State Auto Insurance does write in Florida. Florida law requires that all drivers have a certain amount of car insurance coverage. Florida is a no-fault state, meaning that, regardless of who is at fault, your insurance will cover injuries or medical expenses for you and your passengers. Florida drivers are required to carry at least $10,000 in both personal injury protection (PIP) and property damage liability (PDL) coverage.

| Characteristics | Values |

|---|---|

| Required by law | Yes |

| Minimum personal injury protection (PIP) | $10,000 per accident |

| Minimum property damage liability (PDL) | $10,000 per accident |

| Required to carry bodily injury liability (BIL) | No |

| Average cost of full-coverage car insurance | $3,795 per year |

What You'll Learn

Florida's no-fault insurance laws

Florida's no-fault law was enacted to reduce the number of tort lawsuits related to car accidents. As a result, drivers cannot file suit unless they suffer permanent injuries. This means that instead of suing each other, both parties in an accident will use their own PIP coverage to pay personal bills incurred by the accident.

In addition to PIP, Florida law also requires drivers to have Property Damage Liability (PDL) coverage. PDL pays for damage to another person's property caused by the insured or someone else driving their vehicle. The minimum requirement for PDL coverage is $10,000.

Insuring Your New Car in California: Time Limit?

You may want to see also

Required insurance coverage in Florida

Florida is a no-fault state, meaning that in the event of a crash, each driver's insurance covers their own injuries and losses, regardless of who caused the accident.

Florida law requires that all drivers carry a minimum amount of car insurance coverage. This includes:

- $10,000 in Personal Injury Protection (PIP)

- $10,000 in Property Damage Liability (PDL)

Personal Injury Protection (PIP) covers 80% of all necessary and reasonable medical expenses up to $10,000 resulting from a covered injury, regardless of who caused the crash. It also covers up to 60% of lost wages.

Property Damage Liability (PDL) covers damage to another person's property caused by you or someone else driving your insured vehicle. The minimum PDL coverage is $10,000, which is quite low and may not be sufficient in the event of a serious accident.

It is important to note that Florida does not require bodily injury liability coverage, unlike most other states. However, this type of coverage can be added to your policy and is highly recommended by insurance experts. Bodily injury liability coverage pays for the medical expenses of those injured in an accident caused by you.

In addition to the required minimums, Florida drivers have the option to add other types of coverage to their policy, such as collision coverage, comprehensive coverage, medical payments coverage, and uninsured/underinsured motorist coverage. These additional coverages can provide further protection in the event of an accident.

Failure to maintain the required insurance coverage in Florida can result in the suspension of your driver's license and registration, as well as a reinstatement fee of up to $500.

Home and Auto Insurance: Do Motorcycles Fit the Bill?

You may want to see also

Penalties for driving without insurance in Florida

Driving without insurance in Florida is illegal and can lead to various penalties, including fines, license suspension, and even imprisonment. Here are the penalties for driving without insurance in Florida in detail:

Fines

If caught driving without insurance in Florida, you may be fined up to $500 for a first offense and up to $1,000 for subsequent offenses. The exact fine depends on the number of offenses within a three-year period. The reinstatement fee for the first offense is $150, increasing to $250 for a second offense and $500 for three or more offenses within three years.

License Suspension

Driving without insurance can result in the suspension of your driver's license, license plates, and registration for up to three years or until you provide proof of insurance and pay the necessary fees. This suspension can cause significant inconvenience and restrict your ability to drive legally.

Financial Consequences

In the event of an accident, uninsured drivers may be responsible for covering all damages and injuries out of pocket, which can lead to financial hardship or even bankruptcy. Additionally, uninsured drivers involved in accidents may be required to obtain an SR-22 form from their insurance company, providing proof of insurance to the state for up to three years.

Imprisonment

In certain circumstances, driving without insurance in Florida can result in imprisonment. While this consequence is more likely for repeat offenders or those involved in accidents, it underscores the severity of the offense.

Other Consequences

Uninsured drivers in Florida may also face challenges in obtaining insurance in the future. They may be considered high-risk drivers and may need to purchase insurance from specialized providers at higher rates. Additionally, driving without insurance can impact your ability to obtain a temporary or hardship license, even for work-related purposes.

