HealthLink Insurance Medicaid is a vital program designed to provide healthcare coverage to low-income individuals and families in the United States. This government-funded initiative ensures that those who might not otherwise have access to medical insurance can receive essential healthcare services. The program is a collaboration between the federal government and individual states, offering a range of benefits, including doctor visits, hospital stays, prescription drugs, and mental health services. Understanding the specifics of HealthLink Insurance Medicaid coverage and eligibility criteria is crucial for those seeking affordable healthcare options.

What You'll Learn

- Medicaid Coverage: Understanding eligibility and benefits for healthcare services

- HealthLink Portal: Accessing online resources for Medicaid-related information and claims

- Provider Networks: Locating in-network healthcare providers for Medicaid patients

- Enrollment Process: Steps to enroll in Medicaid and manage coverage

- Fraud Prevention: Measures to protect Medicaid from abuse and ensure program integrity

Medicaid Coverage: Understanding eligibility and benefits for healthcare services

Medicaid is a federal and state-funded program that provides healthcare coverage to low-income individuals and families. It is a joint effort between the federal government and states to ensure that those who need it most have access to essential healthcare services. Understanding the eligibility criteria and benefits of Medicaid is crucial for individuals seeking affordable healthcare options.

Eligibility for Medicaid is primarily based on income and financial status. The program aims to assist those with limited financial resources, and the specific income guidelines vary by state. Generally, Medicaid is available to individuals and families with incomes below a certain threshold, often set at or below the federal poverty level. This threshold is adjusted annually to account for inflation and changing economic conditions. For example, in 2023, the federal poverty level for a family of three is set at $23,520, and states may have slightly different criteria. Applicants must also meet other requirements, such as being a U.S. citizen or legal permanent resident and meeting specific residency criteria in the state where they apply.

The benefits provided by Medicaid are extensive and designed to cover a wide range of healthcare services. Enrollees typically have access to primary care, including doctor visits, vaccinations, and preventive care. Medicaid also covers essential health benefits mandated by the Affordable Care Act, such as hospitalization, emergency services, maternity and newborn care, mental health services, and prescription drugs. Additionally, some states offer expanded benefits, providing coverage for dental, vision, and long-term care services. These additional benefits can significantly improve access to comprehensive healthcare for Medicaid recipients.

To apply for Medicaid, individuals can contact their state's Medicaid agency or use the online application process, often available through the state's health insurance marketplace. The application process may require providing documentation to verify income, citizenship status, and residency. Once approved, beneficiaries receive a Medicaid ID card, which they can use to access healthcare services. It is essential to note that eligibility and benefits can vary by state, so it is advisable to check with your specific state's Medicaid program for detailed information.

In summary, Medicaid coverage is a vital resource for low-income individuals and families, offering essential healthcare services and financial protection. Understanding the eligibility criteria and benefits is key to accessing this program. By meeting the income and residency requirements, individuals can take advantage of the comprehensive healthcare coverage provided by Medicaid, ensuring they receive the necessary care without incurring significant financial burdens.

Unveiling Florida's Medicaid Gym Coverage: A Healthy Investment?

