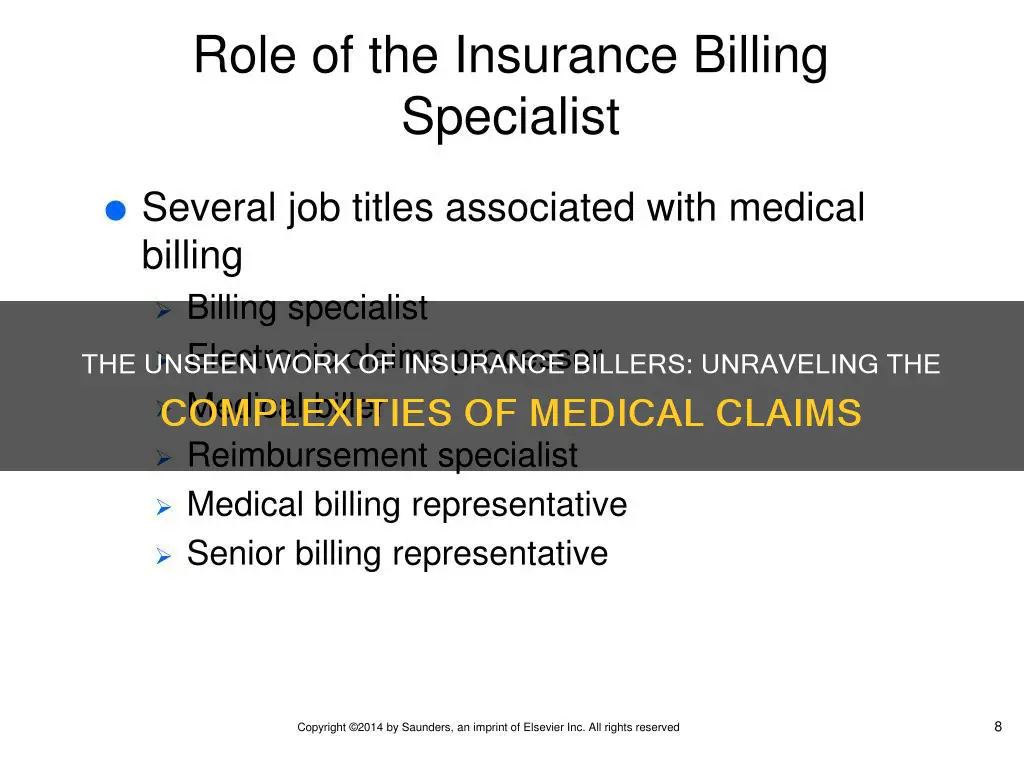

An insurance biller, also known as a medical biller, is a healthcare professional who manages the financial aspects of medical care. They are responsible for calculating and collecting payments for medical procedures and services. This includes updating patient data, developing payment plans, and preparing invoices. They also use billing software to process claims and follow up on unpaid accounts. Insurance billers work in medical administrative offices to ensure that patients are billed quickly and accurately. They communicate with patients about their outstanding balance and handle the administrative responsibilities of billing insurance and processing payments.

What You'll Learn

Reviewing and processing documents

An insurance biller's role involves reviewing and processing documents on a daily basis. They are responsible for verifying billing data, preparing itemized bills or invoices, and keeping records of patient or customer data.

Insurance billers must be proficient in medical billing software and have in-depth knowledge of billing software and medical insurance policies. They need to be able to demonstrate excellent written and verbal communication skills, as they will be communicating with clients, insurance agents, and healthcare providers.

- Reviewing patient medical records and insurance plans: Insurance billers verify coverage of services by reviewing patients' medical charts and insurance plans. They ensure that the services provided are covered by the patient's insurance plan.

- Preparing and submitting billing data and medical claims: Insurance billers collect necessary information, including patient demographics, medical history, insurance coverage, and details of the services or procedures received. They then prepare and submit these claims to insurance companies, ensuring accuracy and compliance with requirements.

- Following up on unpaid claims: Insurance billers perform regular follow-ups on unpaid or outstanding claims. They contact patients, insurance companies, or other relevant parties to resolve any issues and ensure payment.

