Becoming a medical insurance agent can be a rewarding career path for those interested in the healthcare industry and helping individuals navigate the complexities of insurance coverage. This role involves assisting clients in understanding and selecting the right health insurance plans to meet their needs. To embark on this journey, one typically starts by acquiring a solid understanding of the healthcare system and insurance policies. This includes knowledge of various insurance types, coverage options, and the ability to explain these concepts clearly to clients. Obtaining relevant certifications, such as those offered by reputable insurance organizations, can enhance credibility and provide a competitive edge in the job market. Additionally, building strong communication and interpersonal skills is crucial for effectively advising clients and fostering long-term relationships.

What You'll Learn

- Education & Licensing: Obtain necessary degrees and licenses for the role

- Product Knowledge: Study medical insurance plans, coverage, and benefits

- Sales Techniques: Learn effective strategies to sell insurance to potential clients

- Customer Service: Develop skills to provide excellent support to policyholders

- Regulatory Compliance: Understand and adhere to industry regulations and laws

Education & Licensing: Obtain necessary degrees and licenses for the role

To become a medical insurance agent, you'll need to follow a structured path that involves both education and licensing. This profession demands a strong foundation in healthcare and insurance principles, along with the ability to navigate complex regulations. Here's a breakdown of the educational and licensing requirements:

Education:

A bachelor's degree is typically the minimum educational requirement for becoming a medical insurance agent. Many employers prefer candidates with a degree in fields related to healthcare, business, finance, or insurance. Courses in healthcare administration, risk management, insurance principles, and medical terminology can be particularly beneficial. These programs provide a solid understanding of the healthcare system, insurance processes, and the legal and ethical considerations involved in the industry.

Consider pursuing a master's degree or advanced certification if you aspire to take on more specialized roles or senior-level positions. A Master of Business Administration (MBA) with a concentration in healthcare management or a Master's in Healthcare Administration can open doors to leadership and management positions within insurance companies or healthcare organizations.

Licensing:

Obtaining the necessary licenses is a crucial step in becoming a legally authorized medical insurance agent. The specific licensing requirements vary by state, so it's essential to research the regulations in your intended state of practice. Here's a general overview:

- Life and Health Insurance License: This is the most common license for medical insurance agents. It typically requires passing a state-administered exam, such as the Life and Health Insurance Producer Exam (also known as the Series 6-2 or 7-2). This exam covers a range of topics, including insurance principles, ethics, state regulations, and product knowledge.

- State-Specific Licenses: In addition to the life and health insurance license, some states require additional specialized licenses. For example, you might need a property and casualty insurance license or a health insurance agent license, depending on the specific services you plan to offer.

- Continuing Education: Most states mandate ongoing education to maintain your license. This ensures that agents stay updated with changing regulations, industry trends, and best practices. You'll typically need to complete a certain number of hours of continuing education courses every year to renew your license.

Remember, the licensing process can be complex, and requirements may vary. It's crucial to consult with your state's insurance department or regulatory body to understand the specific licensing pathways and any additional certifications or training they may require.

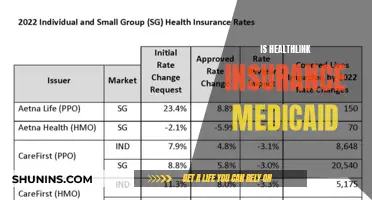

Medicaid Coverage: Navigating Deductibles from Primary Insurance

You may want to see also

Product Knowledge: Study medical insurance plans, coverage, and benefits

To become a medical insurance agent, a comprehensive understanding of insurance products is essential. This knowledge is the foundation of your career, as it enables you to advise clients effectively and build trust. Here's a detailed guide on how to study and master medical insurance plans, coverage, and benefits:

- Understand the Basics of Insurance: Begin by grasping the fundamental concepts of insurance. Learn about the different types of insurance, such as health, life, disability, and property insurance. Understand the principle of risk transfer and how insurance companies manage and mitigate risks. Familiarize yourself with the insurance industry's terminology, including terms like 'premium,' 'deductible,' 'co-pay,' 'copayment,' 'coinsurance,' and 'network.'

- Study Medical Insurance Plans: Medical insurance plans are complex, and each plan has unique features. Here's how to approach this:

- Plan Types: Learn about various medical insurance plans, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Point-of-Service (POS) plans. Understand the differences between these models and their impact on coverage and costs.

