Māori people have among the lowest rates of insurance of all ethnic groups in New Zealand. A survey by the CFFC of over 20,000 people showed that only 20% of Māori had health insurance, compared to 29% of all New Zealanders. This is despite the fact that Māori are less likely to report having private health insurance than non-Māori. This could be due to a variety of factors, such as the cultural imperative of manaakitanga, which prioritises community support, or the disproportionate number of Māori in low-income groups.

| Characteristics | Values |

|---|---|

| Percentage of Māori with private health insurance | 20% |

| Comparison with other ethnic groups | Māori have among the lowest rates of insurance of all ethnic groups in New Zealand |

| Comparison with non-Māori | Less likely to report having private health insurance than non-Māori |

| Factors influencing low insurance rates | Cultural imperative of manaakitanga (generosity and support of those in need), low income, high insurance premiums |

What You'll Learn

- Māori have lower private insurance rates than non-Māori

- Generosity and support within Māori culture may explain low insurance uptake

- Māori are disproportionately represented in low-income groups

- Māori men face higher health and life insurance premiums

- Māori are less likely to have private health insurance cover

Māori have lower private insurance rates than non-Māori

The New Zealand Health Survey, which collected data between 2011 and 2015, found that Māori were less likely to report having private health insurance than non-Māori, even after adjusting for age and sex differences. This disparity in health insurance coverage is further exacerbated by the fact that Māori are disproportionately represented in low-income groups, making insurance premiums a challenging expense for many Māori families.

The low insurance rates among Māori may be attributed in part to cultural factors, such as the Māori cultural imperative of manaakitanga, which prioritizes generosity and support for those in need. Within the Māori community, whānau and hapū often provide financial support during difficult times, such as covering the cost of a tangi after the death of a loved one.

However, it is important to recognize the potential consequences of low insurance uptake. For example, individuals with private health insurance may have more timely access to non-urgent treatment than those without insurance. Additionally, insurance can provide financial protection against unexpected events, reducing the financial burden on the individual and their community.

To address these disparities, it is crucial to have open discussions within whānau about the importance of insurance and explore the types of insurance that can offer suitable protection. Furthermore, it is essential to be cautious when dealing with insurance salespeople to avoid unnecessary or unscrupulous policies.

Hospitals' Private Insurer Contracts: How Do They Work?

You may want to see also

Generosity and support within Māori culture may explain low insurance uptake

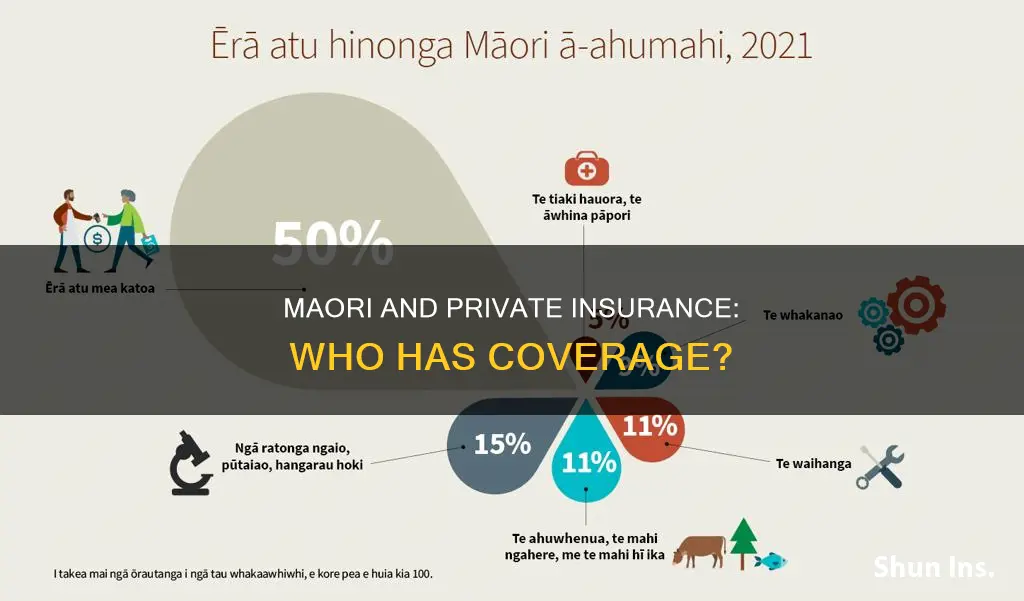

Māori people have among the lowest rates of insurance of all ethnic groups in New Zealand. While the average rate of insurance ownership among New Zealanders is 48% for house insurance, 55% for contents insurance, 64% for car insurance, 29% for health insurance, and 35% for life insurance, the rates among the Māori are significantly lower. Only 32% of Māori have house insurance, 40% have contents insurance, 50% have car insurance, 20% have health insurance, and 32% have life insurance.

The low insurance uptake among Māori could be attributed to their cultural imperative of manaakitanga, which values generosity and support for those in need. This cultural value is exemplified in practices such as whānau and hapū covering the cost of a tangi and providing financial support for bereaved families. As a result, Māori may be less inclined to seek insurance as they rely on their community for support during difficult times.

