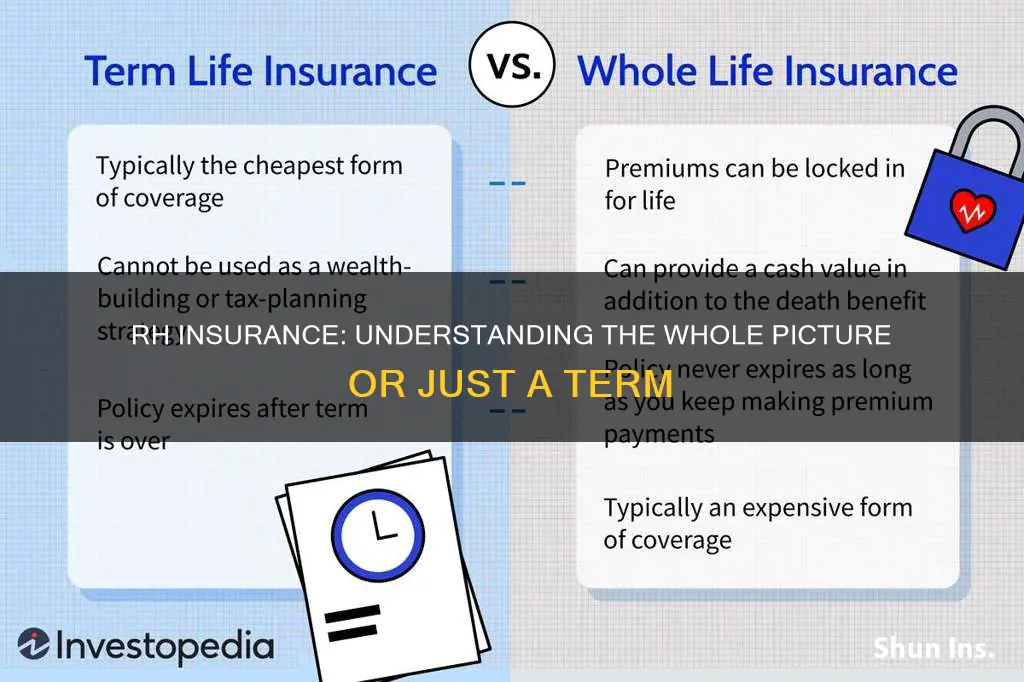

RH Insurance offers both term and whole life insurance. Term life insurance is a type of life insurance policy that provides coverage for a certain period of time, such as 30 years. It is much cheaper than whole life insurance but does not build cash value. On the other hand, whole life insurance is a form of permanent life insurance that lasts as long as you live and includes a cash value account that grows tax-free over time. Whole life insurance is much more expensive than term life insurance, with premiums costing five to 15 times more, but it offers lifelong protection and the ability to borrow against the policy for other financial needs.

| Characteristics | Values |

|---|---|

| Type | Term Life Insurance |

| Coverage | Only for a set period of time |

| Affordability | Cheaper than whole life insurance |

| Use as a wealth-building or tax-planning strategy | Cannot be used as a wealth-building or tax-planning strategy |

| Protection | Only for a limited number of years |

| Cash value | Does not accrue any cash value |

| Whole Life Insurance | Permanent life insurance |

| Cash value | Has a cash value component |

| Cost | Much more expensive than term life insurance |

| Coverage | Lasts your entire life |

| Premium | Can lock in premium for life |

| Loans | Can borrow against the policy |

| Surrender | May face surrender charges if the policy lapses |

What You'll Learn

Term life insurance vs. whole life insurance

Term life insurance and whole life insurance are two of the most common types of life insurance, but they function very differently. Term life insurance covers a person for a set number of years and expires after that term, whereas whole life insurance covers a person for their entire life and builds cash value that can be used while living.

