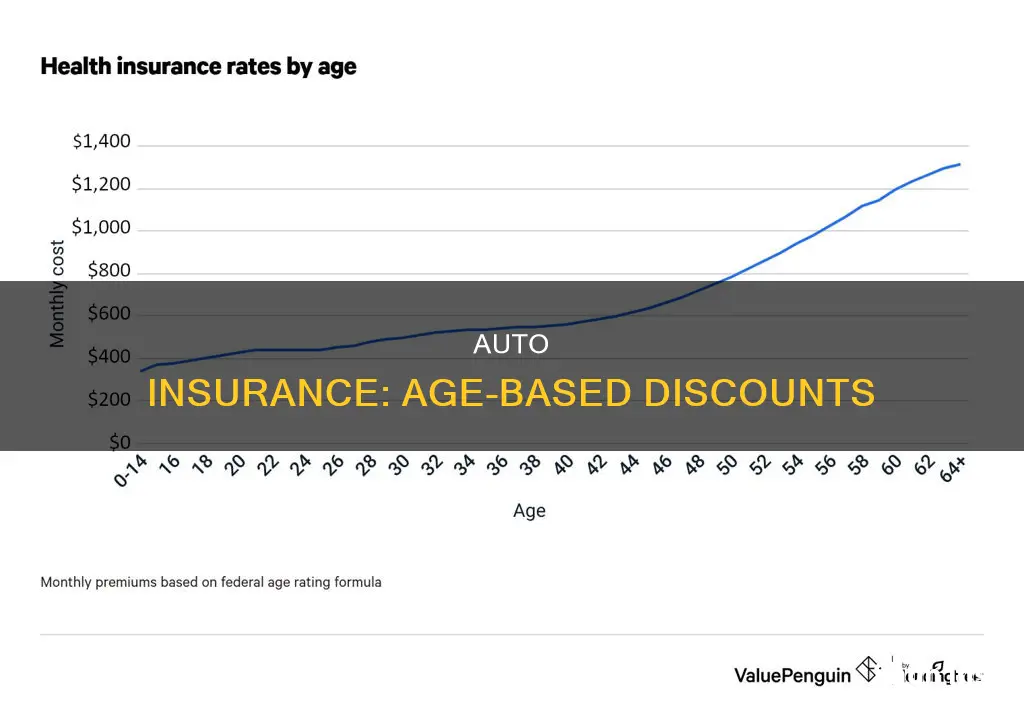

Car insurance rates are highest for new drivers and tend to decrease as drivers get older and gain more experience. The cost of car insurance goes down by about 11% when a driver turns 25, with rates levelling off between the ages of 35 and 55. However, this is not a hard-and-fast rule, as rates can also be influenced by factors such as a driver's claims history, gender, location, credit score, and marital status.

| Characteristics | Values |

|---|---|

| Age when car insurance starts to go down | 18-19 |

| Age when car insurance is the cheapest | 35-55 |

| Age when car insurance starts to go up again | 50s-60s, 70, 75 |

What You'll Learn

Auto insurance rates decrease annually for drivers aged 16-24

Auto insurance rates are highest for new drivers who have just received their licenses, but these rates can go down over time, primarily due to their increasing age. Insurance companies calculate insurance rates based on assessed risk, and younger drivers are generally more likely to have accidents or take risks on the road. As a result, they are considered a high-risk category and are charged higher rates.

How age impacts insurance rates

Age is one of the most important factors in determining car insurance rates. Younger drivers are typically more likely to get into accidents or take risks when driving, so insurance companies charge them higher rates to offset the higher costs associated with claims. As drivers gain more experience, their risk of accidents decreases, and so do their insurance premiums.

Car insurance premiums go down yearly for drivers between the ages of 16 and 24. The biggest drops in insurance premiums occur on the 19th and 21st birthdays, with rates continuing to decline until the driver turns 30. After this, rates tend to plateau until the driver reaches their 50s or 60s.

Factors affecting insurance rates

While age is a significant factor in determining insurance rates, other factors also come into play. These include gender, type of car, location, driving record, credit score, and marital status. Male drivers under 25, for instance, pay higher rates than female drivers of the same age due to their higher involvement in accidents. The type of car also matters, with luxury and sports cars costing more to insure due to higher replacement and repair costs.

