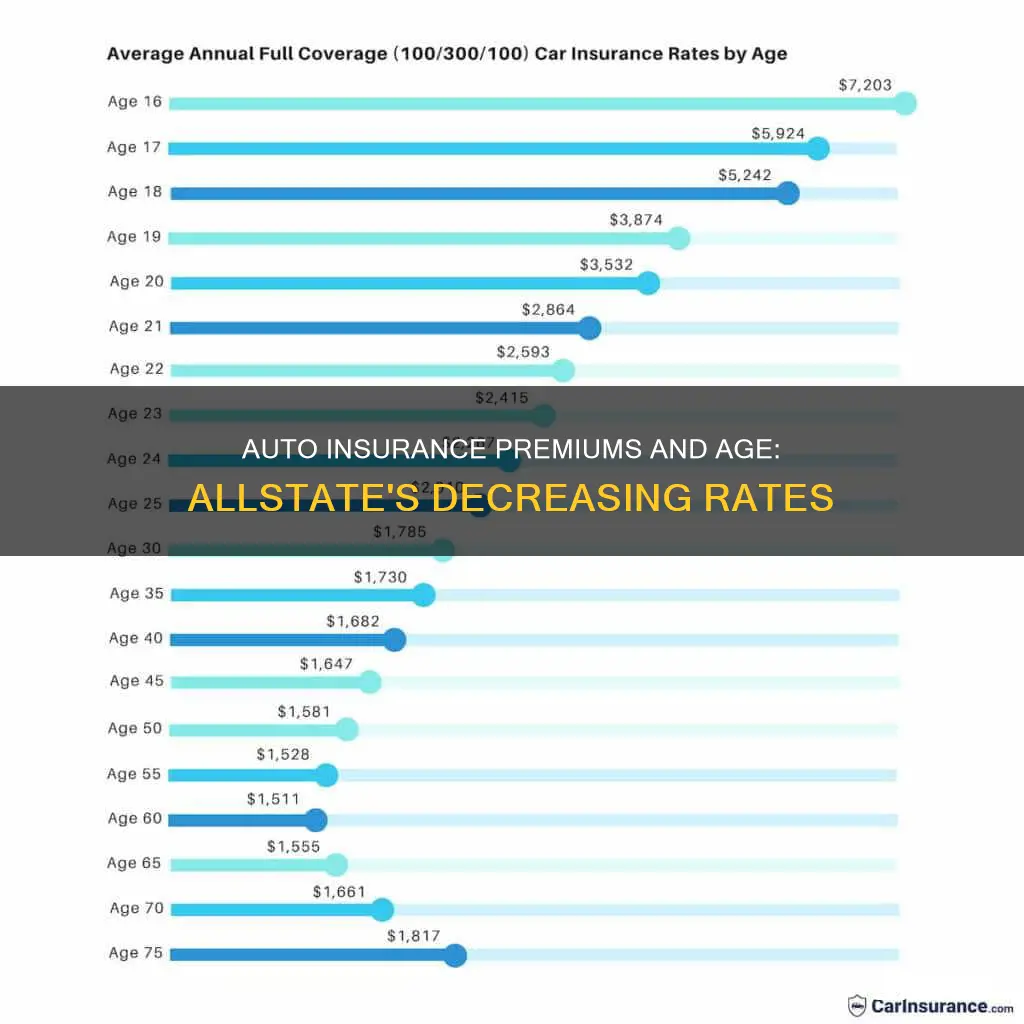

Car insurance rates are calculated based on several factors, including age, gender, driving history, and location. While age is not the only factor that determines insurance rates, it is one of the most significant. In general, car insurance rates decrease as drivers get older, with the most significant drop occurring around the age of 25. This is because younger drivers, particularly those under 25, are considered riskier to insure due to their lack of driving experience and higher accident likelihood. However, it's important to note that insurance rates can vary between different insurance providers, and other factors such as driving history and location can also influence the cost of car insurance.