You may want to see also

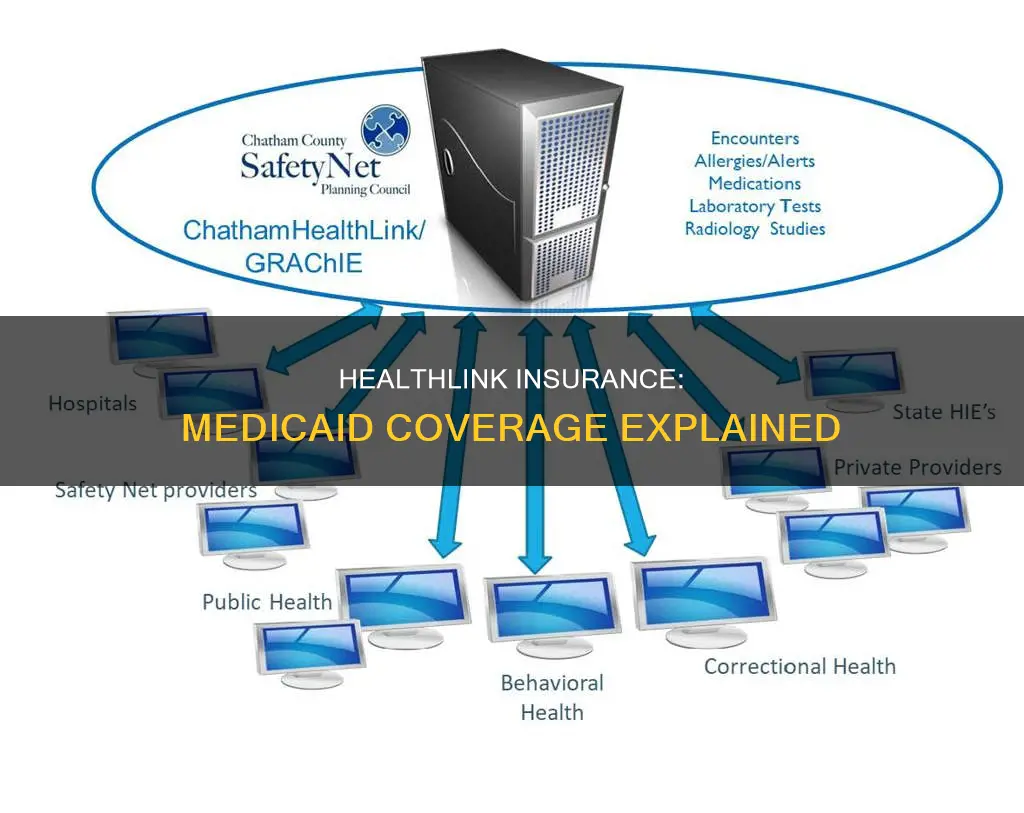

HealthLink Portal: Accessing online resources for Medicaid-related information and claims

The HealthLink Portal is an invaluable online resource for individuals enrolled in Medicaid, offering a comprehensive platform to manage healthcare-related tasks efficiently. This user-friendly interface provides a secure and convenient way to access vital information and services, ensuring that enrollees can take control of their healthcare journey. Here's a step-by-step guide on how to utilize the HealthLink Portal for Medicaid-related matters:

Accessing the Portal: Begin by visiting the official HealthLink website, which is typically accessible through a simple online search. The portal's homepage will display various options and resources tailored to Medicaid beneficiaries. You may need to create an account if you haven't already, ensuring that your personal information is secure and private. This initial step is crucial for personalized access to your Medicaid benefits.

Navigating the Dashboard: Once logged in, you'll typically find a dashboard that serves as your central hub. Here, you can view a summary of your Medicaid coverage, including important details such as your enrollment status, coverage type, and any associated benefits. This overview provides a quick reference for your Medicaid-related information.

Information and Resources: The HealthLink Portal is designed to be a one-stop shop for all things Medicaid. You can explore different sections to access a wealth of resources. For instance, the 'Benefits' section might detail the specific healthcare services covered by your Medicaid plan, while the 'Provider Network' area could list in-network healthcare providers, making it easier to find suitable medical professionals. Additionally, you can find educational materials, FAQs, and guides to enhance your understanding of Medicaid programs and your rights as an enrollee.

Submitting Claims and Requests: One of the most practical aspects of the HealthLink Portal is the ability to submit claims and requests online. If you've received medical services, you can initiate the claims process to ensure timely reimbursement. The portal might provide an online form or a secure messaging system to communicate your needs. For example, you can request prescription refills, schedule appointments, or report any issues related to your Medicaid coverage directly through the portal.

Security and Privacy: It is essential to understand that the HealthLink Portal prioritizes security and privacy. All personal and medical information is encrypted, ensuring that your data remains confidential. You should be able to manage your account settings, update personal details, and control access to your information. Regularly review the portal's privacy policy to stay informed about how your data is handled.

By utilizing the HealthLink Portal, Medicaid enrollees can efficiently manage their healthcare, access relevant information, and promptly address any concerns. This online platform empowers individuals to take an active role in their healthcare journey, making it an invaluable tool for those relying on Medicaid services. Remember, each state's Medicaid program may have its own specific portal and features, so always refer to the official resources for accurate and up-to-date information.

