Private health insurance is a type of health coverage provided by private companies, rather than government-run agencies. It is the most common way Americans get coverage, with 66% of Americans having a private health plan compared to 36% with public plans. Private health insurance is typically purchased through an employer, the Affordable Care Act (ACA) marketplace, or directly from a health insurance company. It covers medical, hospital, and preventive care, as well as mental health services, prescription drugs, rehabilitation, and specialist care. Examples of private health insurance companies include Blue Cross Blue Shield, Kaiser Permanente, UnitedHealthcare, and Cigna.

| Characteristics | Values |

|---|---|

| Definition | Health insurance that is not marketed by government-run agencies |

| Provider | Private health insurance companies, health insurance agents, or online brokers |

| Who gets it? | 49% of Americans get health insurance through employer-sponsored insurance; some buy individual plans directly from insurance companies, local brokers, or online marketplaces |

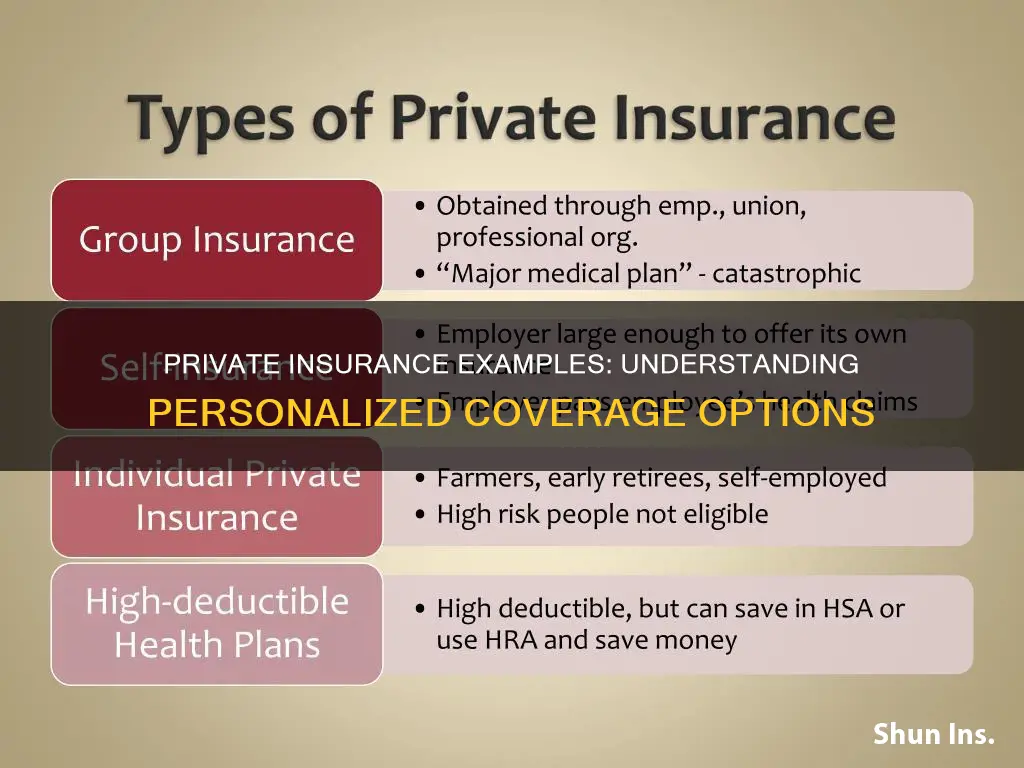

| Types | Individual, Family, Group, Medicare Advantage, Short-term, Catastrophic, Supplemental, Dental and Vision, Long-term Care, Travel, Specific Disease or Illness, High-Deductible |

| Coverage | Medical, hospital and preventive care; hospital services; medical services; mental health services; prescription drugs; rehabilitation and physical therapy; specialist care |

| Cost | Private health insurance is usually more expensive than government-backed health insurance |

| Comparison | Private health insurance covers 66% of Americans, while public insurance covers 36% |

What You'll Learn

Individual health insurance

When choosing an individual health insurance plan, it is important to consider factors such as coverage options, premiums, deductibles, and network providers. These plans can be purchased through private health insurance companies, local health insurance brokers, or online health insurance marketplaces.

