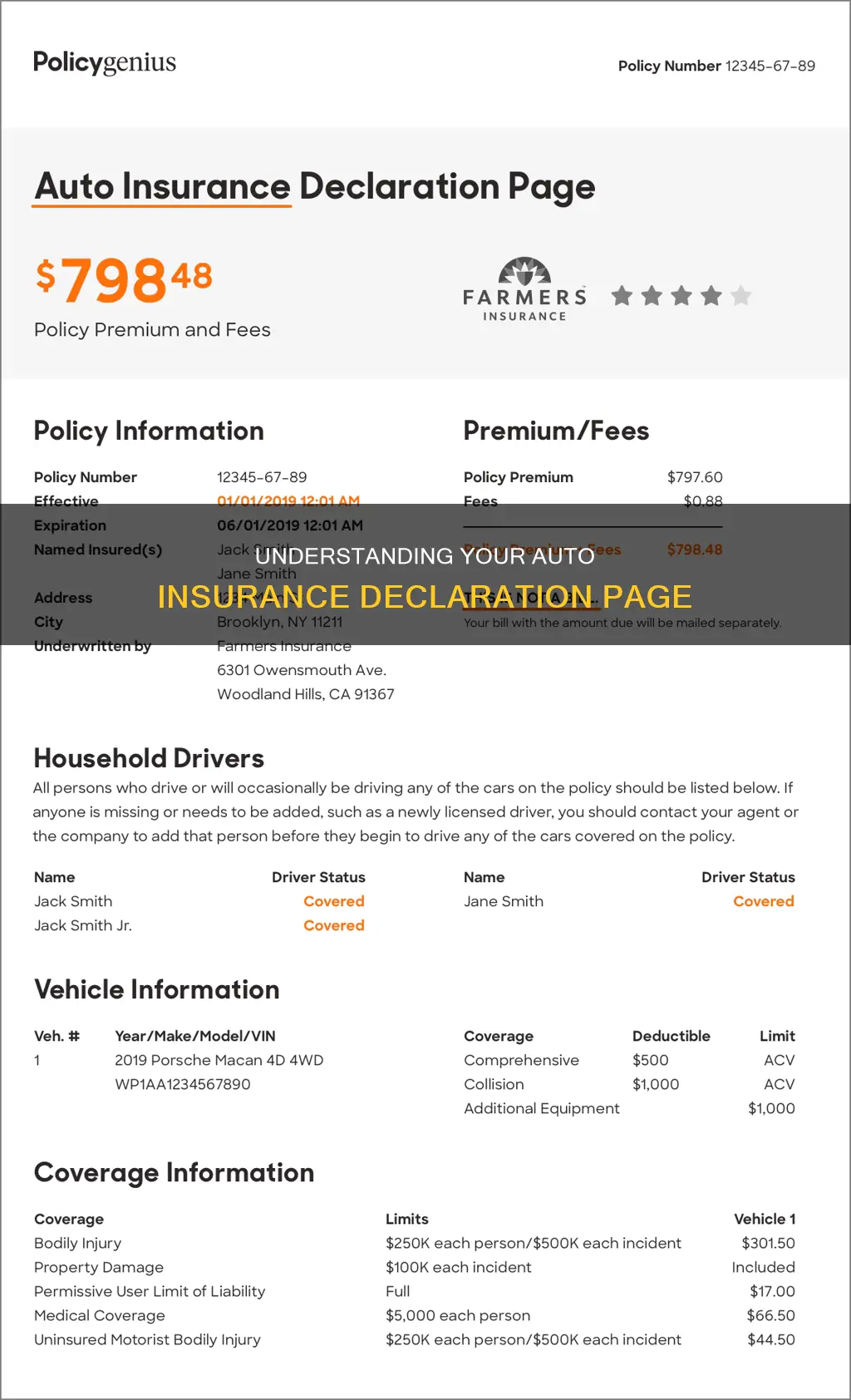

An auto insurance declaration page, also known as a dec page, is a summary of your auto insurance policy. It includes important information such as the policy number, the date coverage starts and ends, the insured drivers, the covered vehicles, the types of coverage, and the cost of coverage. The declaration page is typically the first page of your auto insurance policy and is provided by the insurance company when you buy or renew your policy. It can be used as a quick reference to understand your coverage and costs. While the specific format and content may vary, the declaration page provides a concise summary of your auto insurance policy.