- Coverage Details: Study the specific coverage provided by different plans. This includes understanding what services are covered (e.g., doctor visits, hospitalization, prescription drugs), the extent of coverage (annual or lifetime limits), and any exclusions or limitations.

- Network and Providers: Explore the concept of provider networks. Understand how in-network and out-of-network providers affect costs and coverage. Learn how to locate and utilize in-network providers to maximize benefits for clients.

Analyze Coverage and Benefits: This is a critical aspect of your role as a medical insurance agent.

- Benefits Breakdown: Study the benefits offered by various plans, such as preventive care, emergency services, maternity care, mental health coverage, and prescription drug coverage. Understand the specific conditions and limitations associated with each benefit.

- Cost Structure: Analyze the cost structure of medical insurance plans. This includes understanding deductibles, co-pays, coinsurance rates, and any out-of-pocket maximums. Learn how these factors impact the overall cost for the insured individual.

- Specialized Coverage: Explore specialized coverage options like critical illness insurance, disability insurance, and long-term care insurance. Understand when and why these additional coverage types might be beneficial for clients.

Stay Updated: Medical insurance plans and regulations are subject to frequent changes. Stay updated by:

- Industry Publications: Regularly read industry publications, newsletters, and websites to keep informed about new plan offerings, regulatory changes, and industry trends.

- Government Resources: Government health insurance websites provide valuable information on plan options, eligibility, and enrollment processes.

- Continuing Education: Consider taking courses or attending workshops to enhance your knowledge. Many insurance companies and associations offer training programs to keep agents updated on product changes and industry developments.

Practice and Apply: Learning by doing is crucial. Practice analyzing different medical insurance plans and their benefits. Create sample scenarios and test your knowledge by identifying the best plan for specific client needs. This practical approach will reinforce your understanding and help you become more confident in your product knowledge.

Unraveling Insurance Coverage: Weight Loss Medication and Your Plan

You may want to see also

Sales Techniques: Learn effective strategies to sell insurance to potential clients

To excel in selling medical insurance, it's crucial to understand your target audience and tailor your approach accordingly. Begin by identifying the specific needs and concerns of potential clients. For instance, some individuals might be seeking comprehensive coverage for a family, while others may prioritize affordable premiums for individual plans. By understanding these preferences, you can offer personalized solutions that resonate with their unique circumstances.

One powerful sales technique is to build trust and establish rapport with potential clients. People are more likely to purchase insurance from someone they trust and feel comfortable with. Achieve this by actively listening to their concerns, addressing their questions, and providing honest and transparent information about the insurance products you offer. Share success stories or testimonials from satisfied customers to build credibility and confidence in your recommendations.

Utilize active selling techniques to engage your prospects. Instead of a one-way monologue, involve them in the conversation. Ask open-ended questions to understand their priorities and preferences. For example, "What are your main concerns regarding healthcare coverage at the moment?" or "What features do you value most in an insurance plan?" This interactive approach makes the sales process more engaging and allows you to offer solutions that align with their specific needs.

Provide valuable information and educate your clients about the insurance products. Many people feel overwhelmed by the complexity of insurance policies, so offering clear explanations and comparisons can be immensely helpful. Break down the features and benefits of different plans, highlighting how each aspect addresses specific concerns. For instance, explain how a particular policy's high-deductible option can lower monthly premiums but requires more out-of-pocket expenses for certain services.

Finally, focus on building long-term relationships with your clients. Insurance sales are not just about the initial sale; they are about providing ongoing value. Stay in touch, offer periodic reviews of their policies, and promptly address any concerns or changes in their circumstances. By demonstrating your commitment to their well-being, you can foster loyalty and potentially secure repeat business.

Employer Flexibility in Medical Insurance Contributions: Exploring Options

You may want to see also

Customer Service: Develop skills to provide excellent support to policyholders

Customer service is a critical aspect of being a medical insurance agent, as it directly impacts the satisfaction and loyalty of your clients. Here's a guide on developing the necessary skills to excel in this area:

Active Listening: One of the most important skills for customer service is the ability to listen attentively. When interacting with policyholders, focus on understanding their concerns, questions, or complaints. Pay close attention to their words, tone, and body language. Active listening ensures that you grasp the issue at hand and can provide tailored solutions. Practice giving your full attention to each customer, making them feel valued and understood.

Empathy and Patience: Developing empathy is key to building strong relationships with clients. Try to put yourself in their shoes and understand their unique circumstances. Show genuine care and compassion, especially during challenging conversations. Patience is also essential; some customers may be anxious or frustrated, and maintaining a calm and composed demeanor will help defuse tension. Take the time to explain complex insurance concepts in a simple and understandable manner.

