COC is an acronym with several meanings in the insurance industry. One common meaning is Certificate of Coverage, which is a document that outlines the specifics of an individual's insurance plan, including what is and isn't covered. This certificate is typically provided to the insured person by their insurance company. Another meaning of COC in insurance is Course of Construction, which refers to a type of insurance policy that covers buildings while they are under construction or renovation. This type of insurance is typically obtained by the contractor or developer of the property but can also be acquired by the property owner if they are responsible for insuring the property during construction.

| Characteristics | Values |

|---|---|

| Full Form | Certificate of Coverage |

| Description | A booklet given to each person covered by an insurance plan, describing what is covered and what is not |

| Other Meanings | Course Of Construction, Insurance Continuity Certificate |

What You'll Learn

Course of Construction Insurance

COC insurance is typically purchased by the contractor, developer, or property owner, depending on the contract details. It covers the value of the property being constructed, including materials, supplies, and equipment. It also includes "soft costs," such as reimbursement for delays, legal fees, consulting fees, and advertising expenses.

The policy may be written to cover the entire structure for new construction or renovation projects. It can also be tailored to cover specific projects, such as additions or temporary structures. The coverage usually begins when the construction project starts and ends shortly after its completion or when the building becomes operational.

While COC insurance provides comprehensive protection, there are some exclusions to be aware of. For example, it typically does not cover damage caused by natural disasters like earthquakes, floods, or tornadoes. It also does not cover damage to tools and equipment, mechanical breakdowns, or losses due to faulty design or workmanship.

Obtaining COC insurance is essential for mitigating risks and providing peace of mind during construction projects. It ensures that owners and contractors have the necessary funds to rebuild or start over in the event of unforeseen accidents or incidents.