| Characteristics | Values |

|---|---|

| Policy number | A unique number attached to your policy |

| Policy effective date | The date your policy becomes effective and coverage begins |

| Agent information | Contact information for your insurance agent (if you have one) |

| Policyholder details | Your name, address and phone number |

| Covered drivers | List of any drivers officially covered under the policy and any drivers that are excluded from coverage |

| Vehicle details | The year, make, model, vehicle identification number (VIN) and average mileage of the covered car(s) |

| Coverage details | Types of coverage included in the policy, coverage limits, deductibles, premiums and policy add-ons |

| Policy period | The start and end dates of the policy |

| Loss payee | Any party with a vested interest in the vehicle, including the lender if you lease or finance your vehicle |

| Discounts | Some insurance declarations pages list the insurer discounts that are applied to your policy |

What You'll Learn

Policy number, term period, and coverage limits

The auto insurance declaration page is a summary of your auto policy, usually spanning one or two pages. It contains essential information about your policy, such as the policy number, term period, coverage limits, and other relevant details.

The policy number is a unique identifier for your auto insurance policy and is typically listed at the top of the declaration page. This number is crucial when filing an insurance claim, exchanging information after an accident, or contacting your insurer for support.

The term period or policy period refers to the duration of coverage provided by your auto insurance policy. It includes the effective date, which is when the policy goes into effect, and the expiration date, marking the end of the coverage period. The term period is typically six or twelve months, starting from the effective date.

The declaration page also outlines the coverage limits, which are the maximum amounts your insurer will pay for a covered claim. These limits are usually listed as dollar amounts next to each coverage type. For instance, if you have a $100 limit for towing coverage, your insurer will pay up to $100 for towing services.

Additionally, the declaration page may include information about any additional coverages, such as roadside assistance or towing coverage, as well as any applicable discounts you receive.

It is important to carefully review your auto insurance declaration page to ensure that all the information is accurate and reflects your desired coverage options.

Insuring Cars Without a Valid Driver's License

You may want to see also

Insured drivers and vehicles

The insurance declaration page, also known as a "dec page", is a summary of your auto insurance policy. It includes vital information about insured drivers and vehicles. Here's what you can expect to find regarding insured drivers and vehicles:

Insured Drivers

The declaration page will list the names of all insured drivers, including the policyholder and any additional drivers covered under the same policy. It is important to provide your insurance company with the names of all individuals who will be driving the insured vehicle(s). This section of the declaration page may also list the names of any individuals who are specifically excluded from coverage.

Insured Vehicles

The declaration page will also provide details about the insured vehicles. It will list all cars covered by the policy, including their make, model, year, and Vehicle Identification Number (VIN). If you have chosen different types and amounts of coverage for each vehicle, the declaration page will help you keep track of these variations.

It is important to carefully review the list of insured drivers and vehicles to ensure that all necessary individuals and vehicles are included. If there are any discrepancies or errors, you should contact your insurance provider to make the necessary corrections.

Rental Car Insurance: How Much More Will You Pay?

You may want to see also

Coverage types and amounts

An auto insurance declaration page provides a summary of your auto policy, including the types of coverage you have and the amounts you pay for them. This document is typically one or two pages long and contains essential details such as the policy number, the date coverage starts and ends, and the insured drivers and vehicles.

The coverage types and amounts section of the declaration page outlines the different types of insurance coverages you have selected and the corresponding limits and deductibles. This section can include various coverage types, such as bodily injury liability insurance, collision insurance, comprehensive car insurance, and uninsured motorist coverage, among others.

For each coverage type, the declaration page will specify the limit, which is the maximum amount your insurer will pay for a covered claim. These limits may be listed as per-person or per-accident amounts for certain coverages, such as bodily injury liability. Additionally, if you have comprehensive or collision coverage, your deductible, or the amount subtracted from a claim payout, will be listed.

The declaration page also breaks down the costs associated with each coverage type and vehicle. It shows how much you are paying for each type of coverage and the total premium for your entire policy. Any discounts you qualify for will also be listed in this section, helping you understand the factors contributing to your overall insurance cost.

