Liability car insurance is a type of insurance that covers damage to another person or their property in an accident where you are at fault. This type of insurance is required by most states and covers bodily injury and property damage. While liability insurance is a requirement in most states, the minimum amount of coverage varies. It is recommended that you purchase enough liability insurance to cover your net worth in the event that you are sued for an accident.

| Characteristics | Values |

|---|---|

| Purpose | To pay for damages you cause to others behind the wheel |

| Types of cover | Bodily injury liability coverage; Property damage liability coverage |

| What it covers | Other people's medical costs; Damage to other people's property; Your legal fees if you're sued |

| What it doesn't cover | Your own medical bills; Repairs to your car |

| Cost | Depends on factors such as how much coverage you select |

| Whether you need it | Yes, in most states |

What You'll Learn

Property damage liability coverage

Customizing Your Coverage:

Understanding the Limits:

Property damage liability limits are often expressed with three numbers, such as 25/50/10, indicating the coverage for bodily injury per person, bodily injury per accident, and property damage per accident, respectively. For example, a policy with limits of 100/300/50 would provide up to $100,000 per person in bodily injury liability, $300,000 per accident in bodily injury liability, and $50,000 per accident in property damage liability coverage.

If the cost of damages exceeds your coverage limits, you may be held personally responsible for the remaining amount. To protect yourself from potential lawsuits and financial loss, consider purchasing additional coverage or an umbrella policy, especially if your net worth is high.

In summary, property damage liability coverage is a crucial aspect of auto insurance, providing protection against financial liability for property damage caused by your vehicle. By understanding the coverage limits and customizing them to your needs, you can ensure you have adequate protection in the event of an accident.

Auto Insurance: Can They Deny Coverage?

You may want to see also

Bodily injury liability coverage

Understanding Bodily Injury Limits:

Bodily injury limits are usually presented in a format like "100/300", where the first number represents the maximum coverage per person, and the second number represents the maximum coverage per accident. For example, with a policy of 100/300, your insurance would pay up to $100,000 per person and a total of $300,000 for all injuries in a single accident. It's important to choose appropriate limits to ensure sufficient coverage in the event of a significant accident.

Customizing Your Coverage:

The amount of bodily injury liability coverage you need depends on various factors. While your state may have minimum requirements, it's crucial to assess your specific situation. Consider using a coverage calculator to determine the right amount of coverage for your needs. You can also opt for higher limits or purchase umbrella insurance for additional protection.

Protecting Your Assets:

In summary, bodily injury liability coverage is a vital component of auto insurance, providing financial protection for both yourself and those injured in an accident. By understanding the coverage limits and customizing your policy, you can ensure that you have the necessary protection in place. Remember to review your state's requirements and consider seeking additional coverage if your net worth exceeds the standard limits.

Autoimmune Disorders and Insurance Coverage: Unraveling the Blood Work Mystery

You may want to see also

Liability insurance costs

The cost of liability insurance varies depending on several factors, including the amount of coverage selected and individual state requirements. While liability insurance is a mandatory requirement in most states, the coverage limits can differ significantly.

