When it comes to determining insurance coverage, the police often rely on a combination of official records, driver's licenses, and vehicle registration. They can verify insurance status by checking the vehicle's registration, which typically includes the insurance company's contact information. Additionally, law enforcement officers may request a driver's license, which often contains insurance details. In some cases, they might also ask for proof of insurance during traffic stops or accidents, ensuring that drivers are legally covered and reducing the risk of financial liabilities for the state.

What You'll Learn

- Vehicle Registration: Police can verify insurance by checking vehicle registration records

- License Plate Recognition: Cameras can scan plates, linking them to insurance coverage

- Driver's License: Insurance details are often listed on a driver's license

- Traffic Violations: Tickets may include insurance information for verification

- Accident Reports: Police can access insurance details from accident reports

Vehicle Registration: Police can verify insurance by checking vehicle registration records

When it comes to determining whether a driver is insured, law enforcement officers have several methods at their disposal, and one of the most straightforward is through vehicle registration records. This process is a standard procedure that allows police to quickly and efficiently verify a vehicle's insurance status. Here's how it works:

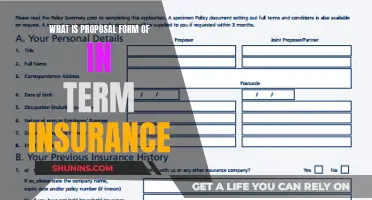

Vehicle registration is a legal requirement for all vehicle owners, and it involves providing detailed information about the vehicle and its owner to the relevant authorities. This registration process includes essential details such as the vehicle's make, model, year, and license plate number, as well as the owner's personal information, including their name, address, and contact details. One critical piece of information included in this registration is the vehicle's insurance coverage.

When a vehicle is registered, the owner must provide proof of insurance, which typically includes the name of the insurance company, the policy number, and the types of coverage provided. This information is then recorded in the vehicle's registration documents, creating a public record. The police can access these records, which are often maintained by government agencies or departments of motor vehicles.

By checking the vehicle registration, police officers can easily identify whether a vehicle is insured or not. If the registration details indicate that the vehicle is registered to an individual or entity with valid insurance coverage, it means the vehicle is legally insured. Conversely, if the registration shows no insurance information or an expired policy, it becomes a clear indication that the vehicle may not be insured, and the driver could face legal consequences.

This method of verification is a standard practice in many countries and is designed to ensure road safety and legal compliance. It allows police to take immediate action if they encounter a vehicle without valid insurance, which can include issuing fines, requiring the driver to obtain insurance, or even impounding the vehicle until the issue is resolved. Therefore, maintaining up-to-date and accurate vehicle registration records is essential for both drivers and law enforcement to ensure a smooth and legal driving experience.

Submitting Psychology Bills to Insurance: A Comprehensive Guide for Practitioners

You may want to see also

License Plate Recognition: Cameras can scan plates, linking them to insurance coverage

The concept of License Plate Recognition (LPR) is a powerful tool in the fight against uninsured driving, a dangerous and illegal practice. LPR cameras are strategically placed at various points along roads and highways, equipped with advanced software that can scan and analyze vehicle license plates in real-time. This technology has become an essential part of law enforcement efforts to ensure that all drivers are legally insured.

When a vehicle passes through an LPR camera's field of view, the camera captures a high-resolution image of the license plate. The software then processes this image, extracting the unique alphanumeric characters that make up the plate. This data is then compared against a database of registered vehicles and their corresponding insurance information. The process is remarkably efficient, often taking just a few seconds to verify or flag a vehicle's insurance status.

The key to this system's effectiveness lies in the comprehensive nature of the database. Law enforcement agencies collaborate with insurance companies and vehicle registration authorities to gather and maintain this data. When a vehicle's license plate is scanned, the system can instantly cross-reference it with the national database, providing immediate feedback on the vehicle's insurance status. If the vehicle is found to be uninsured, the system flags this information, alerting the authorities and enabling them to take appropriate action.

LPR cameras are particularly useful in identifying vehicles that have been reported as uninsured or have a history of insurance fraud. By continuously monitoring the roads, these cameras can help catch drivers who deliberately avoid insurance, a practice that not only endangers other road users but also denies them the financial protection that insurance provides. This technology also assists in locating stolen vehicles, as the insurance status of such vehicles is often compromised, and the system can quickly identify and report them.

In summary, License Plate Recognition cameras play a vital role in ensuring that all drivers are legally insured. By linking license plates to insurance coverage, these cameras provide a real-time, efficient method of verifying insurance status, helping to reduce uninsured driving and its associated risks. This technology is a valuable asset in the hands of law enforcement, contributing to safer roads and a more responsible driving culture.

Insurance MDHS: Change Form Explained

You may want to see also

Driver's License: Insurance details are often listed on a driver's license

When it comes to determining whether a driver has insurance coverage, law enforcement officers have several methods at their disposal. One of the most common and easily accessible sources of information is the driver's license itself. Insurance details are often included on a driver's license, providing a quick and efficient way for the police to verify a driver's insurance status.

The driver's license typically contains a section dedicated to insurance information. This section usually includes the name of the insurance company, the policy number, and sometimes even the policy type. By simply checking this section, police officers can gain immediate insight into whether the driver has valid insurance coverage. This method is particularly useful during routine traffic stops, where officers may quickly glance at the license to assess the driver's insurance status without causing significant delays.

