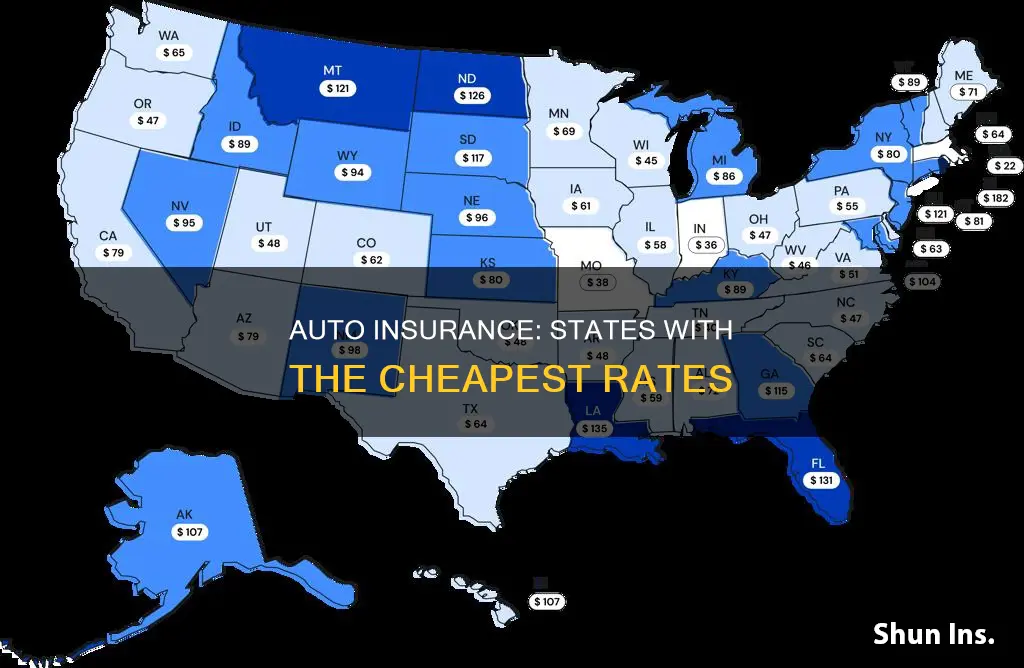

The cost of car insurance varies from state to state, with some states offering rates that are significantly cheaper than the national average. The states with the lowest average full-coverage car insurance rates include Maine, Vermont, Hawaii, Idaho, and Ohio. Meanwhile, Wyoming, Vermont, South Dakota, Hawaii, and Iowa offer the lowest average rates for minimum liability coverage.

| Characteristics | Values |

|---|---|

| States with the cheapest car insurance | Maine, Idaho, Vermont, Ohio, New Hampshire, Wisconsin, North Carolina, Indiana, Iowa, Hawaii, Tennessee, South Dakota, Wyoming, Vermont, Iowa |

| Average annual rate (full coverage) | Maine: $1,175; New Hampshire: $1,265; Vermont: $1,319; Ohio: $1,417; Idaho: $1,428 |

| Average annual rate (liability-only) | Iowa: $338; Vermont: $306; South Dakota: $307; Nebraska: $331 |

| Average annual rate (state-minimum liability-only) | Wyoming: $288; Vermont: $306; South Dakota: $307; Nebraska: $331; Iowa: $338 |

Maine: $1,175

Maine is the cheapest state for car insurance in 2024, with an average insurance premium of $1,175 per year for full coverage. This is 38% less than the national average of $1,895.

Maine's low insurance rates can be attributed to its low population density, resulting in fewer accidents and claims. The state also has a competitive auto insurance market and a low number of uninsured drivers, which help to keep premiums low.

According to one source, the cheapest sample rate in Maine is offered by Auto-Owners Insurance at $620 per year on average.

In addition to location, age, driving history, and the type of vehicle are also factors that affect insurance rates.

Autism and Auto Insurance: Teen Access

You may want to see also

New Hampshire: $1,265

New Hampshire is one of the cheapest states for auto insurance, with rates 40% lower than the national average of $124 per month. The average cost of car insurance in New Hampshire is $105 per month or $1,265 per year, which is $630 less than the national average.

Auto-Owners Insurance offers the lowest rates in New Hampshire, with an average annual premium of $758. However, USAA offers the lowest rates for military families, with an average annual premium of $738.

The cost of car insurance in New Hampshire varies depending on age, gender, driving record, and other factors. For example, drivers aged 30 to 60 pay the lowest rates, at $1,245 per year, while teenagers pay the highest, at $4,141 per year.

Drivers with a clean record will find the lowest rates, with USAA offering an average annual premium of $738. Drivers with a speeding ticket can expect to pay an average of $1,925 per year, while those with an accident on their record will pay around $2,351 per year.

The city you live in also affects the cost of car insurance in New Hampshire. Manchester is the most expensive city, with an average rate of $1,436 per year, while Swanzey is the cheapest, at $1,178 per year.

