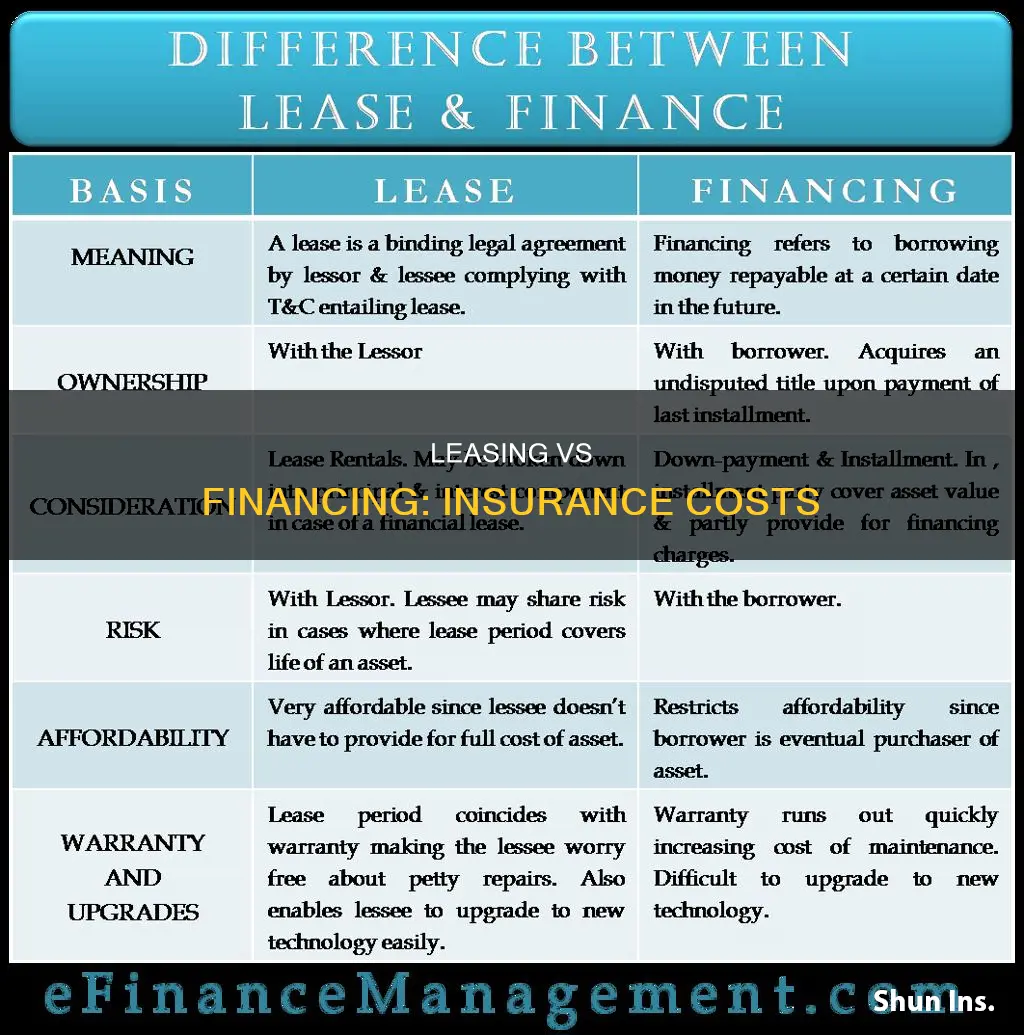

Whether you lease or finance a vehicle, you will need to have full-coverage insurance for it. This insurance costs roughly the same in either case. However, leasing companies typically have stricter insurance requirements than lenders, so you can generally expect to pay more for car insurance on a leased vehicle.

| Characteristics | Values |

|---|---|

| Insurance cost difference | Leasing a car is generally more expensive to insure than financing a car. However, some sources state that there is no difference in insurance costs between leasing and financing a car. |

| Insurance requirements | Lenders and leasing companies require full coverage, including collision and comprehensive coverage, and at least the minimum insurance coverage required by state law. Leasing companies may require higher liability coverage limits, higher liability insurance limits, and lower deductibles, which can increase insurance rates. |

| Additional insurance | Lenders and leasing companies may require gap insurance, which covers the difference between what is owed on the car and its value in the event of a total loss. |

What You'll Learn

- Leased vehicles require higher liability coverage limits, making insurance more expensive

- Lenders and lessors require full coverage to protect the car until the loan is paid off or the lease ends

- Lenders and lessors may also require gap insurance to cover the difference between the car's value and what is owed on the loan

- Insurance companies do not adjust rates based on whether a car is leased or financed

- Leasing companies may require coverage levels that lenders do not, which can increase rates

Leased vehicles require higher liability coverage limits, making insurance more expensive

Leasing a car can be an attractive option for those who want to drive a newer model without committing to a purchase. However, it's important to consider the additional costs associated with leasing, including the cost of insurance. While leasing a car may not directly result in higher insurance rates, the requirements specified in the lease agreement can make insurance more expensive.

