: Track and Trace

You may want to see also

How much does gap insurance cost?

The cost of gap insurance depends on where you purchase it. Buying gap insurance from a car dealership is typically more expensive than buying it from a car insurance company. Dealerships and lenders charge a flat rate, usually between $500 and $700, whereas insurance companies charge an average of $20 to $40 per year when bundled with an existing insurance policy. If you want to buy a standalone gap insurance policy, you can expect to pay between $200 and $300.

If you add gap coverage to a car insurance policy that already includes collision and comprehensive insurance, it will typically increase your premium by around $40 to $60 per year. Lenders charge a flat fee of around $500 to $700 for gap insurance, but if you add the coverage to your loan, you'll also pay interest on it.

Some insurance companies, such as Progressive, offer gap insurance for as low as $5 per month.

Insurance Safeguards for Pedestrians Without Vehicle Cover

You may want to see also

Who should get gap insurance?

Gap insurance is an optional auto insurance coverage that helps pay your car loan if your car is lost or stolen and you owe more than the vehicle is worth. It is not necessary for everyone, but it can be beneficial in certain situations. Here are some factors to consider when deciding if you should get gap insurance:

- Financing or Leasing: Gap insurance is only necessary if you are financing or leasing your vehicle. If you own your car outright, there is no need for gap insurance.

- Down Payment: If you made a small down payment, such as less than 20%, you may want to consider gap insurance. A larger down payment reduces the risk of owing more than the car's value.

- Loan Term: If you have a long finance period, such as 60 months or longer, gap insurance may be a good idea. The longer the loan term, the higher the chances of your car depreciating below the loan amount.

- Vehicle Depreciation: Some vehicles depreciate faster than others. If you purchase a vehicle that depreciates quickly, gap insurance can help protect you from negative equity.

- Negative Equity: If you rolled over negative equity from an old car loan into the new loan, gap insurance can help cover the difference.

- Affordability: Consider whether you can afford to pay the difference between the amount you still owe and the car's value if it is totaled or stolen. Gap insurance can provide financial peace of mind in case of an emergency.

- Alternative Coverage: Some insurance companies offer alternative coverages, such as new car replacement coverage or better car replacement coverage, which may be more suitable for your needs.

In general, gap insurance is recommended for those who have a small down payment, a long finance period, or a vehicle that depreciates quickly. It is also worth considering if you cannot afford to pay off the remaining loan balance in the event of a total loss. However, if you have a large down payment, a short loan term, or a vehicle that holds its value well, you may not need gap insurance. Additionally, be sure to compare the cost of gap insurance from different providers, as it can vary between insurance companies and dealerships.

Vehicle Insurance Expired? Here's What to Do

You may want to see also

When to drop gap insurance

Gap insurance is a smart idea when you first get a car loan due to depreciation. However, once you reach a break-even point, gap insurance becomes an unnecessary expenditure.

When your loan balance is less than your car's value

If your car is now worth more than the balance of your loan, you no longer need gap insurance. Gap insurance covers the difference between what you owe on a car and what the insurance company will pay out if it's a total loss. So, if your car's value is greater than the remaining loan balance, you're essentially paying for coverage that you will never use, even if your car is totalled or stolen.

When you sell or trade your vehicle

You can also drop gap coverage if you sell or trade your vehicle. It is recommended that you wait to cancel until you have completed the sale or trade.

When you pay off your loan early

If you pay off your loan early, you can cancel your gap insurance.

When you no longer need it

If you decide that gap insurance is no longer worth the cost, you can choose to drop the coverage at any point. Gap insurance isn't mandatory and can be cancelled at any time.

When you find a better deal

When you purchase gap insurance through a dealership or lender, it's typically paid upfront and lasts the life of your loan. If you decide to drop this policy and shop around, you may be able to find a better deal with another provider.

Before deciding to drop gap insurance, it is important to review your loan balance and the value of your vehicle. If the balance of your loan is more than the value of your car, it is recommended that you keep gap insurance. Since gap insurance pays the difference between what you owe and the value of your car, you may end up owing money if your car is totalled without it.

Vehicle Insurance Schedule: What's Covered?

You may want to see also

Frequently asked questions

Gap insurance, or guaranteed asset protection, is an optional coverage that pays the difference between what your vehicle is worth and how much you owe on your car at the time it’s stolen or totalled.

Gap insurance covers what’s owed on a car after a total loss, whether that’s the result of an accident or vehicle theft.

Gap coverage can be worth it if you lease a vehicle or have a loan. You also don’t need it if your loan is paid down below the value of your car.

The cost of gap insurance varies but is usually inexpensive. If you buy gap insurance from a dealership, it can cost hundreds of dollars a year. If you add gap coverage to a car insurance policy, it typically increases your premium by around $40 to $60 per year.

You can get gap insurance from most major car insurance companies, though not all offer it. You can also get gap coverage from your dealership or auto lender when you purchase the vehicle.