The Risky Business of Lying on Short-Term Insurance Policies

You may want to see also

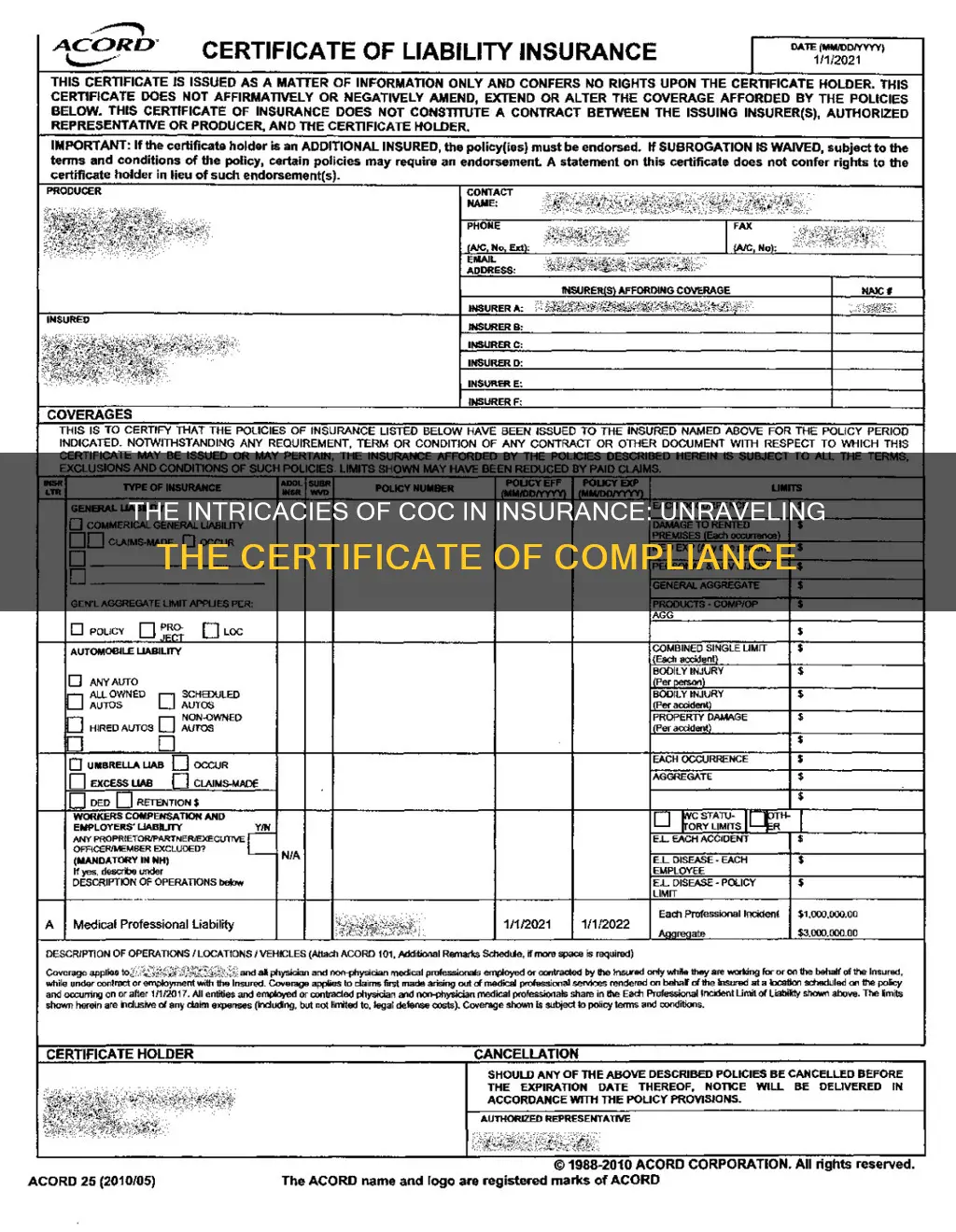

Certificate of Coverage

A Certificate of Coverage (COC) is a document that outlines the specifics of an insurance policy. In the context of health insurance, a COC is provided to individuals covered by certain plans, detailing what is and isn't covered by the insurance. This booklet is subject to any changes or additions stated in a rider.

COC is also used as an acronym in the insurance industry for "Course of Construction". This type of insurance covers the value of property being constructed until it is ready for occupancy. It also covers the contractor's materials at the job site and in transit. Course of Construction insurance is typically obtained by the contractor or developer of the property but, if you are responsible for insuring the property during construction or renovations, you will need this type of policy.

Additionally, in the United Arab Emirates (UAE), a Certificate of Continuity (also referred to as a COC) is a mandatory document that must be produced when changing jobs. This certificate is provided by insurance companies free of charge and is required by the new employer to issue new insurance cards. It contains details such as the health insurance policy number, effective and expiry dates, policy type, nationality, sex, and date of birth of the insured.

Understanding the Nature of Prepaid Insurance: A Short-Term Asset Strategy

You may want to see also

Insurance Continuity Certificate

An Insurance Continuity Certificate, also known as a COC, is a document that proves that an individual has been insured without any gaps. It is required by law for expatriates changing jobs in the UAE. The previous employer must provide this certificate, along with the old insurance card, to the employee. The employee then needs to visit a local branch of the insurance company to obtain the COC. This certificate is necessary for getting a visa stamped and ensuring continuous insurance coverage.

The Health Authority of Abu Dhabi (HAAD) specifies that a Continuity Certificate is required for employees moving to a new employer in Abu Dhabi or when a dependent is moving to another employer. The certificate must include the following information:

- Health Insurance policy number

- Effective Date of Health Insurance policy

- Expiry Date of Health Insurance policy

- Policy Type (Thiqa, enhanced, basic, emergency, etc.)

- Nationality, sex, and date of birth of the insured

- Authorised signatory and insurance company seal

- Certificate issuance date

Additionally, the certificate should include a statement confirming that the insured person(s) is/are covered under the mentioned health policy per Law No. 23 of 2005 regarding health insurance in the Emirate of Abu Dhabi. This certificate is typically valid for 30 days from the issuance date.