Life Insurance and Medicaid: Navigating Dual Coverage

You may want to see also

Provider Networks: Locating in-network healthcare providers for Medicaid patients

When it comes to Medicaid, understanding the provider network is crucial for patients to ensure they receive the best possible care while managing their healthcare costs. Medicaid, a joint federal and state program, offers healthcare coverage to eligible individuals and families with limited income. One of the key aspects of this program is the provider network, which plays a significant role in patient care and coverage.

Provider networks are groups of healthcare professionals, including doctors, hospitals, and other medical facilities, who have agreed to provide services to Medicaid patients at reduced rates. These networks are designed to ensure that Medicaid beneficiaries have access to a wide range of medical services while keeping costs affordable. When a patient enrolls in Medicaid, they are typically assigned to a specific provider network, which they must use to receive full coverage benefits.

Locating in-network healthcare providers is essential for Medicaid patients as it directly impacts their out-of-pocket expenses. In-network providers have negotiated rates with the Medicaid program, meaning their services are covered at a higher rate, often with minimal or no copayments for patients. Out-of-network providers, on the other hand, may not have these negotiated rates, leading to higher out-of-pocket costs for patients. Therefore, patients should verify their providers' network status to avoid unexpected financial burdens.

To locate in-network healthcare providers, Medicaid patients can start by checking their Medicaid ID card or enrollment documents. These resources usually provide information about the assigned provider network and contact details for network providers. Additionally, patients can contact their local Medicaid office or the state's Medicaid agency for assistance in finding in-network providers in their area. Many states also offer online directories or mobile apps that allow patients to search for healthcare providers within their Medicaid network.

It is important for Medicaid patients to understand that while in-network providers offer the most cost-effective care, they may not always be the most convenient or specialized. In such cases, patients can request a referral from their primary care physician to an out-of-network specialist, but they should be prepared for higher out-of-pocket costs. Being aware of the provider network and its benefits is a crucial step in managing healthcare effectively while enrolled in Medicaid.

Maximize Your Life Insurance: Strategies to Shield from Medicaid

You may want to see also

Enrollment Process: Steps to enroll in Medicaid and manage coverage

The process of enrolling in Medicaid can vary slightly depending on your state, but here is a general step-by-step guide to help you navigate the enrollment process and manage your coverage effectively.

Step 1: Determine Your Eligibility

Before enrolling, it's crucial to understand if you qualify for Medicaid. Medicaid eligibility is based on income, family size, and other specific criteria. You can check your state's Medicaid website or contact your local Medicaid office to assess your eligibility. Factors such as income, pregnancy status, disability, or being a senior citizen can influence your eligibility.

Step 2: Gather Required Documents

Once you confirm your eligibility, you'll need to gather the necessary documents to support your application. This typically includes proof of identity, such as a birth certificate or passport, proof of residency, income verification (e.g., pay stubs, tax returns), and information about any existing health coverage. Having these documents ready will streamline the enrollment process.

Step 3: Complete the Application

You can apply for Medicaid online, by mail, or in person. Many states offer online applications through their official healthcare portals, making it convenient and efficient. Fill out the application form accurately and provide all the required information. If you prefer, you can also download the application form from the state's Medicaid website and submit it by mail or in person at your local Medicaid office.

Step 4: Submit Your Application

After completing the application, submit it to the appropriate authority. If you applied online, the system will process your application immediately. For mail or in-person submissions, ensure you follow the instructions provided by your state's Medicaid program. You may be required to provide additional documentation or attend an interview to verify your information.

Step 5: Wait for Approval and Receive Your Coverage

The processing time for Medicaid applications can vary, but you will receive a notification regarding the status of your application. If approved, you will be provided with your Medicaid ID card, which serves as proof of your coverage. This card will enable you to access healthcare services covered by Medicaid. It's essential to review your coverage details and understand the benefits and limitations of your plan.

Managing Your Coverage:

Once enrolled, you can manage your Medicaid coverage by staying updated on any changes in your eligibility or benefits. You can contact your local Medicaid office or log in to your online account (if available) to review your coverage details, update your contact information, and make any necessary changes. Regularly checking for updates ensures that your coverage remains accurate and up-to-date.

