Understanding the status of an insurance license is crucial for both insurance professionals and consumers. Knowing how to check if an insurance license has been revoked is essential to ensure that the insurance agents or brokers you interact with are operating legally and ethically. This guide will outline the steps you can take to verify the status of an insurance license, including checking with state insurance departments, using online resources, and understanding the implications of a revoked license. By following these steps, you can protect yourself and ensure that you are working with licensed and reputable professionals in the insurance industry.

What You'll Learn

- Check State Insurance Department Websites: Visit official state insurance department websites for license status updates

- Search Public Records: Utilize public records databases to find license revocation information

- Contact Insurance Company: Reach out to the insurance company directly for license verification

- Review Regulatory Agency Notifications: Stay informed about regulatory agency notifications regarding license revocation

- Check for Legal Actions: Research legal cases and court documents for any license-related legal actions

Check State Insurance Department Websites: Visit official state insurance department websites for license status updates

To determine if an insurance license has been revoked, one of the most reliable methods is to check the official websites of the state insurance departments. These departments are responsible for regulating and overseeing insurance companies and agents within their respective states, and they maintain detailed records of license statuses. Here's a step-by-step guide on how to do this:

First, identify the state insurance department's website for your specific state. Each state has its own insurance regulatory body, and you can usually find this information by searching for "state insurance department" followed by your state's name. For example, if you're in California, you'd search for "California Department of Insurance." These websites often provide a wealth of information, including license search tools and FAQs.

Once you've located the official website, navigate to the section dedicated to license verification or search for a similar feature. This section typically allows you to search for insurance licenses using various criteria, such as the agent's name, license number, or company name. Enter the relevant details you have, and the system will display the current status of the license. Look for any indicators of revocation, such as "revoked," "suspended," or "inactive" status.

In some cases, the website might provide a direct link to the license holder's profile, giving you access to their license details, including the expiration date, any restrictions, and the type of license. This information can be crucial in confirming the license's status and validity. If the license has been revoked, the website should clearly state the reason for the revocation and provide relevant dates and actions taken by the regulatory body.

It's important to note that insurance license statuses can change frequently, so checking the state insurance department's website regularly is advisable, especially if you suspect any issues with a particular license. Additionally, if you're unable to find the required information online, you can contact the state insurance department directly via email or phone to inquire about a specific license's status.

Protect Your Privacy: Guide to Removing Your Phone from Health Insurance Calls

You may want to see also

Search Public Records: Utilize public records databases to find license revocation information

To determine if an insurance license has been revoked, one of the most effective methods is to search public records. This process involves utilizing online databases and repositories that maintain records of professional licenses, including insurance licenses. Here's a step-by-step guide on how to approach this:

First, identify the relevant state or regional insurance regulatory body. Each state in the United States, for example, has a Department of Insurance or a similar agency responsible for licensing and regulating insurance professionals. These agencies often have websites where they publish public records, including license information. Start by visiting the official website of your state's insurance department. Look for a section or page dedicated to 'Insurance Licensees' or 'Licensed Agents'. Here, you should be able to find a search function or a list of licensed individuals.

When searching, you'll typically need specific details about the insurance professional in question. This may include their name, license number, or any other identifying information. Some websites provide a simple search bar where you can input these details. Others might require you to navigate through different menus and select the appropriate search criteria. Once you've entered the required information, the system should display the corresponding license status. If the license is active, you might find details about the license type, expiration date, and any associated fees.

If the license is revoked, the search results should indicate this status. Revoked licenses are often marked with a clear notice or message stating the revocation date and the reason for the action. In some cases, you might also find information about the disciplinary proceedings or any ongoing legal actions related to the license revocation. It's important to note that the availability and presentation of information can vary depending on the state and the specific database used.

Additionally, some states might offer a 'License Search' tool or a similar feature that allows you to check the status of a license directly. These tools often provide real-time updates and can be a quick way to verify the revocation status. Remember that public records databases are valuable resources for obtaining accurate and up-to-date information about insurance licenses and their statuses.

The Intricacies of Subrogation: Unraveling the Insurance Industry's Complex Web

You may want to see also

Contact Insurance Company: Reach out to the insurance company directly for license verification

If you suspect that an insurance agent's license might have been revoked or is in any way compromised, one of the most direct and reliable methods to verify this is to contact the insurance company they are associated with. Here's a step-by-step guide on how to do this effectively:

- Identify the Insurance Company: Start by gathering the necessary information. You can usually find the name of the insurance company by looking at the agent's business card, website, or any promotional materials they have provided. Alternatively, ask the agent directly for this information.

