Variable life insurance is a type of permanent life insurance that provides lifelong coverage and a cash value account that the policyholder can decide how to invest. It is a good option for those who want to take an active role in their life insurance investments and are comfortable with financial risk. However, it is a complex product with high fees and management costs, and it may not be suitable for those who want basic life insurance or low-cost coverage.

| Characteristics | Values |

|---|---|

| Type | Permanent life insurance |

| Coverage | Lifelong |

| Cash value | Can be invested, offering the potential for greater returns than other types of permanent life insurance |

| Death benefit | Guaranteed minimum |

| Premium | Fixed |

| Investment options | Wide range of funds |

| Investment control | Total |

| Risk | High |

| Fees | High |

| Complexity | High |

What You'll Learn

Variable life insurance: pros and cons

Variable life insurance is a type of permanent life insurance policy that provides coverage for an individual's lifetime as long as premiums are paid. It is also referred to as variable appreciable life insurance and is similar to other permanent policies in that it has a death benefit and cash value.

However, variable life insurance differs from other policy types as it allows the policyholder to decide how to invest the cash value, usually in securities or subaccounts that resemble mutual funds. This gives variable life insurance a higher potential for earning cash compared with traditional policies.

Pros

- The death benefit is often income tax-free.

- There is potential for tax-deferred growth of cash value.

- Flexible premium payments allow the policyholder to adjust the timing and amount of payments within the limits of the contract.

- The policyholder can adjust the coverage amount within the limits set by the insurer.

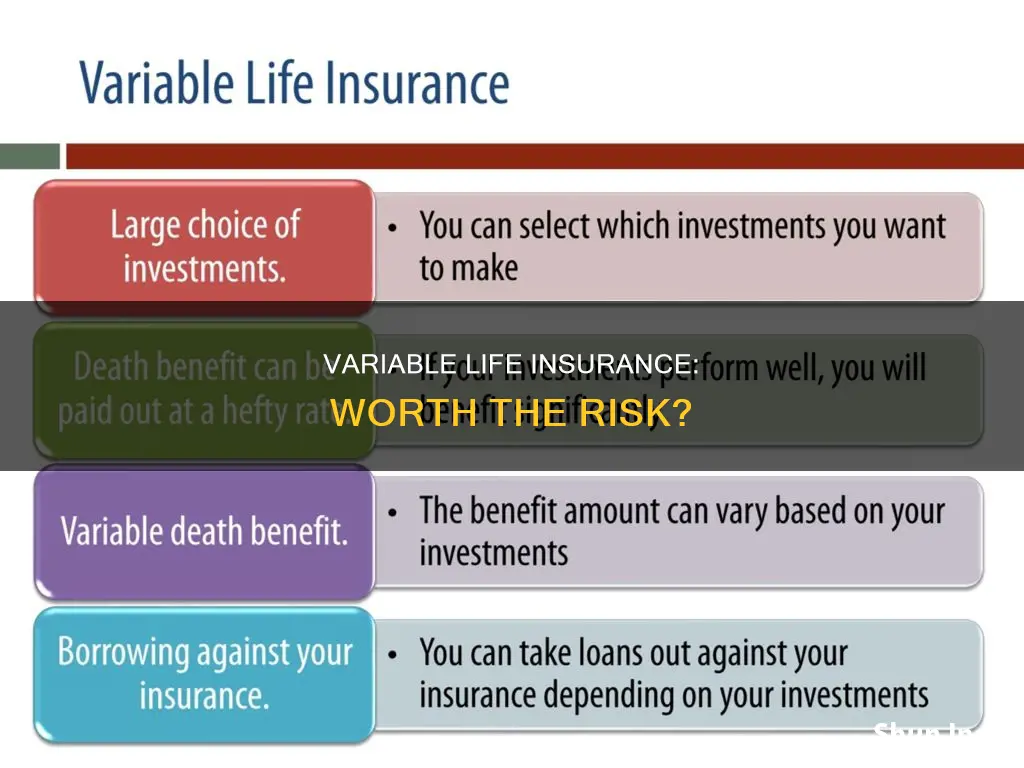

- Variable life insurance has a wider range of investment funds compared to other types of life insurance.

- The policyholder has control over their investments and can allocate money to different funds based on their risk tolerance and financial goals.

- The cash value can be borrowed against as a loan, although interest must be paid.

