Is Gap Insurance Mandatory in California?

Gap insurance is not mandatory in California. However, certain lenders may require customers to have it if they take out a car loan or lease.

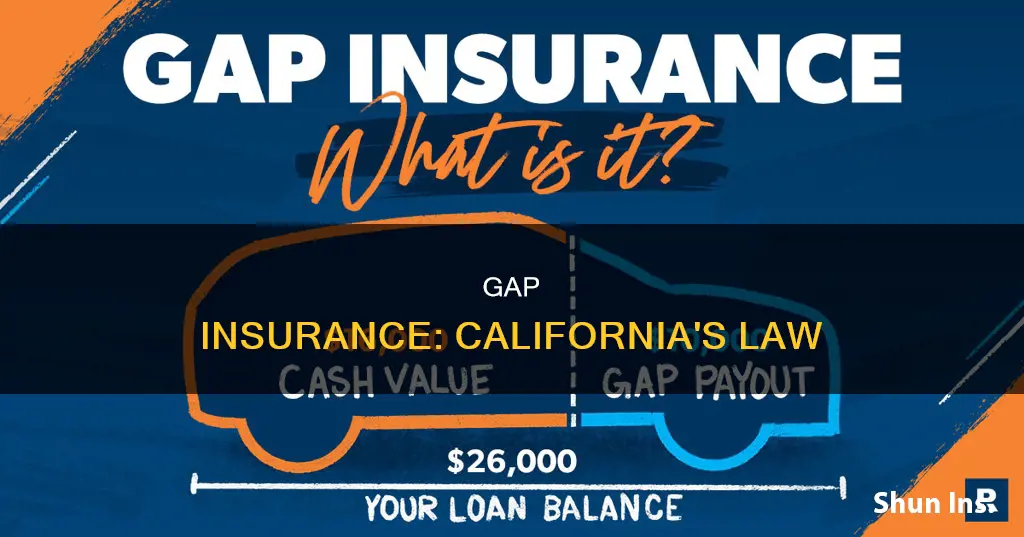

Gap insurance, or guaranteed asset protection insurance, covers the difference between the actual cash value of a vehicle and the outstanding loan balance if the car is stolen or written off. While not compulsory, gap insurance is worth considering for those with auto loans, especially if they have only made a small down payment, have a long loan term, or have negative equity from a previous car loan.

| Characteristics | Values |

|---|---|

| Is GAP insurance mandatory in California? | No, it is not mandatory. |

| Who might require GAP insurance? | Lenders may require customers to have GAP insurance if they get a car loan or lease. |

| Who is GAP insurance suitable for? | Those who have their car on lease or loan, those who have paid only 20% of their auto loan, those who have financed a car for more than 60 months, those with negative equity from a previous car loan, new drivers, those who drive a luxury vehicle that depreciates quickly, those who plan to drive long distances frequently. |

| How much does GAP insurance cost in California? | On average, $2,238 per year. However, Progressive offers GAP insurance for about $1,492 per year. It can also cost as little as $20 per year if added to an existing insurance policy. |

| Where can you buy GAP insurance in California? | From your car insurance company, from a company offering stand-alone GAP insurance policies, from your car dealer, or from the bank/financial institution which offered you a loan for purchasing your car. |

What You'll Learn

- Gap insurance is not required by California state law

- Lenders may require gap insurance for car loans or leases

- Gap insurance is worth it if you owe more on your car than it's worth

- Gap insurance costs vary depending on age, location, and insurance company

- You can buy gap insurance from insurance companies, dealerships, or lenders

Gap insurance is not required by California state law

Gap Insurance in California

Gap insurance is not mandatory in California. The state does not require any driver to carry gap insurance. However, certain lenders in California may require customers to carry gap insurance if they take out a car loan or lease.

Guaranteed Asset Protection (GAP) insurance is an optional type of auto insurance that covers the difference between the actual cash value (ACV) of your car and your outstanding loan balance if your vehicle is declared a total loss. This can happen if your car is stolen or damaged beyond repair.

If your car is stolen or totaled, your insurance provider will pay you the vehicle's ACV, taking into account factors such as its age and wear and tear. Gap insurance will then cover the remaining loan balance, ensuring you don't have to continue making payments on a car that is a total loss.

Who Should Consider Getting Gap Insurance?

While not required by law, gap insurance can be beneficial for those who:

- Lease their vehicle

- Have a low down payment on their car

- Have a long-term loan (over 60 months)

- Drive a luxury vehicle that depreciates quickly

- Plan to drive long distances frequently

Cost of Gap Insurance in California

The cost of gap insurance in California varies depending on factors such as your car's age, the insurance company, your location, and your age. On average, gap insurance costs around $2,238 per year. However, it can be as low as $20 per year when added to an existing collision and comprehensive policy.

Insuring Yourself to Drive Hospital Vehicles

You may want to see also

Lenders may require gap insurance for car loans or leases

While gap insurance is not mandatory in California, lenders may require it for car loans or leases. This is especially true for certain types of vehicles that depreciate faster, such as luxury cars. Lenders may also require gap coverage for leased vehicles.

