Life insurance underwriting is the process of determining an applicant's eligibility for a policy. It involves assessing an individual's risk and financial circumstances to decide whether to approve their application, how much coverage they can have, and what price they will pay. The process can be broken down into financial underwriting and medical underwriting. Financial underwriting evaluates an applicant's financial background and circumstances to ensure the amount of insurance is reasonable and in line with their needs. Medical underwriting examines an individual's health and lifestyle factors, including age, medical history, habits, and occupation, to evaluate the risk they present to the insurer. The underwriting process can vary depending on the insurer and typically takes between two and eight weeks to complete.

| Characteristics | Values |

|---|---|

| What is underwriting? | The process used by insurance companies to assess an applicant's eligibility for coverage and determine the premium. |

| Types of underwriting | Financial underwriting, medical underwriting, full underwriting, accelerated underwriting, simplified issue underwriting, automated underwriting, and guaranteed underwriting. |

| What does an underwriter do? | Underwriters review applications and medical exams, complete risk assessments, and assign classifications. |

| Risk factors | Age, gender, health history, family medical history, criminal history, tobacco use, lifestyle, occupation, driving record, alcohol and drug use, foreign travel, citizenship status, existing policies, and military service. |

| Underwriting process | Application, medical exam, financial documentation, attending physician's statement, verification of third-party records, and calculation of life expectancy and insurance rating category. |

| Outcomes | Acceptance, postponement, rejection, or counteroffer. |

What You'll Learn

What is life insurance underwriting?

Life insurance underwriting is a detailed process that life insurance companies use to assess an applicant's eligibility for coverage and determine the appropriate premium. This involves two key approaches: medical underwriting and financial underwriting.

Medical Underwriting

Medical underwriting examines an individual's health and lifestyle factors, including age, medical history, habits, and occupation, to evaluate the risk they present to the insurer. Factors underwriters take into consideration include your age, gender, medical history, and family medical history. Depending on the insurance company and policy, you may need to undergo a basic medical exam. During the exam, you'll be examined for your weight, blood pressure, and pulse. You may also need to provide a blood and urine sample to test for any medical conditions or risks.

Financial Underwriting

Financial underwriting focuses on ensuring that the coverage amount aligns with the applicant's financial needs and circumstances. Insurers may review income, assets, liabilities, and other financial indicators, along with the applicant's credit history and existing insurance coverage. The objective is to determine that the policy's face amount is justified and that the policy serves as a safety net rather than a financial windfall.

The Underwriting Process

The underwriting process can be swift for some or extend over several weeks for others, possibly requiring medical exams or detailed questionnaires. It typically involves the completion of a life insurance application and a health exam. The insurance company will access various data points, including personal information (such as gender, age, occupation, lifestyle, and hobbies), individual and family medical history, current health conditions, smoking habits, financial information, and more.

Based on the risk assessment, the underwriter will either approve or reject the applicant for coverage. If approved, the underwriter will determine the coverage amount and premium. The more risk the insurance company must assume, the higher the premium will be.

Ispa Insurance: Do They Offer Life Insurance Policies?

You may want to see also

What does a life underwriter do?

A life underwriter is a professional who evaluates applications for life insurance coverage and determines the risk involved in insuring an individual. They are the link between a life insurance company and an insurance agent. They assess various factors, including an applicant's medical history, family history, job, and other relevant information, to analyse the level of risk associated with providing coverage.

Life underwriters base their evaluation of an applicant's risks on the information provided in the application form. They use computer software to determine the level of risk. If the standard evaluation is breached, the life underwriter may resort to other mechanisms for evaluation, such as current medical condition, medical history, job functions, financial standing, and other factors that help establish the realistic level of risk carried by the applicant.

Underwriters will also look at other factors like the likelihood that the insurance company will need to pay a death benefit to the applicant's loved ones. Based on the classification assigned to the applicant and other data, the underwriter will determine eligibility for coverage and the rate.

