When someone passes away, their life insurance policy can provide a financial safety net for their loved ones through the death benefit. This amount of money can be a crucial source of support for beneficiaries, helping them cover expenses, pay off debts, or achieve their financial goals. However, deciding what to do with the death benefit can be a complex and emotional process. This paragraph will explore the various options available to beneficiaries, including how to access the funds, the tax implications, and the different ways to utilize the death benefit to secure the financial future of the deceased's family.

What You'll Learn

- Tax Implications: Understand how death benefits are taxed and potential tax savings

- Beneficiary Selection: Choose beneficiaries carefully to ensure proper distribution of funds

- Investment Options: Explore investment strategies to grow the death benefit over time

- Debt Repayment: Use the death benefit to pay off debts and reduce financial burdens

- Charitable Giving: Donate a portion to charities for a meaningful legacy impact

Tax Implications: Understand how death benefits are taxed and potential tax savings

When a life insurance policyholder passes away, the death benefit is paid out to the designated beneficiaries. This amount can be a significant financial windfall for the recipients, but it's important to understand the tax implications to ensure you make the most of this financial resource. The tax treatment of death benefits varies depending on the type of life insurance policy and the beneficiary's relationship to the policyholder.

For instance, with a term life insurance policy, the death benefit is generally not taxable to the beneficiary. This is because term life insurance is designed to provide coverage for a specific period, and the death benefit is intended to replace income or cover expenses during that time. As long as the beneficiary is not related to the policyholder by a certain degree (often a spouse, child, or parent), the death benefit is typically tax-free.

However, whole life or universal life insurance policies have different tax considerations. The death benefit from these policies is generally subject to income tax, and the amount is added to the beneficiary's income for the year in which it is received. This can result in a significant tax liability, especially if the death benefit is substantial. To mitigate this, beneficiaries can choose to take a lump-sum payment or opt for periodic payments, which may provide some tax advantages.

One potential tax savings strategy is to designate a trust as the beneficiary. By doing so, the death benefit can be distributed according to the trust's terms, which may include specific instructions for tax-efficient distribution. For example, a trust can be structured to make payments to the beneficiary over time, allowing for a more gradual tax treatment. This approach can help minimize the tax burden on the beneficiary, especially if the trust is well-structured and aligned with the policyholder's financial goals.

Additionally, beneficiaries should be aware of the potential impact of the Alternative Minimum Tax (AMT). The AMT is a separate tax system that applies to individuals with high incomes or specific tax preferences. If the death benefit pushes the beneficiary's income above the AMT threshold, they may be subject to this additional tax. Proper planning and understanding of the AMT rules can help beneficiaries avoid unexpected tax liabilities.

In summary, the tax implications of life insurance death benefits can vary, and beneficiaries should be well-informed to make the most of this financial resource. By understanding the tax rules and exploring options like trust beneficiaries, individuals can potentially minimize tax obligations and ensure a more efficient distribution of the death benefit. It is always advisable to consult with a tax professional or financial advisor to tailor a strategy that suits the specific circumstances of the policyholder and their beneficiaries.

Get Life Insurance Leads: Strategies for Success

You may want to see also

Beneficiary Selection: Choose beneficiaries carefully to ensure proper distribution of funds

When it comes to life insurance, the death benefit is a crucial aspect, especially for those who rely on the financial support it provides. The death benefit is the payout made to the beneficiaries upon the insured individual's passing. Choosing the right beneficiaries is a critical decision that can significantly impact the distribution of this financial asset. Here's a guide to help you navigate this important aspect:

Identify Your Beneficiaries: Start by identifying the individuals or entities you want to name as beneficiaries. This could include your spouse, children, parents, or even charitable organizations. Consider who would benefit the most from the financial support and who you trust to handle the funds responsibly. It's essential to be specific and clear about your choices to avoid any potential disputes in the future.

Understand the Types of Beneficiaries: Life insurance policies offer different types of beneficiaries. Primary beneficiaries are the first in line to receive the death benefit, and they can be individuals or charities. Contingent beneficiaries are those who step in if the primary beneficiaries are unable to claim the funds. It's crucial to understand these distinctions to ensure your wishes are honored.

Consider Long-Term Needs: When selecting beneficiaries, think about the long-term financial needs of the individuals involved. For example, if you have minor children, you might want to name a spouse or a trusted family member as a primary beneficiary to provide for their upbringing. For older parents, a beneficiary who can ensure their financial security might be more appropriate. Tailor your choices to the specific circumstances and relationships.

