If you've received a hospital bill, it's important to first check whether it contains the words insurance pending or another indication that the bill has been sent to your insurance company. If it hasn't, you should contact the hospital and ask them to bill your insurance provider. If they refuse or are unable to do so, you may need to fill out a reimbursement form and submit it to your insurance company. Generally, you should not be required to pay upfront for hospital treatment and it is advisable to wait to see how much of the bill will be covered by your insurance plan.

| Characteristics | Values |

|---|---|

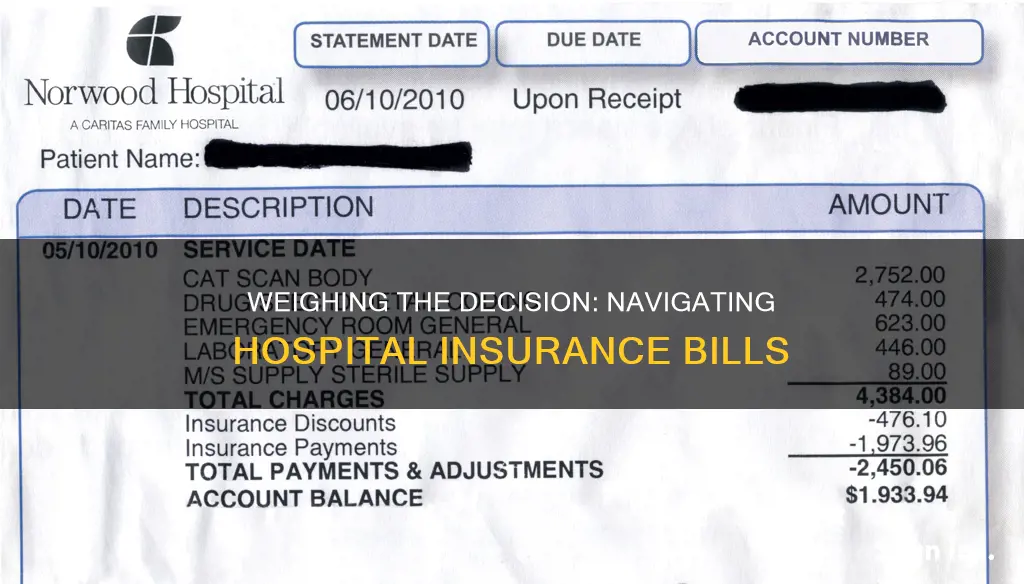

| Should you pay a hospital bill before insurance covers it? | It is not advisable to pay a hospital bill before your insurance covers it. You should wait until you receive the bill from your insurance company, which will show the breakdown of how much they will pay and how much you are responsible for. |

| What to do if you receive a hospital bill | - Contact the medical provider and your insurance company to learn more about your bill. |

| - If you are concerned about your ability to pay the bill, call the medical provider's billing office to ask if they can reduce the charges or set up a payment plan. | |

| What is a surprise medical bill? | A surprise medical bill is an unexpected bill from an out-of-network provider or facility. |

| How does the No Surprises Act protect you? | The No Surprises Act, effective January 1, 2022, protects you from surprise billing for emergency services if you have a group health plan or individual health insurance coverage. It limits the amount you pay out of pocket to what you would typically pay if the healthcare provider were in-network. |

What You'll Learn

Understanding your insurance plan

Health insurance is a contract between you and your insurance company/insurer. It is a plan or policy that covers a percentage of doctors' visits and hospital bills. It helps to offset the costs of medical events, whether planned or unexpected.

Types of health insurance plans

There are different types of health insurance plans available, such as government plans like Affordable Care Act (ACA) plans, Medicare plans, and Medicaid plans. These plans can differ in which providers you can see and how much you have to pay.

Important insurance terms

- Deductible: The amount you owe for covered health care services before your health insurance plan begins to pay.

- Copayment (Copay): An amount you pay as your share of the cost for a medical service or item, like a doctor's visit.

- Coinsurance: Your share of the cost for a covered health care service, usually calculated as a percentage of the total bill.

- Premium: The amount you pay for your health insurance plan each month.

