Many insurance companies require drivers to be at least 25 years old to qualify for certain coverage benefits. This age restriction is often based on the assumption that younger drivers are statistically more likely to be involved in accidents and, therefore, pose a higher risk to insurance providers. As a result, insurers may offer lower premiums or more favorable terms to drivers who meet this age criterion, ensuring that their policies are tailored to meet the specific needs of this demographic.

| Characteristics | Values |

|---|---|

| Age Requirement | 25 years old |

| Insurance Type | Car insurance |

| Legal Requirement | Not a universal rule, varies by country and insurance provider |

| Benefits | Lower premiums, access to specific coverage options |

| Drawbacks | Limited coverage for younger drivers |

| Alternative | Young driver insurance programs, learner driver policies |

| Regulatory Body | Insurance regulatory authorities in respective countries |

| Market Trends | Increasing demand for young driver insurance |

| Cost Factors | Age, driving experience, vehicle type, location |

| Policy Duration | Often short-term, with the option to renew |

What You'll Learn

- Age Requirement: Insurance companies mandate a minimum age of 25 for driving coverage

- Risk Assessment: Younger drivers are considered high-risk, thus higher premiums

- Experience: Insurance providers prefer drivers with more experience on the road

- License Duration: Longer license history may result in lower insurance rates

- Safety Record: A clean driving record can lead to better insurance deals

Age Requirement: Insurance companies mandate a minimum age of 25 for driving coverage

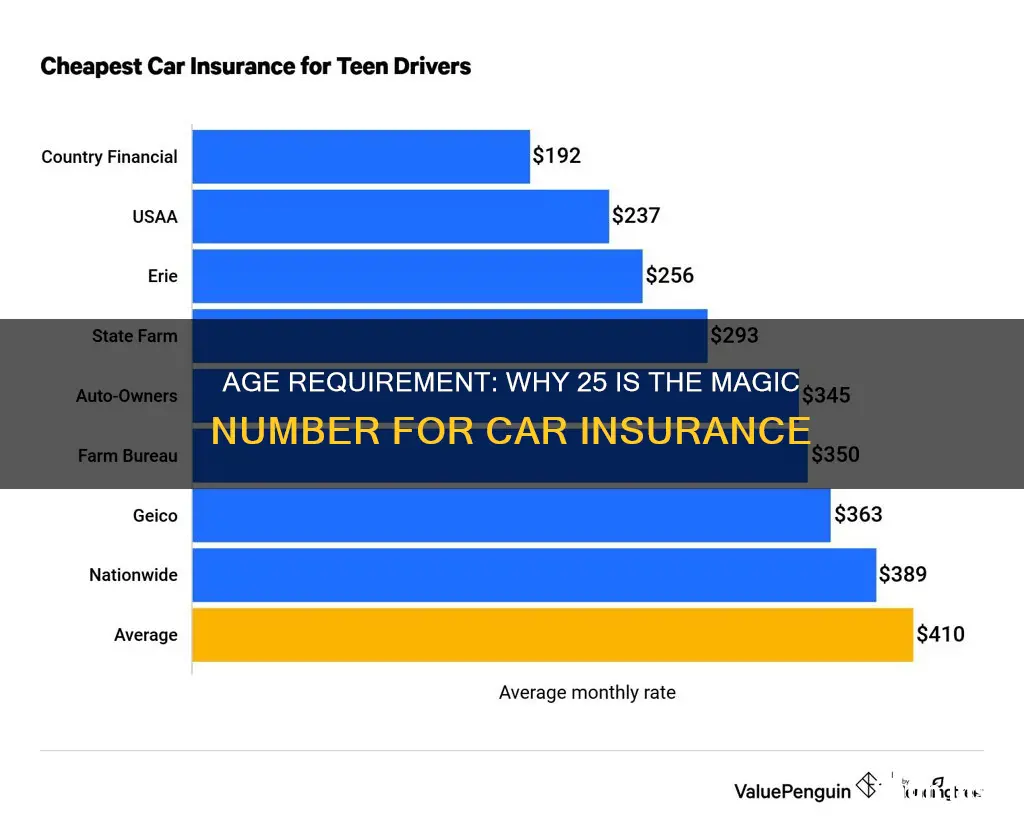

The age requirement for obtaining driving insurance is a critical factor in the insurance industry, and it is set at a minimum of 25 years old by many insurance companies. This age restriction is in place for several reasons, primarily related to risk assessment and cost management. Young drivers, especially those under 25, are statistically more likely to be involved in accidents and file insurance claims. This is often attributed to their lack of experience on the road, higher rates of risky behavior, and a tendency to engage in more adventurous driving. As a result, insurance providers consider this age group as high-risk clients, which influences their premium rates.

