Gap insurance is an optional form of financial protection for drivers in the event that their car is stolen or written off. It covers the difference between the amount owed on a car loan and the car's actual cash value. In California, gap insurance is generally available for newer vehicles and drivers with significant outstanding loan balances. It can be purchased from insurance companies, dealerships, lenders, and manufacturers. Some of the cheapest gap insurance providers in California include Progressive, GEICO, USAA, and Mercury.

| Characteristics | Values |

|---|---|

| Average cost of gap insurance in California | $2,238 per year |

| Cheapest gap insurance companies in California | Progressive, Geico, USAA |

| Average gap insurance cost in California by city | Los Angeles ($2,755 per year), Portola ($1,805 per year) |

| Average gap insurance cost in California by age | 20-year-old driver ($3,978 per year), 30-year-old driver ($2,382 per year) |

| Best gap insurance companies | Travelers, The Hartford, Liberty Mutual |

What You'll Learn

- Gap insurance is not required by law in California

- It's designed for drivers with outstanding loan balances on new vehicles

- It's available from insurance companies, dealerships, lenders and specialised providers

- It's more expensive to buy from a dealership than an insurer

- It's worth it if you owe more on your car than it's worth

Gap insurance is not required by law in California

Gap Insurance in California

While gap insurance is available in California, it is not a legal requirement. This means that drivers are not obliged to take out a gap insurance policy, even if they have an auto loan. However, there are certain situations in which it may be beneficial to have this type of insurance.

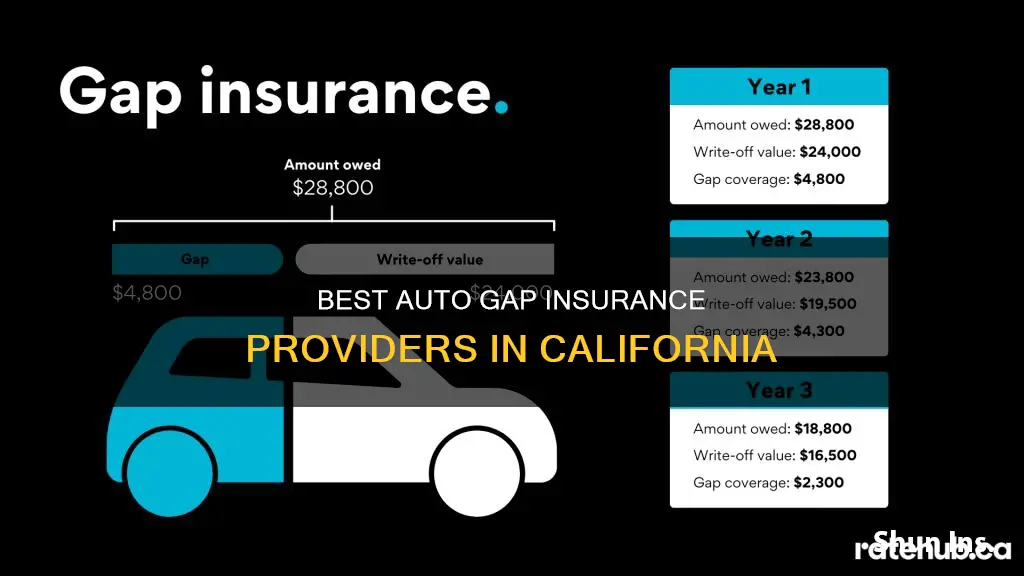

Gap insurance, which stands for "guaranteed asset protection", covers the difference between what you owe on your auto loan and the actual value of your car in the event of a total loss. This could include situations where your car is stolen or damaged beyond repair. In these cases, gap insurance ensures that you don't owe money on a vehicle that you can no longer use.

In California, gap insurance is typically only available for newer vehicles (less than three years old) and for drivers with significant outstanding loan balances. It is also generally more expensive to purchase gap insurance from a dealership than from an insurance company.

When deciding whether to purchase gap insurance, it's important to consider your individual circumstances. For example, if you have a small loan or if you plan to pay off your car in a short amount of time, gap insurance may not be necessary. On the other hand, if you have a large loan and a long repayment period, gap insurance could provide valuable financial protection.

In recent years, the California state government has taken steps to protect consumers from predatory gap insurance policies. This includes requiring insurance companies to inform customers that gap insurance is optional and capping the price of gap waivers.

Auto Insurance: California's Minimum Coverage Requirements

You may want to see also

It's designed for drivers with outstanding loan balances on new vehicles

Gap insurance is specifically designed for drivers with outstanding loan balances on their vehicles. It covers the difference between what you owe on your auto loan and the payout you receive from your insurer if your vehicle is stolen or rendered a total loss. This type of insurance is typically only available for brand-new vehicles or models that are less than three years old.