- Network: The doctors, hospitals, and suppliers your health insurer has contracted with to deliver health care services to their members.

- Out-of-pocket maximum: The maximum amount you pay for deductibles and coinsurance charges within a given year before your insurance company starts paying for all covered expenses.

- In-network: Physicians and medical establishments that deliver patient services covered under your insurance plan. In-network providers usually offer cheaper rates as they have negotiated lower rates with your insurer.

- Out-of-network: Physicians and medical establishments not covered under your insurance plan, resulting in higher costs for the patient.

- Pre-existing condition: Any chronic disease or disability that existed before the date your health insurance became effective. This may impact your premiums.

- Primary Care Physician (PCP): Your first contact for health care, such as a family physician or internist. They monitor your health and refer you to specialists if needed.

Understanding your coverage

It is important to review your insurance plan's benefits to know which services are covered. Your plan may not cover the same services as another plan. Compare your plan with others in the market, such as through the Health Insurance Marketplace, to understand your options.

Additionally, be aware of any restrictions or limitations on the number of primary care visits allowed annually and the specific services covered. Understanding these details will help you choose a plan that suits your individual needs and ensure you can receive the necessary medical treatment without unexpected costs.

Juggling Dual Coverage: Navigating Billing for Two Insurances

You may want to see also

Coinsurance and copayments

Copayments are fixed fees that partially pay for medical services. They are set amounts paid for prescriptions and medical care received. The insurance pays the rest of the cost. Copayments are typically paid at the time of service and are often paid before the deductible has been met. Copayments can vary depending on the type of service received, such as visits to specialists or lab tests, and are generally less than $100 for routine health issues.

Coinsurance, on the other hand, is the percentage of covered medical expenses you pay after you've met your deductible. Your health insurance plan pays the remaining percentage. For example, if you have an 80/20 plan, it means your plan covers 80% and you pay 20% until you reach your maximum out-of-pocket limit. The higher the coinsurance percentage, the higher your share of the cost.

In most health insurance plans, copayments do not apply toward your deductible, whereas coinsurance only comes into effect after you've met your deductible. Once you've reached your out-of-pocket maximum, your health insurance plan should cover 100% of eligible expenses for the rest of the year.

When choosing a health insurance plan, it's important to consider whether you would benefit more from lower monthly premiums or lower coinsurance, which allows your insurer to cover more costs over time.

The Unseen Hand: Understanding the Role of Insurance Producers

You may want to see also

Explanation of Benefits (EOB)

An Explanation of Benefits (EOB) is a statement from your health insurance plan that describes what costs it will cover for medical care or products you've received. It is generated when your provider submits a claim for the services you received.

The EOB is sent by the insurance company to outline the following:

- The cost of the care you received

- Any money you saved by visiting in-network providers

- Any out-of-pocket medical expenses you’ll be responsible for

It is important to note that the EOB is not a bill. It is a statement of the medical services you received and details of how you and your plan will share costs. You will not use the EOB to pay any outstanding bills.

The EOB typically includes the following information:

- Personal details such as your name, member number, and plan information

- Information about your visit, including the date(s) of service, the doctor or clinic's name, and the type of care you received (e.g., preventive care or office visit)

- A breakdown of the charges for the service(s) received, including how much your insurance company paid and the amount you owe

It is recommended to save your EOB until you receive the final bill from your doctor or healthcare provider. Insurance companies often provide online access to past EOBs, so keeping a paper copy is not necessary if you have an online account.

Understanding the Role of a Trustee in Term Insurance: A Comprehensive Guide

You may want to see also

Negotiating medical bills

Medical bills can be expensive and overwhelming, but there are ways to negotiate them down to a more manageable level. Here are some steps you can take:

- Start early: It's best to begin negotiating as soon as you receive a bill or an explanation of benefits (EOB). While medical debts under $500 won't affect your credit score, it's still a good idea to tackle them before they go to a debt collector. Contact the billing department, your healthcare provider's billing agency, and your insurance company.