Life underwriters need strong investigative skills to examine medical records and conduct interviews to evaluate potential risks. They also need excellent writing skills to present their findings in clear and concise reports.

Credit Cards with Life Insurance: What's the Deal?

You may want to see also

How long does the underwriting process take?

The length of the underwriting process depends on the type of underwriting and the complexity of the policy. Traditional underwriting, which involves a questionnaire and a medical exam, typically takes around four weeks but can sometimes take longer. Accelerated underwriting, which uses algorithms and publicly available data to identify healthy applicants, can result in policies being issued online on the same day. Simplified underwriting bypasses the medical exam but requires a questionnaire and usually takes longer than accelerated underwriting.

The underwriting process for life insurance typically takes two to eight weeks to complete. The more extensive the policy, the more detailed and time-consuming the process. During this time, the underwriter will review the application and health exam results and assess the applicant's life expectancy and risk class. The higher the coverage requested, the longer the underwriting process may take.

The underwriting process can be broken down into several steps, each of which can impact the overall timeline:

- Application and verification: After submitting the application, the insurance company will verify the information provided, which may include contacting the applicant to confirm their identity and details.

- Medical exam: A medical examination is often required to confirm the applicant's health details. This exam is typically conducted by a certified paramedical professional at a location of the applicant's choice, such as their home or office.

- Information analysis: The underwriter will analyze various data points, including prescription history, medical records, motor vehicle records, credit history, and background checks.

- Insurance classification: Based on the information gathered, the underwriter will assign an insurance classification rating, which indicates the applicant's insurability based on health and lifestyle factors.

- Final decision: The underwriter will either approve or reject the applicant for coverage and determine the amount of coverage and premium based on the risk assessment.

Life Insurance: Brainly's Guide to Making the Right Choice

You may want to see also

What are the outcomes of underwriting?

The outcomes of underwriting are based on the level of risk the insurance company must assume. The underwriting process involves two key approaches: medical underwriting and financial underwriting. The former examines an individual's health and lifestyle factors, including age, medical history, habits, and occupation. The latter focuses on ensuring the coverage amount aligns with the applicant's financial needs and circumstances.

The outcomes of underwriting can be categorised into insurance classification ratings, which serve as an indicator of the applicant's insurability based on health and lifestyle factors. The "standard" classification acts as the baseline, representing the average risk profile for males and females. The classification can improve if the applicant presents lower health and lifestyle risks, but it can also be adjusted to higher-risk categories, such as substandard, or involve flat extras for higher-than-average risks.

