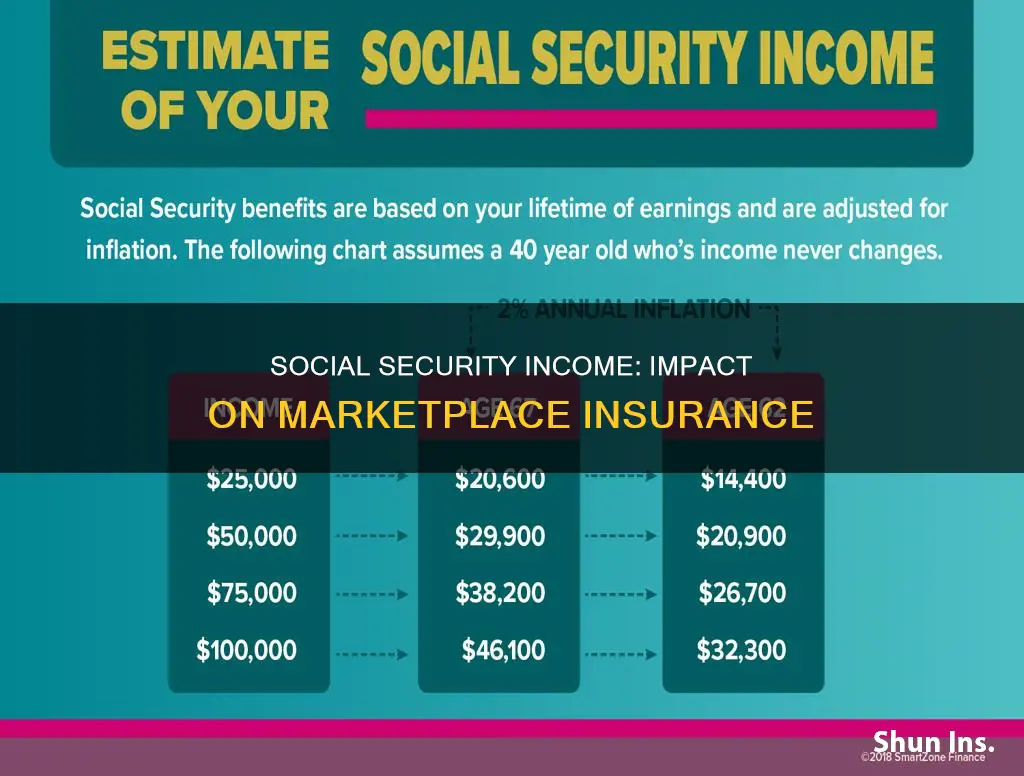

Social Security benefits are counted as income when determining eligibility for premium tax credits in the Marketplace. This includes Social Security Disability Insurance (SSDI) income, but not Supplemental Security Income (SSI). When calculating your Modified Adjusted Gross Income (MAGI) for Marketplace insurance, you must add non-taxable Social Security income to your Adjusted Gross Income (AGI) from your tax return.

What You'll Learn

- Social Security benefits are counted as income for premium tax credits

- Social Security income is included in the calculation for subsidy eligibility

- Non-taxable Social Security income must be added to your AGI to get total household income

- Social Security Disability Income (SSDI) must be included in your MAGI

- Supplemental Security Income (SSI) should not be included in your MAGI

Social Security benefits are counted as income for premium tax credits

Social Security benefits are counted as income when determining eligibility for premium tax credits in the Marketplace. This is true even if you don't make enough money to pay federal income taxes on them. When filling out a Marketplace application, you must estimate your household income for the year, which includes the incomes of your spouse and tax dependents. The Marketplace counts the estimated income of all household members.

The Marketplace uses a figure called modified adjusted gross income (MAGI) to determine eligibility for savings. MAGI includes your total gross income for the tax year, minus certain adjustments like deductions for conventional IRA contributions and student loan interest. Importantly, MAGI does include Social Security Disability Income (SSDI) but not Supplemental Security Income (SSI).

When determining whether your benefits are taxable, you must consider the total of half of your benefits plus all of your other income. If this total exceeds $25,000 per year for individual filers or $32,000 per year for joint filers, then your benefits are taxable.

Insurable Interest: Doctrine or Not?

You may want to see also

Social Security income is included in the calculation for subsidy eligibility

To calculate your MAGI, you start with your AGI from your tax return. Then, if they apply to you, you must add the following:

- Non-taxable Social Security income

- Foreign-earned income (and housing expenses if you live abroad)

- Tax-exempt interest income

Therefore, if you have Social Security income that isn’t included in your AGI on your tax return, you need to add it to your AGI to get your total household income, which is used to determine your eligibility for subsidies.