Auto Owners Insurance: What You Need to Know About Roof Leak Coverage

You may want to see also

Vermont: $1,319

Vermont is one of the cheapest states for auto insurance, with an average annual rate of $1,053, which is $490 less than the national average of $1,543. The average cost of car insurance in Vermont is $96 per month, or $1,156 per year, which is 25.9% less than the national average. The state also has the second-cheapest rates among the 50 states, with an average annual cost of $664, or $55 per month.

Factors Affecting Auto Insurance Rates in Vermont

Auto insurance premiums are influenced by various factors, including age, gender, marital status, credit history, driving record, and location. In Vermont, auto insurance costs vary significantly depending on these factors. For example, a 16-year-old driver in Vermont pays an average of $5,078 per year, while a 50-59-year-old driver pays only $885. Additionally, married motorists in Vermont save an average of $109 per year on their auto insurance policies, compared to the national average savings of $76.

Cheapest Auto Insurance Companies in Vermont

Union Mutual offers the cheapest auto insurance rates in Vermont, with an average annual rate of $676 for full coverage. For minimum coverage, Union Mutual also provides the most affordable option, with an average rate of $159 per year for a 35-year-old driver with a clean driving record. Other inexpensive options for auto insurance in Vermont include Patriot Insurance, State Farm, Geico, and Concord Group.

Tips for Lowering Your Auto Insurance Rates

To find the cheapest auto insurance rates in Vermont, it is recommended to compare quotes from multiple insurers, especially if you have a poor credit score, a history of speeding tickets, or at-fault accidents. Additionally, consider the following tips to lower your auto insurance rates:

- Shop around for the best rates and choose a company that offers the most affordable premium with the best coverage.

- Look for discounts, such as those offered for multiple drivers, a clean driving record, autopay, or having an anti-theft device.

- Maintain a good driving record by practising safe and distraction-free driving to avoid accidents or moving violations, which can increase your insurance costs.

- Select a higher deductible, as a lower deductible results in higher insurance premiums.

- Adjust your coverage by periodically reviewing your policy to ensure you are not paying for unnecessary add-ons and balancing cost and coverage.

Reporting Auto Insurance Fraud in New York: What to Do

You may want to see also

Ohio: $1,417

Ohio is one of the cheapest states for auto insurance, with an average annual rate of $1,417, which is about $125 per month for full coverage and $33 per month for minimum coverage. This is significantly lower than the national average of $2,348 per year for full coverage and $639 per year for minimum coverage.

Ohio's low insurance rates can be attributed to various factors, such as cheaper living costs, a lower probability of accidents and claims, and less congested traffic. The state's insurance rates are calculated based on several factors, including age, gender, driving record, credit score, and vehicle type.

The cost of auto insurance in Ohio can vary depending on the city, with Cleveland and Columbus having notably higher average rates than other cities in the state. This is due to higher population density and more crowded highways, increasing the risk of accidents.

When it comes to insurance providers in Ohio, Westfield and Geico tend to offer lower rates, while Allstate is usually more expensive but provides more coverage. Other options include State Farm, Erie, Nationwide, Grange, and Progressive. USAA is also available for active military members and their families.

It's important to note that insurance rates are personalized, and factors such as age, driving history, and vehicle type can significantly impact the cost of insurance. Shopping around and comparing quotes from different providers is the best way to find the most suitable coverage at a reasonable rate.

Driving Uninsured in Michigan: Is It a Crime?

You may want to see also

Idaho: $1,428

Idaho is one of the cheapest states for auto insurance, with an average annual rate of $1,428 for full coverage. This is significantly lower than the national average of $1,895.

Idaho's low insurance rates can be attributed to its low population density and a relatively small number of uninsured drivers. With fewer people and cars on the road, there are naturally fewer accidents and claims, which helps to keep insurance rates low.

When compared to other states, Idaho's insurance rates are very competitive. For example, Louisiana, the most expensive state for car insurance, has an average annual premium of $2,883. That's almost double the cost of Idaho's full coverage insurance!

If you're looking for cheap auto insurance, Idaho is a great place to be. The state's competitive insurance market and low accident rates mean that residents benefit from affordable coverage options.

It's worth noting that insurance rates can vary within a state, too. Factors such as your age, driving record, credit score, and location within the state can all impact your insurance premiums. However, with its low population density and favourable insurance landscape, Idaho is a great choice for drivers seeking affordable coverage.

Auto Insurance Settlement: Strategies for a Successful Counter Offer

You may want to see also

Frequently asked questions

The cheapest states for auto insurance include Maine, Vermont, Ohio, Idaho, and Hawaii.

Auto insurance rates vary by state due to differences in state regulations, weather, road risks, and local claims history. For example, states with more uninsured drivers tend to have higher insurance rates.

To find the cheapest auto insurance rates, compare quotes from multiple insurance companies. Factors such as your age, driving record, and type of vehicle will affect your insurance rate.