MedCost is a self-funded health benefits plan that offers a range of corporate benefit options to employers, including small to mid-sized businesses. The MedCost Network provides savings for employees and health plans, offering extensive access to a variety of high-quality medical providers and facilities. MedCost members can access benefits and coverage information, including deductibles and balances, pharmacy benefits, and flex spending, through the My MedCost mobile app. The app also provides digital ID cards, EOBs, and claims status. MedCost offers resources and tools to help members understand their plans and manage their benefits, including a Cost Estimator Tool and a national network solution through First Health.

| Characteristics | Values |

|---|---|

| Type | Custom health insurance plans for employers |

| Coverage | Pharmacy, dental, and vision |

| Features | Self-funding benefits, network care approach, controlling costs, compliance resources, mobile app, ID cards, account authorization, flex spending benefits, maternity benefits, wellness benefits |

| Service Area | North Carolina, South Carolina, Virginia |

| Provider Network | First Health, a national network serving over 5.5 million members |

What You'll Learn

MedCost's self-funded level funding

MedCost offers self-funded level funding for small to mid-sized employers. This means that employers can offer benefits to their employees while maintaining greater control over the health plan reserves. MedCost helps employers structure their benefits to complement their employees' needs and support their company's business and financial strategies and goals.

MedCost provides a breadth of benefit services, including plans tailored to a company's unique population, substantial savings through their provider network and efficient claims processing, and customised analytic reports for clearer decisions and results. As a third-party administrator (TPA), MedCost provides accurate, cost-effective, and timely administrative services. They are recognised for their best-in-class claims operations and healthcare administration, ensuring fast and accurate electronic claims administration.

Additionally, self-funded reporting helps employers make better decisions about their healthcare plans, allowing for more customisation each year. Stop-loss insurance provides protection from large claims, with swift reimbursement and excellent coverage ratings. MedCost's self-funded level funding is designed to help employers effectively manage the cost of benefit plans while providing quality medical care to their employees.

AARP Private Insurance: What You Need to Know

You may want to see also

Pharmacy, dental and vision coverage

MedCost provides administration services for pharmacy, dental, and vision coverage. These supplementary benefits are a significant part of a company's overall benefits package.

Pharmacy Coverage

The price for prescription medications can be high and may need to be paid in full until the deductible is reached. Preventative medications may be covered or require only a co-payment. It is recommended to check the Summary Plan Description and list of covered medications to understand what pharmacy benefits are included in your plan.

There are several ways to save on prescription medications:

- Discuss cheaper alternatives, such as generic or over-the-counter versions, with your doctor or pharmacist.

- Check your health plan for preventive coverage and take advantage of any wellness incentives, which may help cover prescription drug costs.

- Request a 90-day prescription and fill it using your health plan's mail-order pharmacy for long-term medications.

- Present your health plan ID card, even for medications not covered under your plan, as some drugs may be eligible for discounts.

- Participate in a Health Savings Account (HSA) or Flexible Spending Account (FSA) through your health plan, if offered.

Dental Coverage

Regular dental check-ups can help identify complex conditions early on, saving pain, money, and time. Poor oral health has been linked to strokes, heart disease, and lung disease. Dental coverage is a practical and affordable addition to a company's self-funded benefit plan, encouraging employees to schedule regular dental visits.

Vision Coverage

Eye care professionals can often detect and predict the risk of developing conditions such as diabetes, multiple sclerosis, hypertension, stroke, and heart disease. Early detection can help minimize the financial impact on benefits costs.

MedCost can help design and administer custom dental and vision programs for small to mid-sized employers.

Private Disability Insurance: Taxable Income?

You may want to see also

Maternity benefits and newborn coverage

MedCost offers a range of benefits to support expectant mothers and their newborns. Here are the key details you need to know about their maternity and newborn coverage:

Maternity Benefits

MedCost understands the importance of maternal health and provides comprehensive support throughout the entire pregnancy journey. Here are the benefits they offer:

- Prenatal Care Coordination: MedCost assigns a personal prenatal nurse to each expectant mother. This nurse helps coordinate appointments, answer questions, and provide guidance throughout the pregnancy.

- Nutrition and Wellness Support: MedCost offers resources to help mothers navigate nutrition during each trimester, ensuring both mother and baby receive the necessary care.

- Understanding Pregnancy Terms: MedCost can help you decipher pregnancy-specific medical terms, so you feel informed and empowered during your pregnancy.

- SmartStarts Maternity Management: Expectant mothers can enrol in the SmartStarts program, which offers valuable information on nutrition, parenting, and overall health. SmartStarts nurses monitor and mentor moms-to-be, aiming for optimal health outcomes.

- Breastfeeding Support: MedCost covers breast pumps under their plans, and all benefit plans must provide breastfeeding support, counselling, and equipment for the duration of breastfeeding.

Newborn Coverage

MedCost also recognises the importance of newborn care and provides the following benefits:

- Add Newborn to Health Plan: It's essential to add your newborn to your health plan coverage within 30 days of their birth date.

- Paediatrician Visits: MedCost can help you find paediatricians and specialists in your network to ensure your baby receives the best care.

- Well-Baby Check-ups and Vaccinations: MedCost covers well-baby check-ups and vaccinations, which are crucial for your newborn's health and development.

- Newborn Hospitalization: In the event your newborn requires hospitalisation, MedCost provides coverage and support to ensure your baby receives the necessary care.

MedCost aims to provide a comprehensive support system for expectant mothers and their newborns, offering guidance, resources, and peace of mind during this exciting and crucial life stage.