For insurance companies, setting a minimum age of 25 for driving coverage is a strategic decision. It helps them manage their risk portfolios and maintain profitability. By excluding younger drivers, especially those in their early 20s, insurance providers can offer more competitive rates to older, more experienced drivers. This age-based pricing structure is a common practice in the insurance industry and is designed to reflect the varying levels of risk associated with different age groups.

The age of 25 is often considered a turning point in a driver's life, as they gain more maturity and responsibility. By this age, individuals are expected to have a better understanding of road safety, improved decision-making skills, and a more stable financial situation. These factors contribute to a reduced risk profile, making it more cost-effective for insurance companies to provide coverage to this demographic.

However, it's important to note that there are exceptions to this age rule. Some insurance companies offer specialized policies for young drivers, often referred to as 'young driver insurance' or 'new driver insurance'. These policies are tailored to meet the unique needs of younger drivers and may provide coverage at a lower cost. Additionally, some insurance providers offer discounts or incentives to drivers who are over 25 but have a limited driving history or have completed advanced driver training programs.

In summary, the age requirement of 25 for driving insurance is a standard practice to manage risk and maintain financial stability for insurance companies. While it may present challenges for younger drivers, it also provides opportunities for older, more experienced drivers to access affordable coverage. Understanding these age-related insurance policies can help individuals make informed decisions when it comes to securing the right driving insurance coverage.

NatGen Auto Insurance: Understanding Rental Car Coverage

You may want to see also

Risk Assessment: Younger drivers are considered high-risk, thus higher premiums

Younger drivers often face higher insurance premiums due to their age being a significant factor in risk assessment. Insurance companies consider this demographic group as high-risk drivers, primarily because of their limited driving experience and the associated higher likelihood of accidents. The statistics show that younger drivers, especially those in their teens and early twenties, are more prone to being involved in traffic collisions, which can lead to increased insurance costs. This is a critical aspect of the insurance industry's risk management strategy, as it directly impacts the financial responsibility of insurance providers.

The primary reason for this classification is the higher accident rate among younger drivers. Research indicates that younger individuals are more likely to engage in risky driving behaviors, such as speeding, reckless driving, and a lack of adherence to traffic rules. These factors contribute to a higher accident rate, which, in turn, increases the potential for insurance claims and, consequently, higher premiums for younger drivers. Insurance providers must consider these risks when setting rates to ensure they can adequately cover potential liabilities.

To mitigate these risks, insurance companies often employ various strategies. One common approach is to offer discounts or incentives to younger drivers who demonstrate responsible behavior. For instance, some insurers provide good student discounts to drivers who maintain a high grade point average, indicating a commitment to education and potentially safer driving habits. Additionally, young drivers can often benefit from the inclusion of a good student or safe driver discount, which can significantly reduce their insurance costs.

Another method to manage risk is through the use of usage-based insurance programs. These programs utilize telematics or other tracking technologies to monitor driving behavior. By analyzing data such as acceleration, braking, and driving patterns, insurers can identify safe drivers and offer them lower premiums. This approach allows for a more personalized risk assessment, rewarding responsible driving habits and potentially reducing costs for younger drivers.

In summary, the insurance industry's approach to younger drivers is a critical aspect of risk management. While younger drivers may face higher premiums due to their age and associated risks, insurance companies employ various strategies to mitigate these costs. These strategies include offering discounts, providing usage-based insurance, and encouraging responsible driving habits. Understanding these factors is essential for younger drivers to navigate the insurance market effectively and potentially secure more affordable coverage.

Understanding Auto Insurance Contract Violations and Their Impact

You may want to see also

Experience: Insurance providers prefer drivers with more experience on the road

Insurance companies often view experienced drivers as lower-risk individuals, which is a significant factor in their pricing and underwriting processes. When it comes to determining insurance rates, the age of the driver is just one piece of the puzzle. The more time a person has spent behind the wheel, the more likely they are to have encountered various driving conditions and situations, which can influence their overall risk profile.

For instance, a 30-year-old driver who has been on the road for a decade might have a more comprehensive understanding of different driving scenarios, from navigating busy city streets to handling unexpected weather changes. This experience can translate into better decision-making and a reduced likelihood of accidents. Insurance providers often use age and driving experience as a way to assess the potential for claims and, consequently, set appropriate premiums.

New drivers, on the other hand, are considered high-risk due to their lack of experience. Young drivers often face higher insurance premiums because they are statistically more likely to be involved in accidents. This is especially true for those under the age of 25, who are often seen as inexperienced and prone to risky behavior. Insurance companies may offer discounts or lower rates to drivers who have accumulated a certain number of years of driving experience, as this indicates a level of maturity and skill behind the wheel.

The experience of a driver can also be enhanced by the number of miles they have logged. More experienced drivers are less likely to file claims due to minor incidents or everyday wear and tear, which can result in significant savings for insurance providers. Additionally, experienced drivers are often more likely to have a better understanding of vehicle maintenance and safety features, further reducing the risk of accidents and potential claims.

