If you're in a hurry to get on the road, you'll be glad to know that most insurance companies offer same-day coverage. The application process is usually quick and easy, taking around 10 to 20 minutes, and you can even apply online or over the phone. However, it's important to have all the necessary information on hand to ensure a smooth and speedy process. This includes personal details, such as your name, date of birth, address, and driver's license number, as well as vehicle information like the make, model, and Vehicle Identification Number (VIN). Once you've submitted your application and made your first payment, your full coverage auto insurance will kick in, providing you with the peace of mind to drive confidently.

| Characteristics | Values |

|---|---|

| How soon does full coverage auto insurance kick in? | As soon as the policy is issued and the first premium payment is made |

| How long does it take to get a quote? | 10-15 minutes |

| How long is a quote valid for? | 30 days |

| How long does it take to get car insurance? | 15 minutes to a few hours |

| How long does it take to add someone to your insurance? | 1 hour |

| Can you get insurance on the same day as an accident? | Yes, but it won't cover anything that happened before it becomes active |

What You'll Learn

- Full coverage auto insurance can be purchased the same day as an accident, but it won't cover any damage that occurred before the purchase

- Most insurance companies offer same-day coverage, with applications taking about 10-15 minutes to complete

- Full coverage auto insurance includes liability, comprehensive, and collision insurance

- Full coverage auto insurance can be purchased online, over the phone, or in person

- The cost of full coverage auto insurance depends on various factors such as the age and value of the car, the driver's age and history, and the chosen deductible

Full coverage auto insurance can be purchased the same day as an accident, but it won't cover any damage that occurred before the purchase

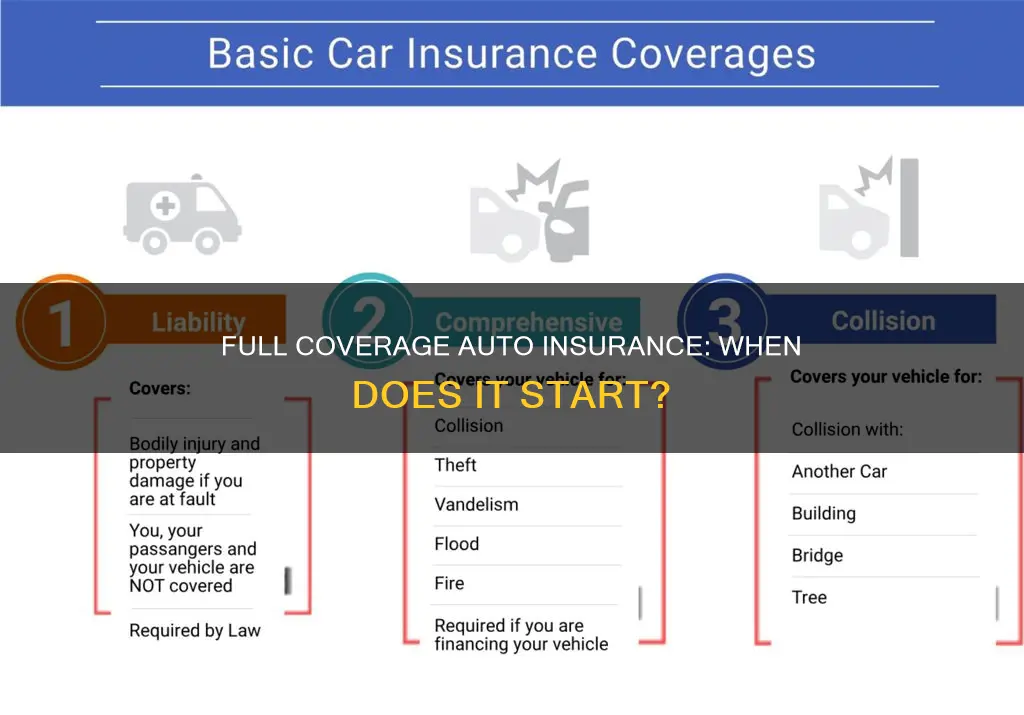

Full coverage auto insurance is a combination of liability, collision, and comprehensive insurance. Liability insurance covers damages or injuries you cause to another vehicle or person, while collision insurance covers repairs to your car after an accident, regardless of who is at fault. Comprehensive insurance covers damage to your car caused by events outside of your control, such as fire, weather, vandalism, animal contact, and theft.

Most insurance companies offer same-day coverage, and it usually takes about 10 to 15 minutes to fill out an application. However, it's important to have the necessary information on hand to make the process smoother. This includes personal information, such as names, dates of birth, driver's license numbers, and vehicle details like the Vehicle Identification Number (VIN) and mileage.

While you can purchase full coverage auto insurance on the same day as an accident, it's important to note that it will not cover any damage that occurred before the purchase. Insurance fraud is committed if you try to claim an accident on a policy that wasn't active at the time. Therefore, it's essential to have active insurance coverage before getting behind the wheel.

To ensure you're adequately protected, it's recommended to research different insurance companies and understand the specific coverages they offer. Additionally, consider your state's minimum insurance requirements and any optional add-ons you may need. By taking the time to compare quotes and coverage options, you can find the best policy for your needs at a competitive rate.

