Being in a car accident is stressful, and it's easy to forget to get all the necessary information from the other driver. If you only have the other driver's policy number and no name or insurance company name, there are a few ways to identify their insurance company. Firstly, report the accident to your insurance company, as the other party might be covered by the same insurer. You can also call different insurance companies to see if they recognise the policy number. Another option is to ask your insurer to put a hold on the claim until you receive the police report, which should contain the other driver's insurance information. Additionally, you can try searching for the insurance company online using the policy number or contacting your local DMV, although privacy laws may restrict their ability to provide information. To avoid this situation in the future, it's recommended to take pictures of the other driver's insurance card and vehicle, as well as filing a police report whenever possible.

| Characteristics | Values |

|---|---|

| Number of digits | 8-13 |

| Format | Numerical, Alphanumeric, or a combination of both |

| Privacy | Confidential and private |

| Purpose | Identifies your individual policy |

| Where to find | Insurance card, billing invoices, declarations page, or online |

| How to use | Required for filing claims, making policy changes, etc. |

What You'll Learn

Ask the other driver

If you've been in a car accident, it's important to remain calm and collected. Check yourself for injuries, and if it's safe to do so, get your insurance card out and exchange insurance information with the other driver. If the accident was particularly bad, the police may arrive at the scene and you may have to give your insurance information to them.

- Their full name

- At least one, if not two, phone numbers

- Their driver's license number

- Their license plate number

- Their insurance information, including:

- Contact information of their insurance company

- Their insurance policy number

If you have your phone with you, ask the other driver if you can take a picture of their driver's license and insurance card. If they don't have an insurance card, be sure to write down as much of the above information as you can.

It's always a good idea to get the police involved, even in minor accidents. The police will look up the other person's information and file a police report. You can then give the police report number to your insurance company, and they will be able to see all the information relating to the accident and the drivers involved.

If the other driver doesn't have insurance or leaves the scene of the accident, you may need to file a claim with your own insurance company.

If you only have the other driver's policy number, it is still possible to identify which insurance company they use. Every auto insurance company has a different structure for numbering their policies, and there is no standard type of auto insurance policy number. They can be any combination of numbers and letters. If you have a direct carrier with a call center, they may not be able to help you identify the company from the policy number. However, if you have an independent insurance agent, they may be able to recognize the company or help you look up the policy number.

If the other driver was at fault for the accident and is not cooperating, you may need to speak to their insurance company. In general, it is advised that you avoid speaking to the other driver's insurance company, but there are some situations when this can benefit your case. If the other driver is lying and their insurance company needs you to confirm the truth, or if the other driver refuses to speak to their insurance company, it may be helpful for you to have a simple conversation with the company. However, be aware that the insurance company's primary goal is to pay out as little money as possible, and they will be looking for ways to disprove your claim. Be careful what you say, and avoid elaborating or getting into any stories about yourself. Keep your answers simple and, if possible, stick to yes or no answers. Do not allow the insurance company to record the conversation.

Obtaining Your Auto Insurance Resale License: A Comprehensive Guide

You may want to see also

Contact your insurance company

Contacting your insurance company is a crucial step to take after a car accident. Here are some detailed instructions on what to do:

It is important to get in touch with your insurance company as soon as possible after a collision. They can assist you in tracking down the other driver's insurance information if it was not provided to you at the scene of the accident. When you contact your insurance company, be prepared to provide them with detailed information about the accident, including the other driver's license plate number. It is also helpful to have a police report on hand, as this will make it easier for your insurance company to track down the other driver's insurance information.

Provide Necessary Information

When you call your insurance company, you will need to provide them with detailed information about the accident. This includes the date, time, and location of the accident, as well as a description of what happened. If you have the other driver's name, contact information, and insurance policy number, be sure to provide that as well. Additionally, it is helpful to provide your insurance company with a copy of the police report, if one was filed. All of this information will assist your insurance company in processing your claim and tracking down the other driver's insurance information if needed.

