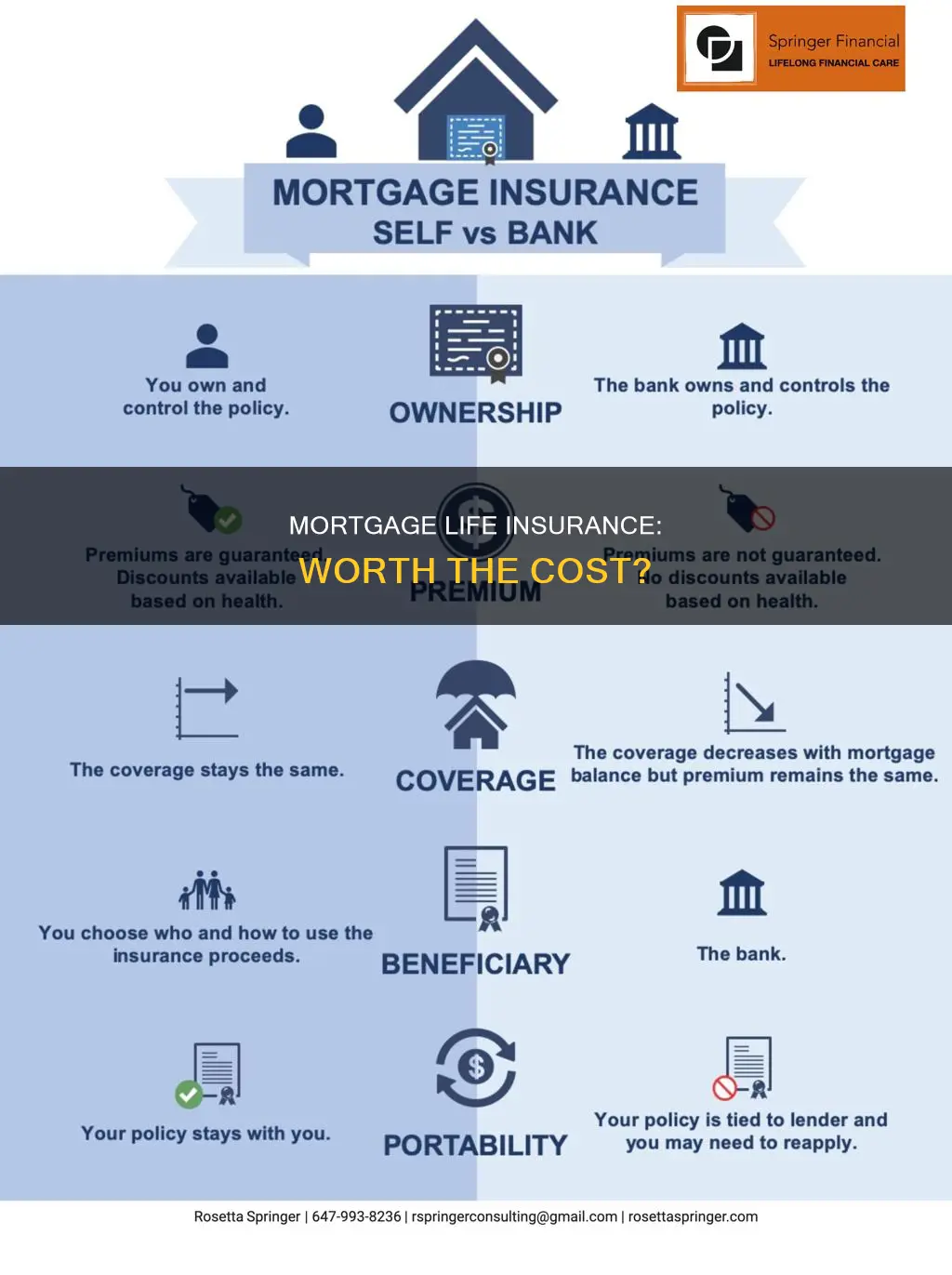

Mortgage protection insurance, also known as mortgage life insurance, is a policy that pays off the balance of your mortgage when you die. While this policy can keep your family from losing the home, it may not be the best life insurance option.

Mortgage life insurance is often sold by the mortgage lender, an insurance company affiliated with your lender or another insurance company that mails you after finding your information via public records. If you buy it from your mortgage lender, the premiums can be rolled into your loan.

