Life insurance is often a safety net for families in the event of the policyholder's death, and one of its advantages is tax relief. Typically, the death benefit paid out to beneficiaries isn't taxed as income, but there are exceptions. For example, if the beneficiary chooses to receive the payout in instalments, any interest accrued may be taxed. Additionally, if the policyholder leaves the benefit to their estate instead of naming a person as the beneficiary, estate taxes may apply. The taxation of life insurance proceeds also depends on the country and its specific laws and treaties. For instance, in the US, life insurance proceeds are generally not taxable, while in Spain, they may be subject to inheritance and donations tax.

| Characteristics | Values |

|---|---|

| Are US life insurance proceeds taxable in Spain? | No, but there are exceptions. |

| Who is taxed? | The beneficiary of the policy. |

| What is taxed? | Inherited intangible assets. |

| Where is it taxed? | The state in which the donor was residing at the time of their death. |

| Are there any treaties that override Spanish tax law? | Yes, treaties may override Spanish tax law. For example, the treaty between Spain and France prevents double taxation. |

What You'll Learn

- Taxation of US life insurance proceeds in Spain depends on the residence of the beneficiary

- Taxation of proceeds may depend on the residence of the insured person

- Proceeds are generally not taxable income, but interest received may be taxable

- Proceeds may be taxable if the policy was transferred for cash or other valuable consideration

- Taxation of proceeds may depend on whether the policy is a foreign life insurance policy

Taxation of US life insurance proceeds in Spain depends on the residence of the beneficiary

The taxation of US life insurance proceeds in Spain depends on the residence of the beneficiary. If the beneficiary resides in Spain, they are subject to Spanish taxation laws, which consider the beneficiary as the taxpayer. This means that the beneficiary will be taxed based on their residence, regardless of where the policy was taken out or where the proceeds are received.

However, in the case of cross-border succession, international treaties may override Spanish tax laws. For example, in the case of a Spanish resident being the beneficiary of a French life insurance policy, the Spain-France treaty of 1963, aimed at preventing double taxation, takes precedence. In this case, the life insurance proceeds would be taxed in France, where the donor was residing at the time of their death.

Therefore, the taxation of US life insurance proceeds in Spain depends on the specific circumstances, including the residence of the beneficiary, the location of the policy, and the existence of relevant international treaties. It is important for beneficiaries to understand their tax obligations and seek expert advice to ensure compliance with the relevant laws.

Life Insurance Settlement: Guaranteed Payment Options

You may want to see also

Taxation of proceeds may depend on the residence of the insured person

The taxation of life insurance proceeds can indeed depend on the residence of the insured person. This is particularly relevant in cases of cross-border succession, where the insured person resides in a different country from the beneficiary. In such cases, the taxation of proceeds may be governed by international treaties between the countries involved.

For example, in a case of cross-border succession between Spain and France, the Subdirectorate General for Wealth Taxes, Charges and Public Prices (the governing body of the Spanish Directorate General for Taxes) issued an expert opinion on the matter. The case involved a Spanish resident who was the beneficiary of a non-Spanish life insurance policy taken out in France by her aunt, who was a French resident.

The governing body's opinion stated that, under Spanish law, when the insured is a natural person other than the beneficiary, the life insurance policy proceeds to be received by the beneficiary are subject to Inheritance and Donations Tax (IDT). According to this law, the beneficiary is considered the taxpayer and is subject to taxation based on their residence or the place where the proceeds will be received.

However, the governing body also held that Spanish law applies without prejudice to international law and treaties incorporated into Spanish law. In this particular case, Spain and France had entered into a treaty to prevent double taxation and establish administrative guidelines for handling estate tax. The treaty stipulated that inherited intangible assets are subject to inheritance tax in the state of residence of the donor (the insured person) at the time of their death.

Therefore, despite Spanish law stipulating that the life insurance policy proceeds must be taxed in Spain, the treaty between the two countries took precedence, and the proceeds were taxed in France, the country of residence of the insured person at the time of their death.

This example illustrates how the taxation of life insurance proceeds can depend on the residence of the insured person, especially in cases of cross-border succession. It is important to consider the specific laws and treaties between the countries involved to determine the applicable taxation rules.

Haven Life Insurance: Commercial Appeal, Personal Impact

You may want to see also

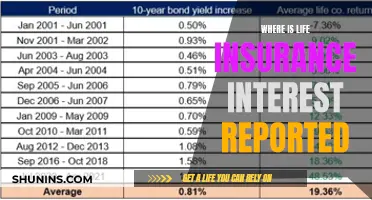

Proceeds are generally not taxable income, but interest received may be taxable

Life insurance proceeds are generally not taxable income, but there are some exceptions. The type of policy, the size of the estate, and the method of payment can determine whether or not life insurance proceeds are taxable. For instance, if the policy is transferred for cash or other valuable consideration, the exclusion for the proceeds is limited to the sum of the consideration paid, additional premiums paid, and certain other amounts.

In the case of US life insurance, proceeds are typically not taxable. However, any interest received is taxable and should be reported. This is because the interest is considered a "gain" on the investment. The timing and rate of tax will depend on the type of income, the category of the foreign life insurance policy, and whether PFIC issues are involved.

If you are a US citizen or resident alien, the Interactive Tax Assistant provided by the Internal Revenue Service can help you determine if the life insurance proceeds you received are taxable or non-taxable.