VA Loans: Private Lender Insurance Protection

You may want to see also

MedCost's mobile app

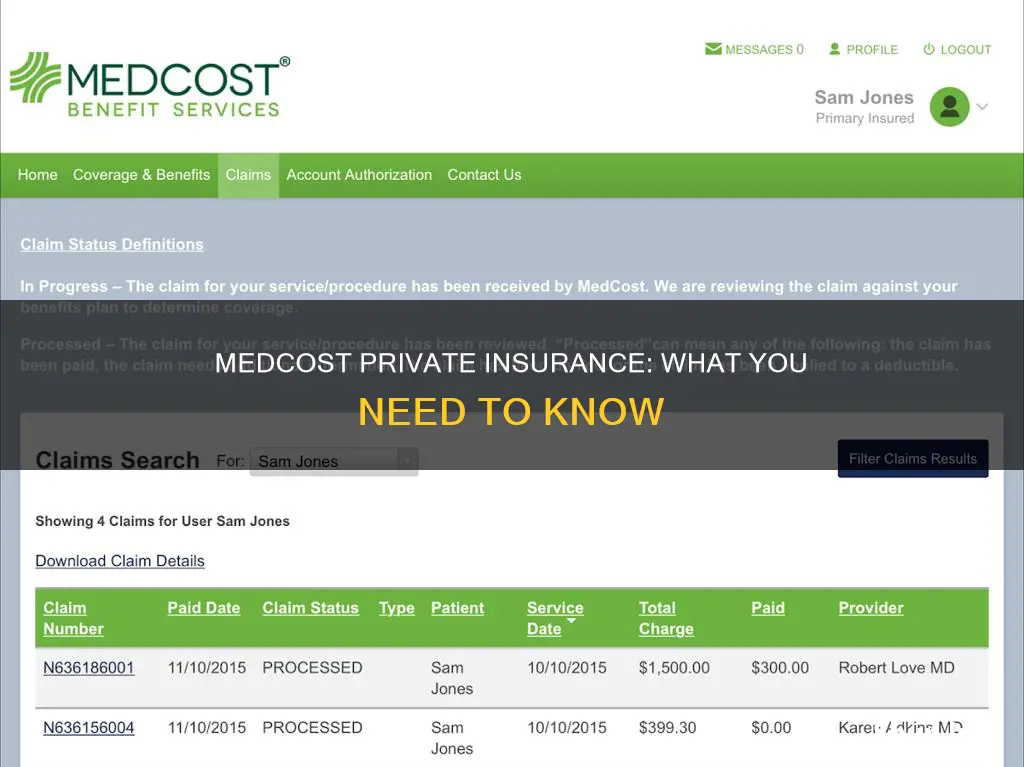

MedCost is a self-funded health benefits service that offers a mobile app to its members. The My MedCost mobile app provides members with quick and easy access to important information and resources related to their health care and benefits.

With the MedCost mobile app, members can access their digital ID card, view their Explanation of Benefits (EOBs), and check the status of their claims. The app also allows members to connect directly to their Member account, where they can find information about their specific health plan, including coverage details, deductibles, and balances. Additionally, members can access tools and resources to help them locate doctors, hospitals, and clinics within their network, making it convenient to find care when needed.

The app also offers guidance on ways to save on prescription medications and provides information about Flex Spending Benefits, including frequently asked questions. For those who are expecting or have a new baby, the app offers valuable maternity resources and benefits information. It also includes quick tips and help sections to assist members in navigating their health benefits and making the most of their plan.

The MedCost mobile app is designed to empower members to take control of their health care choices and make informed decisions about their well-being. By providing easy access to important information and resources, the app helps members stay informed, connected, and proactive in managing their health care journey.

Private Property Accidents: When to Report to Insurance

You may want to see also

MedCost's network

The MedCost Network is designed to provide savings for employees and their health plans, while also offering wide access to a variety of high-quality medical providers and facilities. The network has a significant presence throughout the Carolinas and Virginia.

MedCost members have open access to a large number of healthcare providers in the network, including physicians across a broad range of medical specialties, such as orthopedic surgeons, OB/GYNs, and cardiovascular surgeons. This means that members experience minimal disruption due to a physician or hospital being out-of-network.

To complement its proprietary network footprint in North Carolina, South Carolina, and Virginia, MedCost also offers access to a national network solution through First Health, a leading national network serving over 5.5 million members. This extended network provides security for health plan members who reside outside of the MedCost Network footprint or when travelling.

MedCost's strong network of hospitals, physicians, and other providers gives members the opportunity to receive quality care at a reasonable price. The network is designed to create savings while offering extensive access to a wide range of quality medical providers and facilities. MedCost's vast experience in hospital and physician contracting allows them to provide substantial savings to members while ensuring a continuum of quality care.

MedCost also provides members with resources to help them navigate their health plans, such as the My MedCost mobile app, which gives users access to their digital ID card, EOBs, and claims status. Additionally, MedCost offers a Cost Estimator Tool that compares prices and quality ratings for providers, services, hospitals, and facilities within the member's network and local area.

Becoming a Private Insurance Adjuster: Steps to Success

You may want to see also

Frequently asked questions

MedCost is a self-funded health benefits plan that employers can offer to their employees. It provides control over health plan reserves and customisation options to complement employee needs and support business and financial strategies.

The MedCost Network offers broad access to a large provider network across North Carolina, South Carolina, and Virginia. It includes physicians across a wide range of medical specialties, such as orthopedic surgery, OB/GYN, and cardiovascular surgery.

Understanding your MedCost plan involves selecting a primary care physician, locating a hospital, and familiarising yourself with specialty, urgent, or emergency care facilities in your provider network. You can also use the Cost Estimator Tool to compare prices and quality ratings for providers and services within your network and local area.