Collision insurance is a type of auto insurance that covers the cost of repairing or replacing your car after a crash or collision with an object or another vehicle. While it is not required by law, it is often mandatory if you are leasing or financing your car. Collision insurance is also a good idea if you are a new or inexperienced driver, or if you drive frequently or in areas of high-volume traffic. If you are at fault in an accident, your collision insurance policy will still cover the cost of repairs, whereas liability insurance will not.

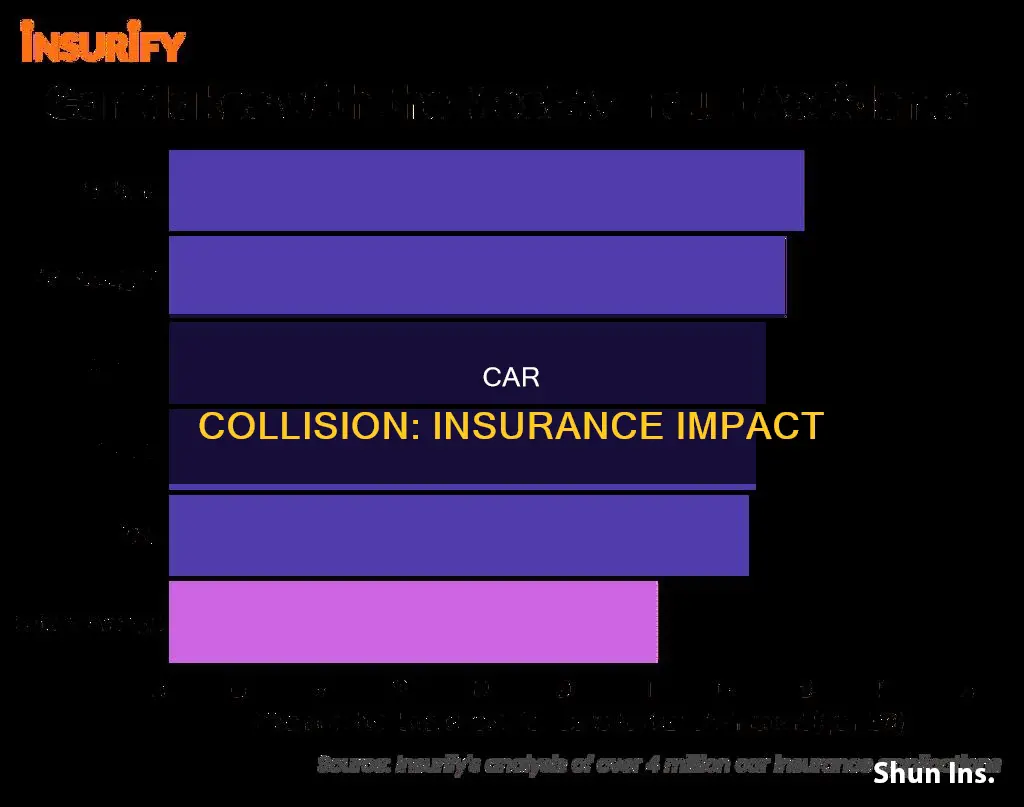

If you cause an accident, your car insurance rates are likely to increase, with the national average rate increase being 45% after an accident with property damage, and 47% after an accident resulting in injuries. However, this increase will depend on your insurance company and state, and may decrease over time if you drive without incident.

| Characteristics | Values |

|---|---|

| Is collision insurance required by law? | No, but it may be required by your lender or lessor if your car is not fully paid off. |

| Does collision insurance cover damage to other vehicles or objects? | No, it only covers damage to the policyholder's vehicle. |

| Does collision insurance cover bodily injuries? | No, it only covers vehicular damage. |

| Does collision insurance cover theft? | No, this is covered by comprehensive insurance. |

| Does collision insurance cover rental car accidents? | It may, but rental car insurance varies by state. |

| Does collision insurance cover vandalism? | No, this is covered by comprehensive insurance. |

| Is collision insurance needed for an old car? | It depends on the value of the car and whether it's paid off. |

| Does collision insurance cover other drivers? | No, it only covers the policyholder's vehicle. |

| Does collision insurance cover hit-and-run accidents? | Yes, but it does not cover bodily injuries sustained in a hit-and-run accident. |

What You'll Learn

Collision insurance is required for financed vehicles

If you're buying a vehicle with a loan from a bank or lender, you'll likely be required to have collision insurance on top of comprehensive and liability insurance. This is known as "full coverage". Lenders require this to protect their investment in case the vehicle is damaged or written off.

Collision insurance covers the cost of repairing or replacing your car if you crash into another vehicle or object, such as a lamppost or a tree. It also covers hit-and-runs, rollovers, and damage caused by uninsured or underinsured drivers.

Collision coverage is often sold alongside comprehensive insurance, which covers non-crash types of damage like fire, hail, theft, or flooding. "Full coverage" insurance typically includes collision and comprehensive insurance, as well as any state-mandated coverage types like liability insurance.

The cost of collision insurance varies depending on factors like the value of your car, your chosen deductible, and your location. On average, full coverage insurance in the US costs around $1,700 per year, but rates can be much higher or lower depending on your specific situation.

You can consider dropping collision insurance when the cost of the coverage plus the collision deductible is higher than the current market value of your car. It may also be worth dropping if the value of your car is equal to or less than your deductible, as the coverage won't pay out much, if anything, in a total loss.

Insuring Your New Car in California: Time Limit?