The mortgage lender is the beneficiary of the policy, not your spouse or other person you choose. This means the insurer will pay your lender the remaining balance on the mortgage if you pass away. Money does not go to your family with this type of insurance.

This differs from a standard term life insurance policy, which is another option if you’re looking for a life insurance policy to help pay off your mortgage if you die. You could choose a regular term life policy with a face value that’s at least the amount of the mortgage that you still need to pay. If you were to die during the policy’s term, your beneficiaries receive the death benefit, which they may choose to use to pay off the mortgage.

| Characteristics | Values |

|---|---|

| Purpose | To pay off the remaining balance on your home loan in the event of your death |

| Provider | Banks, lenders, independent insurance companies |

| Buyer | Homeowners |

| Beneficiary | Mortgage lender |

| Payout | The balance of your mortgage, or partial balance |

| Premium | Stays level over the course of the policy |

| Policy length | Coincides with the number of years left to pay off the mortgage |

| Policy with spouse | Yes |

| Policy end | When the mortgage ends |

| Underwriting | Minimal |

| Medical exam | Not required |

| Riders | Living benefits, return of premium |

| Quote availability | Difficult to obtain online |

What You'll Learn

Mortgage protection insurance vs. term life insurance

Mortgage protection insurance and term life insurance are both designed to protect your mortgage in the event of your death. However, there are several key differences between the two types of insurance that you should consider when deciding which one is right for you.

Coverage

With mortgage protection insurance, the insurance payout goes directly to the lender to pay off the remaining balance of the mortgage. This means that your loved ones will not receive any money directly, although they will benefit from having the mortgage paid off.

Term life insurance, on the other hand, provides a broader application. It can be used to cover a range of financial obligations, such as a mortgage, large debts, healthcare costs, and childcare expenses. The payout from a term life insurance policy goes to the beneficiaries, who can then choose how to use the money.

Cost

The cost of mortgage protection insurance is based on factors such as the remaining balance of the mortgage, the time left on the loan, and the policyholder's age. The premium remains level throughout the term, but the policy's value decreases as the mortgage is paid off.

Term life insurance takes into account many more factors when determining the cost, including age, gender, health, smoking status, occupation, and family history. The application process is more rigorous and usually includes a medical exam. The payout from a term life insurance policy is fixed, and the premiums remain level for the duration of the policy.

Flexibility

Mortgage protection insurance offers limited flexibility as it is designed solely to pay off the mortgage. The coverage cannot be changed, and the policy may not move with you if you change mortgage providers.

Term life insurance provides much more flexibility. Beneficiaries can use the payout for any purpose, including paying off the mortgage, covering final expenses, or paying for a child's education. The policy owner can also choose the amount of coverage and the length of the policy.

Pros and cons

One advantage of mortgage protection insurance is that it is easier to get approved, even for those with poor health or other issues. The premiums are also typically lower than those of term life insurance.

However, a major disadvantage is the lack of flexibility. Most insurers send benefit payments directly to the lenders, so beneficiaries never see any money. The coverage also decreases over time as the mortgage is paid off, and there is no option to renew the policy if you change mortgage providers.

Term life insurance offers several benefits, including flexibility in how the payout is used and the ability to choose the coverage amount and policy length. It also provides financial protection for beneficiaries or loved ones. However, the application process is more rigorous and may include a medical exam.

Christians' Perspective on Life Insurance: A Complex Issue

You may want to see also

Pros and cons of mortgage protection insurance

Pros of Mortgage Protection Insurance

Mortgage protection insurance can be a good option for people who:

- Have been denied term life insurance: If you've been denied term life insurance or whole life insurance due to medical reasons, mortgage protection insurance may be a viable alternative. This is because mortgage protection insurance typically doesn't require a medical exam for qualification.

- Want peace of mind: Mortgage protection insurance ensures that your mortgage will be paid off if you die, providing peace of mind for you and your family.

- Have unstable employment: If your employment is unstable, mortgage protection insurance can provide assistance in paying your mortgage in the future.

- Are young or have health issues: Mortgage protection insurance may be a good option for young people having difficulty getting approved for a life insurance policy or for those with underlying health conditions that could affect their long-term well-being.

Cons of Mortgage Protection Insurance

Mortgage protection insurance has several drawbacks, including:

- Lack of flexibility: The biggest drawback of mortgage protection insurance is that the death benefit goes directly to the mortgage lender, leaving your loved ones without financial support for other expenses. With term life insurance, the beneficiary can use the payout for any purpose, including paying off the mortgage and covering other financial responsibilities.

