Geico offers auto insurance in Michigan, with local agents across the state who are familiar with the area and can help customers save money on their car insurance. The company offers a variety of discounts, including for safe driving, multi-policy holding, and good students. Geico also provides a DriveEasy discount, where customers can save by downloading and enrolling in the DriveEasy app, which uses telematics technology to monitor driving patterns and provide personalized feedback and savings.

| Characteristics | Values |

|---|---|

| Available in Michigan | Yes |

| Discounts | Good Student Discount, Multi-Car Discount, Five-Year Accident-Free "Good Driver" Discount, DriveEasy Discount, Multi-Policy Discount |

| Local Agents | Michael Sloan |

What You'll Learn

- Discounts for students, military personnel, federal employees, and members of professional, medical, and alumni organizations

- GEICO insurance agents in Michigan are knowledgeable about the area and can help customers save money

- GEICO offers a variety of discounts on auto insurance in Michigan

- GEICO offers comprehensive and collision coverage in Michigan

- GEICO offers Michigan car insurance for teen drivers

Discounts for students, military personnel, federal employees, and members of professional, medical, and alumni organizations

GEICO auto insurance is available in Michigan. Local GEICO agents in Michigan are well-versed in the needs of customers in the state and are always looking for ways to help them save money on car insurance.

GEICO offers a variety of discounts for students, military personnel, federal employees, and members of professional, medical, and alumni organizations.

Students

GEICO offers a Good Student Discount to students who maintain a B average or better. This discount allows students to save money on their car insurance while they focus on their studies and achieve their goals.

Military Personnel

GEICO provides special military discounts on insurance for service members, including those on active duty, retired from the Military, or a member of the National Guard or Reserves. They may be eligible for a discount of up to 15% on their total insurance premium. GEICO also offers Emergency Deployment Discounts to military members deploying to imminent danger pay areas designated by the Department of Defense (DoD) and approved by Congress.

Federal Employees

GEICO offers special discounts for federal employees.

Members of Professional, Medical, and Alumni Organizations

GEICO provides membership discounts for various professional, medical, and alumni organizations. GEICO contracts with different membership entities, and customers may qualify for a special discount based on their membership, employment, or affiliation with these organizations. For example, GEICO is proud to offer special savings to alumni association members, faculty, and staff of colleges and universities, including Howard University's Department of Alumni Relations.

Pursuing a Career as an Auto Insurance Adjuster

You may want to see also

GEICO insurance agents in Michigan are knowledgeable about the area and can help customers save money

GEICO auto insurance is available in Michigan. GEICO insurance agents in Michigan are well-versed in the area and are always eager to help customers save money on car insurance. They are knowledgeable about the unique requirements of Michigan's auto insurance laws and can guide customers through the process of obtaining the necessary coverage.

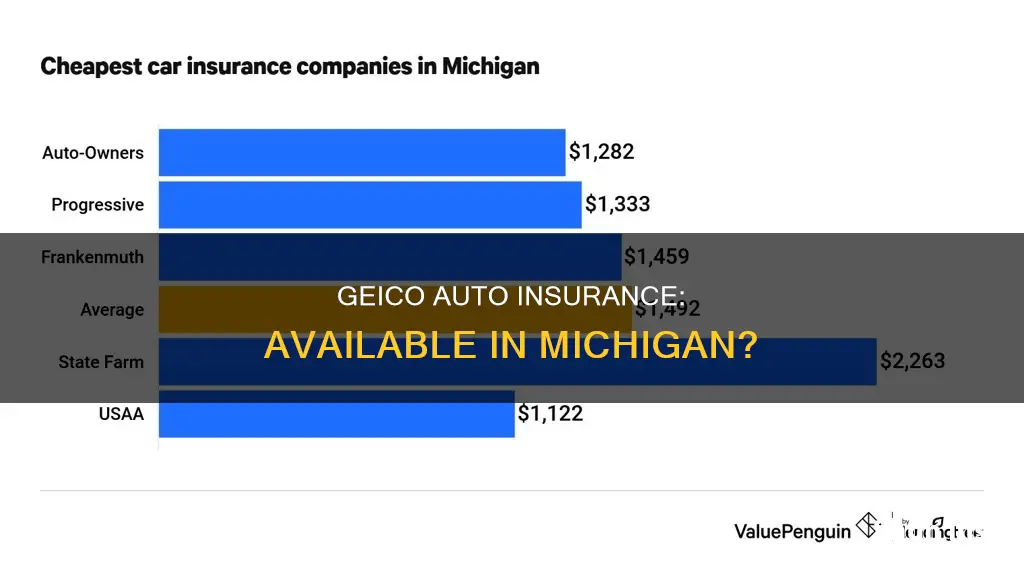

While GEICO's rates are already low, their agents in Michigan go above and beyond to help customers find even more ways to save. They can assist in exploring various discounts, such as those available for military personnel, federal employees, and members of professional, medical, and alumni organizations. GEICO also offers a range of Michigan-specific car insurance discounts, such as the Good Student Discount, the Multi-Car Discount, and the Five-Year Accident-Free "Good Driver" Discount.