- Updating records: Insurance billers maintain accurate records by updating spreadsheets, ledgers, or other documentation. They record late payments, unpaid claims, and any relevant follow-up actions taken.

- Ensuring data accuracy: Insurance billers play a crucial role in verifying the accuracy of billing information. They review highly detailed documents, analyzing medical records, and other data to ensure proper billing and avoid errors.

- Resolving billing discrepancies: When discrepancies arise, insurance billers take the necessary steps to resolve them. They may need to contact insurance companies, patients, or healthcare providers to clarify and correct any billing discrepancies.

The Mystery of MGA: Unraveling the Acronym in the Insurance Realm

You may want to see also

Communicating with patients

Before communicating with patients, it is important for insurance billers to have a base knowledge of billing terms and processes. This allows them to effectively explain billing concepts to patients and build trust. They should also be familiar with the patient's medical history, insurance coverage, and financial situation to provide accurate information.

When communicating with patients about their bills, insurance billers should be professional, courteous, and empathetic. They should ask clarifying questions to understand the patient's concerns and provide detailed explanations of the charges, using simple language and visual aids if possible. It is also important to follow up with patients to ensure their questions have been answered satisfactorily.

In addition to explaining bills, insurance billers also help patients resolve billing issues. This may involve correcting mistakes in patient records, appealing denied claims, and negotiating payment plans. They work with patients to find solutions that fit their budgets and ensure they receive the necessary medical care.

To improve the efficiency of the billing process, insurance billers should stay organized and set clear expectations. They should also regularly communicate with their team and patients to address any concerns and provide updates. By maintaining open and transparent communication, insurance billers can ensure a positive experience for patients.

Understanding Triterm Insurance: The Trifecta of Coverage

You may want to see also

Using billing software

Billing software is a highly specialised accounting solution for generating and submitting payment invoices to patients and their insurance companies. It helps insurers configure billing plans and invoice clients. It also enables users to maintain non-standard payment arrangements and facilitates bill collection and accounts receivable reconciliation.

Insurance billers use billing software to prepare and submit billing data and medical claims to insurance companies. They use it to ensure each patient's medical information is accurate and up to date, and to prepare bills and invoices. They also use it to document amounts due for medical procedures and services.

Billing software can be used to collect and review referrals and pre-authorisations. It can also be used to monitor and record late payments, and to follow up on missed payments and resolve financial discrepancies.

Some billing software can be used to investigate and appeal denied claims. It can also be used to help patients develop payment plans.

Billing software can be used to update rate changes, cash spreadsheets and current collection reports.

The Intricacies of ILS: Unraveling the World of Insurance-Linked Securities

You may want to see also

Following up on unpaid claims

Timely Follow-up:

Insurance billers should promptly follow up on unpaid claims to increase the chances of successful reimbursement. For example, if a claim is submitted in January and remains unpaid by November, the biller should contact the insurer to ascertain the status. Depending on the insurer's requirements, there may be time penalties for delayed follow-up.

Regular Reviews:

To stay on top of unpaid claims, insurance billers should review the aging report regularly. Running a primary aging report every six weeks or 30-45 days provides a sufficient window to inquire about claim statuses and make necessary resubmissions within the time limits.

Troubleshooting Denials:

Understanding why a claim was denied is essential for effective follow-up. Common reasons for claim denials include incorrect information, missing authorization numbers, claims submitted to the wrong insurance company, or incorrect diagnosis/procedure codes. Insurance billers should identify the issue and take corrective action, such as obtaining correct information or submitting an appeal letter.

Consistent Communication:

Insurance billers should maintain constant communication with insurance payers, clearinghouses, providers, and patients. They should clarify and follow up with all parties involved in the reimbursement process. This includes explaining and notifying patients about their bills and issuing Explanations of Benefits (EOBs).

Systematic Organisation:

Given the multitude of tasks an insurance biller handles, staying organised is crucial. Setting aside time at the end of the day or dedicating a specific day of the week for follow-up activities can help ensure regular and thorough attention to unpaid claims.