- Contact the Insurance Company: Reach out to the insurance company's customer service or licensing department. You can typically find their contact details on the company's website or through a quick online search. When you call or email, be prepared to provide the agent's name, license number (if available), and any other identifying details. Clearly state your request for verification of their license status.

- Ask for Verification: Inquire about the agent's current license status. You can ask specific questions like, "Is [agent's name] still authorized to conduct business on behalf of your company?" or "Can you confirm that [agent's name] has a valid insurance license?" The customer service representative should be able to provide you with accurate and up-to-date information regarding the agent's licensing status.

- Request Documentation (if necessary): If the insurance company confirms that the agent's license is revoked or inactive, they might provide you with a formal letter or document stating this. Request such documentation, as it can be useful for your records and may be required in certain legal or regulatory contexts.

- Follow Up if Needed: If you don't receive a response or have any doubts about the information provided, don't hesitate to follow up. Insurance companies often have dedicated teams to handle licensing inquiries, so persistence can ensure you get the verification you need.

By directly contacting the insurance company, you can obtain reliable information about the status of an insurance agent's license. This method is essential for protecting yourself and ensuring that you are dealing with licensed professionals when making insurance-related decisions.

Understanding the Transition: Navigating Insurance Changes when Moving from DC to NY

You may want to see also

Review Regulatory Agency Notifications: Stay informed about regulatory agency notifications regarding license revocation

Staying informed about regulatory agency notifications is crucial for anyone in the insurance industry, as it can provide early warnings about potential license revocation. Regulatory bodies often issue notices or alerts when they take action against insurance professionals, including license suspension or revocation. These notifications can be a valuable resource for insurance agents, brokers, and companies to ensure compliance and take appropriate action to protect their professional standing.

The process of reviewing regulatory agency notifications typically involves a systematic approach. Firstly, identify the relevant regulatory bodies that oversee the insurance industry in your region. These could include state or provincial insurance departments, financial regulatory authorities, or professional associations. Each jurisdiction will have its own set of rules and procedures, so it's essential to know which agencies are responsible for your specific area.

Once you have identified the relevant regulatory agencies, their websites or online portals are usually the primary source of information. These platforms often provide a section dedicated to licensees, where they can access their own records and also find notifications and updates. You should regularly check these sources for any alerts or notices related to license revocation. Regulatory agencies often categorize notifications based on the type of action taken, the reason for the action, and the affected individuals or entities.

When reviewing these notifications, pay close attention to the details. Look for specific dates, the name of the licensee, the nature of the issue (e.g., non-compliance, fraudulent activities), and any consequences or penalties imposed. Understanding the reasons for license revocation can help you identify potential risks and take preventive measures. For instance, if a colleague's license was revoked due to financial misconduct, it serves as a warning to ensure your own practices adhere to ethical standards.

Additionally, consider subscribing to email alerts or newsletters provided by these regulatory agencies. Many agencies offer this service to keep licensees and the public informed about important updates. By staying proactive and regularly reviewing these notifications, you can quickly identify any issues and take the necessary steps to address them, ensuring your insurance license remains valid and in good standing.

Cobra Insurance: What You Need to Know

You may want to see also

Check for Legal Actions: Research legal cases and court documents for any license-related legal actions

When it comes to verifying the status of an insurance license, one crucial step is to delve into legal cases and court documents. This process can provide valuable insights into any potential issues or legal actions related to the license. Here's a detailed guide on how to proceed:

- Online Court Databases: Begin your research by utilizing online court databases, which are often publicly accessible. These databases allow you to search for court cases and documents related to the insurance license in question. You can typically search by the license holder's name, business name, or license number. Look for any lawsuits, administrative actions, or disciplinary proceedings that might be associated with the license. For instance, you might find cases where the insurance company or agent was accused of fraudulent practices, which could lead to license revocation or suspension.

- Legal Research Platforms: There are specialized legal research platforms and services that provide access to a vast collection of legal documents and case law. These platforms often offer advanced search filters, allowing you to narrow down your search based on jurisdiction, case type, and keywords. You can input relevant terms like "insurance license," "revocation," "suspension," or "disciplinary action" to find cases that might be relevant to your inquiry. These platforms often provide detailed case summaries, legal arguments, and outcomes, giving you a comprehensive understanding of any legal actions taken against the license.

- State Insurance Regulatory Bodies: Insurance regulatory bodies at the state level often maintain records of license-related actions, including revocations, suspensions, and disciplinary measures. These bodies typically have online portals or databases where you can search for specific licenses or licensees. Look for any notices, orders, or decisions related to the license in question. For example, you might find a regulatory body's decision to revoke a license due to non-compliance with industry regulations or ethical violations.