In summary, insurance providers consider driving experience as a crucial factor in assessing risk and determining insurance rates. While age is a significant indicator, the number of years spent driving and the associated maturity and skill can significantly impact the cost of insurance. This is why many insurance companies offer incentives and discounts to drivers with more experience, recognizing the value of their reduced risk profile.

Auto Insurance Premiums: The Annual Creep

You may want to see also

License Duration: Longer license history may result in lower insurance rates

A longer driving history can significantly impact your insurance rates, and this is especially true for those approaching the age of 25. Insurance companies often view mature and experienced drivers as lower-risk individuals, which can lead to more favorable insurance terms. When you've been licensed for an extended period, you've had more time to develop your driving skills and gain exposure to various road conditions, potentially reducing the likelihood of accidents and claims. This experience can be a powerful factor in negotiating lower insurance premiums.

The insurance industry often uses age and driving history as key risk assessment tools. For young adults, turning 25 marks a significant milestone, as it is typically when their insurance rates start to decrease. This is because, statistically, drivers under 25 are considered high-risk due to their lack of experience and the higher likelihood of being involved in accidents. As you approach this age, your insurance provider may recognize that you've accumulated valuable driving experience, making you a more reliable and safer driver.

Maintaining a clean driving record is essential to keeping your insurance rates low. Any traffic violations, accidents, or claims will be reflected in your driving history and can significantly impact your premiums. Over time, as you avoid incidents and maintain a safe driving record, your insurance company will see you as a lower-risk customer. This is why it's crucial to drive responsibly and defensively, ensuring that your license remains in good standing.

Additionally, the length of your license can also influence the types of coverage you receive. Longer-term drivers may have the opportunity to choose from a wider range of insurance products, including more comprehensive coverage options. This could include additional benefits like roadside assistance, rental car coverage, or enhanced liability protection, all of which can contribute to a more competitive insurance rate.

In summary, having a longer license history can be advantageous when it comes to insurance rates, especially for those nearing the age of 25. Insurance providers often reward mature and experienced drivers with lower premiums, recognizing their reduced risk profile. By maintaining a safe driving record and taking advantage of the benefits of a longer license duration, you can potentially secure more affordable and comprehensive insurance coverage.

Auto Insurance in Mexico: Is Your Policy Valid?

You may want to see also

Safety Record: A clean driving record can lead to better insurance deals

A clean driving record is a powerful asset for any driver, especially when it comes to insurance. Insurance companies heavily consider a driver's safety history when determining premiums and coverage options. A history of safe driving can significantly impact the cost of car insurance and the overall driving experience.

When you maintain a spotless driving record, it indicates a level of responsibility and awareness on the road. Insurance providers view these drivers as less likely to file claims, thus reducing the risk for the company. As a result, insurers often offer lower premiums and more favorable terms to drivers with a proven track record of safe driving. This can lead to substantial savings over time, as a clean record may qualify you for discounts and reduced rates.

The benefits of a good safety record extend beyond just insurance premiums. Many insurance companies provide loyalty rewards or incentives for customers who consistently maintain a clean driving history. These rewards might include reduced rates, waived fees, or even free gifts as a token of appreciation for their continued trust and safe driving habits. Additionally, a clean record can make the process of obtaining insurance coverage smoother, as insurers may be more inclined to offer competitive deals to drivers with a history of safe driving.

To build and maintain a positive safety record, drivers should focus on defensive driving techniques, adhering to traffic laws, and practicing safe driving habits. This includes avoiding reckless behavior, such as speeding or aggressive driving, and being mindful of road conditions and other drivers. By consistently demonstrating responsible driving, you can not only save money on insurance but also contribute to a safer and more enjoyable driving experience.

In summary, a clean driving record is a valuable asset that can lead to significant advantages in the world of insurance. It opens doors to better deals, lower premiums, and a more positive relationship with your insurance provider. By prioritizing safe driving practices, drivers can ensure they are rewarded with competitive insurance rates and a sense of security on the road.

Understanding Auto Insurance Scores: X907 Explained

You may want to see also

Frequently asked questions

The age requirement to drive and purchase insurance varies by country and insurance provider. In many places, the minimum age to drive is 18, but some insurance companies may require drivers to be 25 or older to qualify for certain coverage options.

Yes, it is possible to obtain insurance even if you are under 25. Many insurance providers offer specialized policies for young drivers, often referred to as 'young driver insurance' or 'junior driver insurance'. These policies may include restrictions, higher premiums, and additional requirements to ensure the driver's safety and reduce risks.

Yes, there are a few exceptions to consider. Some insurance companies offer 'mature driver discounts' for individuals aged 25 and above, assuming they have a clean driving record. Additionally, some insurance providers may offer 'good student' discounts for young drivers who maintain a high grade point average or have completed a driver's education course. These exceptions can help reduce insurance costs for younger drivers.