Self-billing and self-insurance are two different concepts. Self-billing refers to when a business sends out an invoice to a customer for goods or services, while self-insurance, or self-funded insurance, is when an employer uses their own money to cover their employees' benefit claims. Self-insured plans are not subject to state insurance laws and oversight, but rather, they are regulated at the federal level. Self-insurance is a strategy for mitigating the possibility of future loss by putting aside a set portion of money rather than buying insurance.

| Characteristics | Values |

|---|---|

| Definition | "Self-insured" is the traditional model of funding where a third-party insurance company takes on the financial risk of paying for medical claims in exchange for premiums paid to it. Self-insured, otherwise known as “self-funded,” retains the risk for paying medical claims and operates the health plan on its own or through the assistance of vendors such as third-party administrators (TPA). |

| Applicability | Self-insured plans are usually used by large corporations. However, smaller companies are increasingly adopting self-insured plans. |

| Cost | Self-insured plans can save money as they have fewer benefit requirements, do not pay for an insurance company's profit, and may be able to lower plan administration costs. |

| Customization | Self-insured plans have greater control over benefit design for their association health plans. |

| Cash Flow | Self-insured plans pay medical claims as they occur, improving cash flow. However, there is still the possibility for claims volatility among members that can affect cash flow. |

| Risk | Self-insured plans retain the financial risk associated with paying for future medical claims. However, this risk is mitigated through "stop loss" insurance, which covers medical claims that exceed a predetermined amount during a coverage period. |

| Regulation | Self-insured health plans are not subject to state insurance laws and oversight. Instead, they are regulated at the federal level under ERISA (the Employee Retirement Income Security Act) and various provisions in other federal laws like HIPAA and the ACA. |

What You'll Learn

- Self-funded insurance is when an employer uses their own money to cover their employees' claims

- Self-insured plans are not subject to state insurance laws and oversight

- Self-insured plans can be more flexible than traditional, fully-insured plans

- Self-insured plans can be more cost-effective than fully-insured plans

- Self-insured plans are more common among large businesses

Self-funded insurance is when an employer uses their own money to cover their employees' claims