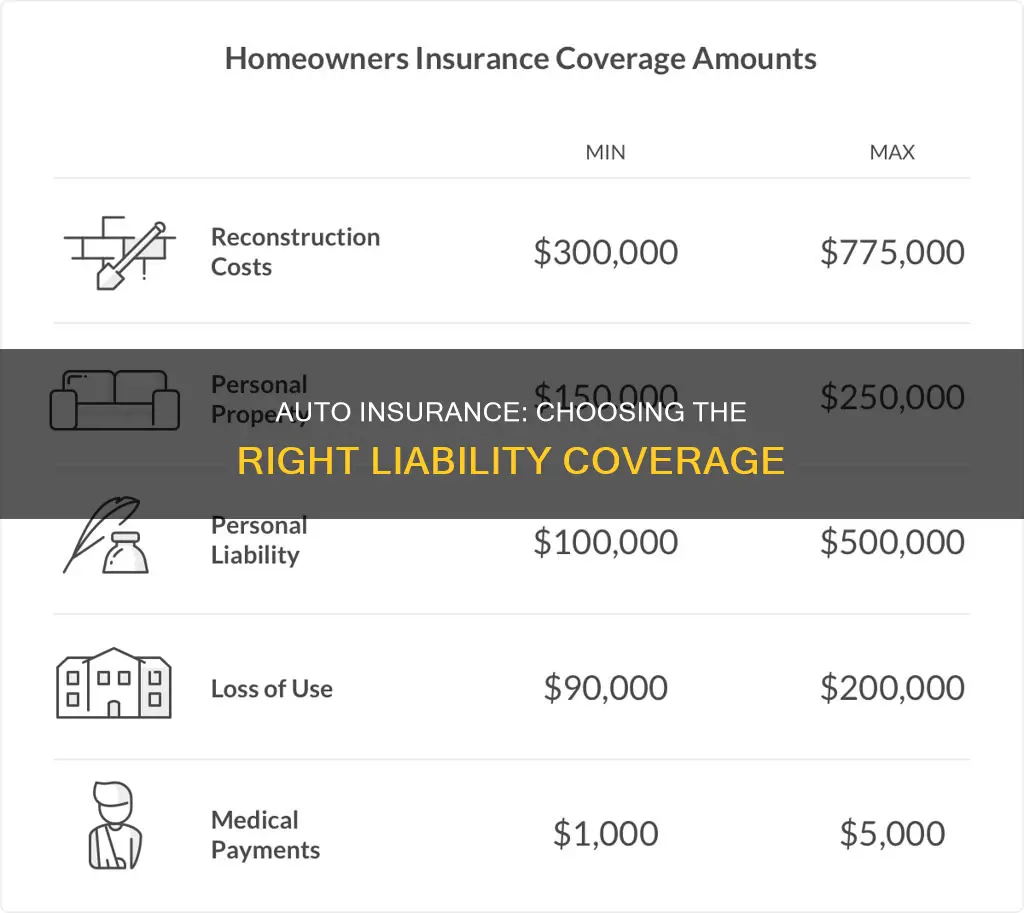

The cost of liability insurance is influenced by factors such as the selected coverage limits, with higher limits typically resulting in higher premiums. For example, the coverage limits of $25,000 in bodily injury per person and $50,000 in total bodily injury per accident, along with $25,000 for property damage per accident, are commonly required. However, some states mandate higher or lower limits, and additional coverages, such as personal injury protection, may be necessary.

The national average cost of minimum car insurance, which typically includes liability coverage, is $493 per year, according to NerdWallet's August 2024 rate analysis. This average increases to $738 per year for drivers with an at-fault accident on their record and $931 per year for those with a recent DUI. It is worth noting that car insurance rates vary by state and are influenced by factors such as age, driving history, vehicle make and model, and credit score.

When determining the cost of liability insurance, it is essential to consider the specific requirements of your state and your individual needs. It is generally recommended to carry more liability coverage than the state-mandated minimum to ensure adequate protection in the event of an accident.

Understanding Auto Insurance: Comprehensive Guide to Coverage

You may want to see also

State-required liability coverage

Nearly all states in the US require drivers to have a minimum amount of auto liability insurance. This typically includes bodily injury liability and property damage liability, but the specific requirements vary from state to state. For example, in Georgia, the minimum liability insurance requirements are $25,000 per person and $50,000 per incident for bodily injury liability, and $25,000 per incident for property damage liability. On the other hand, Florida only requires property damage liability insurance in addition to personal injury protection coverage.

Liability insurance helps cover the costs of any injuries or damages you cause in a car accident, including those of the other driver and their passengers. It can also help pay for legal fees if the other person sues you for their losses. While it is generally a requirement to have at least a minimum amount of liability insurance, it is recommended to purchase more coverage than your state mandates for greater financial protection.

In addition to liability insurance, some states also require other types of auto insurance coverage, such as uninsured/underinsured motorist coverage, personal injury protection, and medical payments coverage. Uninsured/underinsured motorist coverage helps protect you financially if you are in an accident with a driver who does not have enough insurance or does not have any insurance at all. Personal injury protection covers medical expenses for you and your passengers, regardless of who is at fault in the accident. Medical payments coverage is similar but does not cover lost wages or other benefits.

Unraveling the Complexities of Auto Insurance Settlements

You may want to see also

Liability insurance limits

Bodily injury liability limits are typically split into two categories: per person and per accident. The former refers to the maximum amount your insurance will cover for injuries sustained by a single individual in an at-fault accident, while the latter refers to the maximum amount your insurance will cover for injuries caused per incident. For example, if your policy has bodily injury liability limits of $25,000 per person and $50,000 per accident, it will cover up to $25,000 in medical expenses, rehabilitation, and legal costs for each injured person, with a maximum of $50,000 for all individuals injured in a single accident.

Property damage liability limits indicate the maximum amount your insurance policy will pay for damage caused to someone else's property in an at-fault accident. For instance, if you damage another person's car in an accident and your property damage liability limit is $25,000, your insurance will cover the costs of repairs up to that amount.

It's important to carefully consider your liability coverage limits as they can have a significant impact on your financial security. While each state has its own minimum coverage requirements, it's recommended to purchase additional coverage to ensure you're adequately protected. Choosing higher liability limits can provide greater peace of mind and protect your assets in the event of a major accident.

In addition to liability insurance, you may also want to consider other types of coverage, such as personal injury protection, uninsured/underinsured motorist coverage, and comprehensive and collision insurance, to ensure you have comprehensive protection in the event of an accident.

Battling Auto Insurance: Your Rights and Their Responsibilities

You may want to see also

Frequently asked questions

Liability insurance covers damage to another person's property and injuries caused by an accident where you're at fault. It includes property damage coverage and bodily injury coverage.

Auto liability insurance covers the cost of repairs to the other driver's vehicle, a rental vehicle for the other person, damage to buildings, fences, or other structures, and damage to personal property inside a vehicle. It also covers legal fees if you're sued for property damage or injuries you caused.

The amount of liability coverage you need depends on your state's requirements and your personal situation. It's recommended to have enough liability coverage to protect your assets in case you're liable in an accident. You can calculate your net worth and choose a policy that covers your assets.