Car insurance policies typically include multiple types of coverage, with each type covering specific circumstances or events. The three primary coverages are liability, collision, and comprehensive. Liability coverage includes two types of car insurance: bodily injury liability, which covers the medical expenses from an accident you caused, and property damage liability, which covers the repair costs to other vehicles, fences, mailboxes, or buildings from an accident you caused. Collision coverage protects your car from damage in any type of collision, whether with another vehicle or object, and is required if you lease or finance your car. Comprehensive coverage also covers repairs to your car, but only for damage caused by scenarios other than a collision, such as weather, natural disasters, fire, theft, and vandalism.

| Characteristics | Values |

|---|---|

| Bodily Injury Liability Coverage | Covers the medical expenses from an accident you caused |

| Property Damage Liability Coverage | Covers the repair costs to other vehicles, fences, mailboxes or buildings from an accident you caused |

| Collision Coverage | Protects your car from damage in any type of collision |

| Comprehensive Coverage | Covers repairs to your car, but only for damage caused by scenarios other than a collision |

| Uninsured Motorist Coverage | Pays for expenses that result from an uninsured driver hitting you |

| Underinsured Motorist Coverage | Pays when the at-fault driver’s insurance limits are too low to cover all of the injuries or damage they caused |

| Medical Payments Coverage | Pays for medical expenses for you and your passengers following a car accident, regardless of who was at fault |

| Personal Injury Protection | Covers medical expenses for you and your passengers following a car accident, regardless of fault |

What You'll Learn

Bodily Injury Liability

- Funeral costs

- Legal expenses

- Lost wages

- Medical bills

- Pain and suffering

It's important to note that if the other party's medical bills exceed the amount of bodily injury coverage on your policy, you are responsible for paying the remaining amount. To avoid this, it's generally recommended to carry sufficient bodily injury coverage.

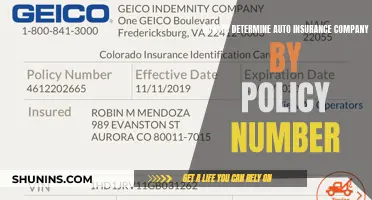

When purchasing car insurance, the required coverage amounts are typically represented as a set of three numbers. For example, $25,000/$50,000/$15,000 would mean:

- $25,000 in bodily injury liability coverage per person

- $50,000 in bodily injury liability coverage per accident

- $15,000 in property damage liability coverage per accident

While purchasing the minimum coverage amounts may be tempting, it's important to consider increasing these limits to realistically address the risks associated with today's litigious environment. Financial experts recommend carrying at least $100,000 in bodily injury liability coverage per person and $300,000 per accident.

Gap Insurance: Florida's Ultimate Car Protection

You may want to see also

Property Damage Liability

The coverage limit for PDL is set by each state, but it's important to note that the required coverage may not be sufficient for your needs. If you own a home or other expensive items, or if you frequently travel in high-traffic areas with expensive vehicles, you may want to consider raising your coverage limit.

If you are found at fault in an accident, your PDL coverage will pay for the cost of repairing or replacing the damaged property, up to your policy's limit. However, if the cost of damages exceeds your coverage limit, you will be responsible for the remaining cost. Therefore, it's crucial to ensure you have adequate coverage to protect yourself financially in the event of an accident.

When reviewing your PDL coverage, it's important to understand how the limits are written. For example, a policy with limits of 100/300/100 would provide:

- $100,000 of Bodily Injury Coverage per person

- $300,000 of Bodily Injury Coverage per accident, with a maximum of $100,000 per person

- $100,000 of Property Damage Coverage for damages to property

While PDL covers damage to other people's property, it's important to note that it does not cover damage to your own property. If you want coverage for damage to your own vehicle, you would need to purchase additional coverages such as collision insurance or comprehensive insurance.

Tornado Damage and Auto Insurance: What You Need to Know

You may want to see also

Collision Coverage

Unlike liability coverage, collision coverage applies regardless of who is at fault in the accident. Collision coverage is not legally required in any state, but it may be required by your lender if you are leasing or financing your vehicle. In this case, collision coverage protects their investment.

If you own your vehicle outright and choose not to carry collision coverage, you will have to pay for any repairs or replacements out of pocket. However, if you are found to be not at fault in an accident, the other driver's liability coverage will typically pay for the damage.

When deciding whether to purchase collision coverage, consider the value of your vehicle, your ability to pay for repairs or a replacement out of pocket, and whether your vehicle will be in storage for an extended period. Collision coverage can provide peace of mind and help you pay for expensive repairs or replacements if your vehicle is damaged.

Auto Insurance: Self-Employed Tax Deduction Explained

You may want to see also

Comprehensive Coverage

In summary, comprehensive auto insurance coverage protects your vehicle from damage caused by unexpected events outside of your control. It is optional but often required by lenders for leased or financed vehicles. It covers a range of non-collision incidents and can provide financial protection and peace of mind for vehicle owners. Whether or not you need comprehensive coverage depends on your vehicle's value, your financial situation, and your personal preferences.

Smart Auto Insurance Savings

You may want to see also

Uninsured/Underinsured Motorist Coverage

Uninsured motorist coverage comes into play when you are hit by a driver with no auto insurance. Underinsured motorist coverage, on the other hand, kicks in when the at-fault driver doesn't have sufficient coverage to pay for the damages or injuries they caused. Both coverages are often offered together, providing a comprehensive safety net.

In the unfortunate event of a hit-and-run accident, you can file a claim against your uninsured motorist coverage. This coverage is especially important considering that nearly 13% of drivers countrywide don't have auto insurance, according to the Insurance Information Institute. In some states, the number of uninsured drivers exceeds 20%.

- Uninsured motorist bodily injury (UMBI): This covers medical bills for you and your passengers if you're hit by an uninsured driver.

- Uninsured motorist property damage (UMPD): This covers repairs to your vehicle if it's damaged by an uninsured driver.

- Underinsured motorist bodily injury (UIMBI): This covers medical bills for you and your passengers if the at-fault driver's insurance limits are too low.

- Underinsured motorist property damage (UIMPD): This covers repairs to your vehicle if the at-fault driver's property damage liability limits are insufficient.

It's important to note that while some states require a deductible for UMPD/UIMPD, UMBI/UIMBI generally doesn't include a deductible. Additionally, in some states, UMPD may not cover hit-and-run incidents, and you would need collision coverage for those situations.

When deciding on the amount of uninsured/underinsured motorist coverage you need, consider matching the limits of your liability coverage. For example, if your liability coverage is $50,000 per person and $100,000 per accident, choosing the same limits for UMBI and UIMBI ensures adequate protection. For UMPD, you can select a limit close to the value of your vehicle.

Minds at Ease: Gap Insurance Explained

You may want to see also

Frequently asked questions

The three main types of auto insurance coverage are liability coverage, collision coverage, and comprehensive coverage.

Liability coverage includes two types of insurance: bodily injury liability and property damage liability. It covers the costs of the other driver's medical bills, property damage, and other expenses if you are at fault in an accident.

Collision coverage protects your car from damage in any collision, whether with another vehicle or an object such as a tree or guardrail. It covers the costs of repairing your car, regardless of who is at fault.

Comprehensive coverage pays for repairs to your car for damage caused by scenarios other than a collision. This includes weather events, natural disasters, fire, theft, vandalism, and falling objects.