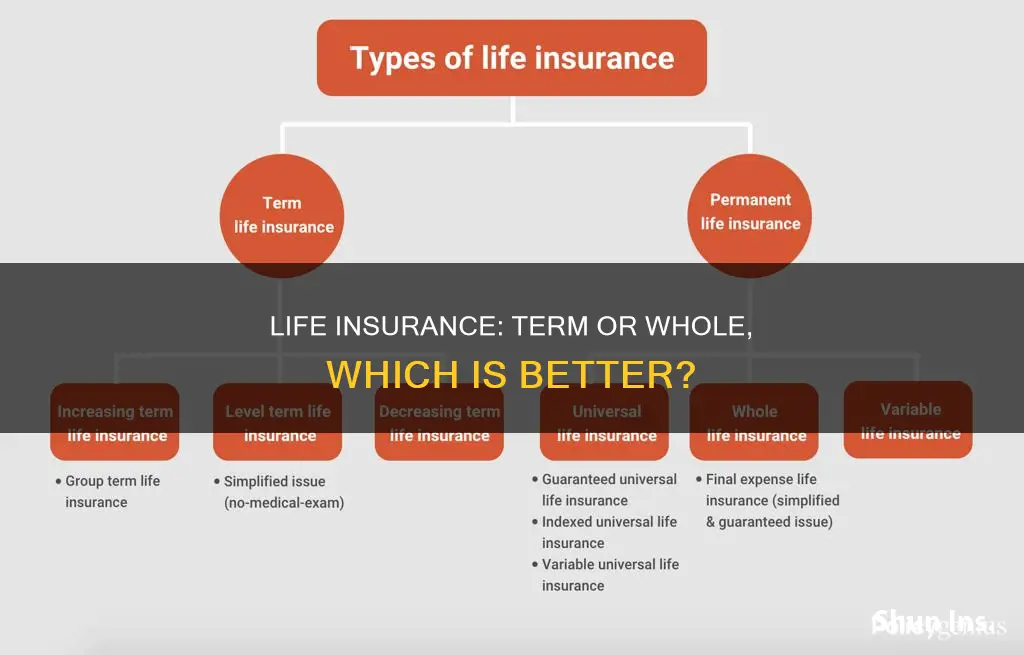

Term life insurance and whole life insurance are two of the most common types of life insurance available. Term life insurance is a good option for those who want coverage for a specific period, such as the length of their mortgage, or want to ensure their family is protected against large debts or expenses. It is also a cheaper option, with lower premiums, and can be a good choice for those who want to protect their family but are on a budget. However, term life insurance does not build cash value, and coverage ends if the policyholder outlives the term length. On the other hand, whole life insurance provides coverage for the policyholder's entire life and has a cash value component that grows over time, tax-free, and can be borrowed against or withdrawn. Whole life insurance is a good option for those who want lifelong coverage and the ability to build cash value but is generally more expensive than term life insurance. When deciding between term and whole life insurance, it is important to consider cost, time frame, and whether a savings component is desired.

| Characteristics | Values |

|---|---|

| Length of coverage | Term life insurance covers a set period, e.g. 10, 20 or 30 years. Whole life insurance covers the policyholder's entire life. |

| Cash value | Term life insurance has no cash value. Whole life insurance has a cash value component that grows over time. |

| Cost | Term life insurance is cheaper. Whole life insurance is significantly more expensive. |

| Complexity | Term life insurance is easier to understand. Whole life insurance is more complex. |

| Premium payments | Term life insurance premiums may change over time. Whole life insurance premiums are locked in and remain the same. |

| Conversion options | Some term life insurance policies can be converted to whole life insurance. Whole life insurance policies can be converted to term life insurance by using the cash value to buy an equal amount of term life insurance. |

What You'll Learn

- Term life insurance is cheaper but only covers you for a set number of years

- Whole life insurance is more expensive but lasts your entire life

- Whole life insurance has a cash value component that grows tax-free over time

- Term life insurance is a good option for those who want to cover specific financial concerns with a timeline, such as a mortgage

- Whole life insurance is a good option for those who want lifelong coverage and the ability to build cash value

Term life insurance is cheaper but only covers you for a set number of years

Term life insurance is a good option for those who want to save money on premiums and only need coverage for a specific period. It's a straightforward type of insurance that simply offers a death benefit to your beneficiaries if you pass away while the policy is in force. This makes it ideal for people who want to ensure their loved ones are taken care of financially if they die unexpectedly.

The main advantage of term life insurance is its affordability. It is much cheaper than whole life insurance because it only covers you for a set number of years, typically ranging from 1 to 30 years. You can choose the term length based on your unique situation, which can help reduce costs in the long run. For example, you might opt for a 20-year policy to cover you until your children are financially independent or a 30-year policy to cover the length of your mortgage.

However, one of the drawbacks of term life insurance is that it does not offer lifelong coverage. If you outlive the term length, your coverage will end and you won't receive any benefits. Additionally, term life insurance does not accumulate cash value like an investment account. This means that if you stop paying premiums, you won't have any money to walk away with.

Despite these limitations, term life insurance can be a good choice for young families due to its lower upfront premiums. It's also a popular option for seniors who are considering their long-term plans. Ultimately, term life insurance is a cost-effective way to ensure financial protection for your loved ones during a specific period.

Term Life Insurance: 20-Year Policy Explained

You may want to see also

Whole life insurance is more expensive but lasts your entire life

Whole life insurance is more expensive than term life insurance, but it lasts your entire life and has additional features that term life insurance does not.