COC is also important for proving to new insurance providers that there have been no breaks in coverage. This allows individuals to claim any pre-existing conditions immediately without waiting periods. It is worth noting that some people have experienced confusion or discrepancies regarding the validity of their insurance coverage during job transitions, so it is essential to carefully review the specific terms and conditions of the certificate and insurance policy.

Understanding Extended-Term Insurance: Unraveling the Dividend Option Mystery

You may want to see also

Builder's Risk Policy

A Builder's Risk Insurance policy, also known as a Course of Construction (COC) insurance policy, is a specialised type of property insurance that covers buildings while they are under construction. It is designed to protect construction projects from property damage and can be crucial in successful risk management.

A Builder's Risk Policy can cover a variety of projects, from new construction to remodelling and installations, and can be applied to both residential and commercial properties. It is often required to comply with government regulations or contractual arrangements.

The policy covers the value of the property being constructed until it is ready for occupancy. It also covers the value of materials at the job site and in transit. It typically covers loss due to fire, windstorm, lightning, hail, theft, and vandalism.

Builder's Risk Insurance does not cover workplace accidents and injuries, liability coverage, or acts of terrorism and war.

The cost of a Builder's Risk Insurance policy depends on the cost of the project, the location, the timeline, the square footage of the construction site, and the expertise and experience of the contractors and subcontractors. It typically accounts for 1% to 5% of the total construction budget.

It is important to note that Builder's Risk Insurance is a temporary policy that lasts for the duration of the project. It is also crucial to understand the terms of the policy, including when coverage begins and ends, as well as any exclusions or limitations.

Unraveling the Meaning of 'Wrap' in Insurance: A Comprehensive Guide

You may want to see also

Coverage for Soft Costs

The acronym COC has several meanings in insurance, including Course of Construction and Certificate of Coverage. In this answer, I will focus on the former definition and discuss coverage for soft costs in the context of Course of Construction insurance.

Course of Construction (COC) insurance is typically obtained by the contractor or developer of a property to cover the value of the property being constructed until it is ready for occupancy. This type of policy can also cover the contractor's value of materials at the job site and materials in transit.

In addition to covering losses due to physical damage to the property, COC insurance can also provide coverage for "soft costs". Soft costs refer to expenses incurred during construction that are not directly related to labour or building materials but are a direct result of a covered loss. These can include:

- Advertising and promotional expenses

- Interest on construction loans

- Architects, engineers, and consultants fees

- Real estate and property tax assessments

- Commissions or fees for lease renegotiation

- Legal and accounting fees

- License and permit fees

By including coverage for soft costs, COC insurance helps to protect against unexpected expenses that can arise during the construction process, providing added peace of mind for clients.

It is important to note that the specific soft costs covered and the extent of coverage can vary across different insurance providers. Therefore, it is crucial for clients to carefully review their COC insurance policies to understand their coverage for soft costs and ensure that all potential expenses are considered.

Unraveling the Complexities of Hostile Fire in Insurance Policies

You may want to see also

Frequently asked questions

COC stands for Certificate of Coverage.

A Certificate of Coverage (COC) is a booklet given to each person covered by an insurance plan. It describes what is covered and what is not, and is subject to changes stated in any rider that might add to or delete some covered benefits.

Course of Construction (COC) insurance provides coverage for buildings while they are under construction. COC covers the value of the property being constructed until it is either moved into or ready for occupancy. It also covers the contractor's value in materials at the job site before being installed, as well as materials in transit intended for the job.

An Insurance Continuity Certificate, also known as a COC, is a document required by law in certain places, such as the UAE. It is provided by an insurance company when an individual changes jobs and needs to transfer their insurance coverage. The new employer may require this certificate to provide insurance cards to the employee.