A proposal form is a crucial document in the insurance industry, especially for term insurance. It is a formal application document that an individual fills out when applying for an insurance policy. The proposal form is used to introduce the customer to the insurance company and serves as a basis for the contract between the two parties. It includes essential personal information such as the customer's name, address, age, occupation, and, in some cases, their medical history. The form also covers policy details, such as the type of insurance, the term, and the sum assured.

The proposal form plays a significant role in the risk assessment and underwriting process, allowing insurance companies to evaluate potential risks and determine the premium amount. It is important for applicants to provide accurate and complete information in the proposal form to ensure adequate insurance coverage and avoid complications such as denial of claims or cancellation of the policy.

| Characteristics | Values |

|---|---|

| Purpose | To introduce the customer to the insurance company and confirm their identity |

| To provide detailed information about the prospective policyholder | |

| To serve as a basis for the insurance contract | |

| To enable the insurer to determine the premium payable | |

| To act as a reference document for claim settlement | |

| Contents | Personal information (name, age, gender, address, occupation, contact details) |

| Policy details (type of insurance, term, sum assured/coverage amount) | |

| Health and lifestyle information (medical history, smoking/drinking habits) | |

| Additional information depending on the type of insurance (e.g., vehicle details for car insurance) | |

| Declaration and signature | |

| Importance | Accurate and honest disclosure is essential for risk assessment and underwriting |

| Enables policy customization | |

| Assists in risk management and financial sustainability of the insurance company | |

| Facilitates smooth claim settlement |

What You'll Learn

Importance of a proposal form

A proposal form is a crucial document in the insurance industry, serving as the foundation for the insurance contract between the insurance company and the prospective customer. It is a formal application document that an individual fills out when applying for an insurance policy. The proposal form plays a significant role in the underwriting process and risk assessment, helping insurance companies tailor policies to meet specific needs. Here are several reasons why proposal forms are important:

Basis for the Insurance Contract:

The proposal form is the basis for the contract between the insurance company and the policyholder. It includes essential information about the proposer and the life assured, such as name, address, age, occupation, and medical history. This information is critical for the insurance company to evaluate the risk, determine premiums, and decide on the terms and conditions of the policy.

Accurate Risk Assessment:

Insurance companies rely on the proposal form to accurately assess the risk associated with providing coverage. For example, when applying for car insurance, the form will include questions about the driver's age, driving history, and vehicle specifications. This information helps insurers evaluate the likelihood of accidents or damages and set appropriate premiums.

Policy Customization:

By providing detailed and accurate information in the proposal form, individuals enable insurance companies to customize policies to their unique needs. For instance, when applying for health insurance, the form may include questions about pre-existing medical conditions, allowing the insurer to tailor the coverage accordingly.

Claim Settlement:

In the event of a claim, the proposal form serves as a reference document for the insurance company. If the information provided in the form matches the circumstances of the claim, it expedites the claims settlement process. Inaccurate or false information, on the other hand, can lead to delays or denial of claims.

Accuracy and Disclosure:

Insurance contracts are based on the principle of utmost good faith. It is essential that individuals disclose information truthfully and completely in the proposal form. Failure to do so can lead to claim denials or policy cancellation. The proposer should carefully fill out the form and verify that all details are correct before signing.

In summary, the proposal form is of utmost importance in the insurance application process. It facilitates accurate risk assessment, customization of policies, and smooth claim settlement. By providing comprehensive and truthful information in the proposal form, individuals can ensure transparency and fairness in their insurance contract.

