Auto insurance is a safeguard for your financial well-being in the case of car accidents, theft, or other incidents beyond your control. It is mandatory in nearly all states, and while the specific requirements vary, there are some common types of coverage. These include liability coverage, which is required in most states and covers injuries and damage caused to others, and collision coverage, which covers damage to your car in a collision and is often required by lenders. Comprehensive coverage, which is also often required by lenders, covers damage to your car in non-collision incidents, such as theft, fire, or vandalism. Uninsured/underinsured motorist coverage protects you if you are hit by a driver without insurance or with insufficient coverage, and medical payments/personal injury protection coverage pays for medical expenses for you and your passengers in an accident. Understanding these different types of coverage and their requirements is essential for ensuring you have the right protection.

| Characteristics | Values |

|---|---|

| Purpose | Financial protection in the event of an accident |

| Coverage | Damage to your vehicle, financial liability for injuries or damages to others, medical bills for you and your passengers, damage caused by uninsured or underinsured motorists |

| Requirements | Nearly all states require auto insurance, lenders may also require certain coverages |

| Types | Liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, personal injury protection |

| Exclusions | Maintenance, mechanical failure, wear and tear, people not listed on the policy but who regularly drive the car |

What You'll Learn

Understanding the basics of auto insurance

Auto insurance is a safeguard for your financial well-being in the case of car accidents, theft, or other incidents beyond your control. It is mandatory in nearly all states and can provide financial protection for you, your passengers, and your vehicle, as well as others and their property.

The basic personal auto insurance mandated by most U.S. states provides financial protection if you or another driver using your car causes an accident that damages someone else's car or property, injures someone, or both. This typically includes liability coverage, which covers the injuries and damage you cause to others. However, it is important to note that basic car insurance does not cover maintenance, wear and tear, or mechanical failure.

When it comes to purchasing auto insurance, it is essential to understand the different types of coverage available, what is required by your state, and what is optional. Some common types of coverage include:

- Bodily Injury Liability: This covers costs associated with injuries and death caused by you or another driver while driving your car.

- Property Damage Liability: This reimburses others for damage caused by you or another driver operating your car to another vehicle or other property.

- Medical Payments or Personal Injury Protection (PIP): Provides reimbursement for medical expenses, lost wages, and other related expenses for you or your passengers.

- Uninsured/Underinsured Motorist Coverage: Reimburses you when an accident is caused by an uninsured or underinsured motorist or in the case of a hit-and-run.

- Collision Coverage: This optional coverage reimburses you for damage to your car that occurs as a result of a collision with another vehicle or object, such as a tree or guardrail.

- Comprehensive Coverage: This provides protection against theft and damage caused by incidents other than a collision, such as fire, flood, vandalism, or natural disasters.

It is also important to understand coverage amounts and deductibles. Coverage amounts refer to the maximum your insurance will pay out per accident or claim, while a deductible is the amount you pay out of pocket before your insurance pays anything.

Full Coverage Auto Insurance: When Does It Start?