It's important to note that obtaining a GEICO insurance quote in Michigan is a bit more complicated than in other states. There are no GEICO agents physically present in Michigan, and the company does not provide quotes online or by phone to Michigan residents. Instead, interested individuals must initiate the process by emailing GEICO with their name and mailing address. GEICO will then send a paper application, and it typically takes around a month for them to provide a quote.

Despite this unique process, GEICO insurance agents are dedicated to serving customers in Michigan and ensuring they receive the necessary coverage at the best possible rates. Their understanding of the local area and insurance landscape enables them to provide valuable guidance and help customers navigate the specific requirements of Michigan's auto insurance market.

Stored Vehicles: Do You Need Insurance?

You may want to see also

GEICO offers a variety of discounts on auto insurance in Michigan

- Good Student Discount: Students who maintain a B average or better are eligible for savings on their car insurance.

- Multi-Car Discount: Insuring multiple cars with GEICO can help drive down premiums.

- Five-Year Accident-Free "Good Driver" Discount: GEICO rewards safe driving habits and responsible behaviour on the road. If you've been accident-free for at least 5 years, you may be eligible for savings on your auto insurance premiums.

- DriveEasy Discount: GEICO offers a discount for downloading and enrolling in the DriveEasy app, which uses telematics technology to monitor driving patterns and provide personalized feedback and savings.

- Multi-Policy Discounts: GEICO offers a discount for bundling your auto insurance with other policies, such as property insurance.

In addition to these discounts, GEICO also offers special discounts for Military and federal employees, as well as membership discounts for various professional, medical, and alumni organizations.

Transferring Vehicle Ownership: IAA's Guide to Certificate Title Transfers

You may want to see also

GEICO offers comprehensive and collision coverage in Michigan

Yes, GEICO offers comprehensive and collision coverage in Michigan. Collision coverage pays for repairs to your car if it's damaged in a collision with another vehicle or object, regardless of who is at fault. This usually comes with a deductible that you must pay out of pocket before your insurance covers the remaining expenses. Comprehensive coverage, on the other hand, offers protection for damage caused to your vehicle by an accident that is not a collision. This can include damage from events such as theft, vandalism, natural disasters, and falling objects. While comprehensive coverage is not required by law, it provides valuable financial protection.

In addition to comprehensive and collision coverage, GEICO also offers other types of auto insurance coverage in Michigan. The state of Michigan requires drivers to maintain property protection insurance (PPI) and personal injury protection (PIP) as part of their auto insurance coverage. PPI covers damages to someone else's property caused by an accident involving your vehicle, with a mandated minimum limit of $1 million per accident. PIP covers expenses resulting from an accident, including medical bills, lost wages, and death benefits, regardless of fault. Michigan law also requires drivers to purchase uninsured and underinsured motorist coverage (UI/UIM) to protect you and your passengers in the event of an accident caused by an uninsured or underinsured driver.

GEICO offers a variety of Michigan car insurance discounts, including the Good Student Discount, Multi-Car Discount, Five-Year Accident-Free "Good Driver" Discount, DriveEasy Discount, and Multi-Policy Discounts.

Liability Insurance: Auto Claims Explained

You may want to see also

GEICO offers Michigan car insurance for teen drivers

GEICO offers a variety of discounts to help parents and teens save on car insurance costs. These include the Good Student Discount, which offers savings to students who maintain a B average or better, and the Five-Year Accident-Free "Good Driver" Discount, which rewards safe driving habits and responsible behavior on the road. GEICO also offers the DriveEasy Discount, which can be accessed through the GEICO mobile app. This app monitors driving patterns and rewards safe driving habits with a discount.

GEICO's insurance solutions are designed to support teens and their families every mile of the journey. The company offers resources aimed at promoting safe driving habits and coverage tailored to inexperienced drivers. GEICO understands that car insurance for teens can be pricier due to their lack of driving experience, but their insurance agents are eager to help find ways to save.

GEICO also offers special discounts for military and federal employees, as well as membership discounts for many professional, medical, and alumni organizations. With GEICO's low rates and variety of discounts, Michigan teens and their parents can find affordable car insurance options.

Car Collision: Insurance Impact

You may want to see also

Frequently asked questions

Yes, GEICO offers auto insurance in Michigan.

The state of Michigan requires drivers to have property protection insurance (PPI) and personal injury protection (PIP) as part of their auto insurance coverage. Drivers must also carry bodily injury liability insurance and uninsured and underinsured motorist coverage (UI/UIM).

GEICO offers various discounts on auto insurance in Michigan, including good student discounts, multi-car discounts, safe driver discounts, and more.

You can get a quote for GEICO auto insurance in Michigan by visiting the GEICO website or contacting a local GEICO insurance agent in the state.

You can report an auto claim with GEICO anytime online, through the GEICO mobile app, or over the phone.