It is important to note that Florida has some of the highest numbers of uninsured drivers in the country, with an uninsured motorist rate over 20%. However, this does not negate the legal requirement to maintain the minimum insurance coverage.

Combining Renters and Auto Insurance

You may want to see also

Recommended insurance coverage in Florida

Florida is a no-fault state, meaning that your own personal injury protection insurance will cover you regardless of who is at fault in an accident. This is mandatory, and Florida law requires that all drivers have a minimum of $10,000 of personal injury protection (PIP) insurance. PIP covers 80% of all necessary and reasonable medical expenses up to $10,000, as well as 60% of lost wages, and $5,000 for death benefits.

Property Damage Liability (PDL) insurance is also mandatory, and Florida law requires a minimum of $10,000 of coverage. PDL covers damage to another person's property, such as a fence, building, or another car.

While Bodily Injury Liability (BIL) insurance is not required in Florida, it is highly recommended. BIL pays for serious and permanent injury or death to others when your car is involved in an accident and the driver of your car is found to be at fault. If you have been convicted of a DUI, BIL is required for a period of three years after your license has been reinstated, with a minimum of $100,000 worth of coverage per person and $300,000 worth of coverage per accident.

Other recommended insurance coverages in Florida include:

- Collision insurance: This covers repairs to your car if it collides with another vehicle, crashes into an object, or turns over, regardless of who is at fault.

- Comprehensive insurance: This covers losses from incidents other than a collision, such as fire, theft, vandalism, or hitting an animal.

- Uninsured motorist insurance: This covers you if you, your passengers, or family members are hit by someone who does not have insurance or has insufficient liability insurance.

- Medical payment insurance: This covers medical expenses beyond those covered by PIP, and applies regardless of who is at fault.

- Rental reimbursement coverage: This reimburses you for car rental if your car is unable to be driven after an accident.

- Accidental death and dismemberment insurance: This provides coverage for accidental death or dismemberment in an auto accident, regardless of who is at fault.

Progressive Auto Insurance: Understanding Glass Coverage

You may want to see also

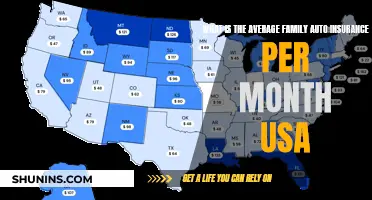

Average cost of car insurance in Florida

Florida is one of the most expensive states in the US for auto insurance. The average cost of car insurance in Florida is $3,430 for full coverage and $1,048 for minimum coverage. This is significantly higher than the national average. The average cost of car insurance in the US is $1,630 for full coverage and $594 for minimum coverage.

The high cost of car insurance in Florida is due to a number of factors, including the state's high accident rate and the large number of uninsured drivers. Florida is a no-fault state, which means that your own personal injury protection insurance will cover your injuries in the event of an accident, regardless of who is at fault. This type of insurance is mandatory in Florida and can lead to higher insurance premiums.

The cost of car insurance in Florida also varies depending on your age, gender, marital status, credit history, and driving record. For example, in Florida, car insurance for a 16-year-old driver is $5,984 per year, while for a driver aged 50 to 60, it is only $1,641 per year. Additionally, men often pay more for insurance than women, but this gap tends to close around age 30.

It's important to note that the minimum coverage required by Florida law may not be sufficient to cover all costs in the event of an accident. It is recommended that drivers obtain coverage above the state-mandated limits to avoid having to pay out of pocket for any expenses that exceed the minimum coverage.

Vehicle Loan and No Insurance: What Now?

You may want to see also

Frequently asked questions

Florida drivers are required to carry at least $10,000 in both personal injury protection (PIP) and property damage liability (PDL) coverage.

The average cost of full-coverage car insurance in Florida is $3,795 per year, well above the national average of $2,681 per year.

Drivers who operate a motor vehicle without the proper auto insurance coverage can face steep penalties, including the loss of driving privileges. Penalties for failure to show proof of insurance in Florida include the suspension of the driver's license and registration for up to three years.

Florida's car insurance minimums are quite low, so it is highly recommended that drivers obtain coverage above the state-mandated limits. Low minimum coverage limits may not adequately cover most costs, leaving drivers at risk of paying out of pocket.