Unraveling the Mystery of Term Insurance: A Step-by-Step Guide to Navigating Your Options

You may want to see also

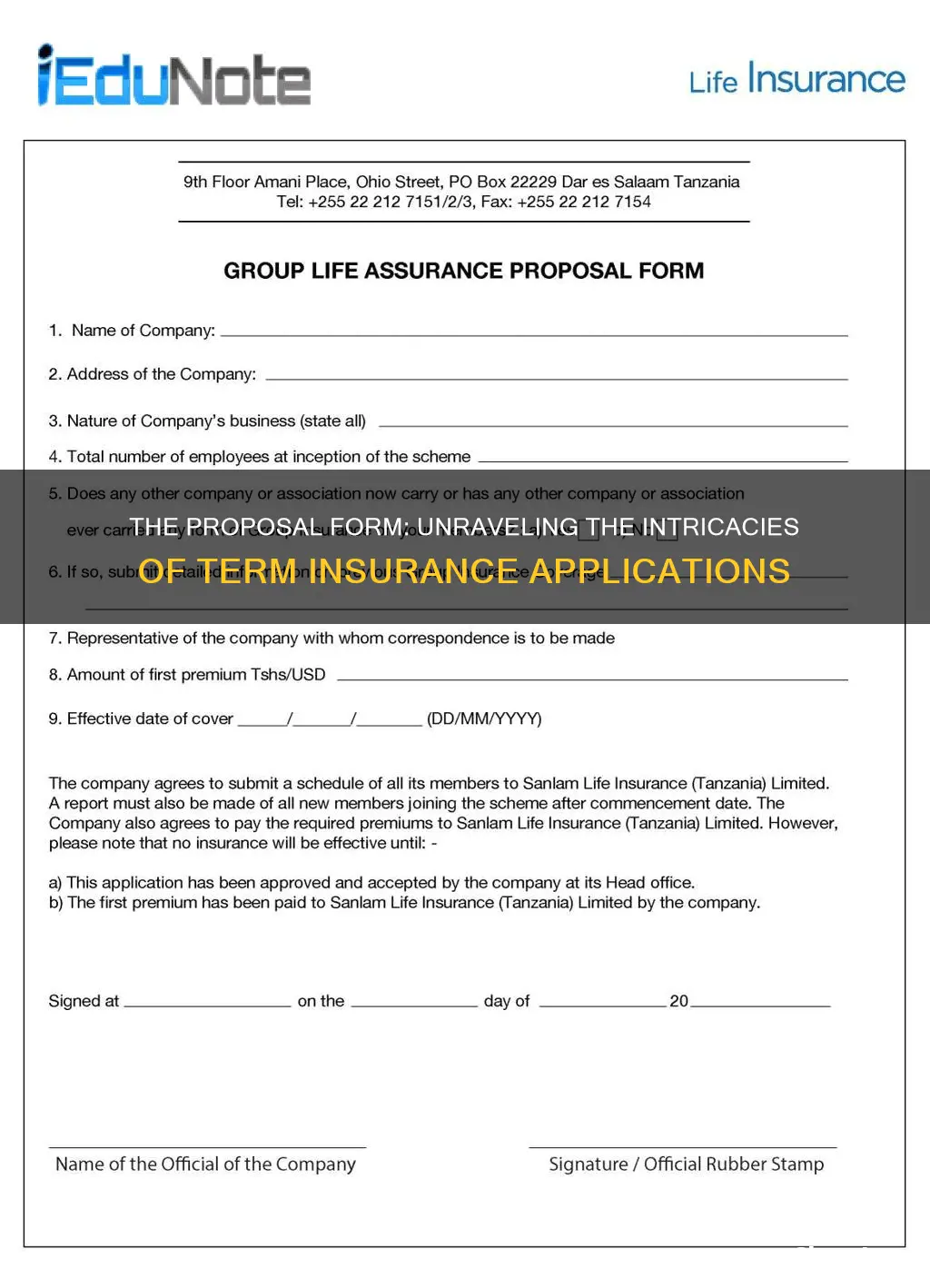

Proposal form requirements

A proposal form is a crucial document in the insurance industry, serving as the foundation of the insurance contract between the prospective customer and the insurance company. It is a formal application document that an individual fills out when applying for an insurance policy. The proposal form helps introduce the customer to the insurance company and confirms their identity. Here are the key requirements and components of a proposal form:

Personal Information:

This section includes the applicant's full name, age, gender, date of birth, occupation, education, and contact details. The name and address are particularly important for identification and communication purposes. The occupation details are significant for life insurance, personal accident insurance, and liability insurance as they can influence the underwriter's decision and premium rates.