- Declining payout: While the premiums for mortgage protection insurance remain the same, the payout decreases as you pay down your mortgage. This means that the policy's value declines over time, which can be a significant disadvantage if you plan to make extra payments to pay off your mortgage early.

- Higher premiums: Mortgage protection insurance premiums are often much higher than those of term life insurance, especially for individuals in good health.

- Limited quotes and comparisons: It can be challenging to obtain quotes for mortgage protection insurance online, making it difficult to compare policies and prices without direct contact with insurers.

Life Insurance for APWU Retirees: What's Available?

You may want to see also

Mortgage protection insurance vs. life insurance

Mortgage protection insurance, also called mortgage life insurance or mortgage protection life insurance, is a policy that pays off the balance of your mortgage when you die. The life insurance death benefit from an MPI policy typically decreases as you pay off your mortgage, while your premiums remain the same.

Mortgage life insurance is often sold through banks and mortgage lenders instead of life insurance companies. Its purpose is to ensure your home is paid off if you die with an outstanding balance on the loan.

The reason lenders like mortgage life insurance is that they're the ones who get paid if you die. The death benefit of a normal life insurance policy goes to your chosen beneficiaries, like your family members. But with an MPI policy, the beneficiary is the lender, who will be paid the remaining balance of your mortgage.

Pros and cons of mortgage protection insurance

Mortgage protection insurance has limited advantages and serious drawbacks, especially when compared to other types of coverage, like term life insurance.

Pros

- Convenience: Mortgage protection insurance aligns with your loan balance and pays the lender directly.

- No medical exam: Policies are typically guaranteed, so you don’t need to take a life insurance medical exam to qualify for coverage.

Cons

- Lack of flexibility: MPI pays the lender, so your family won’t have the freedom to spend the money as they like.

- Declining payout: While premiums stay the same, the payout decreases as you pay down your mortgage.

- Higher premiums: Premiums for MPI are often much higher than term life insurance.

In many cases, term life insurance is a better match as it offers flexibility and can provide funds for beneficiaries to balance mortgage payoff and other financial responsibilities. However, if you’ve been denied term life insurance or whole life insurance for medical reasons, you may want to consider mortgage life insurance.

Haemochromatosis: Life Insurance Considerations and Impacts

You may want to see also

Where to buy mortgage protection insurance

Instant Answer

Best Value:

Sproutt

Best for Military:

USAA

Best for Seniors:

Mutual of Omaha

Best for Online Experience:

Haven Life

Best for Customer Service:

New York Life

Best for Families:

Northwestern Mutual

Best for Quick Quotes:

Fabric

NerdWallet's Best Life Insurance Companies of July 2024

NerdWallet’s scoring of the best life insurance companies

NerdWallet’s scoring of the best life insurance companies is based on consumer experience ratings from J.D. Power, financial strength ratings from AM Best and S&P, and product features.

Document: 9

Url: https://www.nerdwallet.com/article/insurance/life-insurance/how-much-life-insurance-do-i-need

Document: 10

Url: https://www.nerdwallet.com/article/insurance/life-insurance/how-do-i-get-life-insurance

Document: 11

UrlMultiplier: null

Url: https://www.nerdwallet.00/article/insurance/life-insurance/how-much-does-life-insurance-cost

Document: 12

Url: https://www.nerdwallet.com/article/insurance/life-insurance/how-much-life-insurance-cost

Document: 13

Url

Timestamp: null

UrlMulitplier: null

Document: 14

Url: https://www.nerdwallet.com/article/insurance/life-insurance/how-much-does-life-insurance-cost-by-age

Document: 15

Url: https://www.nerdwallet.com/article/insurance/life-insurance/how-much-does-term-life-insurance-cost

Document: 16

Url: https://www0.consumerreports.org/life-insurance/how-to-buy-life-insurance/

Document: 17

Url: https://www.nerdwallet.com/article/insurance/life-insurance/how-much-does-life-insurance-cost-by-age/

Document: 18

Url: https://www.nerdwallet.com/article/insurance/life-insurance/how-much-does-life-insurance-cost-by-state

Document: 19

Url: https://www.nerdwallet.com/article/insurance/life-comparison-tool

Document: 20

Url: https://www.nerdwallet.com/article/insurance/life-insurance/how-much-does-life-insurance-cost-by-age-group/