Tracking Tools:

Utilising tracking tools and software can aid in managing unpaid claims. For instance, using the Insurance Company Aging Report (insaging) can help identify which insurance carriers owe the most money and how old those balances are. Additionally, the Insurance Company Accounts Receivable (inscoar) report provides detailed information on outstanding claims, facilitating targeted follow-up.

Proactive Approach:

Being proactive and assertive when following up on claims is essential, as insurance companies may use stall tactics to delay payments. Having documentation ready, such as W-9 forms or medical records, can help address potential obstacles to payment.

Adhering to Timely Filing Guidelines:

Most commercial insurance companies have timely filing guidelines, typically ranging from 90 days to 365 days. Insurance billers should be mindful of these deadlines and follow up consistently within this timeframe to minimise the risk of denials, rejections, and non-payment issues.

Secondary Insurance Billing:

When patients have multiple insurance plans, insurance billers must first submit a claim to the primary insurance and wait for their response before billing the secondary insurance. Submitting claims in the correct order reduces the likelihood of denials and additional follow-up work.

Attention to Detail:

Insurance billers should pay close attention to details such as patient information, procedure codes, and billing software configurations. Human errors in these areas can lead to claim denials, so double-checking before submission is vital.

In conclusion, following up on unpaid claims is a complex and time-consuming process that requires a combination of organisational skills, persistence, and a solid understanding of the billing and insurance landscape. By implementing these strategies, insurance billers can improve reimbursement rates and provide efficient financial management in the healthcare industry.

The Mystery of "Cat D" in Car Insurance: Unraveling the Acronym's Meaning and Its Impact

You may want to see also

Maintaining records

Patient Data Management:

- Insurance billers are responsible for updating and maintaining patient data in billing software systems. This includes ensuring that patient information, such as contact details and medical history, is accurate and up to date.

- They may also be tasked with requesting any missing patient information to ensure completeness.

Billing and Payment Records:

- Insurance billers prepare and submit billing data and medical claims to insurance companies, carefully documenting amounts due for medical procedures and services rendered.

- They monitor and record late payments, following up on missed payments, and resolving financial discrepancies.

- Additionally, they maintain records of payment plans and track incoming and late payments.

Claims Management:

- Insurance billers play a crucial role in managing insurance claims. They prepare, review, and transmit claims using billing software, ensuring compliance with insurance requirements.

- When claims are denied or rejected, insurance billers are responsible for investigating and appealing these decisions, which may involve communicating with insurance companies and providing additional documentation.

- They also follow up on unpaid claims within standard billing cycles and pursue collection on delinquent accounts.

Compliance and Confidentiality:

- Insurance billers must adhere to regulatory requirements, such as the Health Insurance Portability and Accountability Act (HIPAA), to protect patient confidentiality.

- They ensure that billing and patient information is handled securely and that billing processes comply with insurance guidelines.

- Additionally, insurance billers stay up to date with changes in medical billing codes and regulations to maintain compliance.

Software and Technology:

- Proficiency in using billing software is essential for insurance billers. They maintain billing software by updating rate changes, cash spreadsheets, and collection reports.

- They also utilise electronic health records (EHRs) for secure storage and sharing of patient information, streamlining the billing process and reducing errors.

In summary, maintaining records is a critical function of insurance billers, who ensure accurate financial management, compliance with regulations, and protection of patient confidentiality. Their attention to detail and organisational skills contribute to the efficient operation of healthcare facilities and positive patient experiences.

Billing Insurance: A Guide for Sole Proprietors

You may want to see also

Frequently asked questions

An insurance biller, also known as a medical biller, is a healthcare professional who manages the financial aspects of medical care. They are responsible for managing incoming and outgoing payments for medical treatment, including billing insurance and processing payments.

The duties of an insurance biller include reviewing and processing insurance information, claims, and billing issues; scheduling appointments; maintaining records; negotiating payment arrangements; and using billing software. They also communicate with patients, insurance companies, and collection agencies to resolve unpaid claims and set up payment plans.

While there are no formal education requirements, a high school diploma or bachelor's degree in a related field is preferred. Training programs, certificates, and associate degrees in medical billing are also advantageous. Proficiency in medical billing software, knowledge of insurance policies, strong communication skills, and attention to detail are essential for this role.