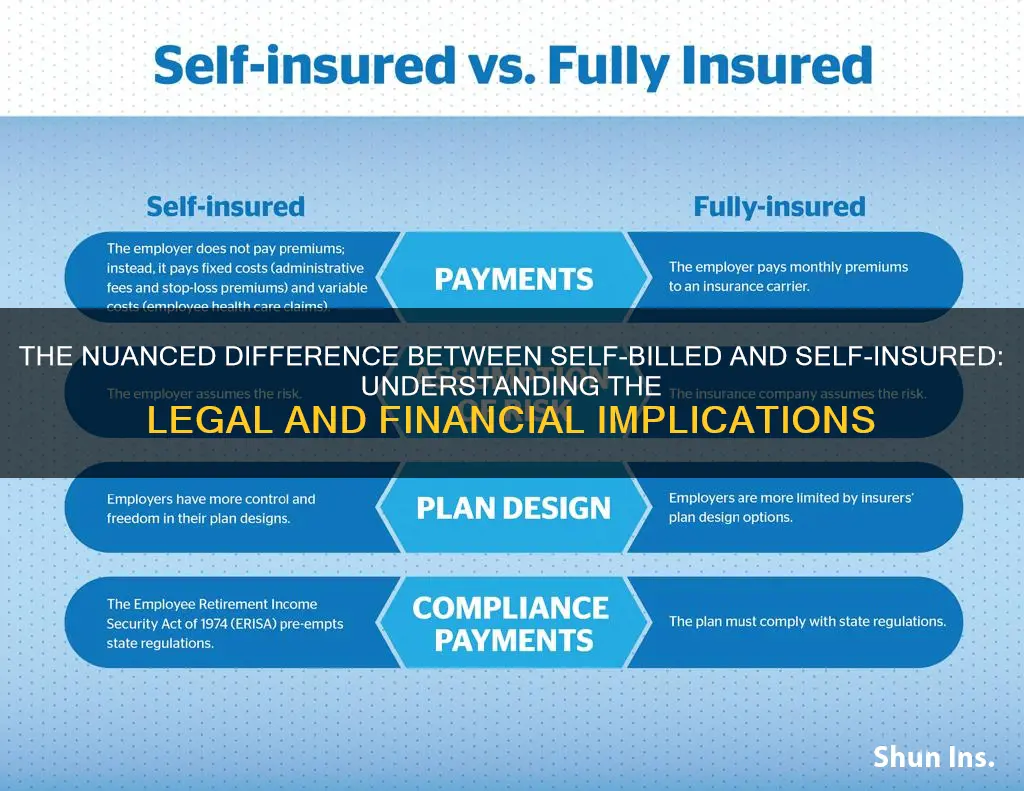

Self-funded insurance, also known as self-insurance, is when an employer uses their own money to cover their employees' claims. In this scenario, the employer takes on the financial risk and responsibility of paying for their employees' health claims. This is different from a fully-insured plan, where the employer purchases health insurance coverage from an insurance company, and the insurance company assumes the financial risk.

In a self-funded plan, the employer will usually set up a special trust fund to allocate money (from corporate and employee contributions) to pay incurred claims. They will also often contract with a third-party administrator (TPA) to handle claims payments and other administrative tasks. The TPA is paid by the employer to manage and administer payments, but the employer is the one who pays the claims.

Self-funded insurance offers several advantages. It gives employers more financial control and flexibility in customizing the plan to meet their specific goals and the health needs of their workforce. It can also provide cost savings, as employers are not paying profit margins to an insurer and are not subject to state-levied premium taxes. Additionally, self-funded plans are subject to less regulation, allowing employers to tailor their health care plan to meet their unique business needs.

However, there are also some disadvantages to self-funded insurance. It can expose the employer to financial risk if claims are higher than expected or if there are regulatory errors or lawsuits. It also requires more management time and resources to monitor the plan's performance.

Overall, self-funded insurance can be a good option for larger employers with the financial resources to take on the risk of paying for their employees' health claims. It offers flexibility and the potential for cost savings but comes with the risk of unpredictable expenses.

The Economics of Insurance: Unraveling the Affordability Paradox

You may want to see also

Self-insured plans are not subject to state insurance laws and oversight

ERISA pre-empts state law for self-insured plans, meaning that state insurance laws do not apply to self-insured plans. This is because self-insured plans are not backed by an insurance policy, and the employer funds and administers its benefit plan, paying claims from its own money. As a result, self-insured plans are under the jurisdiction of the U.S. Department of Labor, rather than state insurance departments.

While self-insured plans are not subject to state insurance laws, there are some basic federal minimum standards that do apply. This includes rules set out by HIPAA, such as the prohibition of employer-sponsored plans from rejecting an eligible employee based on medical history. The ACA also sets out rules that apply to self-insured plans, such as the prohibition of plans from imposing waiting periods for pre-existing conditions.

The federal No Surprises Act, which took effect in 2022, is another example of a federal law that applies to self-insured plans. This Act protects consumers from most instances of "surprise" balance billing.

Overall, the lack of state oversight of self-insured plans can cause frustration and confusion for residents in states with insurance mandates, as self-insured plans are not required to comply with these mandates.

Unlocking Flexibility: Converting Term Insurance to an IUL Policy

You may want to see also

Self-insured plans can be more flexible than traditional, fully-insured plans

Self-insured plans are more flexible than traditional, fully-insured plans. They are subject to less regulation and offer businesses the opportunity to customise their healthcare plans to meet their unique business needs.

Self-insured plans are not subject to state insurance laws and oversight. Instead, they are regulated at the federal level under ERISA (the Employee Retirement Income Security Act) and various provisions in other federal laws like HIPAA and the ACA. This means that self-insured plans are not subject to certain state requirements, allowing businesses to tailor their plans to their specific needs. For example, when a state imposes rules to require health plans to cover vasectomies or infertility treatment, these requirements don't apply to self-insured plans.

Self-insured plans also offer businesses the opportunity to save money. They may have fewer benefit requirements, and they do not pay for an insurance company's profit. Additionally, because companies are paying only for the healthcare costs of their own employees, there may be money left over at the end of the year that can be put toward other business needs.