- Check for errors: Medical billing errors are common, so review your bill carefully. Look for duplicate charges, charges for services you didn't receive, incorrect diagnosis codes, or "unbundling" of services that should be billed together. If you find discrepancies, call your doctor, hospital, or insurance provider to question the charges and request a new, accurate bill.

- Understand your insurance coverage: If you have insurance, review your policy to see what is and isn't covered. Understand terms like deductibles, copayments, and coinsurance. Contact your insurance company to clarify any uncertainties and determine how much they will cover for your treatment.

- Request an itemized bill: Ask your medical provider for an itemized bill that breaks down each service and charge. This will help you identify any errors and give you a clearer picture of your expenses.

- Negotiate a lower bill: If there are no errors, but you still can't afford the bill, contact the billing department and politely ask if they can lower the charges. Be patient and persistent, as this process may take time. You can also offer to pay in cash or request a payment plan to make the bill more manageable.

- Explore financial assistance: Many hospitals are required to offer financial assistance programs for low-income patients. Ask about options like Charity Care or Bridge Assistance. You can also look into illness-related non-profit groups that may provide assistance for specific diseases or treatments.

- Research insured rates: If you're uninsured, you may be charged a higher rate. Research the fair market price for the care you received by looking at what insurance companies typically negotiate for the same services. Then, contact the billing department and ask them to match that rate.

- Appeal insurance decisions: If you believe your insurance company has denied your claim incorrectly or you disagree with the amount they've agreed to pay, you have the right to submit an internal appeal and request an external review. Contact your state's Consumer Assistance Program for help with this process.

- Stay organised and polite: Keep records of all your communications and take notes during calls. Note the time, date, and name of the person you speak to. Remain polite and professional, even if you don't get the response you're hoping for right away.

Surprise medical bills

To protect yourself from surprise medical bills, it is important to understand your insurance plan and what it covers. Many insurance companies cover the costs for preventive care, such as check-ups and vaccinations, but for other services, you may be required to cover all costs until you reach a specified amount, known as a deductible. Once you reach this amount, the insurance company starts paying for covered services. It is also important to know the key insurance terms, such as copay, deductible, and coinsurance, to understand your coverage and responsibilities for costs associated with your care.

If you receive a surprise medical bill, there are steps you can take to resolve the issue. First, contact the medical provider and tell them you believe you have been wrongly billed. Request that your bill be lowered. You can also contact your insurance company for assistance. If you are still unsatisfied, you can file a complaint with your state's insurance regulator or consumer assistance program.

In the United States, the No Surprises Act (NSA) provides additional protections against surprise medical bills. Effective January 1, 2022, the NSA protects people covered under group and individual health plans from receiving surprise medical bills when they receive most emergency services, non-emergency services from out-of-network providers at in-network facilities, and services from out-of-network air ambulance service providers. The NSA also establishes an independent dispute resolution process for payment disputes between plans and providers and provides new dispute resolution opportunities for uninsured and self-pay individuals.

Navigating the Path of 'Do-It-Yourself' Term Insurance: A Guide to Going Solo

You may want to see also

Frequently asked questions

Your insurance plan is a cost-sharing agreement between you and your insurance company. Many insurance companies cover the costs for preventive care throughout the year, such as check-ups and vaccinations. For other services, you may be required to cover all costs until you reach a specified amount, known as a deductible. Once you reach this amount, the insurance company starts paying for covered services.

First, make sure that the bill does not contain the words "insurance pending" or some other indication that the hospital has submitted the bill to the insurance company. If it does not, call the hospital and ask them to bill your insurance company. If the hospital refuses to send this bill, you may need to fill out a reimbursement form and submit it to your insurance company.

A surprise medical bill is an unexpected bill from an out-of-network provider or facility. Your health insurance may not cover the entire out-of-network cost, which could leave you owing the difference between the out-of-network provider's bill and the amount your health insurance paid. This is known as "balance billing".

Coinsurance is the percentage of costs that the patient has agreed to pay. For example, if your health insurance pays 80% of eligible expenses, you may be required to pay the remaining 20% as your coinsurance. Coinsurance is usually billed after a service is received.