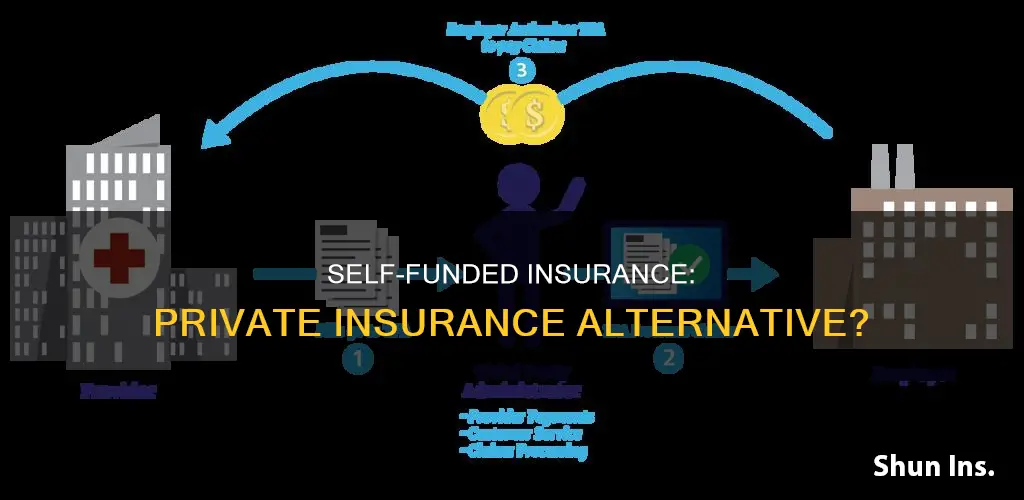

Self-funded insurance, also known as self-insurance, is when an employer assumes the financial risk and responsibility of providing health care benefits to its employees, as opposed to purchasing a fully-insured plan from an insurance company. In a self-funded plan, the employer pays for each out-of-pocket claim as they are incurred instead of paying a fixed premium to an insurance carrier. Typically, a self-insured employer will set up a special trust fund to earmark money (corporate and employee contributions) to pay incurred claims. Self-funded plans are not subject to state insurance regulation but are governed by federal laws such as ERISA, HIPAA, COBRA, and the Civil Rights Act. This type of insurance is often chosen by employers seeking more flexibility and control over their healthcare benefits.

| Characteristics | Values |

|---|---|

| Definition | Self-funded insurance is a type of insurance plan in which the employer assumes the financial risk and pays for the health care benefit claims of its employees out of pocket. |

| Regulation | Self-funded insurance is governed by federal law and is not subject to state insurance regulation. |

| Customization | Self-funded insurance allows employers to customize the plan to meet the specific health care needs of its employees. |

| Cost | Self-funded insurance is often less costly for employers as there are no profit or risk margins to pay to an insurer and no state-levied premium taxes. |

| Cash flow | Self-funded insurance improves the employer's cash flow as they do not have to pre-pay for coverage. |

| Control | Self-funded insurance gives employers more control over the health plan reserves, enabling them to maximize interest income. |

| Risk | Self-funded insurance exposes the employer to the financial risk of high losses due to extraordinary claims. |

| Administration | Self-funded insurance plans can be administered in-house or subcontracted to a third-party administrator (TPA). |

What You'll Learn

- Self-funded plans offer more flexibility and can be customised to meet specific needs

- Self-funded plans are not subject to state insurance regulation

- Self-funded plans are not subject to state health insurance premium taxes

- Self-funded plans are regulated under federal law (ERISA)

- Self-funded plans are not suitable for all employers

Self-funded plans offer more flexibility and can be customised to meet specific needs

Self-funded insurance plans are often more flexible than traditional, fully-insured plans. They are subject to less regulation and offer businesses the opportunity to customise their health care plan to meet their unique business needs.

Self-funded plans are not subject to state insurance regulation, only federal law. This means that employers are not subject to conflicting state health insurance regulations and benefit mandates. This gives employers the freedom to customise their plan to meet the specific health care needs of their workforce, rather than purchasing a 'one-size-fits-all' insurance policy.