Policy Details:

The applicant specifies the type of insurance policy they are applying for, the desired coverage amount or sum assured, and the term of the policy. This information helps the insurance company understand the level of protection sought by the customer.

Health and Lifestyle Information:

For life and health insurance policies, the proposal form typically includes questions about the applicant's medical history and lifestyle choices, such as smoking or drinking habits. This information is crucial for assessing the applicant's health status and potential risks associated with their lifestyle.

Subject Matter Information:

This section is essential for describing the subject matter of the insurance policy. For example, if it is property insurance, details such as the rebuild cost of the house or the type of car owned need to be provided. This information helps the insurer understand the risks involved and set appropriate coverage limits.

Additional Information:

Depending on the type of insurance, additional details may be required. For instance, a car insurance proposal form would include vehicle-specific information, while a travel insurance proposal form might ask about pre-existing travel plans.

Declaration and Signature:

The proposal form must include a declaration by the applicant stating that the information provided is true and accurate to the best of their knowledge. It should also include a statement confirming the applicant's agreement to pay the premium and accept the policy offered by the insurance company. The form must be signed and dated by the proposer or an authorized representative.

It is important to note that proposal form requirements may vary slightly depending on the insurance company and the specific type of policy being sold. However, the above-mentioned components are generally considered standard requirements for a comprehensive proposal form.

The Intricacies of Dwelling Insurance: Unraveling the Concept of 'Dwelling' in Property Coverage

You may want to see also

Contents of a proposal form

A proposal form is a crucial document in the insurance industry, serving as a formal request from the prospective client to the insurance company for protection against risk. It is used by insurance companies to gather detailed information about the prospective policyholder and plays a significant role in the risk assessment and underwriting process. Here are the contents typically found in a proposal form:

Personal Information

This includes the applicant's name, age, gender, date of birth, occupation, contact details, and sometimes their educational background. The name and address are vital for identification and communication purposes, while the occupation can influence the underwriter's decision and the premium rate.

Policy Details

The applicant specifies the type of insurance policy they are applying for, the term of the policy, and the desired coverage amount or sum assured. This section helps the insurance company understand the applicant's needs and tailor the policy accordingly.

Health and Lifestyle Information

For life and health insurance policies, the proposal form will include questions about the applicant's health history and lifestyle choices, such as smoking or drinking habits. This information is crucial for assessing the applicant's health risks.

Additional Information

Depending on the type of insurance, the proposal form may request additional details. For example, a motor insurance proposal form will ask for information about the vehicle, while a home insurance proposal form will inquire about the property to be insured.

Previous Insurance History

The insurance company will want to know about the applicant's previous insurance policies, including the types of coverage they had and any claims made. This information helps assess the applicant's insurance history and identify potential risks.

Declarations and Signature

The applicant must declare that the information provided in the proposal form is true and accurate. They may also be required to disclose any information that could impact the insurer's decision, such as previous criminal convictions. The form must be signed and dated by the applicant.

It is essential to provide accurate and comprehensive information in the proposal form to avoid issues during the underwriting process or claim settlement. The proposal form serves as the foundation for the insurance contract, and all the information provided becomes part of the agreement between the insurer and the insured.

RH Insurance: Understanding the Whole Picture or Just a Term

You may want to see also

Role in the underwriting process

Proposal forms are an essential part of the underwriting process in insurance. They are used by insurance companies to gather detailed information about the prospective policyholder and assess risk. The information provided in the proposal form helps underwriters determine the insurability of the applicant, set the terms and conditions, and decide on the premium.

- Risk Assessment: Proposal forms enable insurers to evaluate the potential risks associated with providing coverage. They include questions about the applicant's personal information, health and lifestyle, and specific details about the insured object, such as its value, condition, and any potential risks. This information assists underwriters in identifying and analysing the risks involved.

- Premium Determination: Based on the information provided in the proposal form, insurance companies can determine the premium amount. For example, factors such as the applicant's age, occupation, driving history (in the case of car insurance), or medical history (in the case of health insurance) can influence the premium rate.

