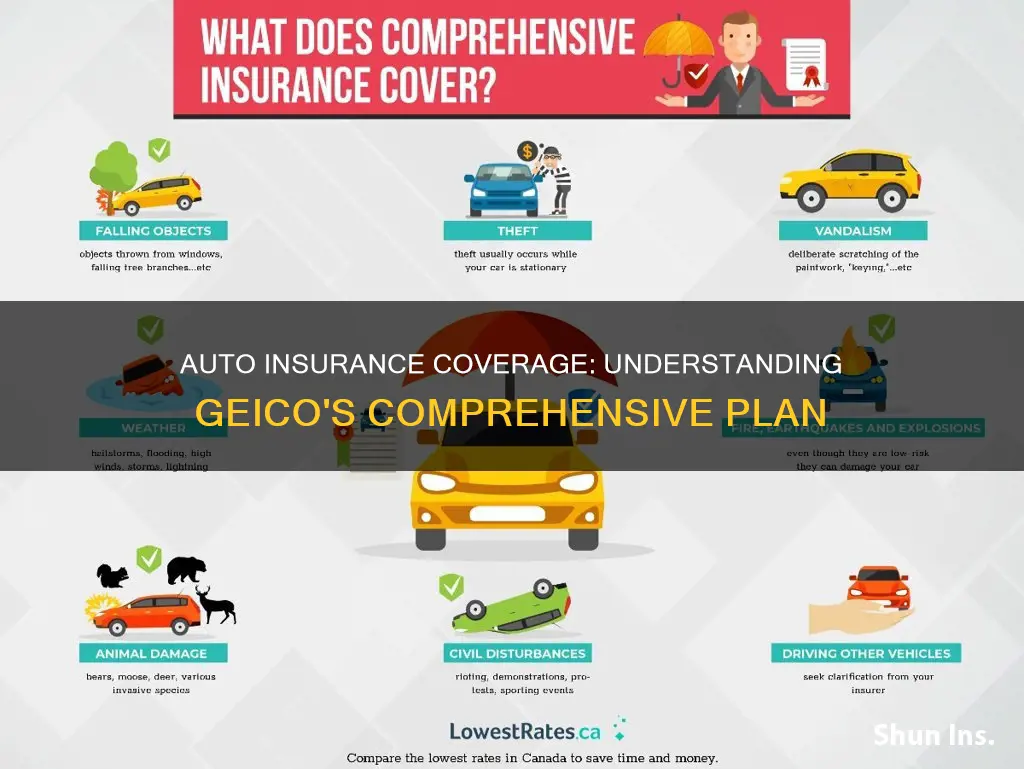

Comprehensive auto insurance covers damage to your vehicle in non-collision incidents. This includes theft, vandalism, hail, and animal collisions. It is an optional coverage that can be added to your policy, and it is important to note that it does not cover normal wear and tear or medical bills resulting from injuries sustained in an accident. Comprehensive coverage is also subject to a deductible, which is the amount you agree to pay before your insurance company starts paying for damages.

| Characteristics | Values |

|---|---|

| Type of insurance | Optional |

| What it covers | Damage to your vehicle not caused by a collision, including theft, vandalism, hail, and hitting an animal |

| What it doesn't cover | Damages caused by hitting another vehicle or object, normal wear and tear, flat tires, broken windshield wipers, medical bills |

| Deductible | You choose the amount |

| Maximum payout | Actual cash value of your vehicle |

What You'll Learn

Comprehensive coverage is optional

Comprehensive coverage is a good idea if you want to protect your vehicle from unexpected events. It can cover damages regardless of who is at fault, and it can help pay for repairs. If you have an auto loan or a leased vehicle, comprehensive coverage may be required by your lender. It is also a good idea if you live in an area where animal collisions are common.

When buying comprehensive coverage, you don't need to choose a limit as you do with other plans. The coverage will usually cover the value of your vehicle, minus your deductible amount. The deductible is the amount you agree to pay before your insurance company pays for any damages. You can usually choose the amount of the deductible, with a higher deductible resulting in a lower insurance cost.

Comprehensive coverage does not include roadside assistance or towing, the cost of a rental car while your vehicle is being repaired, or the replacement of personal property. However, you can obtain additional coverages, such as collision or liability insurance, to supplement your comprehensive coverage.

It's important to consider your insurance needs before choosing a policy to ensure you have adequate coverage. Compare quotes from multiple providers and use resources like Kelley Blue Book or the National Automobile Dealers Association to determine how much coverage you need. You can also raise your deductible or move to a usage-based policy to get a better rate.

Auto Insurance Options for New Residents

You may want to see also

Comprehensive coverage does not cover collision-related damages

Comprehensive auto insurance coverage is an optional coverage that helps cover the cost of damages to your vehicle when you're involved in an accident not caused by a collision. Comprehensive coverage is sometimes referred to as "other than collision" coverage. This means it may cover damages that collision coverage doesn't, such as theft, vandalism, hail, and hitting an animal.

However, it's important to note that comprehensive coverage does not cover collision-related damages. Collision coverage is a separate type of insurance that covers repairs to your vehicle, regardless of who is at fault in the accident. If your car collides with another vehicle or object, such as a fence, mailbox, or telephone pole, this would be covered under collision insurance, not comprehensive insurance.

For example, if you swerve to avoid hitting a deer and end up hitting a tree, this would be considered a collision with an object. In this case, comprehensive coverage would not apply, and you would need collision coverage to cover the cost of repairs. Comprehensive coverage would apply if you hit the deer, as it covers damage from contact with animals.