- Variable life insurance typically has a minimum guaranteed death benefit as long as premiums are paid.

Cons

- Variable life insurance policies are complex and require more hands-on attention.

- They come with higher levels of risk as the cash value is influenced by the performance of the market.

- Variable life insurance policies typically have higher premiums and fees than other types of life insurance.

- The cash value could decrease due to poor investment performance, which could also cause the policy to lapse if the cash value drops too low.

- There is no guaranteed rate of return, unlike whole life insurance policies.

- The administrative burden of monitoring and managing investments falls on the policyholder.

Life Insurance: Multiple Assignment of Benefits Possible?

You may want to see also

How does variable life insurance work?

Variable life insurance is a contract between you and your insurance company. It is a permanent life insurance policy with an investment component. The policy has a cash-value account with money that is invested, typically in mutual funds.

Variable life insurance works much like any life insurance policy in that you pay a premium and then your beneficiaries receive a benefit when you die. As a permanent policy, the coverage is in effect until your death.

Variable life insurance also includes a cash value component that you can access for other purposes, such as to pay for a major expense. The unique feature of variable life insurance is that its cash component can be invested in asset options, mainly mutual funds. The value of your account will depend on the premiums you pay, how your investments perform, and the associated fees and expenses.

You can also allocate money toward a fixed account to receive a fixed rate of interest and reduce overall risk. This rate may change annually, but there is typically a guaranteed minimum, such as 3%.

The insurance company may require you to pay a specific amount of premiums, or it may give you the flexibility to pay premiums as long as you pay the required fees. Some providers may also offer protection against a lapse in coverage if you don't have enough cash value to cover policy fees.

Variable life insurance can provide you with an opportunity to make money in the market that has tax advantages. The investment portion receives favourable tax treatment, so you can draw from these accounts in later years, through loans using the account as collateral instead of making direct withdrawals, and receive tax-free income.

Understanding Split-Dollar Life Insurance: How Does It Work?

You may want to see also

Who is variable life insurance good for?

Variable life insurance is a good idea for those who want lifelong coverage and are willing to take an active role in their life insurance investments. It is also a good option for those who are comfortable with financial risk and have the wealth to absorb potential losses.

Variable life insurance is a form of permanent life insurance that combines lifelong coverage with an investment component. The investment component allows policyholders to invest the cash value of their policy in various securities, such as stocks, bonds, and mutual funds. This provides the opportunity for greater returns compared to other types of permanent life insurance but also comes with higher risk.

Variable life insurance is a good fit for individuals who:

- Are comfortable with financial risk: Variable life insurance policies are exposed to market risk, which means the cash value can increase or decrease based on market performance. Those who are comfortable with this risk and have the financial means to absorb potential losses can benefit from the higher return potential.

- Want lifelong coverage: Variable life insurance policies provide coverage for the insured person's lifetime, as long as premiums are paid. This makes it a good option for those who want long-term coverage.

- Are proactive investors: Variable life insurance requires policyholders to actively manage their investments. Those who are confident in their investment abilities and willing to monitor and manage their investments can benefit from the flexibility and control offered by variable life insurance.

- Are looking for tax advantages: The cash value growth in variable life insurance is tax-deferred, and policy loans are typically not taxed. Additionally, the death benefit paid to beneficiaries is usually tax-free.

- Want flexible premium payment options: Variable life insurance policies often offer flexible premium payment options, allowing policyholders to adjust their payments based on their income and financial situation.

In summary, variable life insurance is a good idea for individuals who are comfortable with financial risk, want lifelong coverage, and are proactive in managing their investments. It offers the potential for higher returns and provides flexibility and control over the investment component. However, it is important to carefully consider the risks and fees associated with variable life insurance before purchasing a policy.

Adderall and Life Insurance: What You Need to Know

You may want to see also

What are the alternatives to variable life insurance?

Variable life insurance is a type of permanent life insurance policy that provides lifelong coverage and a cash value account that you can invest as you choose. While it has a higher earning potential than other types of life insurance, it also comes with higher fees and management costs.

- Whole life insurance: This offers lifelong coverage but with lower risk and reward. Whole life insurance policies have level premiums, a guaranteed death benefit, and guaranteed returns. The cash value grows at a fixed rate, similar to a savings account, and is typically guaranteed to equal the policy's death benefit when the policy matures. Whole life insurance policies have lower fees and are not regulated as securities. However, they offer limited growth potential compared to variable life insurance.

