Group-term life insurance is a common benefit provided by employers. It is a form of pay for services, and is usually included in an employee's gross income. It is a non-wage compensation benefit that may be fully or partially taxable, depending on the benefit and who receives it.

The Internal Revenue Service (IRS) states that the first $50,000 of group-term life insurance coverage provided under a policy carried directly or indirectly by an employer is non-taxable. However, if the total amount of such policies exceeds $50,000, the imputed cost of coverage in excess of $50,000 must be included in income and is subject to social security and Medicare taxes.

The IRS also provides guidelines for certain situations, such as when an employer provides a vehicle for an employee's personal use, and for benefits such as health insurance, bonuses and awards, company cars, housing allowances, and educational assistance.

| Characteristics | Values |

|---|---|

| Definition | A fringe benefit is a form of pay for services. |

| Taxable or Non-taxable | Group-term life insurance is a nontaxable fringe benefit, but only up to a certain amount. |

| Amount | The first $50,000 of group-term life insurance coverage is nontaxable. |

| Taxable Amount | The excess amount over $50,000 is considered a non-cash fringe benefit and is taxable. |

| Tax Type | The excess amount is subject to social security and Medicare taxes. |

| Withholding Income Tax | Employers can decide whether to withhold federal income tax on coverage over $50,000. |

| Reporting | The taxable amount should be reported on Form 941, Form 944, and Form W-2. |

| Spouse and Dependents | Coverage for a spouse or dependent does not qualify as group-term life insurance but can be excluded as a de minimis fringe benefit if it is $2,000 or less. |

What You'll Learn

Group-term life insurance is a fringe benefit

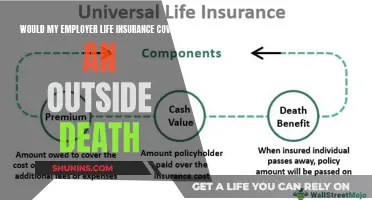

Group-term life insurance is tax-free for the employee up to a certain amount. The IRS provides exclusion rules that exclude all or part of the value of certain fringe benefits from an employee's pay, making that benefit tax-free. The IRS fringe benefit exclusion rule applies to group-term life insurance that meets all of the following requirements:

- The coverage provides a general death benefit that isn't included in the employee's income.

- The employer provides the insurance to at least 10 full-time employees at some point during the year (some exceptions apply).

- The coverage isn't biased towards certain employees.

- The employer directly or indirectly carries the policy.

If the above qualifications are met, the first $50,000 of group-term life insurance coverage is excluded from each employee's taxable income. If the employer pays for more than $50,000, the excess is included in the employee's taxable income and is subject to social security and Medicare taxes (FICA). The employer can decide whether to withhold federal income tax on coverage over $50,000.

Group-term life insurance for spouses and dependents does not qualify as group-term life insurance. However, employers can generally exclude up to $2,000 as a de minimis fringe benefit.

To determine the taxable cost of group-term life insurance, employers can use the IRS chart to find the value of the coverage to include in the employee's taxable income. This chart shows the cost per $1,000 of life insurance coverage each month, which depends on the coverage amount and the employee's age.

Life Insurance: What Business Expenses Can Cover

You may want to see also

It is taxable if the coverage exceeds $50,000

Group-term life insurance is a common benefit provided by employers. It is a non-cash earning on an employee's pay stub. While the first $50,000 of coverage is non-taxable, the excess amount is considered a non-cash fringe benefit, and the premiums for that extra coverage become taxable income for the employee. This "excess" is also subject to social security and Medicare taxes.

The taxable cost of group-term life insurance is determined by the benefit's fair market value. The IRS provides a table to calculate the cost of excess coverage, based on the worker's age. For example, if an employee is 45 years old, their premiums would be calculated at 15 cents per month (or $1.80 a year) for every $1,000 in coverage. The first $50,000 of coverage isn't taxed, so if an employee had $200,000 in total coverage, they would be taxed on the cost of $150,000 in coverage, or $270 for the full year ($1.80 x $150,000).

The amount shown on an employee's paycheck or pay stub for group term life insurance represents the taxable benefit. At the end of the year, the W-2 form will report the total cost of any group insurance received that was in excess of $50,000 and is therefore taxable. This amount will appear in box 12c of the W-2 and also be included in the employee's income for boxes 1, 3, and 5.

Life Insurance: Opting Out and Its Consequences

You may want to see also

The taxable amount is calculated using the IRS Premium Table

The taxable amount of group-term life insurance is calculated using the IRS Premium Table. This table is used to determine the cost of excess coverage based on the worker's age. The first $50,000 of coverage is not taxed and is excluded from the employee's taxable income. Any amount over $50,000 is considered a non-cash fringe benefit and is, therefore, taxable.