In some jurisdictions, the insurance details on a driver's license may also include the vehicle identification number (VIN) or the make and model of the insured vehicle. This additional information can further assist police officers in confirming that the driver is indeed insured for the specific vehicle they are operating. It provides a more comprehensive approach to verifying insurance coverage, ensuring that the driver is not only insured but also covered for the correct vehicle.

However, it is important to note that relying solely on the information provided on a driver's license may not always be sufficient. Insurance details can sometimes be outdated or incorrect, and there may be cases where a driver's license does not reflect their current insurance status. Therefore, police officers often employ additional verification methods, such as checking with the insurance company directly or using specialized databases, to ensure accuracy and compliance with the law.

In summary, the driver's license serves as a valuable tool for police officers to determine insurance coverage. By examining the insurance details listed on the license, officers can quickly assess whether a driver is insured. This practice contributes to road safety and ensures that drivers are held accountable for maintaining the necessary insurance requirements as mandated by law.

Traffic Violations: Tickets may include insurance information for verification

When it comes to traffic violations, law enforcement officers have various methods to verify a driver's insurance status. One common approach is to request the driver's insurance information during the initial stop or citation. This process is often streamlined to ensure public safety and efficient handling of traffic-related incidents.

Upon pulling over a vehicle, an officer may ask the driver to provide proof of insurance. This can be in the form of an insurance card, a digital copy on a mobile device, or any other documentation that clearly displays the driver's insurance details. The information typically includes the driver's name, policy number, insurance company, and coverage type. This verification step is crucial as it helps officers confirm whether the driver has the required insurance coverage, which is a legal obligation in most jurisdictions.

In some cases, officers may have access to a centralized database or a mobile app that allows them to quickly verify insurance information. These digital tools can provide real-time data, ensuring that the driver's insurance status is up-to-date and accurate. By utilizing such technology, police can expedite the process of verifying insurance, reducing the time spent on administrative tasks during a traffic stop.

If a driver is unable to provide valid insurance information, the officer may issue a ticket for driving without insurance coverage. This violation can have legal consequences, including fines and potential license suspension. It is essential for drivers to maintain valid insurance to avoid these penalties and ensure their compliance with traffic regulations.

Additionally, law enforcement agencies often collaborate with insurance companies and regulatory bodies to cross-reference the provided insurance information. This collaborative effort helps in identifying potential fraudulent activities and ensures that drivers are not operating vehicles with invalid or fraudulent insurance policies. As a result, the verification process becomes a critical component of maintaining road safety and legal compliance.

The Legal Definition of Common Carrier and Its Impact on Insurance Policies

You may want to see also

Accident Reports: Police can access insurance details from accident reports

When a police officer responds to an accident, they have a range of tools at their disposal to gather information and determine the involvement of each party. One crucial aspect of this process is the accident report, which provides a detailed account of the incident. This report is a comprehensive document that includes various details, and one of the most important sections is the insurance information.

In many jurisdictions, accident reports are designed to capture specific data, including the insurance details of all drivers involved. This information is typically requested to facilitate the claims process and to ensure that all parties have the necessary coverage. The police officer will often ask for the insurance company's name, policy number, and contact information, as well as the driver's insurance details. This data is then recorded in the accident report, creating a formal record of the insurance status of each driver.

The accident report serves as a valuable resource for law enforcement agencies. It allows them to quickly identify the insurance provider and policy details, which can be crucial in the event of a dispute or further investigation. By accessing this information, the police can efficiently notify the relevant insurance companies about the accident and initiate the claims process. This ensures that the insurance companies are aware of the incident and can provide the necessary support to their policyholders.

Moreover, accident reports also help in determining liability. If the insurance company is informed promptly, they can provide their policyholder with the necessary guidance and support. This includes assisting with the investigation, providing legal advice, and facilitating communication between the involved parties. The insurance company's involvement can also help in resolving disputes and ensuring that the policyholder receives the appropriate compensation.

In summary, accident reports play a vital role in the aftermath of a collision. They provide the police with essential insurance details, enabling them to notify insurance companies, facilitate claims, and assist in liability determinations. This process ensures that all parties involved receive the necessary support and that the legal and financial aspects of the accident are addressed efficiently. It is a critical step in maintaining order and providing assistance during and after an accident.

Becoming a Retail Insurance Broker: Steps to Success

You may want to see also

Frequently asked questions

When an officer pulls you over, they may ask for proof of insurance. They can verify this by checking your vehicle registration and insurance card, which should be readily available in your car. If you don't have the physical card, they can access this information through the Department of Motor Vehicles (DMV) or an online database.

Driving without insurance is illegal and can result in severe consequences. If an officer suspects you don't have coverage, they may request a proof of financial responsibility, which can be in the form of a bond, a self-insurance certificate, or a letter from your insurance company confirming your coverage.

Yes, failing to provide proof of insurance can lead to fines and penalties. The specific consequences vary by jurisdiction, but it is a serious offense that can result in license suspension, vehicle impoundment, and even arrest in some cases. It is always best to carry the necessary documentation to avoid these issues.