| Characteristics | Values |

|---|---|

| Average annual cost of car insurance for a 25-year-old | $3,207 |

| Average annual cost of car insurance for an 18-year-old | $7,179 |

| Average annual cost of car insurance for a 21-year-old | $4,453 |

| Average annual cost of car insurance for a 24-year-old | $3,597 |

| Average monthly cost of car insurance for a 25-year-old | $267 |

| Average monthly cost of car insurance for a 24-year-old | $300 |

| Percentage decrease in car insurance costs when you turn 25 | 11% |

| Percentage decrease in car insurance costs when you turn 19 | 16% |

| Percentage decrease in car insurance costs when you turn 21 | 17% |

| Average annual cost of car insurance for a 25-year-old man | N/A |

| Average annual cost of car insurance for a 25-year-old woman | N/A |

| Average annual cost of car insurance for a man (age not specified) | $3,207 |

| Average annual cost of car insurance for a woman (age not specified) | $3,000 |

| Average annual cost of car insurance with Allstate for a 25-year-old | $5,074 |

What You'll Learn

Auto insurance rates for 25-year-olds

The average cost of auto insurance for 25-year-olds in the United States is $159 per month or $1,909 per year. This is 17% more than the national average for drivers aged 30 to 45. Rates for 25-year-olds are also significantly cheaper than for drivers under 25, who pay an average of $4,648 per year.

The cost of auto insurance can vary depending on factors such as gender, location, driving record, credit score, and the type of coverage. For example, male drivers tend to pay slightly more than female drivers, although this varies by state. Additionally, 25-year-olds who are new drivers will pay higher rates than those who have been driving for several years.

To find cheaper auto insurance rates as a 25-year-old, it is recommended to compare rates from multiple companies, maintain a clean driving record, bundle insurance policies, and get the right amount of coverage.

MetLife Auto Insurance: Is It a Good Choice?

You may want to see also

Male and female driver rates

In 2023, the average cost of car insurance is $2,014 per year for a full-coverage policy. However, insurance rates are highly personalized, and individual factors such as age, gender, location, driving record, and credit score can significantly impact the final premium.

For example, in 2023, an 18-year-old male driver can expect to pay 15% more for car insurance than an 18-year-old female. At age 50, the difference becomes negligible, with males paying only $8 more per year for full coverage than their female counterparts.

The gender gap in insurance rates is most significant for young drivers. Teenage boys pay the highest premiums, reflecting their risk-taking behaviour and higher accident rates. From ages 20 to 24, male drivers pay approximately 8% more than female drivers. After age 25, the difference in insurance rates between men and women becomes minimal, with women paying only about 1% less on average.

It is worth noting that some states have banned the use of gender as a factor in determining insurance rates. These states include California, Hawaii, Massachusetts, Michigan, North Carolina, and Pennsylvania. In these states, insurance rates for men and women should be similar, provided all other factors are the same.

When it comes to specific insurance companies, their approaches to gender-based rates vary. For example, Geico charges women slightly more, while Progressive charges them slightly less. On the other hand, Allstate and State Farm keep their rates identical regardless of gender.

Insurance Fraud: Credit Impact

You may want to see also

Risky driving behaviour

Young drivers are considered some of the riskiest drivers to insure due to their inexperience behind the wheel. In general, car insurance coverage becomes more affordable as drivers gain more experience and enter their early 20s. However, insurance rates may increase again when drivers reach their senior years due to factors such as vision or hearing loss.

While gender is a factor in determining insurance rates, with men typically paying more than women, it is important to note that not all states permit age and gender as rating factors. Additionally, insurance rates are highly personalized and can vary depending on individual rating factors.

To reduce the risk of accidents and lower insurance rates, young drivers should maintain a clean driving record and take advantage of discounts offered by insurance companies, such as good student discounts and driver training discounts.

Insurers Return Premiums Amidst Pandemic

You may want to see also

Discounts for young drivers

Car insurance for young drivers can be expensive, but there are ways to get cheaper insurance. One of the most effective ways to reduce insurance premiums is to maintain a clean driving record. The cost of insurance can also be reduced by taking advantage of discounts aimed at young drivers, such as good student discounts and driver training discounts.