Strategies for lowering insurance rates

Young drivers can employ several strategies to lower their insurance rates. These include getting only the necessary coverage, taking a defensive driving course, considering a pay-per-mile policy, bundling multiple insurance policies, and driving a safe vehicle with modern safety features. Shopping around for the best rates and taking advantage of applicable discounts can also help reduce insurance costs.

Gap Insurance: Payout or Pitfall?

You may want to see also

Rates plateau from age 30 until drivers reach their 50s or 60s

After the age of 30, auto insurance rates tend to plateau until drivers reach their 50s or 60s. This is because, by the time a driver reaches their 30s, they will have gained significant driving experience, which results in a reduced risk profile.

According to Progressive, the average premium per driver tends to decrease significantly from ages 19 to 34 and then stabilise or decrease slightly from 34 to 75. Similarly, car insurance premiums go down yearly for drivers between the ages of 16 and 24, with the biggest drops occurring on their 19th and 21st birthdays. After age 30, rates tend to level off until drivers reach their 50s or 60s.

The Zebra reports that car insurance rates are lowest for drivers in their 50s, averaging $703 for a six-month policy. This is likely because older drivers are considered less risky to insure due to their experience behind the wheel. Data shows that older drivers are less likely to file insurance claims as they age.

However, it's important to note that age is just one factor that insurance companies consider when determining premiums. Other factors include gender, driving history, credit score, marital status, and the type of car driven. Additionally, rates may vary depending on the insurance company and the state you live in, as some states prohibit the use of age and gender as rating factors.

Insurance Salvage Vehicles: What's the Deal?

You may want to see also

Premiums for men and women converge by age 32

Auto insurance premiums are influenced by a range of factors, including age, gender, health, and lifestyle choices. While premiums can vary across different demographics, there is data to suggest that by the age of 32, premiums for men and women tend to converge. This is because, generally, women's premiums decrease while men's premiums increase as they age.

Age is a critical factor in determining auto insurance premiums. As individuals get older, their insurance rates tend to decrease. This is because younger drivers, particularly teenagers, are considered high-risk due to their lack of driving experience and higher likelihood of being involved in accidents. As a result, insurance companies often charge higher premiums for younger drivers to offset the increased risk. However, as drivers gain more experience and demonstrate safer driving habits, their insurance rates gradually decrease.

Gender also plays a role in auto insurance premiums. On average, men tend to pay higher premiums than women. This is because men are generally considered to be riskier drivers due to factors such as engaging in risk-taking behaviour, driving more aggressively, and being involved in more accidents. As a result, insurance companies often charge men higher premiums to account for this increased risk. Women, on the other hand, are typically seen as safer drivers and may benefit from lower premiums, especially if they have a clean driving record and no history of accidents.

By the age of 32, the gender gap in auto insurance premiums tends to narrow. This is because, by this age, men have gained significant driving experience and may have developed safer driving habits, leading to a decrease in their insurance rates. Additionally, women in their early to mid-thirties may experience an increase in their insurance premiums due to factors such as getting married, starting a family, or taking on additional financial responsibilities. As a result, the difference in premiums between men and women becomes less pronounced.

It is important to note that other factors, such as health, driving record, and location, can also impact auto insurance premiums. For example, individuals with pre-existing medical conditions or a history of accidents may pay higher premiums, regardless of their age or gender. Additionally, insurance rates can vary depending on the state or region, with more densely populated and urban areas typically having higher insurance rates.

In conclusion, while auto insurance premiums can vary based on a range of factors, the data suggests that by the age of 32, the premiums for men and women tend to converge. This is due to a combination of factors, including driving experience, safer driving habits, and changing life circumstances, which can result in more similar risk assessments for men and women in this age group.

Contract Hire Gap Insurance: What You Need to Know

You may want to see also

Premiums rise again for drivers over 70

Car insurance rates are largely determined by the risk profile of the driver. Younger drivers are considered to be high-risk due to their lack of experience, and this is reflected in the high insurance premiums they pay. As drivers gain more experience, their risk profile decreases, leading to lower insurance rates. However, this trend doesn't continue indefinitely, and insurance rates start to increase again for drivers over 70.

