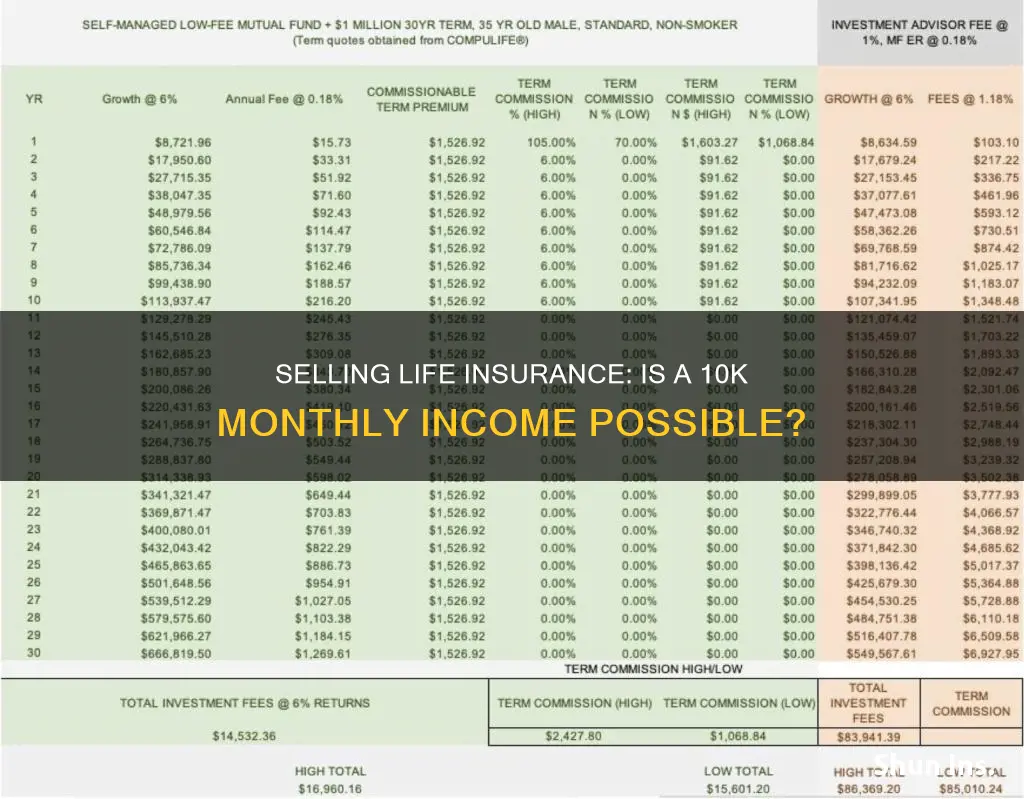

Selling life insurance is a challenging way to make a living, with many new agents burning out within a year. It is a competitive market, and agents are usually paid on a commission-only basis, meaning they need to be making sales to be earning. However, it is possible to make $250k or more per year selling life insurance, with some agents earning up to $223k in their fifth year. Whole life policies pay well, with agents receiving around 80-100% of the first year's premium. To make $10k per month selling life insurance, you would need to be consistently selling policies and earning high commissions.

What You'll Learn

- Life insurance sales can be lucrative, but it's challenging to find customers

- Life insurance agents are paid via commission and must find their own leads

- Life insurance sales jobs are easy to find and have high commission percentages

- Life insurance policies can provide a passive income stream for agents

- Life insurance is a challenging product to sell due to its nature

Life insurance sales can be lucrative, but it's challenging to find customers

Finding qualified customers is notoriously difficult, and any leads provided by your company will likely have been contacted by many other agents. This is where the challenge of being a life insurance agent lies. Even if you find a good prospect, the product itself is hard to sell. People don't like to think about their mortality, and life insurance doesn't offer any instant gratification.

However, if you can get past these hurdles, there is the potential to make good money. Life insurance agents can earn anywhere from $28,000 to $125,000 per year, with the top 10% earning an estimated $134,000. The median salary is over $59,000 a year. Life insurance also has the highest commission rates in the insurance industry. For example, you can earn anywhere from 30% to 90% commission on a policy in the first year, and then 5% to 10% in later years.

So, while it may be challenging, selling life insurance can be lucrative for those who are persistent and have a knack for sales.

Modern Woodsman: A Comprehensive Guide to Cancellation

You may want to see also

Life insurance agents are paid via commission and must find their own leads

Life insurance agents are typically paid via commission and must find their own leads. This means that they make money when they make a sale and are responsible for generating their own customer interest. The amount of commission they receive depends on the type of insurance being sold. For example, life insurance agents can earn anywhere from 30% to 90% of the premium in the first year of a policy, and then 5% to 10% of premiums paid in later years. This structure allows agents to build a passive income stream over time as they continue to earn commissions on policies they have already sold.

Finding qualified customers can be challenging for life insurance agents. Leads provided by the company have often already been contacted by numerous other agents, and exclusive leads, which are harder to find, are very expensive. As a result, many agents turn to cold-calling and door-knocking as a way to generate their own leads. This method requires perseverance and the ability to handle rejection.