Insurance companies use a range of factors to determine insurance premiums, including age and gender. Young drivers, especially teens, are considered to be riskier to insure due to their relative inexperience. As a result, they often face higher insurance premiums. Men are also generally considered to be riskier to insure than women due to a greater propensity for risky driving. However, this does not mean that young men will automatically pay more than young women for their insurance coverage.

In the United States, six states do not allow gender to be used as a factor in determining insurance premiums: California, Hawaii, Massachusetts, Michigan, North Carolina, and Pennsylvania. In these states, insurance rates for men and women with the same rating factors, such as vehicle type and driving history, should be roughly equal.

Credit score is another factor that can impact insurance rates. A poor credit score can lead to higher insurance premiums, regardless of gender. However, insurance companies in California, Hawaii, Massachusetts, and Michigan are restricted from using credit scores as a factor in determining insurance rates.

A driver's record is also important in determining insurance rates. A history of accidents, speeding tickets, or other traffic violations will typically result in higher insurance premiums. Maintaining a clean driving record is one of the most effective ways to keep insurance rates low.

While age, gender, and other factors can influence insurance rates, it is important to remember that these are not the only considerations. Insurance companies offer a range of discounts and coverage options, and by shopping around for quotes and comparing different companies, young drivers can find insurance policies that fit within their budget.

Mileage Rate and Auto Insurance: What's Deductible?

You may want to see also

Senior driver insurance

Senior drivers are often considered more likely to be in accidents and file claims, and so they can face higher insurance premiums. However, there are still ways to find affordable car insurance for older drivers.

How to Get Cheap Car Insurance for Senior Citizens

Firstly, it's important to note that age is just one of many factors that affect insurance premiums. Other considerations include your driving history, credit score, location, gender, deductible, and vehicle type.

- Take a defensive driving course: Many insurance companies offer discounts for taking a safe driving course. This can also help you maintain a clean driving record, which leads to lower premiums.

- Change your driver status: If you've retired and no longer commute to work, you may be able to save on insurance by changing your status to a "pleasure" driver.

- Consider usage-based insurance: Usage-based insurance charges by the mile, which can be beneficial for low-mileage drivers. However, if you drive more than planned, your rates may increase.

- Look for discounts: Insurance companies offer various discounts, such as for bundling policies, insuring multiple vehicles, safe driving, safety features, anti-theft devices, and accident-free records. Ask your insurance agent about all available discounts.

- Consider specialty insurance for seniors: Some insurers offer insurance packages specifically for senior drivers, which may be more cost-effective and better suited to their needs.

- Shop around and compare quotes: No single company has the cheapest rates for all senior drivers, so it's essential to get quotes from multiple providers and compare rates before making a decision.

Best Cheap Car Insurance for Seniors

According to MarketWatch, the following companies offer the cheapest car insurance for seniors:

- Travelers

- USAA

- Nationwide

- Geico

- Progressive

USAA is only available to military members, veterans, and their families.

Forbes also recommends the following insurance companies for seniors:

- Nationwide

- USAA

- Travelers

- Erie

- Auto-Owners

- Geico

- Progressive

Car insurance rates typically increase around age 65 and continue to rise as individuals get older. This is because insurers view older adults as riskier drivers due to age-related factors such as vision or hearing loss and slower response times. However, insurance rates for seniors are generally still lower than those for teens and young adults.

State Auto Insurance: Exploring Florida's Options

You may want to see also

Frequently asked questions

Auto insurance rates generally start to decrease when a driver reaches their early 20s. By 25, drivers might notice a significant reduction in their premiums.

Younger drivers are considered statistically more likely to get into accidents due to their lack of driving experience. This makes them riskier for insurance companies to insure, hence the higher rates.

Other factors that can influence your auto insurance rate include your driving history, credit history, and location.

The cost of car insurance goes down by about 11% when you turn 25. However, this decrease is not guaranteed and can vary depending on other factors and the insurance company.