Understand Your Coverage

Before contacting your insurance company, it is important to understand your policy coverage. Review your policy documents to familiarise yourself with the types of coverage you have, such as collision, comprehensive, or uninsured motorist coverage. This will help you understand what damages may be covered by your insurance company and what steps you need to take next.

File a Claim

If you have the necessary coverage, you can file a claim with your insurance company to cover any damages incurred in the accident. They will guide you through the claims process and let you know what additional information or documentation may be required. It is important to follow their instructions and provide any requested information in a timely manner to ensure your claim is processed efficiently.

Seek Alternative Options

In the event that you are unable to obtain the other driver's insurance information through your insurance company, there are alternative options available. You can try contacting the local Department of Motor Vehicles (DMV) and providing them with the other driver's license plate number. They may be able to provide you with the insurance company's name, but this varies by state. Another option is to reach out to the police, especially if a police report was filed at the scene of the accident. They may be able to assist you in tracking down the insurance information, especially if the other driver provided it to them.

Auto Insurance Options for Georgia Teens

You may want to see also

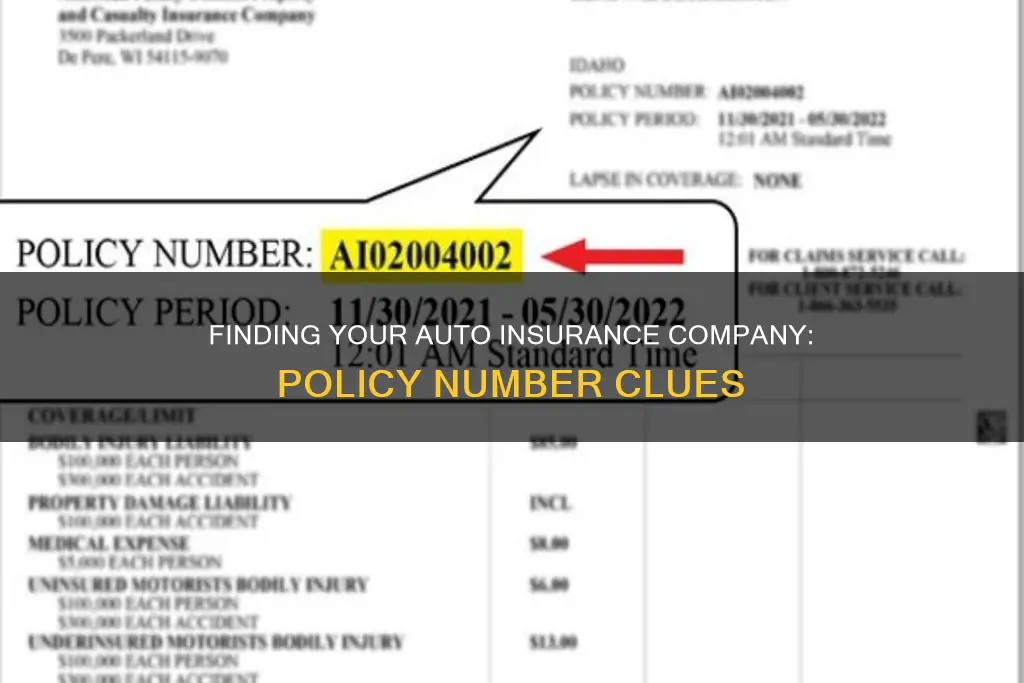

Compare policy number formats

Policy numbers are unique identifiers assigned to insurance policies by insurance companies. They help identify the policyholder, the coverage provided, and other details related to the insurance policy. While the length varies by company, most policy numbers are nine to ten digits long. However, they can also be alphanumeric, containing a combination of letters and numbers.

- American Modern Insurance Group policy numbers use a numerical format of up to 13 digits.