To be successful in selling life insurance, consistency is key. Agents need to have a robust pipeline of potential customers and be able to write consistent business. Policies can take time to be approved, so it's important to have multiple policies in the works at any given time. Additionally, agents should focus on building relationships and understanding their customers' needs rather than being too pushy or focused on making a quick sale.

While selling life insurance can be a tough and competitive way to make a living, it offers the potential for a high salary and passive income. Agents who persevere and consistently write business can be rewarded with renewal commissions and a steady stream of income.

Florida's Life Insurance Replacement: What You Need to Know

You may want to see also

Life insurance sales jobs are easy to find and have high commission percentages

Life insurance sales jobs are abundant and easy to find. They are available on online job search sites and with larger brokerage firms or agencies, individual insurance carriers, or as a self-employed agent.

Life insurance sales jobs also have high commission percentages compared to other insurance sales, such as health insurance. For example, life insurance agents can earn anywhere from 30% to 90% of the premium in the first year and 5% to 10% of premiums in later years. This means that an agent selling a $100 per month policy with a six-month advance would receive a $600 commission.

Additionally, life insurance agents get paid commission renewals for as long as a sold policy is in force, creating a passive income stream. This means that once you sell a policy, you can continue to earn a commission on it as long as the owner continues to pay their monthly premiums. This passive income can add up over time, especially if you consistently write business and build a robust pipeline.

While the challenges of finding qualified customers and the competitive nature of the industry should not be understated, the high commission percentages and passive income potential make life insurance sales an attractive career option for those willing to put in the work.

Life Insurance Benefits: Taxable in California?

You may want to see also

Life insurance policies can provide a passive income stream for agents

Whole life policies, in particular, pay quite well. As a rule of thumb, agents can expect to earn about 80-100% of the first year's premium. If they work for a multi-level sales organization, they may see 25-50% of that commission until they recruit more people or sell more policies.

The key to making money in the life insurance industry is consistency. Agents need a robust pipeline of business to make good money. Policies take time to be approved, which can be frustrating when waiting to get paid. However, consistently writing business will eventually lead to a steady stream of policies issuing and commissions coming in.

Some carriers pay advanced commissions if the client pays for their policy at the time of application. However, newer agents may struggle if the policy gets declined or the client changes their mind, as they may be charged back commissions that they cannot afford to pay back.

Life insurance sales can be lucrative, but it is a challenging career path. Most agents do not last a year in the business, and even fewer make it to five years. The job typically involves cold-calling and door-knocking, and it can be difficult to find qualified customers. The product itself is also hard to sell, as people are often reluctant to discuss their mortality.

However, for those who persevere, the rewards can be significant. Successful life insurance agents can earn a high salary, with the top 10% making an estimated $134,000 per year.

Term Life Insurance: Renewal, Revision, or Release?

You may want to see also

Life insurance is a challenging product to sell due to its nature

Additionally, the sales process for life insurance can be complex and time-consuming. Agents often have to deal with lengthy approval processes for policies, which can result in delays in receiving their commissions. This can be frustrating for agents, especially if they are relying solely on commission-based pay. Furthermore, finding qualified leads and prospects can be difficult, as many companies do not provide their agents with reliable leads. This means that agents often have to resort to cold-calling and door-knocking, which can be time-consuming and demoralizing.

Another challenge is that life insurance agents often face negative perceptions and pressure from the public. They are often viewed in a similar light as used car salespeople or timeshare pushers, which can make it difficult to establish trust with potential customers. Additionally, agents may feel pressured by their companies to sell high-commission policies that may not be in the best interests of the customer. This can create a conflict between ethical selling and meeting sales quotas.

Furthermore, the pay structure for life insurance agents can be unpredictable and unstable. As most companies pay their agents solely through commissions, there is no guaranteed income. This means that agents may go through periods of financial instability, especially when they are first starting out. The competitive nature of the industry and the high turnover rate among agents can also make it challenging to build a stable and long-lasting career.

Overall, while selling life insurance can offer the potential for high earnings, it is a challenging and demanding career path. The nature of the product, the complex sales process, negative public perception, and unpredictable pay structure can make it difficult for agents to succeed in this industry.

Borrowing from Fegli Life Insurance: Is It Possible?

You may want to see also

Frequently asked questions

Life insurance agents can make a good living selling life insurance, but it is not an easy career. It requires a lot of hard work, perseverance, and the ability to convert leads to customers. The amount of money you can make depends on various factors, including your ability to convert leads to customers and the area in which you live. According to the U.S. Bureau of Labor Statistics, insurance sales agents earn a wide range of salaries, from $34,000 to $134,000 per year, with a median salary of over $59,000.

Some advantages of selling life insurance include the abundance of job opportunities, high commission percentages compared to other insurance sales, and the potential for passive income through commission renewals. However, there are also challenges, such as the difficulty of finding qualified customers, the competitive market, and the tough sales process due to people's reluctance to discuss their mortality.

To be successful in selling life insurance, focus on building relationships and providing good customer service. Learn about customer needs and focus on solving their problems rather than just making sales. Develop a professional impression and be patient, as it may take multiple interactions for a lead to become a customer.