There are several factors that contribute to the increase in insurance rates for older drivers. One factor is the increased risk associated with aging. Older drivers may experience physical, cognitive, or visual impairments that can affect their driving abilities. For example, conditions such as cataracts or arthritis can make it more difficult to see or manoeuvre while driving. Additionally, older drivers may have slower reaction times, which can impact their ability to respond to unexpected situations on the road.

Insurers consider older drivers to be higher-risk due to these factors, and as a result, insurance rates tend to creep back up as drivers enter their senior years. While the rates for senior drivers are not as high as those for teen drivers, they can still be a significant expense.

Older drivers can take several steps to mitigate the impact of rising insurance rates. One option is to shop around and compare rates from different insurance providers. Rates can vary widely between companies, so it's worth getting multiple quotes to find the best deal. Additionally, many insurance companies offer discounts for senior drivers, such as loyalty discounts or discounts for affiliation with organizations like AARP. Taking advantage of these discounts can help offset the increase in insurance rates.

Another strategy for reducing insurance costs is to adjust the coverage levels on your policy. If you have an older car, you may not need as much coverage as when you had a newer model. Reducing your coverage levels can help lower your insurance premiums. However, it's important to maintain adequate coverage to protect yourself financially in the event of an accident.

Insurance rates typically decrease as drivers gain more experience and move out of the high-risk category. This decrease in rates continues until drivers reach their 30s, after which the rates tend to plateau until drivers are in their 50s or 60s. At this point, insurance rates may start to increase again due to the increased risk associated with aging.

In addition to age, there are several other factors that can impact insurance rates. Gender is one factor, with men typically paying higher rates than women due to a greater propensity for risky driving behaviour. However, this difference in rates narrows as drivers age, and by age 50, the difference in premiums between genders is minimal.

Driving record is another important factor, with drivers who have a history of accidents, speeding tickets, or other violations typically paying higher rates. Maintaining a clean driving record is one of the best ways to keep insurance rates low. Credit score can also impact insurance rates, with lower credit scores resulting in higher premiums. Additionally, the state you live in and the type of car you drive can also influence your insurance rates.

Insuring Farm Vehicles: What You Need to Know

You may want to see also

Premiums are lowest for drivers in their 50s

Car insurance rates are lowest for drivers in their 50s, with an average six-month policy costing $703. This is because insurers see older, more experienced drivers as a lower risk. Data shows that older drivers are less likely to file insurance claims as they age.

The cost of car insurance decreases as you age, with rates levelling off between the age groups of 35 and 55, then rising slightly as senior drivers are seen as a bit riskier to insure. This is due to risk factors associated with each age group. Seniors may be more likely to get into accidents due to factors such as vision or hearing loss and slowed response time.

While age is one of the most important factors in determining your car insurance rate, it is not the only one. Your driving history, credit history, and location can also impact your premium. For example, if you move to an area with higher rates of theft and vandalism, your insurer will charge you a higher rate to account for the increased risk of damage or theft.

In addition, gender can also play a role in determining your car insurance rate, although this varies by state. In general, men are seen as riskier to insure than women due to a greater propensity for risky driving. However, this gap narrows as drivers age. For example, at age 50, men only pay $8 more on average per year for full coverage than women of the same age.

To get the best car insurance rates, it's important to shop around and compare quotes from multiple providers. Rates can vary widely from one company to another, so it's worth getting new quotes every year to make sure you're getting the best rate. You may also be able to save money by taking advantage of discounts offered by insurance companies, such as good student discounts, driver training discounts, and safe driver discounts.

Auto Insurance and Tax Claims

You may want to see also

Frequently asked questions

Auto insurance rates decrease yearly for drivers between the ages of 16 and 24. The most significant drop in insurance rates occurs at the ages of 19 and 21, with rates continuing to decline until the driver turns 30.

Auto insurance is the cheapest for drivers between the ages of 35 and 55.

Yes, auto insurance rates go down at 25. However, this is not a “magical” milestone, and rates will continue to decrease until the driver is 30.