It is important to note that Income from Social Security Disability Insurance (SSDI) is included in your MAGI, but Supplemental Security Income (SSI) is not. Additionally, the rules for counting income can vary based on specific circumstances, such as for individuals qualifying for Medicaid based on age, disability, or being children in foster care.

The Comprehensive Guide to Navigating Insurance Billing as a Dietitian

You may want to see also

Non-taxable Social Security income must be added to your AGI to get total household income

Social Security benefits are taxable if your total income, including half of your Social Security benefits and other sources of income, surpasses a certain threshold. This can impact your eligibility for tax credits and deductions, as well as your overall tax liability and financial situation.

When determining your eligibility for premium tax credits in the Marketplace, Social Security benefits are counted as income. The Marketplace uses a figure called modified adjusted gross income (MAGI) to determine eligibility for savings. MAGI includes your adjusted gross income (AGI), which is your total income for the tax year minus certain adjustments, as well as other sources of income such as foreign income, Social Security Disability Income (SSDI), and retirement or pension income.

To calculate your AGI, you must first gather all your income sources for the tax year, including wages, salaries, self-employment income, interest, dividends, and rental income. Next, take note of any income exclusions, such as tax-exempt interest and qualified distributions from Roth IRAs. Calculate your total income by adding up all your income sources, then make "above-the-line" deductions, which are adjustments to income. Finally, subtract these deductions from your total income to arrive at your AGI.

While non-taxable Social Security income must be added to your AGI to get your total household income, it is important to note that Supplemental Security Income (SSI) is not included in MAGI calculations. Additionally, if you receive a lump-sum payment of benefits for a previous year, you must include the taxable part of that payment in your current year's income.

Unraveling the Process of Changing Unemployment Insurance in QuickBooks

You may want to see also

Social Security Disability Income (SSDI) must be included in your MAGI

Social Security Disability Insurance (SSDI) is a type of benefit paid to individuals with a disability who have worked enough years to qualify and paid Social Security taxes during their working years. Dependent children may also receive SSDI if a parent is already receiving it.

When it comes to Marketplace insurance, Social Security benefits are counted as income when determining eligibility for premium tax credits. This includes SSDI. The Marketplace uses a specific income number known as modified adjusted gross income (MAGI) to determine eligibility for savings. MAGI includes the total adjusted gross income (AGI) for each member of the household who is required to file a tax return.

It is important to note that SSDI is different from Supplemental Security Income (SSI). SSI is not a Social Security benefit but rather a supplemental income program for those with little to no income. SSI is not included in MAGI calculations.

Therefore, if you are receiving SSDI, it must be included in your MAGI when applying for Marketplace insurance.

Supplemental Security Income (SSI) should not be included in your MAGI

When filling out a Marketplace application, you need to estimate your household income for the year. This includes the income of all household members, such as a spouse or tax dependents. The Marketplace uses a specific income number called modified adjusted gross income (MAGI) to determine eligibility for savings.

MAGI does not include Supplemental Security Income (SSI). SSI provides monthly payments to people with disabilities and older adults with little or no income or resources. Adults and children may be eligible for SSI if they have little to no income, little to no resources, and a disability, blindness, or are 65 or older.

Social Security benefits, on the other hand, are counted as income when determining eligibility for premium tax credits in the Marketplace. This includes Social Security Disability Income (SSDI). Therefore, it is important to understand the difference between SSI and SSDI when reporting income for Marketplace insurance.

When reporting income for Marketplace insurance, it is crucial to provide an accurate estimate of your expected household income. This includes income from all household members who are required to file a tax return. By providing this information, you can ensure that you qualify for the appropriate amount of savings and receive the correct determination for premium tax credits.

NYS Insurance: Covering Your Assets

You may want to see also

Frequently asked questions

Yes, social security benefits are counted as income when determining eligibility for premium tax credits in the marketplace.

MAGI is a tax-based measure of income used to determine financial eligibility for premium tax credits, most categories of Medicaid, and the Children's Health Insurance Program (CHIP). MAGI includes non-taxable social security income, foreign-earned income, and tax-exempt interest income.

Adjusted Gross Income (AGI) is the total income from any source that is not exempt from tax minus deductions for certain expenses. MAGI includes AGI plus tax-exempt interest, social security benefits not included in gross income, and excluded foreign income.