You may want to see also

Collision insurance is not required by law

If you decide against collision insurance, you may be responsible for costly repairs or replacements in the event of an accident. Collision insurance can cover these expenses, even if you are at fault for the accident. Without it, you will have to pay for repairs or a new vehicle yourself.

In some cases, the other driver's insurance may not cover the full cost of damages to your vehicle. Collision insurance can help in this situation, too.

Collision insurance is often required if you have a car loan or lease, but it is not always worth it. As your car gets older and loses value, you may decide to drop collision coverage. If the cost of collision insurance and the collision deductible is higher than the current market value of your car, it may not be worth keeping.

Collision insurance is also not a good choice if the value of your car is low. Be sure to research your car's worth before deciding.

Insurance Companies: Vehicle Value Determinants

You may want to see also

Collision insurance covers hit-and-run accidents

If you do not have collision coverage, you may consider uninsured motorist property damage (UMPD) insurance. In most states, a driver who flees the scene of an accident is considered "uninsured" by insurance companies. UMPD coverage is mandated in some states and available in others, though not all. It typically has a deductible that you will need to pay out of pocket. It's important to note that some states require contact with the vehicle responsible for the hit-and-run for UMPD to apply, and the at-fault driver must be identified in certain states.

If you are the victim of a hit-and-run accident, your insurance policy may help cover the cost of repairs and injuries. In addition to collision and UMPD coverage, uninsured motorist bodily injury (UMBI), personal injury protection (PIP), and medical payments (Med Pay) coverages may also apply, depending on your policy and state.

Vehicle Service Contracts: Insured?

You may want to see also

Collision insurance covers damage to your vehicle in a collision

Collision insurance is an optional add-on to your basic auto insurance policy. It covers the cost of repairing or replacing your car if you collide with another vehicle or object, such as a lamppost or a tree. It also covers damage from hitting a pothole, rolling your car, or if another driver hits your car and doesn't have enough insurance to cover the damage. It's important to note that collision insurance does not cover damage to your car from non-traffic events like theft, extreme weather, or vandalism.

The cost of collision insurance can be high, but you can lower your premiums by choosing a higher deductible. Collision insurance is usually required by lenders if you are financing or leasing your car. If you own your car outright, it's worth considering collision insurance for peace of mind, especially if you drive an expensive car or wouldn't be able to afford repairs after a crash.

When deciding whether to get collision insurance, it's essential to weigh the cost of the insurance and the deductible against the value of your car. Collision insurance might not be worth it if your car is older and has a low market value, as the payout may not be much in the event of a total loss. Additionally, if the collision deductible combined with the total cost of the coverage is higher than your car's market value, it might be more beneficial to drop the collision insurance.

If you decide to get collision insurance, it's important to understand how it works in case you need to file a claim. First, document the damage and contact your insurer to see if you're eligible for reimbursement. If the damage exceeds your deductible, it's likely worth filing a claim. Your insurer will send an adjuster to inspect and estimate the cost of repairs. If you accept their estimate, they will cover the cost of repairs minus your deductible.

Antique Vehicle Insurance: Cheaper Option?

You may want to see also

Collision insurance is costly

Collision insurance is an optional insurance coverage that pays to repair or replace your car if you crash into another vehicle or object, such as a lamppost or a tree. While it is not required by law, it can be costly, especially if you have a history of accidents or live in a state with high insurance rates.

Factors Affecting the Cost of Collision Insurance

The cost of collision insurance can vary depending on several factors:

- Age and Value of Your Car: Collision insurance might not be worth it if you have an old car or a car with a low market value. In such cases, the cost of the insurance might exceed the value of the car, making it impractical to maintain coverage.

- Deductible Amount: Choosing a higher deductible can lower your premium costs. However, this also means you'll have to pay more out of pocket if you need to file a claim.

- State of Residence: Insurance rates can vary significantly from state to state. For example, in 2019, the average annual cost of collision insurance in Washington, D.C., was $539.48, while in South Dakota, it was $248.09.

- Driving Record: If you have a history of accidents or traffic violations, your insurance rates are likely to be higher.

- Other Factors: Insurance companies also consider personal details such as age, gender, marital status, and the number of miles driven when determining insurance rates.

Alternatives to Collision Insurance

If you decide that collision insurance is too costly, there are a few alternatives to consider:

- Liability Insurance: This type of insurance covers damages to another person's vehicle if you cause an accident, but it does not cover repairs to your own car.

- Comprehensive Insurance: This type of insurance covers non-crash-related damage to your vehicle, such as theft, vandalism, or natural disasters.

- Usage-Based Insurance: Some insurance companies offer usage-based programs that track your driving habits and offer discounts for safe driving.

While collision insurance can provide valuable protection in the event of an accident, it is important to weigh the costs and benefits before purchasing this type of coverage. By considering factors such as your car's value, your driving record, and your state of residence, you can make an informed decision about whether collision insurance is worth the cost.

Dropping Vehicle Insurance: Sunday Options

You may want to see also

Frequently asked questions

Yes, if you are at fault for the collision, your insurance premium will likely increase. The national average rate increase is 45% after an accident with property damage, and 47% for causing an accident that results in injuries.

Collision insurance is a type of auto insurance that covers the cost of repairing or replacing your car after a collision with another vehicle or object, regardless of who is at fault.

Collision insurance is not required by law, but it may be required by your lender or leasing company if you are financing or leasing your vehicle.

Collision insurance covers the cost of repairing or replacing your vehicle after a collision with another vehicle or object. It does not cover damage to other vehicles or objects, or bodily injuries sustained in the accident.

The cost of collision insurance varies depending on factors such as the value of your vehicle, your driving record, and the deductible you choose. A higher deductible will result in a lower premium.