The higher liability coverage limits required for leased vehicles are intended to protect the leasing company from potential lawsuits. Since the leasing company owns the vehicle, they are liable if the driver causes an accident that results in injuries or significant property damage. By requiring higher liability coverage limits, the leasing company ensures that the driver has sufficient insurance coverage to pay for any costs associated with an accident.

In addition to higher liability coverage limits, leased vehicles may also require additional types of insurance coverage. For example, leasing companies often require comprehensive and collision coverage, which protect against damage to the vehicle. They may also require gap insurance, which covers the difference between the amount owed on the lease and the vehicle's value if it is totaled. These additional coverage requirements further contribute to the increased cost of insurance for leased vehicles.

It's important to carefully review the insurance requirements specified in the lease agreement before signing. While leasing a car can offer flexibility and lower monthly payments compared to financing, the higher insurance costs associated with leased vehicles can add up over time. Understanding the full cost of leasing, including insurance, is crucial for making an informed decision about whether to lease or finance your next vehicle.

Post-Accident Vehicle Safety Checks

You may want to see also

Lenders and lessors require full coverage to protect the car until the loan is paid off or the lease ends

Full coverage typically includes collision and comprehensive coverage, and at least the minimum insurance coverage required by state law. Collision coverage covers damage to your car from accidents. Comprehensive coverage, on the other hand, covers damage to your vehicle that did not occur while you were driving it, such as theft, vandalism, or fire.

Some lenders and lessors will also require that you carry gap insurance to cover the "gap" between what the car is worth and what you owe on the loan or lease if the car is totaled. Gap insurance is a supplemental form of coverage that's available to help protect you from financial loss if you total a car that's being financed or leased.

Insuring Yourself to Drive Hospital Vehicles

You may want to see also

Lenders and lessors may also require gap insurance to cover the difference between the car's value and what is owed on the loan

Lenders and lessors may require you to carry gap insurance to protect their asset (the car) in the event that it is written off in an accident. Gap insurance covers the difference between the car's value and what is owed on the loan. This is important because standard auto insurance policies only cover the depreciated value of a car, which is usually its current market value at the time of a claim.

When you buy a new car and finance it with a small deposit, in the early years of the vehicle's ownership the amount of the loan may exceed the market value of the car. In the event of an accident that totals your car, gap insurance will cover the difference between what the vehicle is currently worth (which your standard insurance will pay) and the amount you actually owe on the loan. This is important for lenders and lessors because it ensures that they do not face a total loss if you have an accident.

Gap insurance is generally required for a lease. It is also a good idea to consider buying gap insurance if you made less than a 20% down payment, financed for 60 months or longer, purchased a vehicle that depreciates faster than average, or rolled over negative equity from an old car loan into the new loan.

You can purchase gap insurance from your car dealer or from your auto insurance company, who will typically charge less than the dealer. Including gap insurance with collision and comprehensive coverage adds only about $20 a year to the annual premium.

AAA and Salvage Vehicle Insurance

You may want to see also

Insurance companies do not adjust rates based on whether a car is leased or financed

Your lender or lessor may also require you to have gap insurance, which covers any gaps between what you still owe on a car and what it's actually worth at the time of a total-loss accident. Gap insurance is critical when financing a car since newer cars tend to depreciate quickly.

The decision to lease or finance a car depends on your lifestyle, finances, and goals. Some people prefer leasing because they like to upgrade their vehicle every few years, while others prefer to invest in a vehicle that they'll eventually own.

Insuring Old Vehicles in Florida

You may want to see also

Leasing companies may require coverage levels that lenders do not, which can increase rates

Leasing companies typically have stricter insurance requirements than lenders, so you can generally expect to pay more for car insurance on a leased vehicle compared to a financed one. This is because leasing companies own the vehicle outright, whereas lenders technically own financed vehicles until the loan is paid off.

Leasing companies may require higher liability coverage limits, which can increase your rates. For example, the mandated coverage limits are often 100/300/50, which means $100,000 for medical expenses for one person and up to $300,000 per accident, with $50,000 to cover property damage. These limits are much higher than the required state minimums.

Leasing companies may also require you to carry a low deductible, which can increase your premium. A deductible is the amount you pay before your insurance kicks in, and a lower deductible means you will be paying more out of pocket.

Additionally, leasing companies may require gap insurance, which covers the "gap" between what the car is worth and what you owe on the lease if the car is totalled. While gap insurance is optional for financed vehicles, it may be required for leased vehicles as new vehicles depreciate quickly once driven off the lot.

It's important to carefully review the insurance requirements of your leasing company or lender to ensure you are adequately insured.

Insuring Rare Vehicles: Payout Process

You may want to see also

Frequently asked questions

Car insurance is generally the same price whether you lease or finance a vehicle. However, some sources state that insurance for a leased car is more expensive as leasing companies have stricter insurance requirements.

You will need full-coverage insurance, which includes collision and comprehensive coverage, and at least the minimum insurance coverage required by state law. Your lender or lessor may also require you to carry gap insurance.

The average cost of full-coverage insurance is $2,008 per year.

Yes, you must have the minimum required coverage to drive legally in your state, as well as coverage that meets the terms of your lease or auto loan.

Yes, insurance companies will usually ask if you lease your car or have it financed, but this doesn't usually affect the rates they give you.