Understanding the coverage types and amounts outlined on your auto insurance declaration page is crucial for knowing the extent of your insurance protection and the financial implications in the event of a claim. It provides a detailed overview of the coverages you have selected and the associated costs, allowing you to make informed decisions about your policy.

Auto Insurance Claims: History Affects Your Premiums

You may want to see also

Premium and deductible amounts

The premium and deductible amounts are essential components of an auto insurance declaration page. This section provides a breakdown of the costs associated with your insurance coverage.

The premium amount represents the total cost of your insurance policy. It is the price you pay to maintain active coverage. Typically, the declaration page presents the premium as a six-month or yearly total for the entire policy, along with individual premiums for each type of coverage. For instance, if you have collision and comprehensive coverage, the declaration page will display the premium for each of these coverages separately. This transparency allows you to see the contribution of each coverage type to the overall premium.

The deductible amount, on the other hand, is the portion you must pay out of pocket when filing a claim. For example, if you have a $500 deductible and your insurance company approves a claim payout of $1,200, you will receive $700 after the deductible is subtracted. The declaration page outlines the deductibles for different types of coverage, such as collision and comprehensive coverage.

It's important to note that the premium and deductible amounts are inversely related. Increasing your deductible generally leads to a lower premium, as you are assuming more financial responsibility in the event of a claim. Conversely, opting for a lower deductible usually results in a higher premium.

Additionally, the declaration page may provide a breakdown of costs for each insured vehicle. This breakdown is particularly useful if you have multiple cars on the same policy with varying coverage types or limits. It allows you to understand the financial implications of your coverage choices for each vehicle.

Understanding the premium and deductible amounts is crucial when reviewing your auto insurance declaration page. This information empowers you to make informed decisions about your coverage levels, deductible preferences, and overall insurance costs.

Vehicle Damage: What Insurance Covers?

You may want to see also

Discounts and endorsements

Discounts:

Discounts are a great way to reduce your overall premium and can be offered for a variety of reasons. Common auto insurance discounts include:

- Bundling Discounts: Insurers often reward customers for purchasing multiple types of policies, such as combining homeowners and auto insurance.

- Multi-Car Discounts: If you insure multiple vehicles with the same company, you may be eligible for a discount.

- Full Payment Discounts: Paying your policy in full in advance can lead to savings, as some companies offer discounts for this payment method.

- Safety and Anti-Theft Features: If your car is equipped with safety features like airbags or anti-lock brakes, or if it has certified anti-theft devices installed, you may qualify for a discount.

- Good Driver Discounts: Insurers often reward drivers with a history of safe driving or those who have been accident-free for several years.

- Organizational Memberships: Membership in certain professional or academic organizations can sometimes lead to discounts on your auto insurance.

Endorsements:

Endorsements, also known as riders, are changes or additions to your original policy. They can add, exclude, or modify specific coverages to better meet your needs. For example, an endorsement could increase the limit of a particular coverage, providing you with additional protection. Endorsements are a way to customize your policy and ensure it accurately reflects your desired level of coverage.

The discounts and endorsements section of your auto insurance declaration page is a detailed summary of the adjustments made to your policy. It outlines the savings you're receiving and any changes or additions to your coverages. This section, along with the rest of the declaration page, provides a clear and concise overview of your auto insurance coverage, limits, and costs.

Does My Erie Auto Insurance Cover Me for Commercial Vehicles?

You may want to see also

Frequently asked questions

An auto insurance declaration page includes the policy number, policy effective date, agent information, policyholder details, covered drivers, vehicle details, coverage details, policy period, loss payee, and discounts.

An auto insurance declaration page is typically a summary of your auto policy in one or two pages. It may be a stand-alone document or the beginning of your entire auto insurance policy.

A declaration page is not the same as proof of insurance. You should furnish your insurance card or a certificate of insurance if asked for proof of insurance.

You will receive your auto insurance declaration page when you purchase a new policy or renew an existing one. It is usually mailed to you but can also be emailed or faxed.

Auto insurance declaration pages only provide a summary of your policy. For more detailed information, refer to your actual auto policy or contact your insurer or agent directly.