Car insurance is a necessity, but how much car insurance does one need? The answer depends on a variety of factors, including state requirements, the value of the car, and personal preferences.

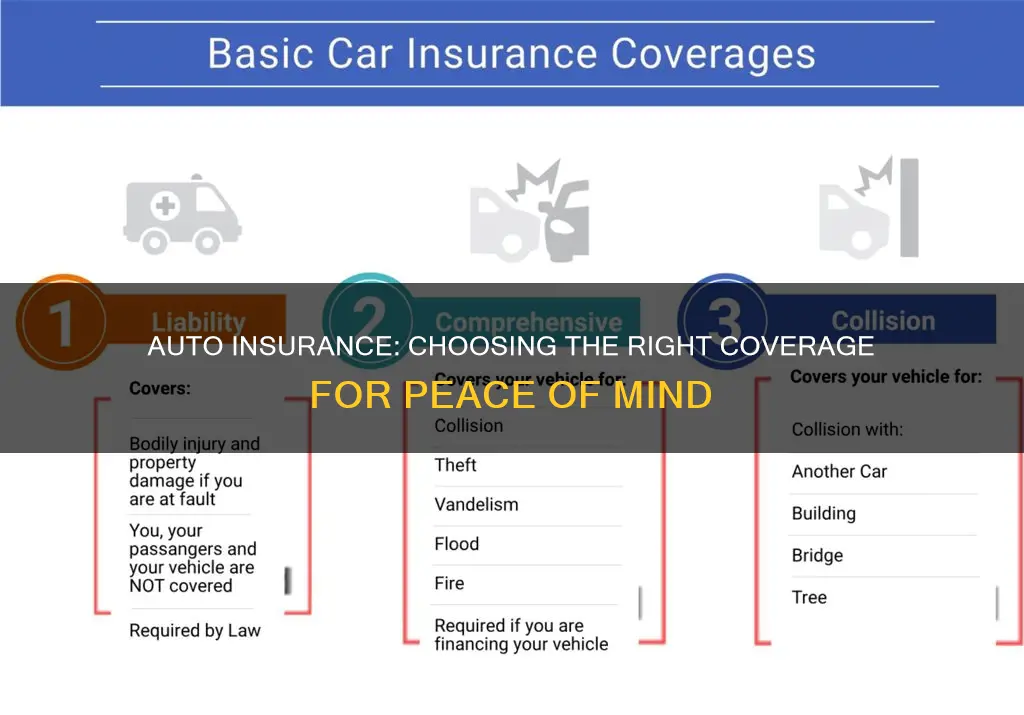

Most states require liability insurance, which covers medical and repair costs for other drivers in an accident caused by the insured driver. The minimum coverage amounts vary by state, with common limits being $25,000 per person and $50,000 per accident for bodily injury, and $25,000 for property damage. However, these minimums may not be sufficient in the event of a serious accident, and it is recommended to have at least $100,000 per person and $300,000 per accident in bodily injury liability and $100,000 in property damage liability.

In addition to liability insurance, full coverage car insurance is also an option. Full coverage includes collision and comprehensive insurance, which cover the cost of repairs or replacement of the insured driver's vehicle in an accident or non-collision incident, respectively. Full coverage is typically required for leased or financed vehicles and recommended for new or expensive cars.

When determining the amount of car insurance needed, it is essential to consider state requirements, the value of the car, and personal preferences for coverage and budget.

| Characteristics | Values |

|---|---|

| Liability insurance | Required in almost every state; minimum coverage varies by state |

| Collision insurance | Optional, but required if the car is leased or financed |

| Comprehensive insurance | Optional, but required if the car is leased or financed |

| Uninsured/underinsured motorist coverage | Required in many states |

| Personal injury protection (PIP) | Required in some states |

| Medical payments (MedPay) coverage | Required in some states |

| Gap insurance | Optional, but required if the car is leased or financed |

| Rental reimbursement insurance | Optional |

| Roadside assistance insurance | Optional |

| Umbrella insurance | Optional |

What You'll Learn

Liability insurance

- Bodily injury liability coverage pays other people’s medical costs when they’re injured in a traffic-related accident you cause. It covers things like medical bills, pain and suffering, lost wages, and even funeral costs.

- Property damage liability coverage pays for damage to other people's property after a traffic-related accident you cause. This can include cars, fences, buildings, and government infrastructure like guardrails and road signs.

- $25,000 in bodily injury per person

- $50,000 in total bodily injury per accident

- $25,000 for property damage per accident

The recommended amount of liability insurance is $100,000 in bodily injury liability insurance per person, $300,000 in bodily injury liability per accident, and $100,000 in property damage liability per accident. This level of coverage is considered full coverage and provides expanded protection in case of an accident. If you have significant assets, you may want even more coverage, with liability protection going up to $500,000 for car insurance.

