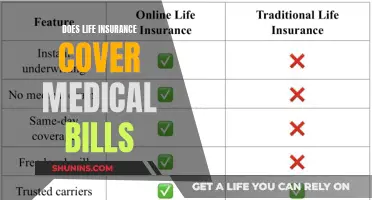

There are different types of medical insurance plans that meet different needs. Some examples include HMO, EPO, PPO, and POS plans.

| Characteristics | Values |

|---|---|

| HMO | Coverage for in-network doctors and hospitals |

| EPO | Services are covered only if you use doctors, specialists, or hospitals in the plan’s network |

| PPO | Coverage for in-network doctors and hospitals |

| POS | Coverage for in-network doctors and hospitals |

| Medicare | Government program |

| Medicaid | Government program |

| Dual Special Needs Plan (D-SNP) | Government program |

| Marketplace | Sold on the health care Marketplace, or Exchange |

| ACA | Put in place to help make health insurance easier for people to get |

What You'll Learn

HMO (Health Maintenance Organisation)

An HMO (Health Maintenance Organisation) is a type of health insurance plan that restricts your provider choices and encourages you to get care from the plan’s network of doctors, hospitals, pharmacies, and other medical service providers. The HMO model helps keep healthcare costs affordable for members.

An HMO plan offers coverage for in-network doctors and hospitals, but will not cover out-of-network providers unless it is an emergency.

Most HMO plans do not require a PCP selection or referral to see specialists.

You prefer a relationship with one doctor who can help manage your care and refer you to specialists as needed.

You can hit the ground running this year before open enrollment by understanding the different types of health insurance you can consider.

Americas Best: Medicaid Coverage and Insurance Options

You may want to see also

EPO (Exclusive Provider Organisation)

Exclusive Provider Organisation (EPO) is a type of health insurance plan that restricts your provider choices and encourages you to get care from the plan’s network of doctors, hospitals, and other medical service providers. Services are covered only if you use doctors, specialists, or hospitals in the plan’s network (except in an emergency).

EPO plans are managed care plans that keep healthcare costs affordable for members. They are designed to meet different needs and vary in coverage, cost, and availability of doctors in your network.

EPO plans are different from HMO plans in that HMO plans offer coverage for in-network doctors and hospitals, but will not cover out-of-network providers unless it is an emergency.

EPO plans are also different from PPO plans in that PPO plans allow you to use out-of-network providers without a referral.

EPO plans are one of the types of Marketplace health insurance plans that you can find in the Marketplace at each metal level – Bronze, Silver, Gold, and Platinum.

Understanding Medical Insurance Coverage for Braces: What You Need to Know

You may want to see also

Medicare

The program is divided into several parts, each with its own specific coverage and benefits. These parts include:

- Part A: This covers hospitalization costs, including inpatient care and skilled nursing facility care.

- Part B: This covers medical services, including doctor visits, outpatient care, and preventive services.

- Part C: This is also known as Medicare Advantage and provides additional benefits such as vision, dental, and hearing coverage through private insurance companies.

- Part D: This covers prescription drug costs and is offered through private insurance companies.

It is important to note that Medicare does not cover all medical expenses and there may be out-of-pocket costs such as deductibles and copayments. Additionally, Medicare Advantage plans offered by private companies may have different coverage and costs compared to traditional Medicare.

Navigating Medical Insurance: Tips for the Unemployed

You may want to see also

Medicaid

The program is administered by the states and funded by the federal government, with specific eligibility requirements and benefits varying by state. Eligibility is determined by income, and individuals and families with low incomes and limited resources may qualify for medical assistance.

Eligibility requirements for Medicaid vary by state, but generally, income-based guidelines are used to determine eligibility. States have the flexibility to set their own income limits and eligibility criteria, and some states may have additional requirements or categories of coverage.

Unraveling Lipo Coverage: Medical Insurance and Body Contouring

You may want to see also

Dual Special Needs Plan (D-SNP)

A Dual Special Needs Plan (D-SNP) is a type of health insurance plan that is specifically designed for individuals with both Medicare and Medicaid eligibility. This plan is tailored to meet the unique needs of these individuals, who often have complex medical conditions and require specialized care.

Medicare and Medicaid are both government-funded programs, but they function differently. Medicare is primarily for individuals aged 65 and older, while Medicaid is for those with low incomes and resources. A D-SNP coordinates services for individuals who are eligible for both programs, ensuring that their medical needs are met through a comprehensive and integrated approach.

These plans are designed to provide a high level of care coordination and support for individuals with special needs. They typically include services such as case management, care planning, and regular reviews to ensure that the individual's medical needs are being met. The goal of a D-SNP is to improve health outcomes and quality of life for individuals with special needs by providing a seamless and integrated approach to their healthcare.

These plans are often offered through managed care organizations that have contracted with both Medicare and Medicaid. This allows them to coordinate services and provide a comprehensive benefits package that meets the unique needs of individuals with special needs.

Individuals who are eligible for both Medicare and Medicaid may benefit from a D-SNP, as it can provide a more comprehensive and coordinated approach to their healthcare. However, it's important to review the specific benefits and coverage of any D-SNP plan to ensure that it meets their individual needs and preferences.

Ambulance Costs: Unraveling Medical Insurance Coverage

You may want to see also

Frequently asked questions

There are different types of health insurance plans that meet different needs. Some examples include HMO, EPO, PPO, and POS plans.

An HMO plan offers coverage for in-network doctors and hospitals, but will not cover out-of-network providers unless it is an emergency. The HMO model helps keep healthcare costs affordable for members.

An Exclusive Provider Organization (EPO) plan is a managed care plan where services are covered only if you use doctors, specialists, or hospitals in the plan’s network (except in an emergency).