The average annual insurance bill will depend on the type of insurance being purchased. For example, the average cost of car insurance in the US is $1,982 per year, while the average cost of health insurance is $456 per month for an individual, excluding those who receive government subsidies.

The average cost of insurance can also vary depending on factors such as age, gender, location, and coverage level. For example, older drivers tend to pay less for car insurance than younger drivers, and the cost of health insurance can vary depending on whether an individual purchases a plan through their employer or through the Health Insurance Marketplace.

| Characteristics | Values |

|---|---|

| Average annual insurance bills for car insurance | $1,483 |

| Cheapest car insurance company | Nationwide |

| Average annual insurance bills for health insurance | $456 for an individual and $1,152 for a family |

What You'll Learn

Average annual insurance bills for car insurance

The average cost of car insurance varies depending on the level of coverage, the driver's age, credit score, location, and other factors.

Average Cost of Car Insurance by Coverage Level

The average cost of car insurance for full coverage is $192 per month or $2,299 per year, while minimum coverage costs $53 per month or $637 per year. Full coverage includes liability, comprehensive, and collision insurance, while minimum coverage only includes the state-mandated minimum level of liability insurance.

Average Cost of Car Insurance by Driver Age

Age is a significant factor in determining car insurance premiums, with younger drivers typically paying more due to their lack of driving experience. The average cost of car insurance for drivers aged 16-19 is $4,958 per year or $413 per month, while drivers aged 50-59 pay the least, with an average monthly cost of around $124.

Average Cost of Car Insurance by Credit Score

In most states, credit score is also considered when calculating car insurance premiums. Drivers with poor credit scores pay significantly more for car insurance than those with good credit scores, as they are considered higher-risk. On average, drivers with poor credit pay about $1,600 more per year for car insurance than those with good credit.

Average Cost of Car Insurance by Location

Car insurance rates vary widely by state and even by ZIP code. The cost of car insurance is influenced by factors such as the number of claims in an area, the cost of repairs, and the frequency of severe weather events. The cheapest states for car insurance include Idaho, Vermont, Maine, Ohio, and Washington, while the most expensive states include New York, Florida, Louisiana, Nevada, and Colorado.

Average Cost of Car Insurance by Company

The cost of car insurance also varies depending on the company providing the coverage. Some of the cheapest car insurance companies include USAA, Geico, State Farm, Erie, and Progressive. It is important to compare quotes from multiple companies to find the best rates.

Other Factors Affecting Car Insurance Costs

Other factors that can affect car insurance costs include driving record, vehicle type, gender, marital status, mileage, and coverage options. Drivers with a clean driving record and good credit score typically pay lower premiums. Additionally, vehicles that are expensive to repair or have high theft rates may have higher insurance costs. Bundling policies, increasing deductibles, and taking advantage of discounts can help lower car insurance costs.

Navigating Out-of-Network Insurance Billing: A Comprehensive Guide

You may want to see also

Average annual insurance bills for health insurance

The average annual cost of health insurance varies depending on factors such as the type of coverage, the number of family members included, and the state in which one resides.

Average Annual Cost of Health Insurance for an Individual

According to eHealth, the average national cost of health insurance for an individual in 2023 was $456 per month or $5,472 per year. This cost can vary depending on the type of plan, with Bronze plans having the lowest premiums and Platinum plans having the highest. The average premium for a Bronze plan in 2023 was $342 per month, while the average premium for a Platinum plan was $737 per month.

Average Annual Cost of Health Insurance for a Family

The average national cost of health insurance for a family in 2023 was $1,152 per month or $13,824 per year. Similar to individual plans, family plan costs vary depending on the type of plan. The average premium for a Silver plan in 2023 was $448 per month, while the average premium for a Gold plan was $472 per month.

Employer-Sponsored Health Insurance

Employer-sponsored health insurance costs can vary based on the employer's contributions and the type of coverage. In 2023, the average annual premium for employer-sponsored health insurance was $8,435 for an individual policy and $23,968 for a family policy. On average, workers contribute 17% of the premium for single coverage and 29% for family coverage.

Affordable Care Act (ACA) Marketplace Plans

Monthly premiums for ACA Marketplace plans vary by state and can be reduced by premium tax credits. The average national monthly cost for an individual on an ACA plan without premium tax credits in 2024 is $477.