- Universal life insurance: This is another form of permanent life insurance that offers flexible premiums. Universal life insurance policies may be a better option if you want the flexibility to adjust your premium payments. However, keep in mind that changing your premium will also affect your death benefit amount.

- Term life insurance: Term life insurance is a more affordable option if you only need coverage for a specific period, such as the length of your mortgage. Term life insurance premiums are significantly lower than variable life insurance because they lack the investment component. However, the death benefit is only guaranteed during the term of the policy, and there is no cash value accumulation.

- Retirement accounts: Instead of investing in variable life insurance, you could prioritize contributing to a 401(k) or individual retirement account (IRA). These accounts offer tax-deferred growth and a wider range of investment options with lower fees. While the money may be less accessible in the short term, you avoid the high fees associated with variable life insurance.

- Guaranteed coverage plan: If you've been denied traditional life insurance due to medical factors, a guaranteed coverage plan can provide an alternative. This type of insurance does not require a medical exam or records, and you are generally eligible unless you exceed the age limit (typically between 50-80 years old). However, these policies often have high premiums and a lower death benefit, making them more suitable for covering final expenses like funeral costs.

- Critical illness insurance: This type of insurance provides a tax-free lump sum if you develop a life-threatening illness. It is designed to replace income rather than provide a death benefit. Some policies have no waiting period, allowing you to immediately access the funds for treatment or living expenses during your recovery.

- Income protection insurance: This insurance provides monthly, tax-free income if you are unable to work for an extended period due to illness or injury. It can be a good alternative if you're unable to qualify for or renew life insurance but want income protection. Income protection insurance is available in terms of 12-60 months and typically pays between 50%-70% of your earnings.

- Accidental Death and Dismemberment (AD&D) insurance: AD&D insurance covers fatal accidents or the accidental loss of a limb. It does not consider your medical history or lifestyle choices, making it an option for those who may not qualify for traditional life insurance. The premiums for this type of insurance can be very affordable, typically costing around $7 to $10 per month per $100,000 of coverage.

IRAs and Life Insurance: What's Included in an Estate?

You may want to see also

What are the tax implications of variable life insurance?

Variable life insurance is a form of permanent life insurance that stays in effect for the insured person's lifetime. It has a death benefit and a cash value that varies according to the amount of premiums paid, the policy's fees and expenses, and the performance of a menu of investment options. The cash value of a variable life insurance policy grows on a tax-deferred basis, and any withdrawals are taxed at the federal income tax rate.

There are several tax implications to variable life insurance. Firstly, the cash value of the policy grows tax-free until it is withdrawn, at which point it is taxed as ordinary income. Secondly, policy loans are not taxed as income unless the policy lapses before the loan is repaid. Thirdly, the death benefit paid to beneficiaries is not subject to federal income tax. Finally, under certain circumstances, the death benefit may not be subject to federal estate tax.

Variable life insurance policies have a range of optional insurance features that may be added for an additional fee, such as long-term care insurance, accidental death benefit, and accelerated death benefit. These features can provide additional financial protection but also come with their own set of fees and expenses. It is important to carefully consider the cost and benefits of these optional features before adding them to a variable life insurance policy.

In addition to the fees and expenses associated with the optional insurance features, there are also ongoing fees and expenses associated with owning a variable life insurance policy. These may include sales fees, surrender charges, mortality and expense risk fees, cost of insurance, administration fees, and loan interest. It is important to understand all the fees and expenses associated with a variable life insurance policy before investing.

Life Insurance: Long-Term Disability Coverage Explained

You may want to see also

Frequently asked questions

Variable life insurance is a type of permanent life insurance that stays in effect for your lifetime. It has a death benefit and cash value and provides coverage for your entire life.

Variable life insurance has a strong investment component that allows you to invest your cash value in professionally managed options of your choosing, such as stocks and mutual funds. It has the potential for greater returns than other types of permanent life insurance. It also has a minimum guaranteed death benefit as long as you pay your premiums.

Variable life insurance policies often have higher fees and management costs than other kinds of permanent life insurance. There is also a risk of losing money if your investments perform poorly, which can cause the policy to lapse if the cash value drops too low.