Comprehensive and collision coverage differ in the situations to which they apply. Comprehensive coverage is designed to cover damages resulting from incidents other than collisions, such as theft, vandalism, natural disasters, and contact with animals. On the other hand, collision coverage applies when your vehicle collides with another object, regardless of who is at fault.

It's important to understand the difference between comprehensive and collision coverage to ensure you have the right protection for your vehicle. While comprehensive coverage is useful for a range of non-collision incidents, it does not cover damages caused by colliding with another vehicle or object.

Texas Auto Insurance: Minimum Requirements You Need to Know

You may want to see also

Comprehensive coverage includes theft, vandalism, fire, and natural disasters

Comprehensive auto insurance covers damage to your vehicle in non-collision incidents. This includes theft, vandalism, fire, and natural disasters.

Theft is covered by comprehensive insurance. If your car is stolen, comprehensive coverage will help you cover the cost. This coverage is important for peace of mind, especially if you live in an area with high crime rates or frequently park your car in unsecured locations.

Vandalism is also covered by comprehensive insurance. Whether it's a keyed car or a smashed window, comprehensive coverage will help you pay for the repairs. This type of insurance is ideal if you live in an area with a high crime rate or frequently park your car in unsecured locations, where the risk of vandalism is higher.

Fire damage is another aspect of comprehensive coverage. If your car catches fire or is damaged by a fire, this insurance will help cover the cost of repairs. This coverage is beneficial if you live in an area prone to wildfires or if you frequently park your car in areas with a high risk of fire, such as near flammable materials or open flames.

Natural disasters are also included in comprehensive coverage. This covers damage caused by events like hurricanes, floods, hail, and falling objects. If you live in an area prone to natural disasters, such as hurricanes or floods, this coverage can provide valuable protection for your vehicle.

Comprehensive coverage is optional, but it can be extremely useful in these situations. It covers a wide range of incidents that are not related to collisions, helping you pay for repairs and replacements. It's important to note that comprehensive insurance does not cover normal wear and tear, flat tires, or broken windshield wipers. Additionally, it won't cover medical bills resulting from accidents. However, for protection against theft, vandalism, fire, and natural disasters, comprehensive coverage is an excellent choice.

Elephant Auto Insurance: Is It Worth the Hype?

You may want to see also

Comprehensive coverage does not include medical bills

Comprehensive coverage is an optional insurance coverage that helps cover the cost of damages to your vehicle when you're involved in an accident that's not caused by a collision. Comprehensive coverage does not include medical bills resulting from injuries sustained in an accident.

Comprehensive coverage can be used no matter who is at fault and helps pay for repairs, over your deductible, so you're not stuck paying the entire bill yourself. It is required by most lienholders along with collision coverage to protect their interest in the vehicle.

Comprehensive coverage covers losses like theft, vandalism, hail, and hitting an animal. For example, if you are driving and hit a deer, the damage would be covered under comprehensive coverage. However, if you swerve to miss the deer and hit a tree, comprehensive coverage doesn't apply because this type of accident is considered a collision with an object.

Comprehensive coverage does not cover damages caused by hitting another vehicle or object. These incidents are covered under collision coverage. It also does not cover normal wear and tear on your vehicle, such as items that need to be replaced over time from usage, like brakes or windshield wipers.

Medical bills from a car accident are covered by medical coverage, also known as personal injury protection (PIP). This coverage pays for medical expenses for you, your relatives, and possibly passengers, regardless of who is at fault in the accident.

Wells Fargo: Gap Insurance Options

You may want to see also

Comprehensive coverage can be used no matter who is at fault

Comprehensive coverage is an optional type of car insurance that helps cover the cost of damages to your vehicle when you're involved in an accident that's not caused by a collision. This means that it can be used no matter who is at fault.

Comprehensive coverage is sometimes referred to as "other than collision" coverage. It covers losses like theft, vandalism, hail, and hitting an animal. For example, if you are driving and hit a deer, the damage would be covered by comprehensive coverage. However, if you swerve to miss the deer and hit a tree, comprehensive coverage doesn't apply because this type of accident is considered a collision with an object.

Comprehensive coverage does not cover damages caused by hitting another vehicle or object. These incidents are covered under collision coverage. It also does not cover normal wear and tear on your vehicle, such as the replacement of parts that need to be replaced over time due to usage, like brakes or windshield wipers.

Comprehensive coverage can be useful if you live in an area where deer and other animals are likely to cross the road. It can also provide peace of mind in the event of theft, vandalism, or natural disasters such as hailstorms or floods.

It's important to note that comprehensive coverage does not include medical bills resulting from injuries sustained in an accident. Medical coverage, also known as personal injury protection (PIP), is a separate type of insurance that covers medical bills, regardless of who is at fault in the accident.

Unraveling the Mystery of Fair Market Value Determinations in Auto Insurance

You may want to see also

Frequently asked questions

Comprehensive coverage is insurance that covers damages not related to a collision. This includes theft, broken glass, flooding, fire, hail, or any other natural disaster.

GEICO's comprehensive coverage includes theft, vandalism, hail, and hitting an animal. It also covers fire, glass breakage, natural disasters, and falling objects.

Comprehensive coverage does not include damages caused by a collision with another vehicle or object. It also does not cover normal wear and tear, flat tires, or broken windshield wipers.

Comprehensive coverage can be used no matter who is at fault and helps pay for repairs over your deductible. It is also required by most lienholders and can protect your vehicle in a variety of situations.