Review and Update Regularly: Life circumstances change, and so should your beneficiary selections. Major life events like marriages, births, or deaths in your family may require you to review and update your beneficiary designations. Regularly assess your policy to ensure that the beneficiaries are still the best fit for your current situation. This proactive approach can prevent potential issues and ensure a smooth distribution of the death benefit.

Seek Professional Advice: If you're unsure about the process or have complex financial situations, consider consulting a financial advisor or an insurance professional. They can provide valuable guidance on beneficiary selection, tax implications, and other related matters. Their expertise can help you make informed decisions and ensure that your life insurance policy aligns with your overall financial plan.

By carefully considering these factors, you can ensure that the death benefit from your life insurance policy is distributed according to your wishes and the best interests of your loved ones. It is a crucial step in managing your financial affairs and providing for those who depend on you.

Life Insurance Payout: Are There Tax Implications for Beneficiaries?

You may want to see also

Investment Options: Explore investment strategies to grow the death benefit over time

When it comes to the death benefit from a life insurance policy, it's essential to understand that this amount is typically intended to provide financial security for your loved ones after your passing. While the primary purpose is to cover funeral expenses and outstanding debts, there are various investment options you can consider to potentially grow this benefit over time. Here are some strategies to explore:

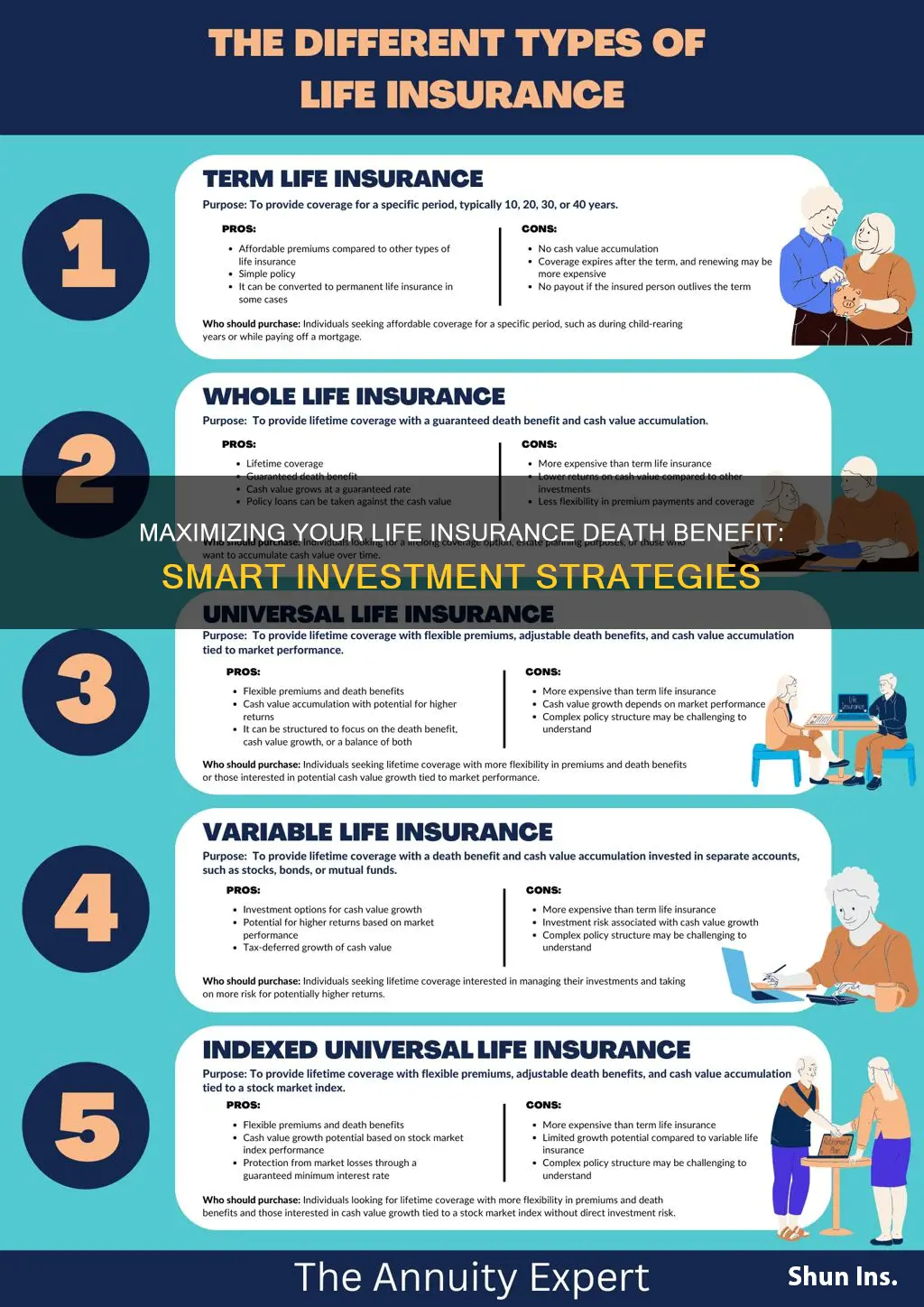

- Invest in the Policy's Cash Value: Many life insurance policies, especially those with a whole life or universal life component, accumulate cash value over time. This cash value can be invested within the policy itself, often through an investment account. You can direct a portion of the death benefit into this investment account, allowing it to grow tax-deferred. Common investment options within the policy include stocks, bonds, and mutual funds. By regularly reviewing and adjusting your investment strategy, you can potentially increase the value of the death benefit, providing a more substantial financial cushion for your beneficiaries.

- Consider Index Funds or ETFs: Exchange-Traded Funds (ETFs) and index funds are popular investment vehicles that can be used to grow the death benefit. These funds track specific market indexes, such as the S&P 500 or NASDAQ-100, and offer diversification across various assets. By investing in these funds, you can potentially benefit from long-term market growth. ETFs and index funds are generally low-cost and provide a simple way to invest in a broad range of companies or asset classes. You can allocate a portion of the death benefit to these funds, ensuring that the money is invested in a well-diversified portfolio.