You may want to see also

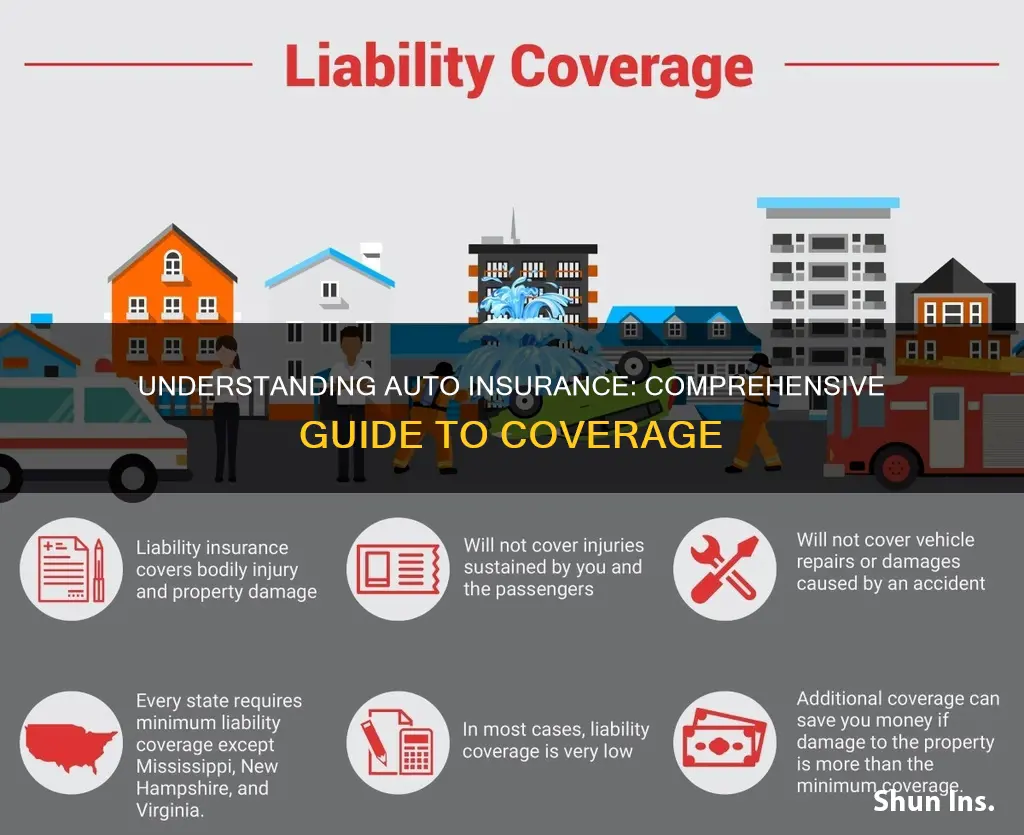

Required vs. optional coverage

Auto insurance is mandatory in nearly all US states, except for New Hampshire. Each state has its own requirements for the minimum amount of insurance coverage that drivers must have. However, there are also optional coverages that drivers can choose to add to their policies for additional protection.

Required Coverage

The main type of mandatory auto insurance is liability coverage, which includes bodily injury liability and property damage liability. Bodily injury liability covers the costs associated with injuries and death caused by the policyholder or another driver operating their car. This can include injuries suffered by a driver, passenger, or other individuals such as pedestrians. Property damage liability, on the other hand, reimburses others for damage caused by the policyholder or another driver operating their car to another vehicle or other property, such as buildings or utility poles.

In addition to liability coverage, many states also require medical payments or personal injury protection (PIP) coverage, and uninsured motorist coverage. Medical payments or PIP coverage provides reimbursement for medical expenses, lost wages, and other related expenses for the policyholder and their passengers. Uninsured motorist coverage, as the name suggests, protects the policyholder in the event of an accident caused by an uninsured motorist or in a hit-and-run situation. Underinsured motorist coverage can also be added to cover costs when another driver lacks adequate insurance to pay for the damages resulting from a serious accident.

Optional Coverage

While the above-mentioned coverages are typically required by state law, there are several other types of auto insurance coverages that are optional. Collision coverage, for example, is optional and reimburses the policyholder for damage to their car that occurs as a result of a collision with another vehicle or object, such as a tree or guardrail. It's important to note that collision coverage does not include damage due to mechanical failure or normal wear and tear.

Comprehensive coverage is another optional coverage that protects against theft and damage caused by incidents other than collisions, such as fire, flood, vandalism, or falling objects. Glass coverage is often included within comprehensive coverage, specifically for windshield damage, which is common. However, supplemental glass coverage can also be purchased separately.

Optional coverages may also include gap insurance, which is especially important for leased or financed vehicles. Gap insurance covers the difference between the market value of the car and what is still owed on it in the event of a total loss or theft.