However, it is important to note that there are other factors contributing to the low insurance rates among Māori. One significant factor is the disproportionate number of Māori in low-income groups. Insurance premiums may be seen as a luxury or unnecessary expense for families who are living paycheque to paycheque. Additionally, health and life insurance premiums can be higher for Māori men due to their increased risk of certain diseases and shorter life expectancy, making these types of insurance even less accessible.

To address these issues, it is crucial to have open discussions within whānau about the importance of insurance and the potential financial risks of not having adequate coverage. It is also encouraging that organisations are taking steps to embrace cultural diversity and fluency, with some insurance companies normalising the use of te reo and embracing Te Ao Māori values in their workplaces. By increasing cultural intelligence and understanding the specific needs and values of the Māori community, insurance companies can develop more relevant and accessible products.

In conclusion, the low uptake of insurance among Māori may be influenced by their cultural values of manaakitanga, which prioritises community support and generosity. However, it is also important to recognise the impact of socioeconomic factors and the need for insurance companies to create inclusive products that cater to the unique needs of different ethnic groups.

Oregon Hospitals: Baby Drug Testing and Private Insurance

You may want to see also

Māori are disproportionately represented in low-income groups

Māori have among the lowest rates of insurance of all ethnic groups in New Zealand. According to a survey of more than 20,000 people, only 32% of Māori had house insurance, 40% had contents insurance, 50% had car insurance, 20% had health insurance, and 32% had life insurance. These rates are significantly lower than those of other ethnic groups in the country.

The low insurance rates among Māori could be partly due to the cultural imperative of manaakitanga, which prioritizes generosity and support for those in need. Additionally, there may be a disproportionate number of Māori in low-income groups, making insurance premiums unaffordable for many families.

The issue of low insurance coverage among Māori has potential health implications. Individuals with private health insurance may have more timely access to non-urgent treatment than those without insurance. Māori are less likely to have private health insurance than non-Māori, which could lead to delays in accessing healthcare services.

Addressing the disparities in income and insurance coverage among Māori is crucial to ensuring equitable access to health services and improving overall health outcomes for this community.

Understanding Your Insurance Coverage: Private Insurance Identification

You may want to see also

Māori men face higher health and life insurance premiums

However, this can leave the community vulnerable to financial risk. Peter Cordtz, Head of Communities, highlights the importance of understanding the purpose of insurance and encourages whānau to discuss the potential costs of unexpected events and explore insurance options that could offer protection.

One of the reasons for the higher premiums faced by Māori men is their increased risk of certain diseases and shorter life expectancy. This is likely due, in part, to the disproportionate number of Māori in low-income groups, which can make insurance premiums a challenging expense to fit into the budget.

To address these disparities, the New Zealand government has introduced measures to protect consumers in their dealings with financial institutions, including banks and insurers. These measures aim to improve access to insurance for all New Zealanders, including Māori men.

Additionally, initiatives such as Te Wiki o Te Reo Māori, or Māori Language Week, are helping to increase the use of te reo Māori in the insurance industry, fostering a more inclusive environment for Māori customers and employees.

Germany's Private Insurance: A Complementary Coverage Option

You may want to see also

Māori are less likely to have private health insurance cover

A range of factors may contribute to the lower rates of private health insurance among Māori. One significant factor is household income, which has been found to have the strongest association with private health insurance coverage. Māori are over-represented in low-income groups, and insurance premiums may be one of the first costs to be cut when budgets are tight. The prioritisation of spending on immediate needs over future possibilities can make it challenging for individuals and families to afford private insurance.

Cultural factors may also play a role in the lower rates of insurance among Māori. The Māori cultural imperative of manaakitanga, which values generosity and support for those in need, may influence the uptake of insurance. Within the Māori community, whānau and hapū often provide financial support for bereaved families, covering the costs associated with a tangi, for example. This cultural context of mutual support may reduce the perceived need for insurance.

Additionally, the design of insurance products and sales practices may contribute to the lower rates of private health insurance among Māori. Head of Communities Peter Cordtz, who is Māori Samoan, has cautioned against unscrupulous insurance salespeople who might push unnecessary policies. He has also noted that premiums for health and life insurance can be weighted against Māori men due to their increased risk of certain diseases and shorter life expectancy. These factors may make private health insurance less accessible and less appealing to Māori.

It is important to note that while Māori may have lower rates of private health insurance, they can still access New Zealand's public healthcare system, where the government pays most of the costs. Free or subsidised health and disability services are provided to eligible individuals, including subsidised primary healthcare, subsidies on prescribed medications, and free public hospital services.

Dual Coverage: Medi-Cal and Private Insurance

You may want to see also

Frequently asked questions

20% of Māori have health insurance, compared to 29% of all New Zealanders.

Māori have a culture of taking care of each other, which may be a reason for the lower rates of insurance. Another reason could be that there is a disproportionate number of Māori in low-income groups, and insurance premiums may be one of the first costs to be cut when budgeting.

The CFFC's Financial Capability Barometer survey showed that Māori had lower rates of house insurance (32% vs. 48%), contents insurance (40% vs. 55%), car insurance (50% vs. 64%), and life insurance (32% vs. 35%) compared to all New Zealanders.