Servicemembers' Group Life Insurance (SGLI) is a Department of Veterans Affairs program that provides low-cost group life insurance to eligible service members. The maximum coverage amount was raised from $400,000 to $500,000 in March 2023, with the option to reduce coverage in $50,000 increments or cancel it entirely. SGLI includes Traumatic Injury Protection (TSGLI), which provides financial assistance to members in the event of a traumatic injury, with coverage ranging from $25,000 to $100,000. The monthly premium for $500,000 worth of coverage is $31, including a $1 TSGLI charge. When leaving the military, SGLI coverage remains in effect for 120 days, and can be converted to Veterans' Group Life Insurance (VGLI).

What You'll Learn

SGLI coverage

Servicemembers' Group Life Insurance (SGLI) is a Department of Veterans Affairs program that provides low-cost group life insurance to eligible service members. SGLI offers term coverage to active-duty members of the Army, Navy, Air Force, Space Force, Marines, or Coast Guard, as well as commissioned members of the National Oceanic and Atmospheric Administration (NOAA) or the U.S. Public Health Service (USPHS).

- A maximum coverage of $500,000, with the option to reduce in $50,000 increments or cancel entirely.

- 120 days of free coverage from the date of discharge from the military.

- The option to convert to Veterans' Group Life Insurance (VGLI) after leaving the military.

- Traumatic Injury Protection (TSGLI), which provides additional coverage for traumatic injuries, with a range of $25,000 to $100,000 depending on the nature of the injury.

- Part-time coverage for Reserve members who don't qualify for full-time coverage.

- The ability to choose beneficiaries and change them as needed.

The cost of SGLI is 6 cents per $1,000 of coverage, with an additional $1 monthly charge for TSGLI, resulting in a monthly premium of $31 for the maximum coverage of $500,000.

To manage SGLI coverage, service members can use the SGLI Online Enrollment System (SOES) to make changes to their coverage amount and beneficiaries.

Universal Life Insurance: What's Guaranteed and What's Not

You may want to see also

Eligibility criteria

Servicemembers' Group Life Insurance (SGLI) offers low-cost term coverage to eligible service members. If you meet the eligibility criteria, you will be automatically signed up for SGLI.

You may be eligible for full-time SGLI coverage if you meet at least one of the following requirements:

- You are an active-duty member of the Army, Navy, Air Force, Space Force, Marines, or Coast Guard.

- You are a commissioned member of the National Oceanic and Atmospheric Administration (NOAA) or the U.S. Public Health Service (USPHS).

- You are a cadet or midshipman of the U.S. military academies.

- You are a member, cadet, or midshipman of the Reserve Officers Training Corps (ROTC) engaged in authorized training and practice cruises.

- You are a member of the Ready Reserve or National Guard, assigned to a unit, and are scheduled to perform at least 12 periods of inactive training per year.

- You are a volunteer in an Individual Ready Reserve (IRR) mobilization category.

If you are in nonpay status with the Ready Reserve or National Guard, you may still be eligible for full-time SGLI coverage if you meet the following two requirements:

- You are scheduled for 12 periods of inactive training for the year.

- You are drilling for points rather than pay.

Please note that if you are in nonpay status, you must pay your premiums directly.

The maximum amount of SGLI coverage is $500,000, which can be purchased for $31 a month, including SGLI and TSGLI coverage. This coverage is offered in $50,000 increments, with the new coverage amounts being $450,000 for $27 a month and $500,000 for $30 a month.

If you qualify for SGLI, you will be automatically signed up through your service branch. You can check with your unit's personnel office for more information.

Life Insurance: Job Change Impact Explained

You may want to see also

Benefits

Servicemembers' Group Life Insurance (SGLI) is a Department of Veterans Affairs program that provides low-cost group life insurance to all eligible military members. Here are some of the benefits of SGLI:

Maximum Coverage

SGLI offers a maximum coverage amount of $500,000, which was increased from $400,000 in March 2023 to reflect the current cost of living. This increase ensures that service members' coverage keeps pace with inflation and provides adequate financial protection.

Automatic Enrollment

Eligible service members are automatically enrolled in SGLI at the maximum coverage amount, ensuring immediate protection without any delays. This automatic coverage gives peace of mind to service members and their families.

Flexibility

SGLI participants have the flexibility to choose their level of coverage. They can reduce the insurance in $50,000 increments, opt for part-time coverage, or even refuse coverage entirely if they prefer to seek alternative insurance options. This flexibility allows service members to customize their coverage according to their individual needs and preferences.

Traumatic Injury Protection (TSGLI)

SGLI includes Traumatic Injury Protection (TSGLI), which provides financial assistance in the event of traumatic injuries. This coverage ranges from $25,000 to $100,000, depending on the nature of the injury, and is designed to help members and their loved ones during the recovery process. This benefit can be especially valuable in mitigating the financial impact of unexpected injuries.

Affordable Premiums

SGLI is known for its affordable premiums, costing only 6 cents per $1,000 of coverage. The monthly premium for the maximum coverage amount of $500,000 is $31, which includes the $1 monthly charge for TSGLI. This low-cost structure makes SGLI an attractive option for service members seeking comprehensive life insurance coverage without a significant financial burden.