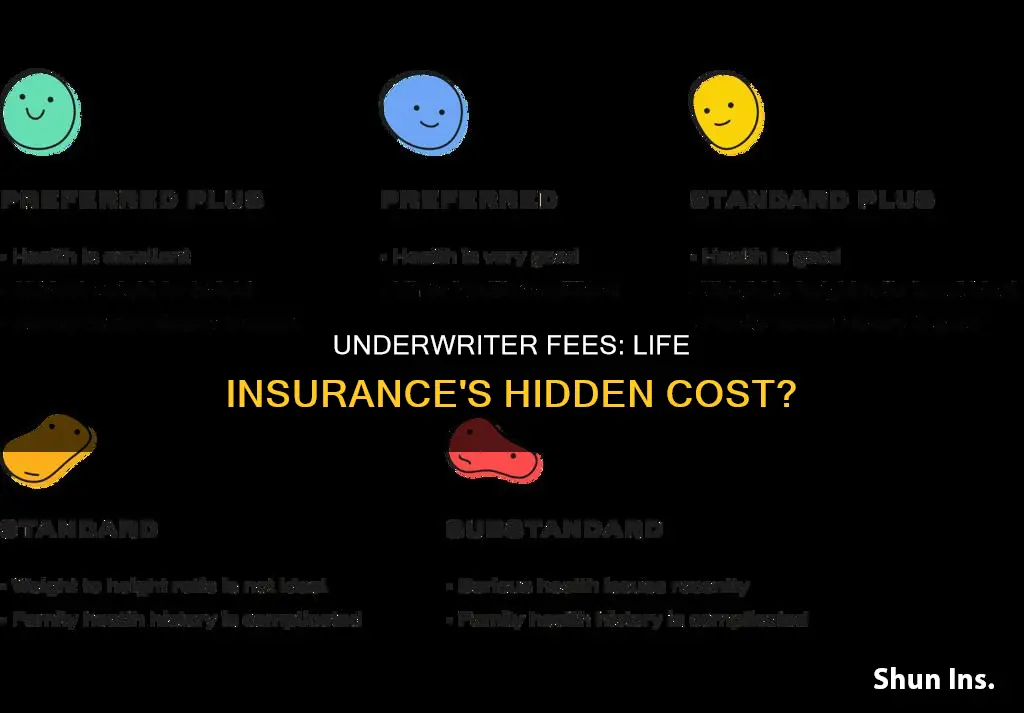

The insurance classification categories include:

- Preferred Plus or Preferred Elite: Excellent health, ideal height-to-weight ratio, and minimal or no bad habits that would impact health.

- Preferred: Very good health, but with some minor health issues such as high blood pressure or high cholesterol.

- Standard Plus: Generally healthy but with more risk factors than those in the Preferred class.

- Standard: Not an ideal height-to-weight ratio and a complicated family history.

- Substandard: Serious health issues and/or serious obesity, with a further classification system called "table rating" that assigns a certain percentage increase on the standard price for coverage.

- Tobacco/Smoker Ratings: For those who have used tobacco or nicotine products within the past 12 months, with premium costs up to three times higher than non-tobacco ratings.

Based on the risk assessment, the underwriter will either approve or reject the applicant for coverage. If approved, the underwriter will determine the amount of coverage and the price, with higher-risk applicants paying more expensive premiums.

Supplemental Life Insurance: Do You Need It?

You may want to see also

What are the warning signs from underwriters?

Underwriting standards for life insurance vary from company to company, but there are some universal parameters that most insurers follow when looking for "red flags". Insurers may respond to these potential dangers by decreasing their coverage, charging more premiums, or rejecting an application altogether.

- Smoking history: A history of smoking is one of the most significant grounds for rejecting a life insurance application.

- Potentially fatal diseases: A diagnosis of potentially fatal diseases like diabetes, heart disease, cancer, HIV/AIDS, or a blood-borne illness can also lead to rejection.

- Obesity: A body mass index (BMI) of 40 or above is a common reason for insurers to request further medical documentation and could lead to rejection.

- Uncontrolled blood pressure: Life insurance companies may deny coverage if you have high blood pressure that is not controlled with medication.

- Risky travel: Insurers may reject applications if the applicant plans to travel to unsafe or unstable regions.

- Drug use: The use of illegal drugs will automatically lead to rejection, while marijuana use is handled differently by various insurance carriers.

- Risky occupations: Applicants with dangerous jobs, such as pilots or police bomb technicians, may need to seek coverage from specialized carriers or employer plans.

- Alcohol use: Above-average alcohol consumption will likely lead to higher premiums, and heavy drinking may result in rejection.

Life Insurance: Can You Cover Your Ex?

You may want to see also

Frequently asked questions

Life insurance underwriting is the process of evaluating an applicant's eligibility for coverage and the associated costs. It involves assessing an individual's risk factors, including their medical history, lifestyle choices, and financial situation. This process helps insurance companies determine the applicant's risk level and set the premium amount accordingly.

Underwriters consider various factors, including age, gender, health history, family medical history, occupation, lifestyle choices (such as smoking or risky hobbies), driving record, and financial situation. They use these factors to assess the likelihood of the applicant's death during the policy period.

The underwriting process for life insurance typically takes around two to eight weeks. However, it can be shorter for accelerated or automated underwriting and longer for applicants with complex medical or financial histories.