Gap Insurance: Getting a Refund

You may want to see also

Collision insurance

When deciding on collision insurance, consider the cost of your car and its potential repair costs. If you choose a higher deductible, you will pay less per month on your premium. However, this also means you will have to cover more of the repair costs when the need arises.

Occupational Licenses: Can You Get Auto Insurance?

You may want to see also

Comprehensive insurance

On the other hand, comprehensive insurance may not be worth the cost if your car is older and has little value. In this case, the coverage may not be worth the price, especially if you have enough cash to cover unexpected repair or replacement costs.

When deciding whether to get comprehensive insurance, it's important to consider factors such as the value of your car, your financial situation, and the likelihood of experiencing a covered event. You can use the following formula to help determine if comprehensive insurance makes financial sense for you:

- Find the six-month premium cost of your comprehensive policy.

- Subtract the deductible amount from the value of your car.

- Subtract your six-month comprehensive coverage premium amount from the value of your car after deducting the deductible.

- If the result is a negative number, it makes financial sense to drop the comprehensive policy. If the result is a large positive number, keep the comprehensive coverage. For a low positive number, you can decide whether to maintain the policy or save the money and prepare to replace or repair your car out of pocket if necessary.

Overall, comprehensive insurance can provide valuable protection for your vehicle in a range of scenarios. However, it is important to weigh the costs and benefits to determine if it is the right choice for your specific situation.

Allstate vs Progressive: Cheaper Auto Insurance in South Carolina?

You may want to see also

Uninsured motorist insurance

There are two main types of uninsured motorist coverage: uninsured motorist bodily injury (UMBI) and uninsured motorist property damage (UMPD). UMBI covers medical bills for both you and your passengers if you are injured in an accident with an uninsured driver. It may also cover lost wages and pain and suffering. UMPD, on the other hand, covers damage to your vehicle caused by an uninsured driver. In some states, UMPD may also cover damage to other property caused by an uninsured or underinsured driver.

When deciding how much uninsured motorist coverage to purchase, it is generally recommended to choose limits that match your liability coverage. For example, if your liability coverage limits are $50,000 per person and $100,000 per accident, you would choose the same limits for your UMBI and UIMBI coverage. For UMPD coverage, you can select a limit that is similar to the value of your vehicle.

In summary, uninsured motorist insurance is a crucial component of auto insurance, offering financial protection in the event of an accident with an uninsured or underinsured driver. By selecting appropriate coverage limits and understanding the specifics of your policy, you can ensure that you have the necessary protection in place.

Umbrella Insurance: Auto Coverage Explained

You may want to see also

Personal injury protection

PIP covers reasonable medical costs, including surgeries, medications, diagnostics (X-rays, CT scans), prosthetics, nursing care, physical therapy, and medical devices. It also covers lost wages due to injury and recovery, and the replacement of necessary services normally provided by the injured party, such as childcare or household maintenance.

The amount of PIP insurance you need depends on your state's requirements and your personal financial situation. Some states require a minimum amount of PIP coverage, such as $2,500, while others may offer it as an optional coverage type. If PIP is optional in your state, you may want to consider declining it if you have a good health insurance plan that covers similar expenses. However, PIP has some additional perks that your health insurance may not provide, such as reimbursement for lost wages and services.

When deciding on the amount of PIP coverage, consider the potential costs of medical treatment, lost income, and replacement services that you may need in the event of an accident. Additionally, consider your state's minimum requirements and whether you want additional financial protection. In Texas, for example, you can typically increase your PIP coverage from the minimum of $2,500 to $5,000 or $10,000 for added protection.

Benefits of PIP

PIP can provide valuable financial protection in the event of a car accident, especially if you are hit by an uninsured or underinsured driver, or in the case of a hit-and-run accident. Unlike liability insurance, claiming PIP does not typically cause your insurance rates to rise.

Chase Auto Insurance: Travel Companion or Just a Car Cover?

You may want to see also

Frequently asked questions

The minimum amount of auto insurance you need is your state's minimum liability requirements. This is the smallest amount of coverage you need to drive legally. However, it is recommended that you get more coverage than the state minimum to protect yourself and your assets.

It is recommended that you get the highest amount of liability coverage that you can reasonably afford. A good rule of thumb is to get enough coverage to match your net worth. The recommended coverage limits are $100,000 per person, $300,000 per accident in bodily injury liability and $100,000 per accident in property damage liability, also known as 100/300/100 coverage.

When deciding how much auto insurance to get, you should consider your state's minimum requirements, your budget, and your personal needs. You should also think about the value of your car and whether you can afford to pay for repairs or replacement out of pocket. If you have a lease or loan on your car, you may be required to get full coverage insurance.