In California, gap insurance is generally an option for drivers who:

- Are the original loan or lease holder on a new vehicle purchase

- Have both collision and comprehensive coverage

- Have a vehicle that is less than two to three model years old

Gap insurance is commonly confused with new car replacement coverage. However, it is important to note that gap coverage is a way to financially protect yourself if you have an outstanding loan on your vehicle and experience a total loss. On the other hand, new car replacement coverage helps drivers obtain a new version of their damaged vehicle's make and model.

When shopping for gap insurance in California, you may hear it referred to as loan/lease coverage. Many major insurers offer gap insurance policies, and it can also be purchased from dealerships. It is recommended to buy gap insurance from an insurance provider rather than a dealer or lender to get lower prices. Progressive, Allstate, and Nationwide are some of the insurance companies that offer gap insurance in California.

Auto Insurance: Keeping Your Original Policy in CT

You may want to see also

It's available from insurance companies, dealerships, lenders and specialised providers

Gap insurance is available from insurance companies, dealerships, lenders, and specialised providers.

Insurance Companies

Many major insurance companies offer gap insurance, although not all do. It is generally cheaper to buy gap insurance from an insurer than a dealership or lender. Some of the insurance companies that offer gap insurance include:

- Progressive

- Allstate

- Nationwide

- State Farm

- USAA

- AAA

- Esurance

- Dairyland

- Travelers

- The Hartford

- Liberty Mutual

- Kemper

Dealerships

Dealerships also sell gap insurance, often at a higher price than insurers. Some dealerships include gap insurance for free. Dealerships may offer gap insurance for convenience, but it will likely be added to your auto loan, which means you will pay interest on it.

Lenders

Lenders and financial institutions can also provide gap insurance. They may include gap insurance for free or add it to your loan amount, in which case you will pay interest on it.

Specialised Providers

Specialised providers also offer stand-alone gap insurance policies. This option may require more work to find a provider, but it can be a good choice if your insurance company does not offer gap insurance.

Strategies to Lower Auto Insurance Premiums: Money-Saving Tips

You may want to see also

It's more expensive to buy from a dealership than an insurer

Several companies provide auto gap insurance in California, including:

- Progressive

- Allstate

- Nationwide

- USAA

- Dairyland

- Travelers

- GEICO

- Mercury

- Orion Indemnity Company

- Direct Auto

- Anchor

- Sun Coast

- Aspire General

- Bristol West

- Tesla

Gap insurance is optional in California, but it can be purchased from an insurance company, dealership, manufacturer, or lending institution. It is important to note that gap insurance is typically more expensive when purchased from a dealership than from an insurer. This is because the cost of dealership gap insurance is usually added to your auto loan, resulting in interest charges. On the other hand, purchasing gap insurance from an insurer will only lead to a minimal increase in your premium.

For example, gap insurance from a dealership can cost several hundred dollars or more, whereas adding it to an existing full-coverage policy from an insurer will only increase the premium by around $40 to $60 per year. In general, it is recommended to buy gap insurance from an insurer rather than a dealer to obtain the lowest prices.

Additionally, gap insurance from a dealership is often included in the auto loan, making it difficult to cancel. With insurer-provided gap insurance, you usually have the flexibility to remove the coverage when it is no longer needed, potentially resulting in cost savings.

Rebuilt Rides: Does NJ Auto Insurance Cover Rebuilt Title Cars?

You may want to see also

It's worth it if you owe more on your car than it's worth

If you owe more on your car than it's worth, gap insurance can be a good idea. This type of insurance covers the difference between the actual cash value of your vehicle and the amount you still owe on your loan or lease if your car is totaled or stolen. This can help protect you from having to pay out of pocket for a vehicle you no longer have.

For example, let's say you buy a new car for $30,000. You put down $3,000 and finance the remaining $27,000. A month later, your car is stolen. At this point, the value of your car has depreciated to $23,000. If you have comprehensive insurance, your insurance company will pay out the value of the car minus your deductible. However, without gap insurance, you would still owe $4,000 on your car loan, plus the deductible amount. With gap insurance, this difference would be covered.

Gap insurance is typically offered by car dealerships, lenders, and insurance companies. It is usually more expensive to purchase gap insurance from a dealership than from an insurer. In California, the state government has passed laws to protect consumers from predatory gap insurance policies and to ensure that customers know that purchasing gap insurance is optional. When shopping for gap insurance in California, it is recommended to check with your current insurance provider first, as this will likely be the cheapest option.

Removing Your Auto From Insurance Policy

You may want to see also

Frequently asked questions

Gap insurance, or guaranteed asset protection, covers the difference between the amount you owe on your auto loan and the payout you receive from your insurer if your vehicle is stolen or totaled.

No, gap insurance is not required in California. It is an optional coverage type that you can purchase if you want additional protection.

The cost of gap insurance in California can vary depending on factors such as the value of your car, the insurance company, your location, and your age. On average, gap insurance in California costs around $2,238 per year.