Insurance Coverage for Compounded Medications: What You Need to Know

You may want to see also

Fraud Prevention: Measures to protect Medicaid from abuse and ensure program integrity

Medicaid, a vital public assistance program, is susceptible to fraud, waste, and abuse, which can significantly impact its effectiveness and sustainability. Fraudulent activities not only result in financial losses but also undermine the program's integrity and erode public trust. To safeguard Medicaid and ensure its long-term viability, robust fraud prevention measures are essential. Here are some comprehensive strategies to protect the program from abuse and maintain its integrity:

Enhanced Screening and Verification: Implementing rigorous screening processes for all applicants is crucial. This includes verifying eligibility criteria, such as income, residency, and citizenship. Advanced data analytics can be employed to identify patterns and anomalies in applications, flagging potential fraud. For instance, using predictive modeling to detect unusual claim patterns or discrepancies in patient information can help identify fraudulent activities. Regular audits and random checks of enrolled beneficiaries can further reinforce this process.

Strengthening Provider Networks: Medicaid fraud often involves fraudulent billing practices by healthcare providers. Establishing a robust provider network with stringent background checks and ongoing monitoring can mitigate this risk. All healthcare providers should undergo a comprehensive screening process, including checking their medical licenses, malpractice history, and previous disciplinary actions. Regular performance reviews and feedback systems can ensure that providers adhere to ethical standards and billing guidelines. Additionally, implementing a real-time claims processing system can help identify and flag unusual billing patterns promptly.

Educating Healthcare Professionals: Raising awareness among healthcare professionals about the consequences of fraud is essential. Providing comprehensive training and educational programs can help prevent fraudulent activities. These programs should emphasize the importance of ethical billing practices, patient confidentiality, and the legal implications of fraud. By fostering a culture of integrity, healthcare providers can become the first line of defense against Medicaid fraud.

Implementing Advanced Technology: Technology plays a pivotal role in fraud detection and prevention. Advanced data analytics, machine learning algorithms, and artificial intelligence can analyze vast amounts of data to identify suspicious activities. These tools can detect patterns in fraudulent claims, identify potential abuse, and flag high-risk cases. Additionally, implementing secure electronic health record systems can ensure data integrity and make it easier to verify patient information.

Collaborative Efforts and Information Sharing: Fraud prevention requires collaboration between various stakeholders, including state agencies, healthcare providers, law enforcement, and technology experts. Establishing inter-agency task forces and information-sharing platforms can facilitate the exchange of data and best practices. By combining resources and expertise, these collaborative efforts can effectively combat fraud on a larger scale. Regular meetings and joint initiatives can also help identify emerging trends and adapt prevention strategies accordingly.

In summary, protecting Medicaid from fraud requires a multi-faceted approach that combines enhanced screening, robust provider networks, education, advanced technology, and collaborative efforts. By implementing these measures, the program can maintain its integrity, ensure efficient resource allocation, and provide quality healthcare services to those in need. It is crucial to stay vigilant and adapt strategies as new challenges and fraud patterns emerge in the dynamic landscape of healthcare.

Is Medical Mutual a Good Insurance Choice?

You may want to see also

Frequently asked questions

HealthLink Insurance is a health insurance program designed to provide coverage for individuals and families who qualify for Medicaid. It is a state-run program that offers a range of health benefits, including doctor visits, hospital stays, prescription drugs, and more.

Eligibility for HealthLink Insurance is based on income and other factors. You can check your eligibility by visiting the Medicaid website or contacting your local Medicaid office. They will guide you through the application process and help determine if you qualify.

HealthLink Insurance typically covers essential health benefits, including preventive care, doctor visits, emergency services, hospitalization, maternity care, mental health services, and prescription drugs. The specific coverage may vary by state, so it's important to review the details of the program in your region.

HealthLink Insurance has a network of participating healthcare providers. When you use in-network providers, you usually pay less out-of-pocket. It's recommended to use the provider directory provided by your Medicaid program to find in-network doctors, hospitals, and pharmacies to ensure you receive the full benefits of your coverage.