Many individuals wonder whether their medical insurance will cover the cost of braces, a common orthodontic treatment. The answer to this question depends on several factors, including the type of insurance plan, the specific coverage details, and the reason for seeking braces. Generally, medical insurance plans may not cover the full cost of braces, as they are often considered a cosmetic procedure. However, in some cases, insurance may provide coverage if braces are deemed medically necessary to correct severe dental issues or address specific health concerns. It is essential for individuals to review their insurance policies and consult with their providers to understand the extent of their coverage and any potential out-of-pocket expenses.

What You'll Learn

- Eligibility Criteria: Understand who qualifies for braces coverage based on age, health, and insurance plan

- Coverage Limits: Learn about the maximum amount your insurance will pay for braces treatment

- Pre-Approval Process: Discover the steps needed to get approval for braces from your insurance provider

- Out-of-Pocket Costs: Explore potential expenses you may need to pay for braces treatment

- Alternative Financing: Discover options like payment plans or loans if insurance doesn't cover braces fully

Eligibility Criteria: Understand who qualifies for braces coverage based on age, health, and insurance plan

When considering whether medical insurance will cover the cost of braces, it's essential to understand the eligibility criteria set by insurance providers. These criteria often revolve around age, overall health, and the specific terms of your insurance plan.

Age is a critical factor. Most insurance plans cover braces for children and adolescents, as this is a period when dental development is active. Typically, coverage begins around the age of 7 or 8, when permanent teeth start to emerge, and continues until the late teens or early twenties. However, some plans may have age limits, so it's important to check your policy. For adults, coverage is often more limited and may require a special assessment of the need for braces.

Your overall health also plays a role. Insurance companies generally require that you are in good health to qualify for braces coverage. This means you should not have any significant dental issues that could be exacerbated by the procedure, such as severe gum disease or uncontrolled tooth decay. Additionally, pre-existing medical conditions that could affect the healing process or increase the risk of complications may also be a consideration.

The specific terms of your insurance plan are the most crucial factor. Different insurance companies and policies have varying levels of coverage for braces. Some plans may cover the entire cost, while others may only cover a portion, especially for adults. It's essential to review your policy or contact your insurance provider to understand what is covered and any associated costs. Some plans may also require a referral from a dentist or a pre-authorization process to confirm the need for braces.

In summary, eligibility for braces coverage through medical insurance is primarily determined by age, overall health, and the specific terms of your insurance plan. Understanding these criteria can help you navigate the process and determine your options for financing braces.

Unraveling Insurance Coverage: Medical Spa Treatment and Reimbursement

You may want to see also

Coverage Limits: Learn about the maximum amount your insurance will pay for braces treatment

When considering braces treatment, it's crucial to understand the coverage limits set by your medical insurance. These limits define the maximum amount your insurance provider will pay for the procedure, and they can significantly impact the financial burden you may face. Here's a detailed breakdown of what you need to know:

Insurance coverage for braces is often limited to a specific amount, which can vary widely depending on your insurance plan and the region you reside in. For instance, a common coverage limit might be $5,000 to $10,000 for standard braces treatment. However, this is just a starting point, and the actual amount covered can be much lower or higher. It's essential to review your insurance policy carefully to find the specific coverage limit for braces. This information is typically found in the policy's 'Benefits Schedule' or 'Dental Coverage' section.

The coverage limit is not just about the total cost of the treatment; it also applies to individual components of the braces. For example, the insurance might cover a certain number of braces adjustments, a specific amount for the braces themselves, and a limited number of dental visits related to the treatment. Understanding these individual limits is crucial to managing your expectations and financial planning.

In some cases, insurance companies may offer additional benefits or have specific programs for braces treatment. These can include discounted rates, pre-approved providers, or specialized plans for children's braces. If your insurance provider offers such programs, they can significantly reduce out-of-pocket expenses. It's worth checking with your insurance company to see if these options are available to you.

