Insurance is a vital aspect of financial planning and risk management, offering individuals and businesses a safety net against unforeseen events. It involves a contract between an individual or entity (the insured) and an insurance company, where the latter agrees to provide financial compensation in the event of specified losses, damages, or liabilities. The concept of insurance has evolved over centuries, with its roots tracing back to ancient civilizations, and it has become an indispensable part of modern life. Understanding the intricacies of insurance policies, coverage options, and claims processes is essential for anyone looking to protect their assets, manage risks, and ensure financial security. This guide aims to provide an overview of insurance fundamentals, helping readers navigate the complex world of insurance and make informed decisions.

What You'll Learn

- Types of Insurance: Health, life, auto, home, and more

- Insurance Coverage: Understanding what is covered and what is not

- Claims Process: Steps to file a claim and receive compensation

- Policy Terms: Definitions and explanations of insurance policy language

- Insurance Regulation: Government oversight and industry standards

Types of Insurance: Health, life, auto, home, and more

Insurance is a vital financial tool that provides individuals and businesses with protection against various risks and uncertainties. It offers a safety net, ensuring that potential losses are mitigated and financial stability is maintained. When it comes to insurance, there are numerous types, each catering to specific needs and concerns. Here's an overview of some common types of insurance:

Health Insurance: This type of insurance is designed to cover medical expenses and healthcare costs. It provides financial protection against unexpected illnesses, injuries, and medical treatments. Health insurance plans often include coverage for doctor visits, hospital stays, prescription drugs, and preventive care. With the rising costs of healthcare, having a comprehensive health insurance policy is essential to ensure access to quality medical services without incurring substantial out-of-pocket expenses.

Life Insurance: Life insurance is a critical financial safeguard that offers financial protection for one's loved ones in the event of an untimely death. It provides a death benefit, which is a lump sum payment, to the designated beneficiaries. This benefit can help cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or daily living expenses, ensuring that the family's financial obligations are met and their well-being is protected. Term life insurance and whole life insurance are two common forms, each with its own advantages and coverage terms.

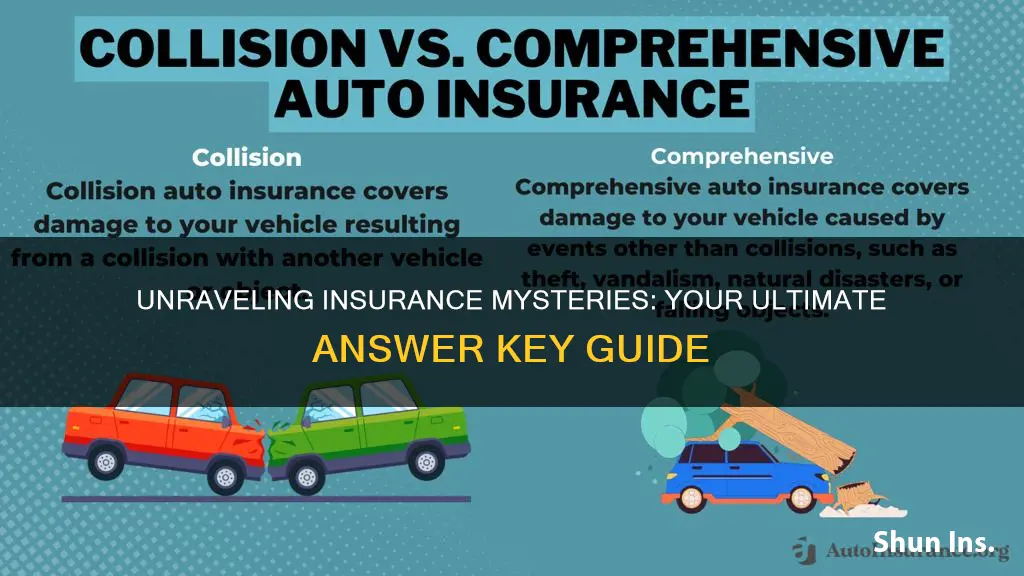

Auto Insurance: Auto insurance is mandatory in most places and provides coverage for vehicles in case of accidents, theft, or damage. It typically includes liability coverage, which protects against claims made by other drivers or pedestrians for bodily injury or property damage caused by the insured driver. Additionally, comprehensive and collision coverage can protect against non-collision incidents like natural disasters or theft. Auto insurance rates vary based on factors such as driving record, vehicle type, and coverage options.

Homeowners or Home Insurance: Home insurance, also known as homeowners insurance, protects homeowners and landlords from financial losses due to property damage or liability claims. It covers the physical structure of the home, personal belongings, and liability for accidents that occur on the property. Home insurance policies often include coverage for natural disasters like fires, storms, or floods, as well as liability protection if someone is injured on the insured property. This type of insurance is crucial for safeguarding one's most significant investment.

Other types of insurance include travel insurance, which covers medical and trip-related expenses during travel, and disability insurance, which provides income replacement if an individual becomes unable to work due to illness or injury. Additionally, there's renters insurance, which protects tenants' personal belongings and offers liability coverage, and business insurance, which caters to various business needs, including property damage, employee-related risks, and professional liability.