Document: 21

Url: https://www.nerdwallet.com/article/insurance/life-insurance/how-much-does-life-insurance-cost-by-state-and-age/

Document: 22

Url

Timestamp: null

Document: 23

Url: https://www.nerdwallet.com/article/insurance/life-insurance/how-much-does-life-insurance

Document: 24

Url: https://www.nerdwallet.com/article/insurance/life-insurance/how-much-does-term-life-insurance-cost

Document: 25

Url: https://www.nerdwallet.com/article/insurance/life-insurance/how-much-does-life-insurance-cost-by-age-group

Document: 26

Url: https://www.nerdwallet.com/article:insurance/life-insurance/cost-by-age

Document: 27

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-age-group

Document: 28

Url: https://www.nerdwallet.com/article/insurance/life-insurance/how-much-does-life-insurance-cost-by-state-and-age

Document: 29

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-age

Document: 30

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-age-group

Document: 31

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-state-and-age/

Document: 32

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-age-group

Document: 33

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-state

Document: 34

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-state-and-age-group

Document: 35

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-age

Document: 36

Url

Timestamp: null

Document: 37

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-state-and-age-group

Document: 38

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-term-life-insurance-by-age

Document: 39

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-state-and-age

40

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-age-group

41

Url: https://www.nerdwallet.com/article/insurance/life-insurance/how-much-does-life-insurance-cost-by-age-and-state

42

Url: https://www.nerdwallet.com/article/insurance/life-insurance/how-much-does-life-insurance-cost-by-age-group

43

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-term-life-insurance-by-state-and-age

44

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-state

45

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-term-life-insurance-by-state-and-age-group

46

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-state-and-age

47

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-term-life-insurance

48

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-state-and-age-group

49

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-term-life-insurance-by-state

50

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-state-and-age-group

51

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-term-life-insurance-by-state-and-group

52

Url: https://www.nerdwallet.com/article/insurance/life-insurance/cost-of-life-insurance-by-state-and-age-group

NerdWallet's picks for the best life insurance companies of July 2024

NerdWallet's picks for the best life insurance companies

Best Overall: State Farm

Best Instant Issue: Bestow

Best Value: Sproutt

Best for Military: USAA

Best for Seniors: Mutual of Omaha

Best for Online Experience: Haven Life

Best for No Medical Exam: Ethos

Best for Customer Service: New York Life

Best for Families: Northwestern Mutual

Best for Quick Quotes: Fabric

Best for Estate Planning: Principal Financial Group

Best for Final Expenses: Lincoln Financial Group

Best for Term Life: MassMutual

Best for Whole Life: Guardian Life

Best for No-Exam Options: Bestow

Best for Breadth of Options: Principal Financial Group

Best Instant Issue: Bestow is our pick for the best instant issue life insurance company. Bestow offers a simple online application process and affordable pricing.

Bestow offers a simple online application process and affordable pricing.

Best InstantInstant Answer

Best Value: Sproutt is our pick for the best value life insurance company. Sproutt offers a personalized online application process and affordable pricing.

Sproutt offers a personalized online application process and affordable pricing.

Best for Military: USAA is our pick for the best life insurance company for military members. USAA offers affordable pricing and unique benefits for military members and their families.

USAA offers affordable pricing and unique benefits for military members and their families.

Best for Seniors: Mutual of Omaha is our pick for the best life insurance company for seniors. Mutual of Omaha offers affordable pricing and a simple online application process.

Mutual of Omaha offers affordable pricing and a simple online application process.

Best for Online Experience: Haven Life is our pick for the best online life insurance company. Haven Life offers an intuitive online application process and affordable pricing.

Haven Life offers an intuitive online application process and affordable pricing.

Best for Customer Service: New York Life is our pick for the best life insurance company for customer service. New York Life offers a high-quality customer service experience.

New York Life offers a high-quality customer service experience.

Best for Families: Northwestern Mutual is our pick for the best life insurance company for families. Northwestern Mutual offers affordable pricing and a high-quality customer service experience.

North

Term Life Insurance: Cash Surrender Value Explained

You may want to see also

Do you need mortgage protection insurance?

Mortgage protection insurance (MPI) is an insurance policy that pays off the remainder of your mortgage if you pass away or become disabled and can't work. MPI is not a legal requirement, and it is not always a financially prudent decision. However, it can be a good option for some people.