Gap insurance, or guaranteed asset protection, covers the difference between the depreciated value of a car and the remaining loan amount in the event of a total loss. This type of insurance is beneficial for those who put little money down on a vehicle and choose a long payoff period, as they may owe more than the car's current value.

In California, dealers and lenders are not allowed to require gap waivers as a condition for financing. Additionally, they cannot consider a customer's decision not to purchase a gap waiver when setting the terms of a financing contract. However, certain lenders in California may still require customers to carry gap insurance if they obtain a car loan or lease.

It is important to note that gap insurance is optional and rarely required by lenders or lessors. The decision to purchase gap insurance depends on individual circumstances, such as the loan amount, down payment, and vehicle depreciation rate.

Encompass Gap Insurance: What's Covered?

You may want to see also

Gap insurance is worth it if you owe more on your car than it's worth

In California, gap insurance is not required by law. However, certain lenders in the state may require customers to carry gap insurance if they take out a car loan or lease. Gap insurance, or Guaranteed Auto Protection, covers the difference between the depreciated value of a car and the loan amount owed if the car is involved in an accident.

Gap insurance is worth purchasing when you owe more on your car loan or lease than the car is worth. This type of insurance is especially useful if you:

- Made a small down payment (less than 20%)

- Have a long finance period (over 5 years)

- Bought a vehicle that depreciates quickly

- Rolled over negative equity from an old car loan into the new loan

If your car is financed and you still have an outstanding loan balance, gap insurance can cover the remaining amount if your vehicle is totaled or stolen. In this case, your insurer will pay a maximum of the car's actual cash value (ACV), and gap insurance will cover the remaining loan amount.

The cost of gap insurance varies but is generally inexpensive, typically costing around $20-$60 per year when added to a car insurance policy that includes collision and comprehensive insurance. If purchased from a dealership, gap insurance can cost hundreds of dollars a year and is often added to your auto loan payments with interest.

Where Can I Buy Gap Insurance?

You can typically buy gap insurance from car insurance companies, banks, credit unions, or dealerships/auto lenders when you purchase the vehicle. However, it is usually cheaper to add gap coverage to an existing policy from an insurance company rather than buying it from a dealership.

Direct Line's Gap Insurance: What You Need to Know

You may want to see also

Gap insurance costs vary depending on age, location, and insurance company

Gap insurance is not mandatory in California or any other state in the US. However, certain lenders in California may require customers to carry gap insurance if they take out a car loan or lease.

The cost of gap insurance varies depending on several factors, including age, location, and the insurance company. Generally, gap insurance is cheaper when purchased from an insurance company than a dealership. Insurance companies typically charge an average of $20 to $40 per year when bundled with an existing insurance policy, while dealerships charge a flat rate of around $500 to $700.

Age can impact the cost of gap insurance as it is often priced at 5% to 6% of the collision and comprehensive premiums on an auto insurance policy. Therefore, older drivers with higher collision and comprehensive premiums may pay more for gap insurance.

Location can also affect the price of gap insurance, as state laws and regulations can influence insurance rates. Additionally, the actual cash value (ACV) of the vehicle and the auto insurance claims history can impact the cost.

When deciding on gap insurance, it is essential to consider the different rates offered by insurance companies and dealerships. It is worth noting that adding gap insurance to an existing insurance policy will only increase the comprehensive and collision insurance cost by a small percentage. On the other hand, purchasing gap insurance from a dealership will result in a higher overall cost, as the sum is usually added to the auto loan and accrues interest.

Audi Financial: Gap Insurance Essential?

You may want to see also

You can buy gap insurance from insurance companies, dealerships, or lenders

In California, gap insurance is not mandatory, and it is not required by law. However, certain lenders in California may require customers to carry gap insurance if they take out a car loan or lease.

Several insurance companies in California offer gap insurance, including Progressive, Allstate, and Nationwide. These companies provide various add-on coverage options and discounts, allowing customers to find the best policy for their needs.

Additionally, dealerships and lenders in California offer gap waivers, which are similar to gap insurance. When you purchase a gap waiver, the lender agrees to cancel any outstanding debt if your car is totalled or stolen and its actual cash value (ACV) is insufficient to cover the remaining loan amount. However, gap waivers are heavily regulated in California, and sellers are required to disclose certain information to buyers.

When deciding where to purchase gap insurance, it is essential to compare quotes from multiple providers and consider factors such as cost, coverage limits, and the reputation of the company.

Vehicle Insurance: Am I Covered?

You may want to see also

Frequently asked questions

No, GAP insurance is not mandatory in California. However, certain lenders in California may require customers to carry GAP insurance if they take out a car loan or lease.

Guaranteed Asset Protection (GAP) insurance is an optional type of auto insurance that covers the difference between the actual cash value of your car and the outstanding loan balance if your vehicle is declared a total loss.

The cost of GAP insurance in California varies depending on factors such as the age of the driver, the value of the car, the insurance company, and location. The average cost is $2,238 per year, but it can be as low as $20 per year when added to an existing insurance policy.