- Public Records Requests: If you're unable to find the necessary information through online resources, consider submitting a public records request to the relevant government agencies or courts. This process allows you to formally request access to specific documents or case files. By providing a clear and concise request outlining the license details and the information you seek, you can obtain the necessary legal documents. Public records requests are a legal right in many jurisdictions, ensuring transparency and accountability.

By conducting thorough research on legal cases and court documents, you can uncover valuable information about the status and history of an insurance license. This step is essential in ensuring that the license is still valid and in good standing, providing peace of mind for both consumers and businesses. Remember, each jurisdiction may have its own specific procedures and resources for accessing legal records, so adapting your search strategy accordingly is crucial.

Stop Insurance Telemarketers: Hang Up Forever

You may want to see also

Frequently asked questions

You can verify the status of an insurance company's license by contacting your state's insurance regulatory body. They often provide an online search tool or a helpline where you can input the company's name or license number to access real-time information about their licensing status, including any revocations or suspensions.

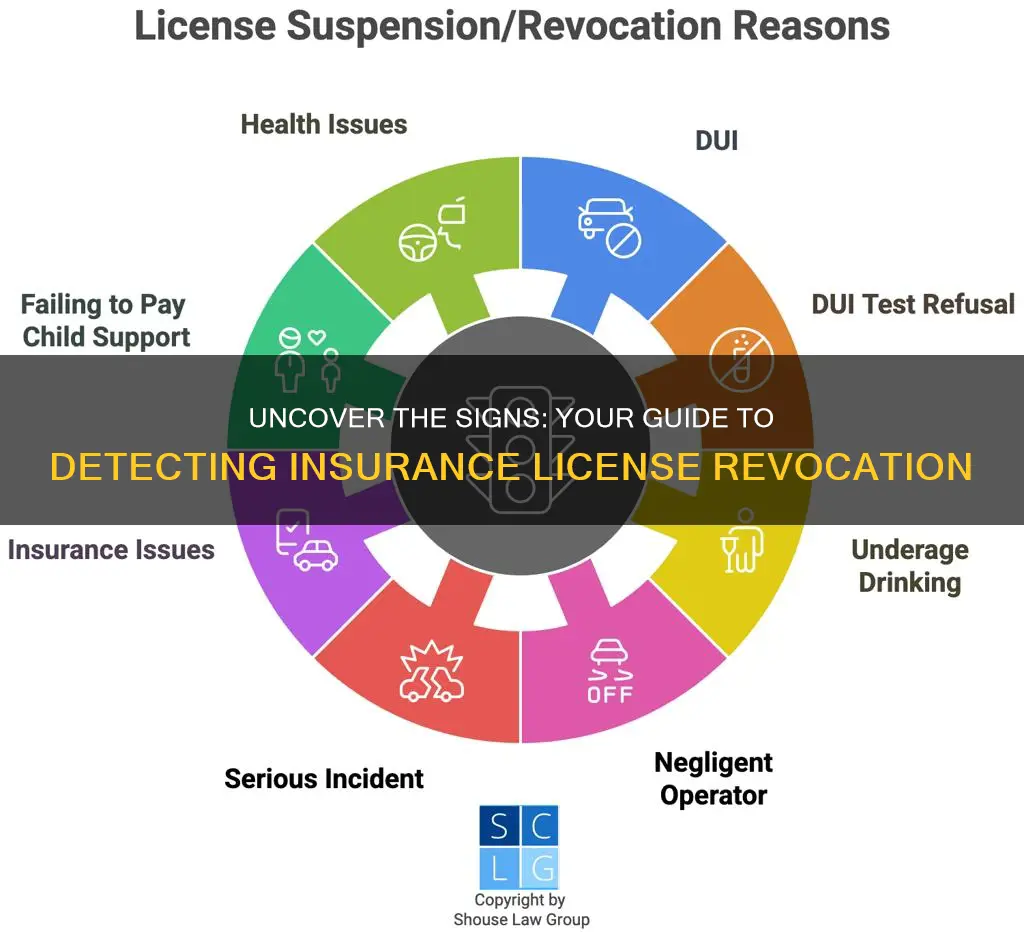

Insurance license revocation typically occurs when an insurance professional or company engages in fraudulent activities, violates insurance laws or regulations, or fails to meet the necessary standards of conduct and competence. This can include cases of misrepresentation, financial misconduct, or negligence in handling customer claims.

Yes, many regulatory bodies offer notification services. You can sign up for alerts or newsletters from your state's insurance department to receive updates on license changes, including revocations. Alternatively, you can regularly check the department's website for any recent license actions.

If you have concerns, it's best to contact the insurance regulatory authority directly. They can provide official confirmation and guidance on how to proceed. In the meantime, you can also reach out to the company's customer service to inquire about their licensing status and ensure you are dealing with a legitimate and authorized entity.