Other Factors Affecting Health Insurance Costs

In addition to the type of plan and the number of family members, other factors that can influence health insurance costs include age, location, tobacco use, and lifestyle factors. Age is a major contributing factor, with premium costs increasing as one gets older. Tobacco use can also affect pricing, with health insurance companies charging smokers up to 50% more than non-smokers. Location can impact pricing due to the level of competition in an area, with rural areas often having higher prices due to fewer insurance companies.

Understanding the Complexities of Extended Term Insurance Calculations

You may want to see also

Average annual insurance bills for homeowners insurance

The average cost of homeowners insurance in the US is $1,903 per year, according to a 2023 study. However, the cost varies depending on the state, with some states having an average cost as low as $458 per year, while others have an average cost as high as $5,858 per year. The base rate is for a policy with $300,000 in dwelling coverage, $300,000 in liability coverage, and a $1,000 deductible.

The cost of homeowners insurance is determined by various factors, including the state and city in which the home is located, the age and characteristics of the home, and the coverage amount selected. For example, the average cost of homeowners insurance in Oklahoma is $5,858 per year, while in Hawaii, it is only $613 per year.

The cost of homeowners insurance can also be affected by the company providing the insurance. For example, Erie offers the cheapest average home insurance premium of the companies surveyed at $1,471 per year, while Country Financial's average annual premium of $2,646 is the most expensive.

Additionally, the cost of homeowners insurance has been increasing in recent years due to factors such as inflation, severe weather, and climate change. Homeowners insurance rates are expected to continue rising in 2024 due to these factors.