Term Life Insurance

Term life insurance is a more affordable option than whole life insurance, as it is cheaper and only covers a specific period. It is a good choice for those who want to protect their family members financially, such as parents with young children or people with a mortgage. The length of the term can be chosen by the policyholder, usually ranging from 10 to 30 years, and the premiums will stay the same during this period. However, term life insurance does not build any cash value, and if the policyholder outlives the term, the coverage ends and no benefits are received.

Whole Life Insurance

Whole life insurance, on the other hand, is a permanent form of insurance that lasts your entire life, as long as premiums are paid. It also includes a cash value component that grows over time, which can be borrowed against or withdrawn. The premiums for whole life insurance are locked in and do not increase, but they are much higher than those of term life insurance. Whole life insurance is a good option for those who want lifelong coverage, such as parents with disabled children, and for those who want the added flexibility of the cash value component.

There is no definitive answer to which type of insurance is better, as it depends on individual needs and financial goals. Term life insurance is sufficient for most families and is a good choice for those who want affordable coverage for a specific period. Whole life insurance is more expensive but offers lifelong coverage and the ability to build cash value, making it a good option for those with lifelong dependents or those looking for additional financial flexibility.

Haven Insurance: Understanding the Fine Print

You may want to see also

Benefits of term life insurance

Term life insurance is a good option for people who want substantial coverage at a low cost. Here are some of the benefits of term life insurance:

Affordability and flexibility

Term life insurance is usually the most affordable option when you want life insurance to cover financial obligations that are temporary. It offers short- and long-term coverage at an affordable rate compared to other types of policies, making it a good fit for young families on a budget.

Financial protection for loved ones

Term life insurance offers a death benefit to beneficiaries, providing them with financial support while they grieve and adjust to their new lives without the deceased. The money received can help cover funeral expenses, medical bills, and other final expenses. It can also be used for income replacement, making it easier for surviving spouses and children who relied on the deceased's salary or wages.

Customizable coverage for specific needs

Term life insurance allows you to customize coverage to meet a wide variety of specific needs. For example, you can select a term length that corresponds to the expected period in which a mortgage will be paid off, or provide coverage to replace lost income until children graduate from high school or college.

Convertibility and future options

The conversion feature in term life insurance policies allows policyholders to convert their policy into a permanent form of life insurance, such as whole life or universal life. This is particularly beneficial if you develop health issues later in life, as you don't need to go through underwriting again. It also gives policyholders the flexibility to choose when and how to convert their coverage.

No cash value accumulation

One of the primary benefits of term life insurance is the lower premium payments since it doesn't accumulate cash value like permanent life insurance. This means that no additional costs are added to the premium, making it an attractive option for those looking for affordable coverage.

Term Insurance Payout Frequency: Unraveling the Mystery of When Benefits Are Disbursed

You may want to see also

Drawbacks of term life insurance

Term life insurance is the most basic form of life insurance. It is designed to provide affordable death protection over the short term and only pays out if you die during the term. While it is a good option for many, there are some drawbacks to consider.

Increasing Premiums

One of the major disadvantages of term insurance is that your premiums will increase as you get older. When you buy term life insurance in your 20s or 30s, it will be much cheaper compared to when you need to renew your policy later on in your 50s or 60s. After the initial guarantee period, you can expect a significant increase in your premium.

No Cash Value

Term life insurance is not structured to provide cash value. This is a significant disadvantage when compared to permanent policies like whole life insurance. Term life builds no equity, and there is no investment component, meaning there is no cash value to the policy after paying for it for 20 or 30 years.

Limited Coverage

Your term policy will stop providing coverage when the term ends. If you want to renew your policy after the term ends, your situation might not be favourable due to increased costs associated with older age. Additionally, you may have become uninsurable during the term, making it difficult to qualify for coverage or obtain an affordable policy.

Difficulty Securing Coverage at Older Ages

As you enter older age (after 65), it becomes much more difficult to secure term life insurance. The majority of life insurance companies do not provide policies at these ages, and those that do are often limited and expensive.