Understanding the different types of insurance and their benefits is essential for making informed financial decisions. Each type of insurance serves a unique purpose, and having the right coverage can provide peace of mind, knowing that you and your loved ones are protected against unforeseen circumstances.

Marketplace Insurance: Government-Approved?

You may want to see also

Insurance Coverage: Understanding what is covered and what is not

Insurance coverage is a critical aspect of financial planning, providing a safety net and peace of mind to individuals and businesses alike. It is essential to understand what is covered by your insurance policies to ensure you are adequately protected and to avoid any unpleasant surprises when you need to make a claim. Here's a breakdown of how to navigate the complexities of insurance coverage:

Review Your Policy Documents: The first step to understanding your insurance coverage is to thoroughly review your policy documents. These documents, often lengthy and complex, outline the specific terms, conditions, and exclusions of your insurance contract. Pay close attention to the following sections: 'Coverage Details,' 'Exclusions and Limitations,' and 'Claim Process.' These sections will provide a comprehensive overview of what is covered and what is not. For instance, in health insurance, you'll find details about medical procedures, treatments, and medications covered, as well as any pre-existing conditions that might be excluded.

Identify Covered Risks: Different types of insurance cover various risks and perils. For example, property insurance protects against damage to your home or belongings due to natural disasters, theft, or accidents. In contrast, life insurance provides financial protection for your beneficiaries in the event of your death. Understanding the specific risks your insurance policy covers is crucial. For instance, a standard auto insurance policy typically includes liability coverage for bodily injury and property damage to others, collision coverage for damage to your vehicle, and comprehensive coverage for non-collision incidents like theft or natural disasters.

Know the Exclusions: Insurance policies often have exclusions, which are specific events or circumstances that are not covered. These can vary widely depending on the type of insurance. For instance, in health insurance, common exclusions might include cosmetic procedures, pre-existing conditions (for new policies), or certain lifestyle-related issues like smoking-related illnesses. In property insurance, common exclusions could include earthquakes, floods, or damage caused by intentional acts. Understanding these exclusions is vital to ensure you are not left with unexpected costs.

Understand Policy Limits: Insurance policies also have limits, which determine the maximum amount the insurer will pay for a covered loss. For example, in liability insurance, the policy limit specifies the maximum amount the insurer will pay for bodily injury or property damage claims. It's important to know these limits to ensure you have sufficient coverage. If you exceed the policy limit, you may be responsible for covering the remaining costs out of pocket.

Seek Clarification: If you have any doubts or questions about your insurance coverage, don't hesitate to contact your insurance provider. They can provide clarification on any ambiguous terms and ensure you understand your policy inside and out. It's better to seek clarification now rather than facing unexpected costs when you need to make a claim.

Uncovering Medical History: Linking New Docs to Past Insurance Records

You may want to see also

Claims Process: Steps to file a claim and receive compensation

The claims process is a crucial aspect of insurance, ensuring that policyholders receive the compensation they are entitled to after a covered event. When filing a claim, it's essential to understand the steps involved to ensure a smooth and efficient experience. Here's a comprehensive guide to help you navigate the process:

- Understand Your Policy: Before initiating a claim, thoroughly review your insurance policy. Different policies have varying coverage and exclusions. Identify the specific events or incidents covered, the types of losses or damages compensable, and any relevant policy limits. This knowledge will help you determine if your situation qualifies for a claim and guide you in the subsequent steps.

- Document and Report the Incident: Promptly gather and document all relevant evidence and information related to the incident. This includes photographs, videos, witness statements, repair or replacement estimates, and any other supporting documents. Contact your insurance company as soon as possible to report the incident. Provide them with detailed information about what happened, when it occurred, and the extent of the damage or loss. Quick reporting increases the chances of a swift claims process.

- File the Claim: Your insurance company will provide you with the necessary claim forms or documentation. Fill out these forms accurately and completely, providing all the requested information. Include all the supporting evidence gathered in step 2. Ensure that you understand the coverage limits and any potential deductibles or co-pays associated with your claim. If you have any doubts or questions, contact your insurance provider for clarification.

- Cooperation and Communication: During the claims process, maintain open communication with your insurance adjuster. Provide them with any additional information or documentation they may request. Be cooperative and transparent to facilitate a faster resolution. Keep records of all correspondence, including emails, letters, and phone call summaries. This documentation will be essential if there are any disputes or delays in the process.

- Claim Review and Settlement: The insurance company will review your claim based on the provided information and evidence. They may conduct investigations, consult experts, or verify the details. If your claim is approved, the insurance company will settle the compensation according to the terms of your policy. This may involve direct payments to repair or replace damaged items, medical bill coverage, or other specified benefits. Keep track of all payments received and ensure that the settlement covers all eligible expenses.