Pros of MPI

- Guaranteed acceptance: MPI policies are often issued on a "guaranteed acceptance" basis, which can be beneficial if you have a health condition that makes it difficult to obtain life insurance.

- Peace of mind: MPI can provide you and your family with a sense of security, knowing that your mortgage will be paid off if you die or become disabled.

- No medical exam required: MPI policies typically do not require a medical evaluation, making them more accessible than traditional life insurance policies.

- Simple for your heirs: In the event of your death, the insurance company sends the money directly to the lender, so your family doesn't have to handle any payments or disbursements.

Cons of MPI

- More cash out of your pocket: The MPI premium is an additional expense that can strain your monthly budget.

- Might not be the best use of your money: If your mortgage is almost paid off or you have sufficient funds to cover it, MPI may not be a necessary expense.

- Payoff amount declines: As you pay off your mortgage, the MPI payout decreases, while your premiums remain the same. This can be a significant drawback, especially if you plan to make extra payments to pay off your mortgage early.

- Potentially better alternatives: MPI is paid directly to your lender, so it won't provide financial protection to your loved ones beyond paying off your mortgage. A life insurance policy might be a better option, as it offers more flexibility in how the payout can be used.

- Lack of flexibility: MPI is specifically designed to cover your mortgage payments and may not cover other expenses such as HOA dues, property taxes, or homeowners insurance.

- Higher premiums: MPI premiums are often higher than those for term life insurance, especially for individuals in good health.

Who should consider MPI?

MPI can be a good choice for individuals who:

- Have health issues or a poor medical history that makes it difficult or expensive to obtain traditional life insurance.

- Are concerned about their loved ones' ability to make mortgage payments if they were to die or become disabled.

- Have unstable employment and may need assistance with mortgage payments in the future.

- Prefer the convenience of a policy that is offered and administered by their mortgage lender.

Alternatives to MPI

Before deciding on MPI, consider the following alternatives:

- Term life insurance: This type of policy offers more flexibility, as the payout can be used by your beneficiaries for any purpose, including paying off the mortgage. Term life insurance also tends to have lower premiums and more coverage options.

- Build savings and investments: Instead of paying premiums for MPI, you could invest your money and grow your savings. This way, you can pass on a lump sum to your loved ones, which they can use to make mortgage payments or pay off the loan.

- Level term life insurance: This type of policy offers a fixed amount of coverage for a specific period, typically 10 to 30 years. It is more flexible than MPI, as the payout can be used for various purposes, including paying off the mortgage, covering final expenses, or replacing lost income.

Life Insurance for Children: Is It Worth It?

You may want to see also

Frequently asked questions

Mortgage life insurance, also known as mortgage protection insurance, is a type of insurance policy that pays off the remainder of your mortgage if you pass away or become disabled and can't work. The beneficiary of the policy is typically the mortgage lender, not your family, which means they won't receive a lump sum of cash.

A benefit of mortgage life insurance is that it can provide peace of mind that your mortgage will be paid off if something happens to you. It is also usually easier to obtain than traditional life insurance as it often does not require a medical exam or consider your health and occupation when determining eligibility and premiums. However, the premiums for mortgage life insurance are often higher than those for term life insurance, and the payout decreases as you pay off your mortgage, while your premiums stay the same. Additionally, your family won't have the flexibility to use the payout for other expenses.

Term life insurance offers more flexibility as it allows you to choose your coverage amount and policy length, and the payout can be used for any purpose. Term life insurance also typically offers level premiums and death benefits. In contrast, mortgage life insurance is less flexible as the payout goes directly to the lender, and it may not cover other expenses your family may have.

Mortgage life insurance is not a requirement, and it may not be the best option for everyone. Most people will find more value and flexibility with other types of life insurance policies, such as term life insurance. However, if you have been denied term life insurance or whole life insurance due to medical reasons, or if you are unable to afford traditional life insurance, mortgage life insurance may be worth considering.

MPI is an optional insurance policy that pays off your mortgage if you die or become disabled. The beneficiary of an MPI policy is typically the mortgage lender. PMI, on the other hand, is required if you take out a conventional mortgage with a down payment of less than 20% and protects the lender if you stop paying your mortgage. MIP refers to the type of mortgage insurance required for FHA loans, which allows for lower down payments. Like PMI, MIP protects the lender, not the borrower, and is usually paid for the duration of the loan term.