For example, let's say an employer provides $100,000 in group-term coverage to two employees, William and Charlotte, who are 26 and 57 years old, respectively. To calculate the taxable amount, we need to determine the monthly cost of the insurance, which depends on the coverage amount and the employee's age. According to the IRS Premium Table, the cost per $1,000 of coverage for William is $0.06 per month, while for Charlotte, it is $0.43 per month.

Next, we calculate the excess coverage, which is the total coverage minus the tax-exempt amount of $50,000. In this case, the excess is $50,000. We then divide the excess by $1,000 since the premiums are per $1,000 of insurance, which gives us 50. This number is then multiplied by the cost per $1,000 from the table to get the monthly taxable income.

For William, the monthly taxable income is $0.06 x 50 = $3. To get the annual taxable income, we multiply the monthly amount by 12, which gives us $36.

For Charlotte, the monthly taxable income is $0.43 x 50 = $21.50. The annual taxable income is $21.50 x 12 = $258.

Therefore, the taxable amount of group-term life insurance for William and Charlotte is $36 and $258, respectively, calculated using the IRS Premium Table.

Gerber Life Insurance: Doubling Benefits for Parents

You may want to see also

The benefit is reported on an employee's W-2 form

Group-term life insurance is a common benefit provided by employers. It is a non-cash earning on an employee's pay stub. It is taxable after the first $50,000 of coverage. If the employer-provided coverage is greater than $50,000, the excess amount is considered a non-cash fringe benefit, and the premiums for that extra coverage become taxable income for the employee. This "excess" is subject to social security and Medicare taxes (FICA tax). The employer can decide whether to withhold federal income tax on coverage over $50,000.

The amount shown on an employee's paycheck or pay stub for group term life insurance represents the taxable benefit. When an employee receives a W-2 form from their employer at the end of the year, it will report the total cost of any group insurance received that was in excess of $50,000 and is therefore taxable. That amount will appear in box 12c of the W-2 and also be included in the employee's income for boxes 1, 3, and 5.

The IRS has a table in its "Publication 15-B: Employer's Tax Guide to Fringe Benefits," that employers can use to determine the cost of excess coverage, based on the worker's age. For example, if an employee is 45 years old, their premiums would be calculated at 15 cents per month (or $1.80 a year) for every $1,000 in coverage. The first $50,000 of coverage isn't taxed, so if an employee had $200,000 in total coverage, they'd be taxed on the cost of $150,000 in coverage, or $270 for the full year ($1.80 x $150,000).

Group-term life insurance is a fringe benefit, which is a benefit that employers offer in addition to an employee's regular wages. There are taxable and non-taxable fringe benefits. The IRS fringe benefit exclusion rule applies to group life insurance that meets all of the following requirements:

- The coverage provides a general death benefit that isn't included in income.

- The employer meets the 10-employee rule (must provide the insurance to at least 10 full-time employees at some time during the year; some exceptions apply).

- The coverage isn't biased toward certain employees.

- The employer directly or indirectly carries the policy.

VGLI Whole Life Insurance: Is It Worth the Cost?

You may want to see also

The benefit is also subject to social security and Medicare taxes

Group-term life insurance is a common benefit provided by employers, and it is a taxable fringe benefit when the coverage amount exceeds $50,000. The imputed cost of coverage in excess of $50,000 must be included in income and is subject to social security and Medicare taxes. This is true even if the employees are paying the full cost they are charged.

The determination of whether the premium charges straddle the costs is based on the IRS Premium Table rates, not the actual cost. The benefit is taxable even if the employees are paying the full cost they are charged.

As an employer, you must include the amount of group-term life insurance beyond $50,000 worth of coverage, reduced by the amount the employee paid toward the insurance, in the employee's wages. Report it as wages in boxes 1, 3, and 5 of the employee's Form W-2. Also, show it in box 12 with code C.

Life Insurance and Superannuation: What's the Connection?

You may want to see also

Frequently asked questions

The Internal Revenue Service (IRS) defines a fringe benefit as "a form of pay for services." They are usually included in an employee's gross income and are usually non-wage compensation. Fringe benefits may be fully or partially taxable, depending on the benefit and to whom it is paid.

Taxable fringe benefits may include health insurance coverage for non-dependent people or excessive coverage amounts, cash bonuses and awards, company cars for personal use, housing allowances, and educational assistance over a certain amount.

In most cases, the value of the taxable fringe benefit is determined by the benefit’s fair market value. However, the IRS does provide guidelines for many fringe benefits. For example, when an employee is provided a vehicle for personal use, the IRS calculates the taxable value based on a standard mileage rate or a percentage of the vehicle’s fair market value.