Auto Insurance: Uncovering the Truth About Life Insurance Coverage

You may want to see also

Most insurance companies offer same-day coverage, with applications taking about 10-15 minutes to complete

The application process will go more smoothly if you have the following information ready:

- Full names of everyone who will be on the policy

- Social security numbers for all drivers

- Birthdays of all drivers

- License numbers for all drivers

- Vehicle Identification Numbers (VINs) for all vehicles to be insured

- Your address and the address where the car is kept

- An estimation of how many miles you drive per year

- Your declarations page from your previous car insurance policy

Having this information ready will help you get through the application process quickly and efficiently.

In addition to gathering the necessary information, you can also speed up the process by researching companies and knowing what types of coverage you need ahead of time. Comparing quotes from multiple companies will also help you find the best rates and ensure you're getting the coverage you need.

So, if you're in a hurry to get insured, don't worry – most insurance companies can have you covered in no time!

Uninsured Motorist Auto Insurance: Understanding the Coverage and Claims Process

You may want to see also

Full coverage auto insurance includes liability, comprehensive, and collision insurance

Most insurance companies offer same-day coverage, and it takes about 10 minutes to fill out an application. However, the time it takes for auto insurance to become effective can vary depending on the insurance provider and specific circumstances. While auto insurance coverage typically starts as soon as the policy is issued and the first premium payment is made, there may be a waiting period for certain coverage types.

Full coverage auto insurance typically includes liability, comprehensive, and collision insurance, along with any other coverages mandated by your state. It is important to note that there is no consensus on what "full coverage" means, and no insurer can provide a policy that covers you 100% in all situations.

Liability insurance is a mandatory coverage in nearly every state and covers damages or injuries you cause to another vehicle or person up to a certain limit. Comprehensive and collision insurance are typically optional but may be required if you lease or finance your vehicle. They cover damages to your own vehicle, regardless of who is at fault in the incident. Comprehensive insurance covers events outside your control, such as fire, weather, vandalism, animal contact, and theft. Collision insurance covers accidents involving another vehicle or a stationary object.

Mandatory Vehicle Insurance: What's Covered?

You may want to see also

Full coverage auto insurance can be purchased online, over the phone, or in person

Most major insurance companies offer same-day coverage, and the application process is usually quick, taking about 10 minutes. However, it's important to have the necessary information on hand to make the process smoother and faster. This includes knowing the types of coverage you need, as well as having basic information such as the full names, social security numbers, birthdays, license numbers, and vehicle details of all drivers to be included in the policy.

You can purchase full coverage auto insurance by contacting insurance companies directly through their websites, phone numbers, or physical offices. Many insurance companies offer online applications and instant quotes on their websites, making it convenient for customers to purchase coverage from the comfort of their homes. Some companies may also allow you to speak directly with a representative over the phone or in person to guide you through the process and answer any questions.

It's worth noting that full coverage auto insurance typically refers to a combination of liability, comprehensive, and collision insurance, providing protection in most scenarios. However, there is no universally accepted definition, and the specific coverages included may vary by state and insurance company. Therefore, it's always a good idea to review the policy details and ensure that it meets your needs.

Auto Damage Insurance Adjusters: Salary Insights

You may want to see also

The cost of full coverage auto insurance depends on various factors such as the age and value of the car, the driver's age and history, and the chosen deductible

The cost of full-coverage auto insurance depends on a variety of factors, and it's important to note that the term "full coverage" can be misleading as no single policy offers 100% coverage in all situations. Full coverage typically includes liability, comprehensive, and collision insurance, but the specific components can vary by state and insurance company. Here are some key factors that influence the cost of full-coverage auto insurance:

Age and Value of the Car

The age and type of vehicle you drive have a significant impact on insurance costs. Generally, newer and more expensive vehicles with advanced features and technology tend to be more costly to insure. This is because they are more expensive to repair or replace. Additionally, the brand of the vehicle also matters, with some brands having higher average insurance costs than others.

Driver's Age and History

The age and driving history of the insured individual are crucial factors in determining insurance rates. Younger and less experienced drivers, especially teenagers and those below 25, often face higher insurance costs due to their higher risk of being involved in accidents. Insurance companies also consider the driver's record, including any accidents, serious traffic violations, or DUIs. A clean driving record can help secure lower premiums.

Chosen Deductible

The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Typically, insurance policies offer deductible amounts ranging from $250 to $2,500. Opting for a higher deductible usually results in lower insurance premiums. However, it's important to choose a deductible that you can comfortably afford in case of an accident or claim.

Auto Insurance: Canadian in Texas

You may want to see also

Frequently asked questions

Full-coverage auto insurance typically includes liability, collision, and comprehensive insurance. While there is no consensus on what "full-coverage" means, it generally starts as soon as the policy is issued and the first premium payment is made. However, there may be a waiting period of a few days or weeks for comprehensive and collision coverage.

Full-coverage auto insurance typically includes liability, collision, and comprehensive insurance. Liability insurance covers damages or injuries you cause to others and their property. Collision insurance covers repairs to your car after an accident, regardless of who is at fault. Comprehensive insurance covers damage to your car from events other than a collision, such as theft, vandalism, or weather damage.

You can get full-coverage auto insurance by purchasing a policy from an insurance company. The process usually takes about 10-15 minutes if you have the necessary information, such as your driver's license, vehicle information, and payment details. Most companies offer same-day coverage, so your insurance can be active as soon as you make your first payment.