Understanding the Insurance Coverage of Short-Term Bonds

You may want to see also

Whole life insurance benefits

Whole life insurance is a permanent policy that offers lifelong coverage. This means that it will pay out to your loved ones no matter when you pass away. Here are some of the key benefits of whole life insurance:

Lifelong coverage

Whole life insurance lasts forever, no matter how old you are when you pass away. Unlike term life insurance, there is no expiration date. This means that you don't have to worry about renewing your policy or finding new coverage later in life, when doing so may be more difficult due to age or health issues.

Fixed premiums

Whole life insurance premiums are typically fixed throughout the duration of the policy. This makes it easy to budget for your payments, as they will not change over time. However, it's important to note that whole life insurance premiums tend to be higher than those of term life insurance policies.

Death benefit

Whole life insurance provides a death benefit to your beneficiaries upon your passing. This benefit is guaranteed and typically yields a large outcome. The death benefit is established when you sign up for the policy and stays the same as long as the policy remains active. Additionally, death proceeds are generally non-taxable to the beneficiary.

Cash value growth

Whole life insurance policies offer a cash value growth component. This means that your policy accumulates cash value over time, which can be withdrawn or borrowed against to cover expenses or meet financial goals. The cash value grows tax-free in a secure account, and you may be able to access it before the policy expires. The cash value can also be used to pay your premiums.

Investment opportunities

Some whole life insurance policies are eligible for dividends, which can be redeemed for cash or used to boost your policy's cash value. Additionally, the cash value of your policy can serve as potential loan collateral in case of a financial emergency.

Peace of mind

Whole life insurance provides peace of mind for you and your loved ones. Knowing that you have lifelong coverage and a guaranteed death benefit can help ease financial worries and allow you to focus on what matters most.

Term Insurance: Navigating the Purchase Process with Confidence

You may want to see also

Whole life insurance drawbacks

Whole life insurance is a type of permanent insurance that covers you for your entire life. While it has its benefits, there are several drawbacks to this type of insurance.

Higher Premiums

Whole life insurance premiums are typically higher than those of term life insurance policies. This is because whole life insurance provides lifelong coverage and includes a cash value component that grows over time. According to a survey by Consumer Reports, whole life insurance premiums can be up to 10 times more expensive than term life insurance for the same death benefit.

Smaller Death Benefit

Due to the higher cost of whole life insurance, you will receive a lower death benefit compared to a term life policy for the same amount of money. If you need a large amount of insurance coverage, such as when you have a young family dependent on your income, term life insurance may be a more suitable option.

Lack of Investment Control

With whole life insurance, the insurance company decides how to invest the cash value portion of your policy. If you are an experienced investor and comfortable taking on risk, you may prefer to invest this money yourself. Variable life insurance policies offer more control over investments, but they also carry the risk of losing the invested amount and earned interest if the market crashes.

Effects of Inflation

Whole life insurance policies offer interest rates between 1% and 4% on the cash value of your account. However, during periods of high inflation, the interest earned may not keep up with the rising cost of living, resulting in reduced purchasing power.

Complexity

Whole life insurance policies are more complex than term life insurance due to their investment and policy loan features. This complexity can make them more challenging to understand and manage compared to the simplicity of term life insurance.

ICICI Term Insurance: Unraveling the Benefits and Features

You may want to see also

Frequently asked questions

RH Insurance offers both whole and term insurance. Whole life insurance is a form of permanent life insurance that lasts your entire life, while term life insurance only covers you for a specific period.

Term life insurance is more affordable than whole life insurance and offers basic coverage for a specific duration. It is ideal for those who only need coverage for a certain period, such as when raising children or paying off a mortgage.

Whole life insurance provides lifelong protection and includes a cash value component that grows tax-free over time. It allows you to borrow against or withdraw from the policy for other financial needs. Whole life insurance is suitable for those who want coverage for their entire lives, including lifelong dependents like children with disabilities.

The choice between term and whole life insurance depends on your needs and budget. Term life insurance is generally sufficient for most people due to its affordability. However, if you have maxed out your tax-advantaged retirement accounts or have lifelong dependents, whole life insurance may be a better option.