Quick Problem-Solving: Efficient problem-solving is a hallmark of excellent customer service. Train yourself to identify issues promptly and offer immediate solutions. Stay updated on company policies and procedures to provide accurate and timely assistance. If a problem requires further investigation, assure the customer that you will take the necessary steps and provide regular updates. Quick response times and effective problem-solving can significantly enhance customer satisfaction.

Effective Communication: Clear and concise communication is vital. Ensure that you explain policy details, coverage options, and any changes or updates in a straightforward manner. Avoid using jargon that might confuse customers. Adapt your communication style to suit different personalities and preferences. Whether it's over the phone, email, or in-person interactions, maintain a professional yet friendly tone to create a positive customer experience.

Continuous Learning: The insurance industry is ever-evolving, with new products, regulations, and customer needs emerging regularly. Stay updated on industry trends and changes in company policies. Attend training sessions, webinars, or workshops to enhance your knowledge. By continuously learning, you can provide the most relevant and up-to-date information to your clients, ensuring their needs are met effectively.

Tummy Tuck Coverage: Understanding Medical Insurance Options

You may want to see also

Regulatory Compliance: Understand and adhere to industry regulations and laws

When pursuing a career as a medical insurance agent, understanding and adhering to industry regulations and laws is paramount. The insurance sector is heavily regulated to protect consumers and ensure fair practices. Here's a detailed guide on how to navigate this crucial aspect of your profession:

Research and Stay Informed: Begin by thoroughly researching the regulatory framework governing medical insurance. This includes federal and state laws, as well as industry-specific regulations. Familiarize yourself with the regulations set by the relevant insurance departments and agencies. For instance, in the United States, the federal government's Health Insurance Portability and Accountability Act (HIPAA) sets standards for protecting personal health information. Similarly, each state has its own insurance department that provides guidelines and rules for insurance agents.

Obtain Necessary Licenses and Certifications: To become a medical insurance agent, you'll typically need to obtain specific licenses and certifications. These requirements vary by location, so research the specific credentials needed in your region. For example, in the US, you might need a life and health insurance license, which often involves passing exams on insurance principles, ethics, and state-specific regulations. Stay updated on any changes in licensing requirements to ensure your compliance.

Understand Consumer Protection Laws: Medical insurance agents must be well-versed in consumer protection laws to ensure fair treatment of clients. These laws safeguard consumers' rights and provide guidelines for insurance companies and agents. Familiarize yourself with regulations related to insurance product disclosure, claim handling, and dispute resolution. For instance, know the procedures for handling complaints and how to provide accurate and transparent information to policyholders.

Ethical Conduct and Professional Standards: Adherence to ethical standards is essential for maintaining trust with clients and the industry. Stay informed about professional codes of conduct and ethical guidelines provided by insurance associations and regulatory bodies. These standards often cover areas like confidentiality, conflict of interest, and fair treatment of customers. By upholding these principles, you'll build a reputable and reliable career in medical insurance.

Stay Updated on Industry Changes: The insurance industry is dynamic, with frequent regulatory changes and updates. Stay informed about any amendments to laws and regulations that could impact your practice. Subscribe to industry newsletters, attend webinars or workshops, and join professional networks to keep abreast of the latest developments. This proactive approach ensures that you can provide the most accurate and compliant advice to your clients.

Understanding Your Options: Can You Cancel TriTerm Medical Insurance?

You may want to see also

Frequently asked questions

Typically, a high school diploma is the minimum educational requirement. However, many employers prefer candidates with a bachelor's degree in fields such as business, finance, or healthcare administration. Some companies may also offer on-the-job training to help agents understand the industry and develop the necessary skills.

Yes, obtaining a license is crucial for medical insurance agents. The requirements vary by state, but most states require agents to pass a licensing exam, which may include a combination of written and practical tests. These exams often cover topics such as insurance laws, ethics, and medical terminology. Additionally, staying updated with continuing education requirements is essential to maintain the license.

Medical insurance agents should possess strong communication and interpersonal skills to effectively interact with clients and healthcare providers. They need to be detail-oriented, organized, and able to manage multiple tasks. Problem-solving abilities and a customer-centric approach are vital for resolving client issues and providing suitable insurance solutions. Additionally, being adaptable and keeping up with industry changes is key to staying competitive in this field.