However, it is important to note that self-insured plans come with more financial risk and administrative burden, particularly for small employers. In a self-insured plan, the employer assumes all financial risk for providing benefits to employees. They are responsible for calculating the fixed and variable costs of the plan, which can include administrative expenses, staff management fees, third-party administrator fees, software administration fees, and medical claim payouts.

To reduce the risk, employers can implement stop-loss or excess-loss insurance, which will reimburse them for health claims that exceed a set amount. This coverage option can be used to cover catastrophic health claims on one covered person (known as specific coverage) or cover employee claims that significantly exceed the expected level for the group of covered persons (known as aggregate coverage).

**Understanding Insurance Reimbursement: The Insured's Path to Payment**

You may want to see also

Self-insured plans can be more cost-effective than fully-insured plans

Cost Savings

Self-insured plans can offer significant cost savings for employers. In a self-insured plan, employers pay for employee medical claims and associated fees from their own assets. This means that employers only pay for what they use, and if there is money left over at the end of the year, it can be put towards other business needs. In contrast, with fully-insured plans, employers pay a fixed premium each month to the insurance company, regardless of the level of medical claims. This can result in employers spending a significant sum even if employees don't use much healthcare.

Flexibility

Self-insured plans offer greater flexibility in terms of benefit design and customization. Employers can tailor the health coverage to the specific needs of their employees, which is not always possible with fully-insured plans that are usually offered as preset packages. Self-insured plans are also subject to less regulation, giving employers more freedom to design a plan that meets their unique business needs.

Control

Self-insured plans give employers more financial control and transparency over their healthcare spending. They can set aside their own funds to pay for healthcare costs and manage these funds directly, rather than relying on an insurance company. This allows employers to remove insurer profit from their healthcare spending and gain a better understanding of their healthcare spend.

Risk Management

While self-insured plans may carry a higher level of risk, this risk can be mitigated through "stop-loss" insurance. Stop-loss insurance covers medical claims that exceed a predetermined amount during a coverage period, protecting employers from high-cost or catastrophic claims. Additionally, small businesses can purchase stop-loss insurance to place a limit on the number of claim expenses they are liable for each year, providing some level of protection.

The Many Faces of Insurance Brokers: Exploring Alternative Terms for Intermediaries

You may want to see also

Self-insured plans are more common among large businesses

Another reason is that self-insured plans offer greater flexibility and customization options for large businesses. They can tailor their health plans to meet the specific needs of their employees, which is especially beneficial for large companies with diverse workforces. Self-insured plans also allow businesses to design benefit packages that align with their employees' demographics and health profiles. For example, a company with a younger workforce might prioritize maternity or mental health coverage, while a manufacturing firm might focus on occupational therapy and physical rehabilitation benefits.

Additionally, self-insured plans can provide cost savings for large businesses. They eliminate the need to pay premiums to insurance companies and give employers more control over healthcare expenditures. Large businesses can set aside funds to pay for their employees' healthcare costs directly, potentially resulting in leftover funds at the end of the year that can be allocated to other business needs. Self-insured plans may also have lower administrative costs and fewer benefit requirements, further contributing to cost savings.

Furthermore, self-insured plans offer large businesses access to their employees' claims data, enabling better budgeting and forecasting of healthcare expenses. By analyzing this data, employers can identify the most prevalent types of claims and associated costs, helping them modify their plans and implement resources to reduce claims.

Lastly, self-insured plans for large businesses are often supported by stop-loss insurance, which protects against substantial claims. This type of insurance reimburses employers for claims that exceed a predetermined amount, providing an additional layer of financial protection.

Nuemd's Secondary Insurance Billing: An Automatic Advantage?

You may want to see also

Frequently asked questions

Self-insured health insurance is when an employer uses their own money to cover their employees' medical claims. The employer will usually contract a third-party administrator (TPA) to manage the claims and administration of the plan.

Self-billed is not a term commonly used in the insurance industry. However, self-insured, or self-funded, refers to when an employer covers their employees' medical claims themselves, rather than purchasing insurance from a commercial insurer.

Self-insured health insurance can offer financial savings to employers, as well as the option to tailor the health plan to the employer's and employees' needs. Self-insured plans are also subject to fewer regulations and state requirements, and at the end of the plan year, there may be money left over that can go back to the employer.