AARP, formerly the American Association of Retired Persons, is a non-governmental, non-profit, non-partisan organisation that empowers people to choose how they live, regardless of their age. AARP offers its members access to carefully selected benefits, including health care policies, long-term care products, and pharmacy services. While AARP is not an insurance company, it does provide branded coverage to its members through third-party companies like UnitedHealthcare and The Hartford. AARP members can access a range of insurance options, including health, life, auto, and homeowners insurance, as well as vision and dental plans.

What You'll Learn

AARP's relationship with UnitedHealthcare

AARP, formerly the American Association of Retired Persons, is a non-governmental, nonprofit, nonpartisan organisation. Its mission is to empower people to choose how they live, regardless of their age. AARP Services, Inc., a branch of AARP, cultivates relationships with companies to provide its members with products that can help or enrich their lives.

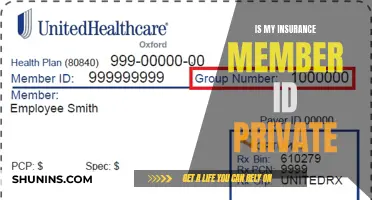

UnitedHealthcare is a subsidiary of UnitedHealth Group, a healthcare giant. UnitedHealthcare offers health care coverage and benefits services. It has provided AARP-branded health insurance plans since 1997.

AARP and UnitedHealthcare have shared a common mission for over 25 years: to advance healthcare for older Americans. UnitedHealthcare offers AARP-branded Medicare Advantage, Medicare Part D, and supplemental benefit plans. These plans are designed to improve health outcomes and create better consumer experiences for older Americans.

In 2024, AARP and UnitedHealthcare extended their agreement through 2025, with the option to further extend it until 2030. This extension continues the organisations' longstanding relationship and their commitment to improving the health and well-being of Americans aged 50 and older.

UnitedHealthcare's AARP-branded Medicare Advantage plans are also known as Medicare Part C. They combine Medicare Part A (hospital stays) and Part B (doctor visits) and often include Part D (prescription drug coverage) as well as routine vision, hearing, dental, and fitness coverage. These plans are not available in Alaska, Delaware, Maryland, Michigan, Mississippi, Montana, Wyoming, or US territories.

UnitedHealthcare also offers AARP-branded Medicare Part D plans, or Medicare prescription drug plans, which can be used in conjunction with Original Medicare or an Advantage plan that does not include prescription drug coverage.

Additionally, AARP offers a Medicare Supplement or Medigap policy through UnitedHealthcare. This policy can be used by those not enrolled in a Medicare Advantage program to reduce copayments, coinsurance, and deductibles under Medicare. Medigap policies generally do not cover long-term care, vision, or dental.

AARP members can also access other medical-related plans through AARP's affiliation with providers such as Delta Dental, EyeMed, and HearUSA. These plans include dental, vision, and hearing services.

Bernie Sanders' Plan: Private Insurance Ban and Medicare

You may want to see also

AARP's dental insurance plans

AARP is a non-governmental, nonprofit, nonpartisan organisation that empowers people to choose how they live, regardless of their age. While AARP is not an insurance company, it does offer branded insurance coverage to its members.

AARP's dental insurance plan is administered by Delta Dental Insurance Company and insured by Dentegra Insurance Company, Delta Dental Insurance Company or its affiliate companies. The plan offers individual or family coverage for the most common dental procedures.

There are two types of plans available: a preferred provider organisation (PPO) insurance plan and a dental health maintenance organisation (HMO) plan. The PPO plan offers flexibility, a large network of dentists to choose from, and no referral requirements to see a specialist. The HMO plan, on the other hand, offers predictable costs and lower out-of-pocket expenses but requires the use of an in-network dentist and a referral to see a specialist.

The PPO plans cover preventive, basic, and major services, including dentures, teeth whitening, implants, and orthodontics. The annual deductible is as low as $40, and the plan pays up to $1,500 annually. The HMO plan, DeltaCare, has no deductibles or annual maximums and offers immediate coverage for root canals, crowns, and dentures.

The AARP dental insurance plan is available in all 50 states, the District of Columbia, Puerto Rico, and the Virgin Islands. The cost of the plans varies depending on the state and the specific plan chosen.

In addition to dental insurance, AARP also offers other medical-related plans, such as vision and hearing care, through its affiliations with other providers.

Haven Insurance: Private Hire Car Protection

You may want to see also

AARP's vision insurance plans

AARP is a non-governmental, non-profit, non-partisan organisation that empowers people to choose how they live, regardless of their age. AARP Services, an arm of AARP, vets and fosters relationships with companies so that members have access to products that can help or enrich their lives.

AARP offers vision insurance plans through VSP, America's largest vision insurance provider. The AARP Vision Plans from VSP are available in every state except Massachusetts, Montana, North Carolina, and three US territories. Members can choose from four vision plans tailored for individuals and their families. All plans include an annual eye exam, glasses and lens enhancements, such as progressives and anti-glare coating, and more.