Conversion Options

When service members leave the military, their SGLI coverage remains in effect for 120 days after their discharge. During this transition period, they have the option to convert their SGLI to Veterans' Group Life Insurance (VGLI), a similar program designed for veterans. This conversion option ensures continuity of coverage and allows former service members to maintain life insurance protection as they navigate their post-military lives.

SGLI provides valuable benefits to eligible service members, including a substantial maximum coverage amount, automatic enrollment, flexibility in coverage choices, traumatic injury protection, affordable premiums, and conversion options upon leaving the military. These benefits contribute to the financial security and peace of mind of service members and their families.

Term Life Insurance: Auto-Renewal and You

You may want to see also

Premiums

Servicemembers' Group Life Insurance (SGLI) is a Department of Veterans Affairs program that provides low-cost group life insurance to eligible service members. If you meet the eligibility criteria, you will be automatically signed up for SGLI.

The premium is the amount you pay to the insurance company to maintain your coverage. The current basic SGLI premium rate is 6 cents per $1,000 of insurance coverage. This means that for $500,000 worth of coverage, the monthly premium is $30. All SGLI participants must also pay a $1 monthly charge for Traumatic Injury Protection coverage (TSGLI), bringing the total monthly premium for $500,000 worth of coverage to $31. The premium is automatically deducted from your base pay.

If you are in non-pay status with the Ready Reserve or National Guard, you may still be eligible for full-time SGLI coverage if you meet certain requirements. However, you must pay your premiums directly.

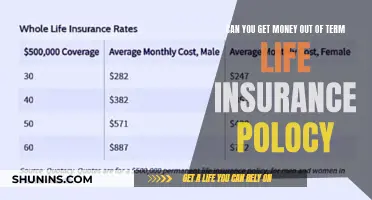

The amount of your life insurance premium depends on two main things: who you are and what you want. Insurance companies use a process called underwriting to evaluate factors like your age, health, and lifestyle to determine your level of risk and set your premium.

The younger you are, the less likely it is that you will die, so older people tend to have higher premiums. Women also tend to live longer than men and therefore usually have lower premiums. If you smoke or are overweight, you are at a higher risk of death and will likely have a higher premium. Insurance companies will also look at your family history, previous illnesses, cholesterol, and blood pressure levels.

The type and amount of coverage you choose will also affect your premium. The higher the coverage, the higher the premium. With term life insurance, your premium will increase as you age, while with permanent life insurance, your premium usually stays the same.

FAFSA and Life Insurance: What You Need to Know

You may want to see also

Conversion to VGLI

Servicemembers' Group Life Insurance (SGLI) is a Department of Veterans Affairs program that provides low-cost group life insurance to all military members. When you leave the military, your SGLI coverage will stay in effect for 120 days after your discharge. After you get out, you can convert your SGLI to VGLI (Veterans' Group Life Insurance), a similar program, if you wish.

The VGLI program allows service members to convert their SGLI coverage to a VGLI renewable term life insurance policy. It is easy to convert an SGLI Policy to a VGLI policy if you follow a few simple steps.

Firstly, you must apply to convert SGLI to VGLI within one year and 120 days from discharge. Veterans who submit their application within 240 days of discharge do not need to submit evidence of good health, while those who apply more than 240 days after discharge are required to answer questions about their health. If you are unable to access the internet, you can apply for the SGLI/VGLI conversion via the US postal service using form SGLV 8714. The form should be mailed to the Office of Servicemembers' Group Life Insurance (OSGLI) at PO Box 41618, Philadelphia, PA 19176-9913. You will need to include the first month's premium (listed on the form) and a copy of your DD 214 or other proof of service.

Secondly, you must select a company from the Participating Companies listing and apply to their local sales office. You will need to provide the agent who takes the application with a copy of your separation document (Form DD-214 or NGB-22, or written Reservist orders along with a copy of your last Leave & Earnings Statement (LES)).

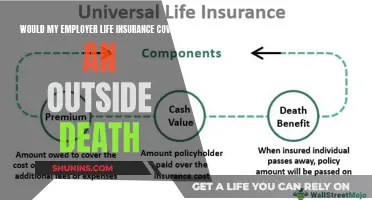

It is important to note that service members may convert their coverage to a commercial policy at standard premium rates, without having to provide proof of good health. The conversion policy must be a permanent policy, such as a whole life policy. Other types of policies, such as Term, Variable Life, or Universal Life Insurance are not allowed as conversion policies. In addition, supplementary policy benefits such as Accidental Death and Dismemberment or Waiver of Premium for Disability are not considered part of the conversion policy.

Progressive's Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

SGLI stands for Servicemembers' Group Life Insurance. It is a currently owned life insurance contract that is provided to eligible servicemembers in the Army, Navy, Air Force, and Marine Corps. It is a term life insurance policy that offers comprehensive coverage at affordable rates.

Active duty servicemembers, as well as reservists and members of the National Guard who are called to active duty, are eligible for SGLI. This includes those in the Delayed Entry Program (DEP) and members of the Ready Reserve who are scheduled to perform at least 12 periods of Inactive Duty Training per year.

SGLI offers a maximum coverage amount of $400,000, which is payable to the designated beneficiary/beneficiaries in the event of the insured servicemember's death. It includes a traumatic injury protection component, which provides payment between $25,000 and $100,000 if the servicemember suffers certain traumatic injuries. SGLI also offers accelerated death benefits, where members diagnosed with a terminal illness can receive a portion of their life insurance benefits early.