For example, employers can decide to contract with the providers or provider networks that are best suited to meet the health care needs of their employees. Self-funded plans also allow employers to retain control over the health plan reserves, enabling them to maximise interest income. This income would otherwise be generated by an insurance carrier through the investment of premium dollars.

Additionally, self-funded plans can be designed to suit the unique needs and interests of employees. Employees can often customise their coverage based on their individual needs and preferences, providing flexibility and choice.

Molina's Insurance Status: Private or Public?

You may want to see also

Self-funded plans are not subject to state insurance regulation

In the United States, self-funded insurance plans are not subject to state insurance laws and oversight. Instead, they are regulated at the federal level under the Employee Retirement Income Security Act (ERISA) and various provisions in other federal laws like the Health Insurance Portability and Accountability Act (HIPAA) and the Affordable Care Act (ACA).

ERISA prohibits states from "deeming" self-funded plans to be subject to state insurance requirements. The "deemer" clause in ERISA states that:

> "Neither an employee benefit plan...nor any trust established under such a plan, shall be deemed to be an insurance company or other insurer...or to be engaged in the business of insurance...for purposes of any State purporting to regulate insurance companies [or] insurance contracts...."

As a result, self-insured plans are regulated by the U.S. Department of Labor, rather than state insurance departments. This means that state-based laws and regulations, which typically only apply to fully-insured plans, do not apply to self-insured plans. For example, when a state mandates that health plans cover vasectomies or infertility treatment, these requirements do not apply to self-insured plans.

However, it is important to note that self-insured plans are still subject to certain federal minimum standards. This includes rules from HIPAA prohibiting employers from rejecting an eligible employee based on medical history, and ACA rules prohibiting plans from imposing waiting periods for pre-existing conditions. The Pregnancy Discrimination Act, which requires employer-sponsored health plans to include maternity coverage, also applies to self-insured plans.

While self-insured plans offer businesses more flexibility and customization, they also come with financial risk. Self-insured employers must have the financial resources to cover their employees' medical claims, which can be unpredictable. To mitigate this risk, many self-insured employers purchase stop-loss insurance to reimburse them for claims above a specified dollar level.

Insurers' Influence: Regulating Public Police and Privacy

You may want to see also

Self-funded plans are not subject to state health insurance premium taxes

Self-funded insurance plans, also known as self-insured plans, are a type of health insurance plan in which the employer assumes the financial risk of providing health care benefits to their employees. Instead of paying a fixed premium to an insurance carrier, the employer pays for each claim out of pocket as they are incurred. This means that the employer is responsible for paying the health care claim costs for their employees, which can vary depending on the health needs of their workforce.

One of the advantages of self-funded plans for employers is that they are not subject to state health insurance premium taxes. These taxes typically range from 2% to 3% of the premium's dollar value. By avoiding these taxes, employers can save a significant amount of money, especially if they have a large number of employees.

The reason self-funded plans are exempt from state health insurance premium taxes is that they are regulated under federal law, specifically the Employee Retirement Income Security Act (ERISA). This means that they are subject to different regulations and requirements than traditional insurance plans.

While avoiding state health insurance premium taxes can be a significant benefit for employers, it's important to note that self-funded plans may still be subject to other taxes and regulations. For example, self-funded plans may be subject to federal income tax on certain benefits. Additionally, employers who choose self-funded plans must have the financial resources to cover the cost of employee health claims, which can be unpredictable.

In conclusion, self-funded plans offer employers more flexibility and control over their health care benefits. By avoiding state health insurance premium taxes, employers can save money and allocate their resources as they see fit. However, it's crucial for employers to carefully consider the potential risks and ensure they have the financial stability to cover employee health claims before opting for a self-funded plan.

Understanding Reimbursement: Private and Public Payers Explained

You may want to see also

Self-funded plans are regulated under federal law (ERISA)

Self-funded insurance plans, also known as self-insured group health plans, are regulated under federal law, specifically the Employee Retirement Income Security Act (ERISA). This is in contrast to state-licensed health plans, which are regulated under state law, although federal law may also apply or supersede state authority in certain cases.

ERISA was enacted in 1974 to protect workers from the loss of benefits provided through the workplace. It applies to all private employers and employee organisations, such as unions, that offer health plans to their employees. Only churches and government groups are exempt.