- Insurability Decision: Underwriters use the proposal form to decide on the insurability of the applicant. They assess whether the risk associated with providing coverage to a particular individual or asset is acceptable or not. In some cases, certain risks may be excluded from the policy or additional terms and conditions may be applied.

- Policy Customisation: Proposal forms allow insurance companies to tailor policies to meet the specific needs of applicants. For instance, when applying for health insurance, the proposal form may include questions about pre-existing medical conditions, enabling the insurer to customise the coverage accordingly.

- Accuracy and Disclosure: Accurate and honest disclosure of information in the proposal form is crucial. Insurance contracts are based on the principle of utmost good faith, requiring both parties to act in good faith and provide complete and accurate information. Misrepresentation or omission of relevant information can lead to complications, such as denial of claims or cancellation of the policy.

In summary, proposal forms play a vital role in the underwriting process by facilitating risk assessment, premium determination, insurability decisions, and policy customisation. They serve as a starting point for the underwriting process, providing insurance companies with the necessary information to make informed decisions about the risks involved and the appropriate coverage for the applicant.

Long-Term Security: Exploring the Benefits of 20-Year Term Life Insurance Plans

You may want to see also

Accuracy and disclosure

- Risk Assessment: Insurance companies rely on accurate information to assess the risk associated with providing coverage. Inaccurate or incomplete information can lead to an incorrect evaluation of the risks and may result in inappropriate coverage or premium amounts.

- Underwriting Process: The proposal form is the starting point for the underwriting process. Underwriters use the information provided to determine the insurability of the applicant, set the terms and conditions, and decide on the premium. Inaccurate information can lead to complications during the underwriting process.

- Claim Settlement: In the event of a claim, the information provided in the proposal form is cross-referenced by the insurance company. Inaccurate or false information can result in delays or denial of claims.

- Policy Customization: By providing accurate and detailed information in the proposal form, individuals can ensure that their unique needs and requirements are considered, and the policy is tailored accordingly.

To ensure accuracy and disclosure in the proposal form, it is essential to follow these guidelines:

- Provide Honest and Complete Information: The proposal form should be filled out truthfully and honestly. Failure to disclose relevant information or providing misleading information can lead to claim denials or policy cancellation.

- Understand the Questions: It is important to carefully read and understand the questions on the proposal form. If any clarification is needed, individuals should seek guidance from the insurance company or an insurance agent.

- Verify the Details: After completing the proposal form, individuals should review it to verify that all the information provided is accurate and correct. This includes personal details, such as name, address, and occupation, as well as specific details about the insured object or risk.

- Seek Professional Advice: If individuals have any doubts or concerns about the proposal form, it is advisable to seek professional advice from insurance experts or brokers. They can provide valuable guidance and ensure that the form is completed accurately.

By prioritizing accuracy and disclosure in the proposal form, individuals can establish a strong foundation for their insurance contract, maintain a transparent relationship with the insurance company, and ensure that their insurance coverage meets their specific needs and requirements.

Navigating the Path of 'Do-It-Yourself' Term Insurance: A Guide to Going Solo

You may want to see also

Frequently asked questions

A proposal form is a formal application document that an individual fills out when applying for an insurance policy. It serves as a request for protection against a certain risk and includes personal details, information about the insured object, and other relevant information.

A proposal form typically includes personal information such as name, age, gender, occupation, and contact details. It also covers policy details like the type of insurance, the term, and the sum assured. Health and lifestyle questions may be included, as well as additional information depending on the type of insurance.

The proposal form is crucial as it serves as the basis for the contract between the insurance company and the policyholder. It helps insurance companies assess risks, determine premiums, and tailor policies to the applicant's needs. Accurate information is vital to ensure adequate coverage and smooth claim settlements.

The proposal form is the starting point for the underwriting process, where insurance companies evaluate and analyze the risks involved. It helps determine the insurability of the applicant, set the terms and conditions, and decide on the premium amount. Inaccurate information can lead to complications like claim denials or policy cancellation.