In Spain, inherited intangible assets are subject to tax in the state in which the donor was residing at the time of their death. This means that if you are a Spanish resident and the beneficiary of a non-Spanish life insurance policy, you may be taxed in Spain for the entire estate inherited, regardless of where the estate is located. However, if there is an international treaty in place governing the matter, this will prevail over Spanish tax law. For example, Spain has entered into a treaty with France to prevent double taxation, so in this case, the life insurance policy would be taxed in France, where the donor was residing at the time of their death.

Life Insurance Options for Cancer Patients Seeking a Mortgage

You may want to see also

Proceeds may be taxable if the policy was transferred for cash or other valuable consideration

In the context of US life insurance proceeds, proceeds typically refer to the death benefit paid out to beneficiaries. Generally, these proceeds are not taxable and do not need to be reported as income. However, there are certain scenarios where proceeds may be subject to taxation. One such scenario relates to the transfer of the policy for cash or other valuable consideration.

When a life insurance policy is transferred to someone else for cash or other valuable consideration, the tax exclusion for the proceeds is limited. In such cases, the exclusion is restricted to the sum of the consideration paid, any additional premiums paid by the new policyholder, and certain other amounts. This means that if the proceeds exceed these amounts, the excess may be taxable. This is an important consideration for those who are thinking about transferring their life insurance policy to someone else in exchange for value.

It is worth noting that there are exceptions to this rule, and the specifics can vary depending on individual circumstances. The type of income document received, such as Form 1099-INT or Form 1099-R, will determine how the taxable amount is reported. Additionally, the rules may differ for policies with a cash value component, such as whole or universal life insurance. Consulting official sources, such as the Internal Revenue Service (IRS) guidelines, or seeking advice from a tax professional, can provide clarity on the tax implications of transferring a life insurance policy in a particular situation.

In the context of Spain, the taxation of life insurance proceeds may be influenced by international treaties to which Spain is a signatory. For example, in the case of a cross-border succession between Spain and France, a treaty between the two countries took precedence over Spanish tax law. This treaty stipulated that inherited intangible assets, including life insurance policies, are subject to taxation in the state where the donor resided at the time of their death. Therefore, when considering the tax implications of life insurance proceeds in Spain, it is essential to be aware of any relevant international treaties that may impact the taxation of such proceeds.

Term Life Insurance: Cash Surrender Value and Benefits

You may want to see also

Taxation of proceeds may depend on whether the policy is a foreign life insurance policy

Taxation of life insurance proceeds may depend on several factors, including the type of policy, the residence of the insured and the beneficiary, and the structure of the payout. In the context of Spain and the US, the taxation of proceeds may also depend on whether the policy is a foreign life insurance policy.

A foreign life insurance policy is one that is based overseas. These policies are often more than just a death benefit policy; they can also serve as investment vehicles, providing income in the form of dividends, capital gains, interest, and proceeds. The income generated from these policies is generally taxable in the US, and the value of the policy must be reported to the IRS.

If a US citizen owns a foreign life insurance policy, several tax issues come into play. For example, if the policy generates dividends, interest, or capital gains, these may be taxable as foreign passive income. Additionally, if the policy has a surrender value or cash value, there may be additional tax implications, such as PFIC (Passive Foreign Investment Company Rules) and FBAR reporting requirements.

In the case of inherited intangible assets, such as life insurance policies, the taxation may depend on the residence of the donor (the insured) and the beneficiary at the time of the donor's death. In Spain, for instance, the proceeds of a life insurance policy are generally subject to Inheritance and Donations Tax (IDT), with the beneficiary considered the taxpayer. However, if there is an international treaty in place between Spain and the country of residence of the donor, the treaty may take precedence over Spanish tax law. For example, Spain has entered into a treaty with France to prevent double taxation, where inherited intangible assets are taxed in the state of residence of the donor at the time of death.

Therefore, the taxation of life insurance proceeds can be complex, especially when dealing with foreign life insurance policies. It is essential to consider the specific circumstances of the policy, the insured, and the beneficiary, as well as the tax laws and treaties of the relevant countries. Consulting with a tax professional is advisable to navigate the tax implications of foreign life insurance policies.

Death Row Inmates and Life Insurance: Is It Possible?

You may want to see also

Frequently asked questions

It depends on the residence of the beneficiary. If the beneficiary resides in Spain, the proceeds are taxable in Spain. However, if the beneficiary resides in a different country, the proceeds may be taxable in that country.

In this case, the proceeds may still be taxable in Spain. The taxation of life insurance proceeds depends on the residence of the beneficiary and the place where the proceeds are received.

Yes, if there is an international treaty in place between Spain and the country of residence of the donor, that treaty may take precedence over Spanish tax law. For example, Spain has entered into treaties with France, Greece, and Sweden regarding inheritance tax.

Yes, the type of policy, the size of the estate, and the method of payout can also determine the taxation of life insurance proceeds. For example, if the policy is part of the deceased's estate and the value of the estate exceeds the federal estate tax threshold, estate taxes must be paid.

Yes, if the beneficiary chooses to receive the payout as an annuity or installment payments, any interest accrued may be subject to taxes. Additionally, if the beneficiary withdraws or takes out a loan against the cash value of a whole life policy, they may have to pay income taxes on the excess amount.