Maximizing Insurance Billing for Locum Tenens Physical Therapy Services

You may want to see also

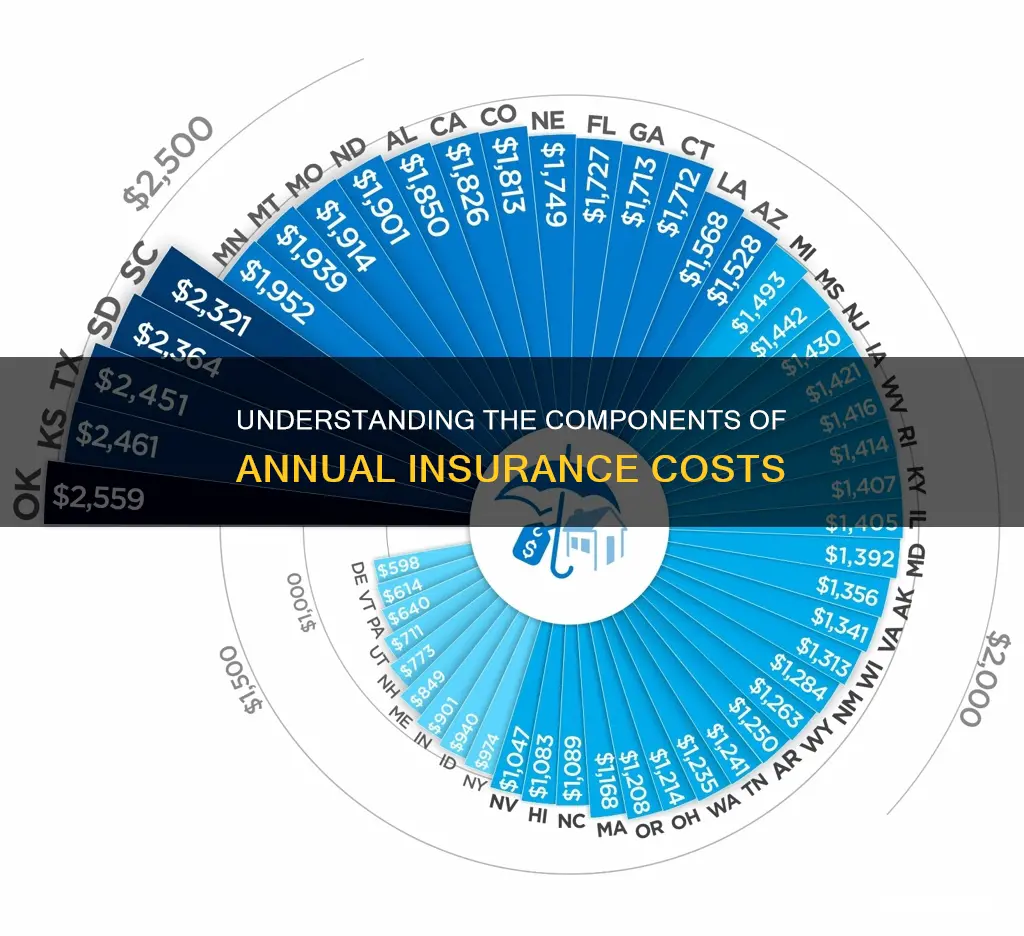

Average annual insurance bills by state

The average annual cost of insurance varies depending on the type of insurance, as well as other factors such as location and individual circumstances. Here is a breakdown of average annual insurance bills by state in the United States for different types of insurance:

Home Insurance

The average cost of homeowners insurance in the United States is around $1,300 to $2,600 per year, but rates vary significantly by state. In 2024, Oklahoma had the highest average home insurance rate at $5,858 per year, while Hawaii had the lowest at $613 per year. Other states with high home insurance rates include Louisiana ($4,477), Nebraska ($4,165), and Mississippi ($3,636). Location is a significant factor in home insurance rates, with states prone to natural disasters such as hurricanes, wildfires, and tornadoes tending to have higher premiums.

Car Insurance

The average annual cost of car insurance in the United States is around $1,700 to $1,900 per year for full coverage, and around $500 per year for minimum coverage. However, car insurance rates vary widely by state, with some states having much higher or lower rates than the national average. In 2024, the cheapest states for full coverage car insurance were Wyoming ($1,069), Vermont ($1,251), Massachusetts ($1,348), Idaho ($1,361), and Ohio ($1,380). On the other hand, the most expensive states for full coverage car insurance were Florida ($3,797), Louisiana ($3,608), Rhode Island ($3,341), Texas ($2,966), and Kentucky ($2,965). Factors such as state laws, the percentage of uninsured drivers, the frequency of natural disasters, and claim rates contribute to the variation in car insurance rates between states.

Health Insurance

The average cost of health insurance also varies by state, but the exact figures for each state are not readily available. As of 2024, the average person in the United States pays $477 per month for marketplace health insurance. For employer-sponsored group health insurance, the average American worker paid $1,401 in 2023. Costs vary based on factors such as age, the number of people on the plan, coverage level, location, and employer.

Life Insurance

Life insurance costs vary depending on factors such as the length of the policy, age, health history, tobacco use, and gender. As an example, a healthy 30-year-old male with a $1 million, 20-year term life insurance policy can expect to pay around $648 per year, or $54 per month.

Understanding Insurance Coverage: Navigating Lab Bill Payments

You may want to see also

Average annual insurance bills by age

The cost of insurance is highly dependent on age, with older people paying less for life insurance and young drivers paying more for car insurance.

Life Insurance

The average cost of life insurance is $26 a month, based on data for a 40-year-old buying a 20-year, $500,000 term life policy. However, life insurance rates can vary dramatically among applicants, insurers and policy types. Generally, the younger and healthier you are, the cheaper your premiums.

Car Insurance

Car insurance rates are highest for teens and young adults due to their increased likelihood of being involved in an accident. The average car insurance cost for teens is high but decreases when they turn 20. The cost of auto insurance coverage generally begins to drop by the time a driver reaches their early 20s. By 25, drivers might notice a pretty significant reduction in their premiums.

Health Insurance

In 2023, the average national cost of health insurance was $456 for an individual per month. However, costs vary among the wide selection of health plans.

Understanding Renewable Term Insurance: Unraveling the Benefits and Mechanics

You may want to see also

Frequently asked questions

The average cost of car insurance is $165 per month, according to a 2024 rate analysis by NerdWallet. However, your rate will vary depending on factors such as where you live, the vehicle you drive, your age, and your driving history.

On average, a single person pays about $117 a month for employer-sponsored coverage and $477 a month for a plan on the health insurance marketplace, before any subsidies.

The average cost of health insurance per month depends on the type of coverage and the number of people covered. For an individual, the average cost is $456 per month, while for a family, it is $1,152 per month.

In 2023, the average homeowners insurance annual premium for $350,000 in coverage was $1,582. However, homeowners insurance costs can vary widely depending on factors such as the value of your home, your insurance history, the type of coverage you need, your credit score, and whether you need flood insurance.