Under ERISA, there are requirements for the administration of self-funded plans, including rules around disclosure, reporting, and fiduciary standards, as well as claims and continuation coverage. For example, employers must provide a summary plan description to employees that includes information about the plan's premiums, deductibles, and copays. They must also file an annual report with the federal government and meet certain standards, such as nondiscrimination in premiums and eligibility.

One of the key implications of ERISA for self-funded plans is that it generally preempts state laws that would otherwise regulate the operation of health plans. This means that state mandates do not apply to those covered by self-funded plans. However, there may be exceptions, such as in the case of Connecticut's state employee plan, which abides by state mandates by contract.

In addition to ERISA, there are other federal laws that apply to self-funded health plans, including the Health Insurance Portability and Accountability Act (HIPAA) and the Consolidated Omnibus Budget Reconciliation Act (COBRA). These laws provide additional protections for employees and ensure that health plans meet certain standards.

Private Insurance: Is It Worth the Hype?

You may want to see also

Self-funded plans are not suitable for all employers

Self-funded insurance plans are not suitable for all employers. While self-funded plans can be appealing, they come with inherent risks and may not be the best choice for every business. There are several reasons why self-funded plans may not be a good fit for some employers:

Cost Uncertainty and Budgeting

Unlike fully-funded plans with set premiums, self-funded plans have unpredictable costs that depend on employee claims. This uncertainty can make it challenging to budget for healthcare expenses year over year. In a self-funded plan, budgeting becomes crucial and will depend on employee demographics such as age, region, and number of dependents. It is important to try to anticipate the number and amount of claims that may be received. Unexpected high-cost claims can impact cash flow and strain finances. Therefore, it is essential to have sufficient reserves and risk mitigation strategies, such as stop-loss insurance, in place to manage financial risks.

Administrative Burden

Self-funded health insurance requires more administrative involvement compared to fully-funded plans. Employers will need to oversee claims processing, manage provider contracts, handle regulatory compliance, and ensure accurate reporting. This administrative burden can be demanding, especially for small businesses with limited staff and resources. It is important to assess whether the business has the capacity to effectively handle these additional responsibilities. One option to alleviate this burden is to hire a Third-Party Administrator (TPA) to handle these administrative tasks.

Not Suitable for All-Sized Businesses

Self-funded health insurance may not be a good fit for smaller businesses with limited financial resources and employee populations. Assuming the financial risk associated with self-funding can be challenging for smaller businesses. It is crucial to carefully evaluate the business's financial stability and risk tolerance before deciding to self-fund health insurance. Larger businesses with more financial resources and a larger employee base may be better positioned to absorb the risks associated with self-funding.

Employee Demographics and Health Risks

When considering self-funded health insurance, it is important to assess the demographics and health risks of the employee population. If employees have higher health risks or a history of expensive medical treatments, self-funding may lead to higher costs. Conducting a thorough analysis of employees' health status can help determine if self-funding is a viable option. Businesses with employees who have lower health risks and less complex medical needs may find self-funding more suitable.

In summary, while self-funded insurance plans offer advantages such as flexibility and potential cost savings, they may not be suitable for all employers. It is important to carefully consider the inherent risks, administrative burden, financial stability, and employee demographics before deciding whether to adopt a self-funded insurance plan.

Champva Private Insurance: What You Need to Know

You may want to see also

Frequently asked questions

A self-funded insurance plan is one in which the employer assumes the financial risk of providing health care benefits to its employees. The employer pays for claims out of pocket instead of paying a fixed premium to an insurance carrier.

Self-funded insurance plans offer more flexibility and control over healthcare benefits. They are also often less costly as there are no profit or risk margins to pay to an insurer and no state-levied premium taxes. Self-funded plans are also not subject to state insurance regulations.

Self-funded plans can be unpredictable and expose the employer to financial risk. They also require more management time and resources to monitor the plan's performance. Additionally, the employer may be exposed to regulatory penalties and the risk of lawsuits.

Self-funded insurance is not private insurance. It is a type of insurance plan where the employer assumes the financial risk and pays for the health care benefits of its employees directly, rather than through an insurance carrier.