- Explore Real Estate Investment: Investing in real estate can be a powerful strategy to grow the death benefit. This could involve purchasing rental properties, which can generate monthly income and potential long-term appreciation. Alternatively, you can invest in real estate investment trusts (REITs), which are companies that own and operate income-producing real estate. REITs offer a way to invest in real estate without directly owning properties. Both options provide an opportunity to build wealth over time, which can be used to increase the value of the death benefit.

- Diversify with Alternative Investments: To further diversify your investment portfolio, consider alternative investments such as precious metals, commodities, or private equity. These assets can provide a hedge against market volatility and offer the potential for significant returns. For instance, investing in gold or silver can protect against inflation and economic downturns. Private equity investments, on the other hand, involve funding startups or established companies, which can lead to substantial returns if successful. By incorporating these alternative investments into your strategy, you can potentially enhance the growth of the death benefit.

Remember, when exploring investment options, it's crucial to assess your risk tolerance, time horizon, and financial goals. Consulting with a financial advisor can provide personalized guidance based on your specific circumstances. They can help you navigate the various investment strategies and ensure that your life insurance death benefit is utilized effectively to secure the financial future of your loved ones.

Selling Sister Life Insurance: Conflict or Care?

You may want to see also

Debt Repayment: Use the death benefit to pay off debts and reduce financial burdens

When a life insurance policyholder passes away, the death benefit, which is the amount of money the policy was set to pay out, can be a crucial financial resource for beneficiaries. One of the most practical and beneficial uses of this death benefit is to pay off debts and reduce financial burdens. Here's a detailed guide on how to approach this:

Assess the Debt Situation: Begin by making a comprehensive list of all outstanding debts. This includes any personal loans, credit card balances, medical bills, and any other financial obligations. Calculate the total amount owed to get a clear picture of the financial burden. It's important to prioritize debts based on interest rates, as high-interest debts can quickly accumulate and become unmanageable.

Prioritize High-Interest Debts: Focus on paying off debts with the highest interest rates first. These debts can include credit cards or personal loans with steep interest charges. By targeting these debts, you can minimize the overall cost of borrowing and reduce the long-term financial impact. For example, if you have a credit card with a 20% annual interest rate and a balance of $5,000, paying it off as soon as possible can save you a significant amount of money in the long run.

Consider Debt Consolidation: If you have multiple debts with varying interest rates, consider consolidating them. Debt consolidation involves taking out a new loan to pay off all existing debts, resulting in a single, more manageable payment. This strategy can simplify your financial obligations and potentially lower your monthly payments. When applying for a consolidation loan, ensure you understand the terms, interest rates, and any associated fees to make an informed decision.