- GMAC Insurance and Mercury Insurance policy numbers are in an alphanumeric format, with the alphabetical code preceding or following the numerical digits.

- GEICO policy numbers are typically 8-10 digits long and start with numbers.

- State Farm policy numbers usually consist of around 10 to 13 numbers and letters, such as "182 4338-D39-47A."

- Progressive policy numbers can be a combination of 8 or 9 digits, such as "12345678" or "12345678-1."

- Safeco policy numbers may include letters and numbers, such as "K1111111."

- Liberty Mutual policy numbers can include letters and numbers, such as "AOX-111-1111111-1111."

It is important to note that insurance companies may use different policy number formats, and there is no standard format for policy numbers. Therefore, it can be challenging to determine the insurance company solely based on the policy number format.

Auto Club Homeowners Insurance: College Student Coverage

You may want to see also

Consult other agents

If you're struggling to identify an auto insurance company using just a policy number, it may be worth consulting other agents for help. Here are some steps you can take:

Ask Around Local Agencies

If your insurance company can't help and the two policy numbers don't match, your best bet is to visit a local independent insurance agent. Independent agents often represent multiple companies and have experience working with various providers. They may be able to recognise the company or help you look up the policy number. With their assistance, you can then proceed with your claim.

Call Other Insurance Companies

Although it may seem unlikely that other insurance companies will be of help, it is still worth calling them and providing them with the policy number. They may not be able to provide any proof, but it is worth trying.

Ask Your Insurer to Put a Hold on the Claim

While this may take longer than the insurance company usually allows, you can request the police report once it is filed and obtain the information you need from there.

Get a Copy of the Police Report

If the policy number you have been given looks incorrect or incomplete, try obtaining a copy of the police report, if one was made. Police officers are required to take down insurance information, so their report is likely to be accurate. The police report should include the name of the other driver's insurance company, which may be all you need.

Call Your Local Agent

If you don't even have the name of an insurance agent to search for, try calling your own agent and explaining your situation. Ask if they have any idea which company the policy number belongs to. Insurance agents are exposed to multiple types of policy numbers every day, so they may be able to recognise the company at a glance or be willing to do some research to help you.

Insuring Your Vehicle in BC

You may want to see also

Contact the DMV

If all other methods of identifying an insurance company by policy number have been exhausted, you could try contacting the DMV. However, it is important to note that, due to privacy laws, they most likely will not be able to give you any information.

If you live in a state that requires insurance reporting, you may be able to call or visit your local DMV and ask them to search for the company by providing them with the policy number. In some states, providing proof of insurance is part of the registration procedure, so they may be able to help. They may also require the name or vehicle description of the other party before releasing any information.

However, if your state does not require insurance reporting, this method of research is unlikely to be feasible. Not all states keep current databases of all drivers with active insurance, so the DMV may not have access to the information you need.

If you are unsure whether your state requires insurance reporting, you can try contacting your local DMV to inquire about their specific policies and procedures. It is always worth trying, especially if all other options have been exhausted.

U.S. Auto Insurance Availability: USAA's Oregon Offering

You may want to see also

Frequently asked questions

A policy number is a unique identifier assigned to an insurance policy by an insurance company. It helps identify the policyholder, the coverage provided, and other details related to the insurance policy.

It is important to identify a car insurance company using a policy number because it helps you obtain important information about your car insurance policy such as coverage details, policy limits, and contact information for your insurance provider.

You can identify a car insurance company using a policy number by contacting your state’s department of insurance or by using an online insurance database, such as the National Association of Insurance Commissioners (NAIC) database.

Make sure that you have the entire policy number. Companies use different number formats so the number of characters could vary, but you will need to know the entire number. If you’re given letters preceding or following the numbers, include those in your query as well.

If you only have the policy number, you can try reporting the accident to your insurance company, calling other insurance companies to see if they recognize the number, or asking your insurer to put a hold on the claim until you can obtain a copy of the police report, which should contain the necessary information.