The EyeHealth Focus Plan, designed to meet the unique needs of AARP members, is only offered to AARP members. Benefits include no copays for annual eye exams, a $20 retinal screening copay, a $55 copay for progressive lenses, and a $40 copay for an anti-glare lens coating. This plan also includes a generous $200 featured frame allowance.

VSP has the country's largest independent eye doctor network, making it easy for members to find a provider near them. VSP's network includes independent optometrists and well-known optical retail chains. Members can also use their benefits immediately after enrolling, with no waiting period.

AARP Vision Plans from VSP are a valuable option for anyone needing corrective lenses, as these services are generally not included in basic health insurance policies.

Tricare: Private Insurance or Government-Sponsored Health Coverage?

You may want to see also

AARP's life insurance options

AARP, formerly the American Association of Retired Persons, is a non-governmental, nonprofit, nonpartisan organisation. Its primary focus is to help Americans over 50 live their best lives by offering members access to carefully chosen benefits from third-party companies.

AARP is not an insurance company, but it does offer branded insurance coverage to its members through its relationship with UnitedHealthcare. AARP members can access a range of insurance products, including life insurance.

Term Life Insurance

Term life insurance provides coverage for a set amount of time, helping beneficiaries manage expenses such as funeral costs, unpaid bills, and other financial obligations after the policyholder's passing. AARP's term life insurance offers coverage ranging from $10,000 to $150,000 for members aged 50 to 74 and their spouses aged 45 to 74. The coverage lasts until the policyholder turns 80, and there is no waiting period for coverage to begin. While a medical exam is not required, a health questionnaire and access to other medical information are necessary.

Permanent Life Insurance

Whole life insurance is a type of permanent life insurance that lasts for the entire lifetime of the policyholder and grows in cash value over time, provided policy premiums are paid on time. AARP's permanent life insurance offers coverage ranging from $5,000 to $50,000 for members aged 50 to 80 and their spouses aged 45 to 80. According to the website, premiums are locked for life, and no medical exam is required, but a health questionnaire must be completed.

Guaranteed Acceptance Life Insurance

AARP also offers a second whole life policy called Guaranteed Acceptance Life Insurance. This policy provides coverage for members aged 50 to 80 and their partners aged 45 to 80, with a maximum death benefit of $25,000. No medical exam or health questionnaire is required for this policy, but payouts are limited for the first two years.

In addition to the above, AARP also provides two riders: the Term Rider Protect Plus and the Guaranteed Exchange Option. The former raises coverage limits, while the latter allows policyholders to exchange their term coverage for whole life insurance without proving insurability.

Private Insurance: A Canadian's Perspective on Coverage

You may want to see also

AARP's vehicle insurance benefits

AARP, formerly the American Association of Retired Persons, is a non-governmental, nonprofit, nonpartisan organisation. Its mission is to empower people to choose how they live, regardless of their age.

AARP is not an insurance company, but it does offer branded coverage to its members through third-party companies. AARP Services, Inc. vets and fosters relationships with these companies so that AARP members have access to products that can help or enrich their lives.

- Auto insurance — AARP's auto insurance program from The Hartford offers an average member saving of $577.

- Motorcycle insurance — AARP's motorcycle insurance program from Foremost offers discounts on coverage, roadside assistance, and more.

- Collectible vehicle insurance — AARP's collectible vehicle insurance from The Hartford offers coverage designed specifically for classic and collectible cars.

- Recreational vehicle insurance — AARP's recreational vehicle insurance from The Hartford offers specialised protection for your RV, motorhome, or trailer.

- Mobile home insurance — AARP's mobile home insurance program from Foremost offers insurance for nearly every type of mobile and manufactured home.

- ATV, golf cart, and snowmobile insurance — AARP's insurance program from The Hartford offers customised coverage for recreational vehicles.

- Boat and personal watercraft insurance — AARP's boat and personal watercraft insurance from The Hartford offer customised coverage for your boat or watercraft.

In addition to the above, AARP also offers a range of other insurance products, including dental, vision, and life insurance.

Oregon Hospitals: Baby Drug Testing and Private Insurance

You may want to see also

Frequently asked questions

AARP members have access to a range of insurance plans, including life insurance, auto insurance, and dental insurance. They also have access to Medicare insurance benefits and free resources to help them navigate their options and enroll in a plan.

AARP membership costs $12 for the first year when signing up for automatic renewal. After the first year, the standard membership costs $16 annually, with a reduced rate of $12 offered for those who auto-renew.

AARP Medicare Advantage, or Part C, is administered by a private company and often includes Part D (prescription drug coverage) as well as routine vision, hearing, dental, and fitness coverage. Original Medicare, on the other hand, is the government benefit that Americans receive when they turn 65.