Negotiate with Creditors: In some cases, creditors may be willing to negotiate and offer a reduced settlement amount for outstanding debts. This can be a viable option if you're facing financial difficulties and cannot afford the full debt amount. Contact your creditors and explain your situation; they might provide options to settle the debt for less than the original amount. However, be cautious and ensure you understand any potential consequences, such as a negative impact on your credit score.

Create a Repayment Plan: Develop a structured plan to repay the debts using the death benefit. Allocate the funds wisely, prioritizing the highest-interest debts first. Consider setting up automatic payments to ensure timely repayments and avoid late fees. If possible, consult a financial advisor who can provide personalized advice and help you create a sustainable debt repayment strategy.

By strategically using the death benefit to pay off debts, you can significantly reduce financial stress and improve your overall financial health. It allows you to regain control of your finances, avoid further debt accumulation, and work towards a more secure financial future for your beneficiaries. Remember, responsible debt management is a crucial aspect of effective financial planning.

Sleep Meds and Life Insurance: What's the Verdict?

You may want to see also

Charitable Giving: Donate a portion to charities for a meaningful legacy impact

When considering what to do with the death benefit from a life insurance policy, charitable giving can be a powerful and meaningful way to leave a lasting impact. This approach allows you to support causes and organizations that are important to you, ensuring that your legacy extends beyond your lifetime. Here's a guide on how to navigate this process:

Identify Your Passionate Causes: Begin by reflecting on the charities or organizations that resonate with you. These could be related to your personal values, hobbies, or causes that you believe in. For instance, if you have a deep connection with environmental conservation, consider supporting organizations working towards sustainable practices. If you're passionate about education, explore options to fund scholarships or educational programs. The key is to choose causes that hold personal significance.

Research and Select Charities: Conduct thorough research to identify reputable charities that align with your chosen causes. Look for organizations with strong track records, transparent financial practices, and a clear mission. Review their websites, financial reports, and charity ratings to ensure they are legitimate and effective. You can also seek recommendations from friends or family who share similar interests, or consult with financial advisors who can provide valuable insights.

Determine the Donation Amount: Decide on a portion of the death benefit that you wish to donate. This could be a specific percentage or a fixed amount. Consider your financial goals and the impact you want to have. You might allocate a larger sum to a single significant charity or distribute it across multiple organizations. Remember, even a smaller donation can make a difference, and combining it with other sources of funding can create a substantial impact.

Set Up the Donation: Work with your life insurance provider or a financial advisor to set up the donation process. They can guide you through the necessary steps, including beneficiary designation and payment methods. You may choose to donate the entire death benefit or a portion of it. Some insurance companies offer options to donate directly to charities, ensuring a seamless process. Alternatively, you can designate the charity as a beneficiary and manage the distribution according to your preferences.

Create a Lasting Legacy: By donating a portion of the life insurance death benefit to charities, you contribute to a meaningful legacy. This act not only supports important causes but also inspires others to consider similar charitable giving. Your generosity can encourage family members and friends to engage in philanthropy, creating a ripple effect of positive change. Additionally, it provides an opportunity to educate and involve your loved ones in a meaningful way, fostering a sense of shared values and purpose.

Unlocking Equity: Understanding Equity-Indexed Life Insurance

You may want to see also

Frequently asked questions

A life insurance death benefit is the amount of money paid out to the beneficiaries when the insured individual passes away. It is a financial safety net provided by life insurance companies to ensure financial security for the loved ones left behind.

The process of accessing the death benefit depends on the insurance company and the policy details. Typically, the beneficiaries must notify the insurance company of the insured's passing and provide necessary documentation, such as a death certificate. The insurance company will then review the policy and initiate the claims process, which may involve a claims adjuster or a claims representative.

A A: The use of the death benefit is generally determined by the policy terms and the beneficiaries' preferences. Common uses include covering funeral expenses, paying off debts, providing financial support to dependents, funding education, or investing for long-term financial goals. It is essential to consider the beneficiaries' needs and financial goals when deciding how to utilize the death benefit.

Yes, there can be tax considerations. In many jurisdictions, life insurance death benefits are generally tax-free for the beneficiaries. However, the insurance company may be required to report the payment to the tax authorities, and there could be estate tax implications depending on the policy and the insured's overall estate. It is advisable to consult with a tax professional to understand the specific tax rules in your region.

If there are multiple beneficiaries, the death benefit can be distributed according to the policy's terms. This may involve a proportional distribution among the beneficiaries or a specific order of priority as outlined in the policy. It is crucial to review the policy and, if necessary, consult legal or financial advisors to ensure the beneficiaries' rights and interests are protected.