In the United States, private health insurance is the most common way for individuals to obtain health coverage. According to the U.S. Census Bureau, 66% of Americans have a private health plan, compared to 36% with public plans. Private health insurance is provided by private companies, rather than government-run programs like Medicare, Medicaid, or the Children's Health Insurance Program (CHIP).

There are several types of private health insurance plans available, including employer-sponsored health insurance, ACA marketplace plans, and individual health insurance purchased directly from an insurance company. Individual health insurance plans offer flexibility and tailored coverage to meet the specific needs, budgets, and preferences of the individual policyholder.

Understanding HMO and PPO: Private Insurance Options

You may want to see also

Family health insurance

One of the main advantages of family health insurance is the convenience of having all family members covered by the same policy, simplifying administrative tasks such as premium payments and claims processing. These plans often include a network of preferred healthcare providers, resulting in lower out-of-pocket expenses for those who use in-network services. Family policies usually cover dependent children up to the age of 26, regardless of their financial dependence status. Preventive care services, like vaccinations and screenings, are often included at no additional cost to promote overall family wellness.

Families can sometimes customize their coverage by adding optional benefits, such as dental insurance, vision insurance, or additional benefits tailored to specific family members' needs. When choosing a family health insurance plan, it is essential to carefully assess the family's healthcare needs, budget, and preferences. Evaluating the plan's details, provider network, and cost-sharing structure will help ensure it aligns with the family's requirements. Additionally, families may be eligible for government subsidies or tax credits to reduce the cost of their health insurance if they purchase it through a government-sponsored health insurance marketplace.

Job-Based Insurance: Private or Public?

You may want to see also

Group health insurance

The cost of group health insurance is shared between the organisation and its members, with employers often paying a significant portion of the premiums. In addition, employers can enjoy favourable tax benefits for offering group health insurance to their employees.

Unicare Private Insurance: What You Need to Know

You may want to see also

Dental and vision insurance

Dental insurance plans usually have waiting periods for some procedures. It is important to be aware of these waiting periods when choosing a plan. Most dental insurance covers dental procedures, but it is important to understand what specific procedures are covered under your plan.

Vision insurance is also a cost-effective option that can contribute to your overall health. It covers expenses related to vision care, such as eyeglasses and contact lenses.

In the United States, the Federal Employees Dental and Vision Benefits Enhancement Act of 2004 allowed eligible Federal and Postal employees, retirees, and their eligible family members to purchase dental and vision insurance on a group basis. This program, called the Federal Employees Dental and Vision Insurance Program (FEDVIP), offers competitive premiums and no pre-existing condition limitations.

Obamacare: Public or Private Insurance?

You may want to see also

Travel health insurance

When choosing a travel health insurance plan, it is important to assess your primary health plan and determine what kind of coverage you will need while abroad. It is also crucial to understand the specific benefits and exclusions of the travel health insurance plan, as pre-existing conditions may not always be covered.

The cost of travel health insurance can vary depending on factors such as age, destination, and desired coverage level. On average, these plans can cost less than $3 per day and provide valuable peace of mind and financial protection in case of medical emergencies during international travel.

Warren's Private Insurance: Abolish or Overhaul?

You may want to see also

Frequently asked questions

Some examples of private health insurance include Blue Cross Blue Shield, Kaiser Permanente, UnitedHealthcare, and Cigna.

Private health insurance is a contract between you and a private health insurance company that mandates the insurer to pay some or all of your medical expenses as long as you pay your premium.

You can get private health insurance through an employer, the Affordable Care Act (ACA) marketplace, or directly from a health insurance company.