Furthermore, it's important to remember that insurance coverage for braces is not universal. Different insurance providers may have varying interpretations of what is covered and what is not. Some may include additional benefits like orthodontic appliances or retainers, while others might have separate coverage limits for these items. Always clarify with your insurance company to ensure you have a comprehensive understanding of your benefits.

In summary, knowing the coverage limits for braces treatment is essential for managing your financial expectations. It allows you to make informed decisions about your orthodontic care and ensures that you are aware of any potential out-of-pocket expenses. Always review your insurance policy, ask questions, and seek clarification to ensure you receive the best possible care within the constraints of your insurance coverage.

Southwest Medical Insurance: Unlocking Coverage Details

You may want to see also

Pre-Approval Process: Discover the steps needed to get approval for braces from your insurance provider

The process of obtaining pre-approval for braces from your medical insurance provider can vary depending on your insurance plan and location. However, here is a general overview of the steps you can expect:

Step 1: Gather Information

Start by collecting all the necessary details about your insurance plan. This includes understanding the coverage options, any specific requirements or restrictions, and the contact information for your insurance provider. It is crucial to know your plan's coverage for orthodontic treatments, as different plans may have varying levels of coverage and approval processes.

Step 2: Contact Your Insurance Provider

Reach out to your insurance company and inquire about the pre-approval process for braces. You can typically do this by calling their customer service line or submitting an online request through their website. Be prepared to provide your personal and medical information, including your insurance details, treatment plan, and any relevant medical records.

Step 3: Submit Required Documentation

Your insurance provider will likely require specific documents to assess your case. This may include a detailed explanation of the proposed orthodontic treatment, a consultation report from your orthodontist, and any other supporting medical evidence. Ensure that you provide all the necessary paperwork to increase the chances of a successful pre-approval.

Step 4: Follow-up and Communication

After submitting your application, maintain regular communication with your insurance provider. Inquire about the status of your pre-approval request and be proactive in providing any additional information they may require. It is essential to stay informed and respond promptly to any requests for further documentation.

Step 5: Understanding the Decision

Once your insurance provider makes a decision, carefully review the terms and conditions of their approval or denial. If approved, understand the coverage details, any out-of-pocket expenses, and the expected timeline for the treatment. If not approved, seek clarification on the reasons and explore options for appealing the decision, if applicable.

Remember, the pre-approval process is designed to ensure that your insurance plan covers the necessary orthodontic treatment. Being proactive, well-informed, and responsive during this process can significantly contribute to a successful outcome.

Understanding Medical Insurance: The Three Essential Coverages Explained

You may want to see also

Out-of-Pocket Costs: Explore potential expenses you may need to pay for braces treatment

When considering braces treatment, it's crucial to understand the financial commitment involved, as out-of-pocket costs can vary significantly. Medical insurance coverage for braces is often limited, and what is covered may depend on your specific plan and the country's healthcare system. Here's an overview of the potential expenses you might encounter:

Initial Consultation and Treatment Planning: Before the actual braces placement, you'll typically have an initial consultation with an orthodontist. This visit is essential to assess your dental needs and create a treatment plan. The cost of this consultation can range from $100 to $300 or more, depending on your location and the orthodontist's expertise. During this visit, you'll also discuss the estimated duration and cost of the entire treatment process.

Braces Placement and Adjustments: The placement of braces itself can vary in cost. Traditional metal braces typically start at around $3,000 to $5,000 for the initial setup, and this price may increase for more complex cases. This initial cost includes the brackets, wires, and other materials. Additionally, regular adjustments are necessary to tighten the wires and ensure the braces work effectively. Each adjustment visit can range from $50 to $150, and multiple visits may be required over the course of the treatment.

Retainers and Aftercare: After the braces are removed, patients often need to wear retainers to maintain their new smile. Retainers can cost anywhere from $200 to $500 or more, depending on the type and the orthodontist's recommendations. Proper aftercare is essential to prevent tooth movement and potential issues. This may include regular check-ups with your orthodontist to ensure the retention phase is successful.