Whole life insurance is a permanent policy that covers a person for their entire life. It can be useful for those who need more flexibility than a term life insurance policy, especially when thinking about their income needs in retirement and their estate planning. While whole life insurance is primarily a life insurance policy, the cash value that it accumulates can be useful later in life. This cash value grows at a guaranteed rate and can be borrowed against or withdrawn. The cash value of whole life insurance makes it a more complex and expensive product than term life insurance.

Whole life insurance is a good option for those who want a policy that builds cash value. Unlike term life insurance, whole life insurance has a cash value that builds over time on a tax-deferred basis. This cash value can be used as a savings vehicle for retirement or the policy can be closed out if you’re in financial need, although you’ll need to pay a surrender charge if cancelling the policy early. You can also withdraw some of the cash value from the policy or take out a loan against its equity, but remember that any cash value taken out may need to be paid back for your beneficiaries to receive the policy’s full benefit.

Whole life insurance may also be a good option if you want a policy that lasts your entire life. Whole life insurance policies will remain in effect for the duration of the insured person’s lifespan, as long as the premiums are paid. This is in contrast to term life insurance, which only lasts for a set period of time.

Haven Life Insurance: A Symbol of Trust and Protection

You may want to see also

Whole life insurance has a cash value component that grows tax-free over time

Whole life insurance is a permanent policy that covers a person for their entire life. In addition to the death benefit, it has a cash value component that grows at a guaranteed rate over time. This cash value can be borrowed against or withdrawn later in life. The cash value grows in a tax-deferred account, meaning it is not subject to taxes until it is withdrawn. This makes whole life insurance a useful tool for estate planning and for those looking to maximize their financial potential.

The cash value of a whole life insurance policy is an investment that can be used while the policyholder is still alive. It grows at a guaranteed rate set by the insurer, and the policyholder can borrow against the equity or withdraw some of the money. However, if the policyholder dies before the loan is repaid in full, the death benefit will be reduced by the amount still owed. The policy can also be surrendered for cash.

The cash value of whole life insurance policies is an important feature that sets them apart from term life insurance policies. Term life insurance policies only cover a set period of time and do not have a cash value component. Whole life insurance policies, on the other hand, offer lifelong coverage and the opportunity to build cash value. This makes whole life insurance a more expensive option, but it can be a good choice for those who want the flexibility and financial benefits that come with the cash value component.

The cash value component of whole life insurance policies is an important consideration when deciding between term and whole life insurance. Whole life insurance policies offer the security of lifelong coverage, as well as the opportunity to build cash value that can be used to meet future financial needs. However, the higher premiums of whole life insurance policies may be a factor for those on a limited budget. Ultimately, the decision between term and whole life insurance depends on an individual's financial goals and circumstances.

Life Insurance and Motorcycle Accidents: What's Covered?

You may want to see also

Term life insurance is a good option for those who want to cover specific financial concerns with a timeline, such as a mortgage

Term life insurance is also a good option for those who want affordable coverage. It is generally the cheapest type of life insurance, making it a popular choice for young families and seniors. The premiums are lower because there is only a payout if the policyholder dies during the term. If the policyholder outlives the term, the coverage ends, and no benefits are received.

Term life insurance can also be useful for those who want coverage for a specific period. For instance, parents might choose a term that covers them until their child is financially independent. Additionally, some term life policies can be converted into whole life insurance policies, providing the option to extend coverage if needed.

Overall, term life insurance is a good choice for those who want affordable, flexible coverage for a specific period, such as the length of a mortgage. It allows policyholders to ensure their financial commitments are covered without committing to lifelong insurance.

Imputed Life Insurance: Understanding Your Coverage Benefits

You may want to see also

Whole life insurance is a good option for those who want lifelong coverage and the ability to build cash value

The cash value of whole life insurance grows at a guaranteed rate set by the insurer, and the premiums remain the same throughout the policy. This makes whole life insurance a good option for those who want predictable payments and the security of knowing that their cash value is growing. Additionally, the death benefit is guaranteed, so your beneficiaries will receive a payout when you die.

However, it's important to consider the drawbacks of whole life insurance. The premiums are typically much higher than those of term life insurance, as whole life insurance includes both insurance and investment components. Whole life insurance is also more complex than term life insurance, and the death benefit will be reduced by any outstanding loans or withdrawals made against the cash value.

When deciding between term and whole life insurance, it's important to consider your financial goals and budget. Whole life insurance is a good option for those who want lifelong coverage and the ability to build cash value, but it's important to weigh the pros and cons before making a decision.

Ohio National: Life Insurance Options in New York

You may want to see also

Frequently asked questions

Term life insurance covers you for a set number of years, whereas whole life insurance usually costs much more but can last your entire life.

Term life insurance is cheaper and easier to understand than whole life insurance. However, it only covers you for a limited number of years and does not build cash value.

Whole life insurance offers lifelong protection and includes a cash value component that you can borrow against or withdraw from. However, it is significantly more expensive than term life insurance and can be complex.

Consider your family situation, budget, long-term goals, and other factors. Term life insurance may be a good choice if you only need coverage for a specific time period or want lower premium payments. Whole life insurance may be better if you want a policy that builds cash value or provides lifelong coverage.

Yes, you can have more than one life insurance policy. In some cases, it makes sense to have both term and whole life insurance to cover different needs.