It's important to note that the specific requirements and options for auto insurance coverage may vary depending on the state and individual circumstances. It's always a good idea to review your state's insurance regulations and consult with an insurance professional to ensure you have the appropriate level of coverage.

Insurance: Who or What Is Covered?

You may want to see also

Liability insurance

- Injuries caused to another person while driving.

- Damage caused to other vehicles while driving.

- Damage caused to someone else's property, such as a mailbox or street sign.

- Legal expenses associated with accident-related lawsuits.

It's important to note that liability insurance does not cover your own injuries or damage to your property; instead, it focuses on protecting you from claims made by others for damages you have caused.

Understanding Coverage Limits:

When selecting a liability insurance policy, you will choose a coverage limit, which is the maximum amount your insurance will pay out for injuries or property damage you cause to others. It is generally recommended to select a liability limit that matches or exceeds your total net worth to ensure your assets are adequately protected.

Liability coverage limits for vehicles are typically represented by three numbers, such as 25/50/25. These numbers correspond to the maximum coverage for bodily injury per person, bodily injury per accident, and property damage per accident, respectively. For example, a policy with limits of 15/30/5 would provide a maximum of $15,000 for a single injured person, $30,000 for all injured parties, and $5,000 for property damage.

White Cars: Cheaper Insurance?

You may want to see also

Comprehensive and collision coverage

Collision Coverage

Collision coverage is an optional insurance coverage that reimburses you for damage to your car that occurs as a result of a collision with another vehicle or object, such as a tree or guardrail, when you are at fault. It will cover damage from potholes or if you roll your car. It will not cover mechanical failure or normal wear and tear on your car. Collision coverage is not a state mandate, but your financing company might require it if you have an outstanding car loan.

Comprehensive Coverage

Comprehensive coverage provides protection against theft and damage caused by incidents other than a collision. This includes fire, flood, vandalism, hail, falling rocks or trees, and other hazards. It also covers damage from contact with animals. Comprehensive coverage does not include accident-related damage to your vehicle.

If you have a car loan or lease, you are likely required to purchase both comprehensive and collision coverage by the lender or leasing company. This ensures that you do not walk away from your loan or lease if your car is stolen or totaled. Once your car loan is paid off, collision and comprehensive coverage become optional. However, it is wise to consider whether you could easily pay for repairs or a new car if your car is damaged or stolen. If the answer is no, then these coverages are a smart buy.

Income and Auto Insurance: The Premium Connection

You may want to see also

Uninsured/underinsured motorist coverage

Uninsured motorist coverage will protect you if you are hit by a driver with no auto insurance. This coverage will pay for injuries to you and your passengers, as well as damage to your vehicle. It is important to note that this coverage also applies in the case of a hit-and-run accident. Underinsured motorist coverage, on the other hand, will protect you if you are hit by a driver who doesn't have enough insurance to cover the damages or injuries they caused. This type of coverage is usually offered alongside uninsured motorist coverage and can provide additional protection if the at-fault party doesn't have high enough policy limits.

In some states, such as Illinois and New Hampshire, both uninsured and underinsured motorist coverage are mandatory. In other states, only one of these coverages is required, or it may be optional. Even if it is not required in your state, it is highly recommended for all drivers to have this coverage to protect themselves financially. Without it, you could be responsible for paying medical bills or vehicle repairs out of pocket if you are in an accident with an uninsured or underinsured driver.

When considering uninsured/underinsured motorist coverage, it is important to understand the different types of coverage available. Uninsured motorist bodily injury (UMBI) will cover medical bills for you and your passengers, while uninsured motorist property damage (UMPD) will cover damage to your vehicle. Similarly, underinsured motorist bodily injury (UIMBI) and underinsured motorist property damage (UIMPD) will cover medical bills and vehicle damage, respectively, when the at-fault driver has insufficient insurance. Depending on your state, you may be required to have a deductible for UMPD/UIMPD, but UMBI/UIMBI generally does not include a deductible.

Get Your Georgia Auto Insurance License: A Guide

You may want to see also