Additional Procedures: In some cases, additional procedures might be necessary during or after braces treatment. This could include extractions of impacted teeth, which can range from $200 to $500 per tooth. Other potential costs may include dental implants, bridges, or additional cosmetic procedures to enhance your smile post-treatment. These extra expenses can vary widely and should be discussed with your orthodontist.

Understanding your insurance coverage is vital to managing these out-of-pocket costs. Many insurance plans offer some coverage for orthodontics, but the extent of coverage varies. It's advisable to contact your insurance provider to determine what procedures and treatments are covered and to what extent. Additionally, exploring payment plans or financial assistance options offered by orthodontist offices can help make braces treatment more affordable.

Vision Care Coverage: Uncovering Insurance Options for Eye Health

You may want to see also

Alternative Financing: Discover options like payment plans or loans if insurance doesn't cover braces fully

If your medical insurance doesn't fully cover the cost of braces, you have several alternative financing options to consider. Here's a detailed look at some of these alternatives:

Payment Plans: Many orthodontists offer payment plans, allowing you to spread the cost of braces over several months. This option can make braces more affordable by reducing the upfront financial burden. When discussing payment plans with your orthodontist, be sure to understand the terms, including any interest rates, down payment requirements, and monthly payment amounts.

Orthodontic Financing Companies: Specialized financing companies provide loans specifically for orthodontic treatments. These companies often offer competitive interest rates and flexible repayment terms. Research reputable financing companies and compare their offerings to find the best fit for your financial situation.

Personal Loans: Traditional personal loans from banks or credit unions can also be used to finance braces. These loans typically have fixed interest rates and repayment terms. Consider your creditworthiness and compare loan options to find the most favorable terms.

Crowdfunding Platforms: Some individuals have successfully raised funds for orthodontic treatments through crowdfunding platforms. While this option may not be suitable for everyone, it's worth exploring if you have a strong support network or a compelling story to share.

Dental Savings Plans: Dental savings plans are not insurance but offer discounted rates on orthodontic treatments. These plans typically require a monthly membership fee and provide access to a network of orthodontists who offer reduced prices. Dental savings plans can be a cost-effective alternative to traditional insurance.

When considering these alternative financing options, it's crucial to carefully review the terms and conditions, including any associated fees, interest rates, and repayment schedules. Additionally, ensure that you understand your rights and responsibilities as a borrower.

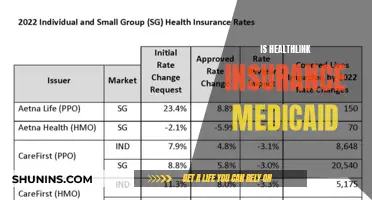

Life Insurance and Medicaid: Navigating Dual Coverage

You may want to see also

Frequently asked questions

Medical insurance typically does not cover the cost of braces, as they are considered a cosmetic procedure. Insurance plans usually have specific categories for medical and cosmetic treatments, and braces are generally classified as an aesthetic treatment. However, there might be some exceptions, especially if braces are recommended for medical reasons, such as correcting severe bite issues or improving oral health. In such cases, it's best to check with your insurance provider to understand your coverage.

Yes, some insurance companies offer specialized plans or add-ons that cover orthodontic treatments. These plans often require a separate application process and may have specific criteria for eligibility. It's advisable to research and compare different insurance providers to find options that suit your needs and budget.

In some cases, medical insurance might cover a portion of the braces treatment if it is deemed medically necessary. For example, if braces are recommended to address severe dental issues that could lead to further health problems, insurance may provide some coverage. However, this is not a standard practice, and it's essential to consult with your dentist and insurance company to understand the potential for coverage.

If you don't have medical insurance, you still have options to finance your braces. Many orthodontists offer payment plans or work with third-party financing companies. These alternatives allow you to spread the cost of braces over time, making it more manageable. Additionally, some orthodontists provide discounts for cash payments or may offer special promotions to attract patients without insurance coverage.