- Appeal and Dispute Resolution: In the unlikely event of a denied claim or dissatisfaction with the settlement, you have the right to appeal. Review the reasons for the denial and gather additional evidence or documentation to support your case. Contact your insurance company's appeals department or seek legal advice if necessary. Insurance companies often have internal dispute resolution processes to address disagreements and ensure fair treatment of policyholders.

Remember, each insurance company may have slightly different procedures, so it's essential to follow their specific guidelines. Being proactive, organized, and well-informed throughout the claims process can significantly impact the efficiency and success of your claim.

Understanding Cash Surrender: A Guide to Your Insurance Policy

You may want to see also

Policy Terms: Definitions and explanations of insurance policy language

When it comes to understanding insurance policies, the language used can often be complex and confusing. This is where the concept of 'policy terms' comes into play, as it provides a comprehensive framework to decipher the various components of an insurance contract. Policy terms are the specific words and phrases used in an insurance policy that define the rights and obligations of both the insurer and the policyholder. These terms are crucial as they outline the coverage, exclusions, and conditions of the insurance agreement.

One of the most fundamental policy terms is 'coverage,' which refers to the protection or benefits provided by the insurance policy. It is essentially the insurance company's commitment to pay for specified losses or damages as outlined in the policy. For instance, in a health insurance policy, coverage might include medical expenses, hospitalization, or even prescription drug costs. Understanding the coverage limits and what is covered is essential for policyholders to ensure they receive the intended benefits.

Another critical aspect is 'exclusions,' which are specific events, circumstances, or actions that are not covered by the insurance policy. These exclusions are often listed in the policy document and can vary widely depending on the type of insurance. For example, in a homeowner's insurance policy, common exclusions might include damage caused by earthquakes, floods, or intentional acts of vandalism. Knowing these exclusions is vital as it helps policyholders understand what they are responsible for and what the insurance company will not cover.

'Premiums' is a term that refers to the amount of money the policyholder pays to the insurance company to maintain the policy. This premium is typically calculated based on various factors such as the type of coverage, the policyholder's risk profile, and the policy's duration. Understanding how premiums are determined and how they relate to the coverage provided is essential for managing insurance costs effectively.

Additionally, 'deductibles' are a significant policy term, representing the amount of money a policyholder must pay out of pocket before the insurance coverage kicks in. For instance, in a car insurance policy, if a deductible is set at $500, the policyholder will have to pay the first $500 of any claim before the insurance company starts covering the remaining costs. Deductibles are a way for insurance companies to manage risk and encourage policyholders to be more cautious.

In summary, insurance policy language is filled with various terms that define the terms of the agreement. Understanding coverage, exclusions, premiums, and deductibles is essential for both insurers and policyholders to ensure a smooth and fair insurance experience. By familiarizing oneself with these policy terms, individuals can make informed decisions and effectively manage their insurance coverage.

The Art of Billing: Navigating Primary and Secondary Insurance

You may want to see also

Insurance Regulation: Government oversight and industry standards

Insurance regulation is a critical aspect of the insurance industry, ensuring that companies operate fairly and ethically while providing essential financial protection to consumers. Government oversight and industry standards play a pivotal role in maintaining the integrity of the insurance market. This regulation is designed to protect policyholders, promote market stability, and foster a competitive environment.

Government Oversight:

Governments worldwide implement regulatory bodies to oversee the insurance sector, aiming to safeguard public interests. These regulatory authorities set and enforce rules, ensuring that insurance companies adhere to specific standards. Their primary goals include preventing fraud, ensuring financial stability, and protecting consumers' rights. For instance, insurance regulators might require companies to maintain certain capital levels, ensuring they can fulfill their financial obligations to policyholders. They also conduct regular examinations to verify compliance with regulations and may impose penalties for non-compliance. Government oversight often involves licensing and registration processes for insurance providers, allowing only qualified and reputable entities to operate.

Industry Standards:

Parallel to government intervention, insurance companies voluntarily adhere to industry standards set by professional associations and trade bodies. These standards are designed to promote best practices and maintain a high level of professionalism within the industry. For example, the Insurance Information Institute (III) in the United States provides resources and guidelines for insurers to enhance customer service, manage claims efficiently, and maintain financial stability. Industry standards often include codes of conduct, ethical guidelines, and recommendations for product design and marketing. By voluntarily adopting these standards, insurance companies demonstrate their commitment to integrity and customer satisfaction.

The interplay between government oversight and industry standards is crucial for the effective regulation of insurance. While government regulators provide a legal framework and enforce compliance, industry standards offer a self-regulatory mechanism that fosters a culture of excellence and innovation. Together, they ensure that insurance companies operate with transparency, fairness, and accountability, ultimately benefiting consumers and the overall market.

In summary, insurance regulation, through government oversight and industry standards, is essential for maintaining a robust and trustworthy insurance industry. It encourages companies to provide reliable coverage, manage risks effectively, and treat customers with integrity. As the insurance landscape continues to evolve, these regulatory measures will remain vital in adapting to new challenges and ensuring the long-term sustainability of the sector.

Restoration & Monitoring: Comprehensive Insurance Coverage Explained

You may want to see also